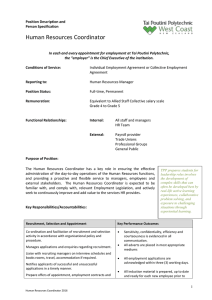

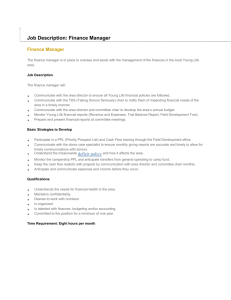

Title Bookkeeper Summary The Book Keeper is responsible for the

advertisement

Title Bookkeeper Summary The Book Keeper is responsible for the company's financial plans and policies; it's accounting practices, the conduct of its relationships with lending institutions and the financial community, the maintenance of its fiscal records, and the preparation of financial reports including monthly bank reconciliations. This position involves supervision over general accounting, property accounting, internal auditing, cost accounting, and budgetary controls. The Bookkeeper will report to the Director. Core Competencies Quality Orientation – completes tasks keeping in mind all aspects involved regardless of magnitude, checking tasks and processes while having attention to detail. Time Management - Maximizes time in order to accomplish as many tasks as possible in a timely manner keeping in mind prioritizing tasks as needed. Problem Solving – Resolves difficult and complicated challenges. Accountability & Dependability – takes personal responsibility for the quality and timeliness of work and achieves results with no oversight, including following guidelines, standards, regulations and principles. Research & Analysis – examines data to grasp issues, draw conclusions and solve problems. Decision Making & Judgement – makes timely informed decisions that take into account facts, goals, constraints and risks. Sees the big, long-range picture. Aligns direction, services and performance with organization. Ethics & Integrity – Earns the trust and respect of others through consistent honesty and professionalism in all interactions. Diplomatically handles challenging or tense interpersonal situations. Planning & Organizing – Coordinates ideas and resources to achieve goals Providing Consultation – Communicates with clients to identify and resolve complex and sensitive issues. Developmental & Continual Learning – Displays outgoing commitment to learning and self-improvement Job Duties Maintain and balance the accounts of three books using QuickBooks. Keep financial records and establish, maintain and balance various accounts using QuickBooks. Post journal entries and credit cards, bank reconciliation, prepare trail balance of books, maintain general ledgers and prepare monthly financial statements on a timely basis. Calculate employee hours and prepare cheques for payroll. Pay payroll remittance on a timely basis and reconcile to general ledger (GL). Liaise with employees regarding payroll and payroll deductions/problems. Pay HST on a timely basis and reconcile to general ledger (GL). Issue record of employment (ROEs) as required on a timely basis Pay Health Tax on a timely basis. Pay WSIB remittance on a timely basis Assist chartered accountant with preparation of corporation tax returns. Prepare financial and budget reports as requested and on a timely basis. Analyze overdue accounts payables and clear accounts payable on a timely basis. Post accounts receivable (AR) and deposit slips. Process credit card transactions Provide general accounts receivable (AR) services including preparation of “late”, “final” notices/letters to clients. Follow-up A/R problems with clients via telephone and/or email. Liaise with clients regarding questions/problems related to their accounts. Complete annual T4’s for employees on a timely basis. Complete annual statements for clients for income tax return purpose on a timely basis. Prepare books/information for annual audit to as requested by the auditor. Transfer funds between accounts and report balances as required by The Director. (These accounts will include contingency funds relative to HST and employee vacation payments) Maintain accurate and organized in-house files related to payroll, accounts receivable, accounts payable and other financial files. Prepare invoices for Veteran Affairs clients and liaise with Veteran Affairs re: any payment issues, inquiries or concerns. Assist service coordinators in the preparation of insurance forms or forms requested by employees. Provide advice and assistance to LAS franchisees as needed (including orientation to new franchisees during the franchise course). The bookkeeper has the final responsibility for providing effective financial controls for the organization.