2010 Forms 990 and 990-EZ

advertisement

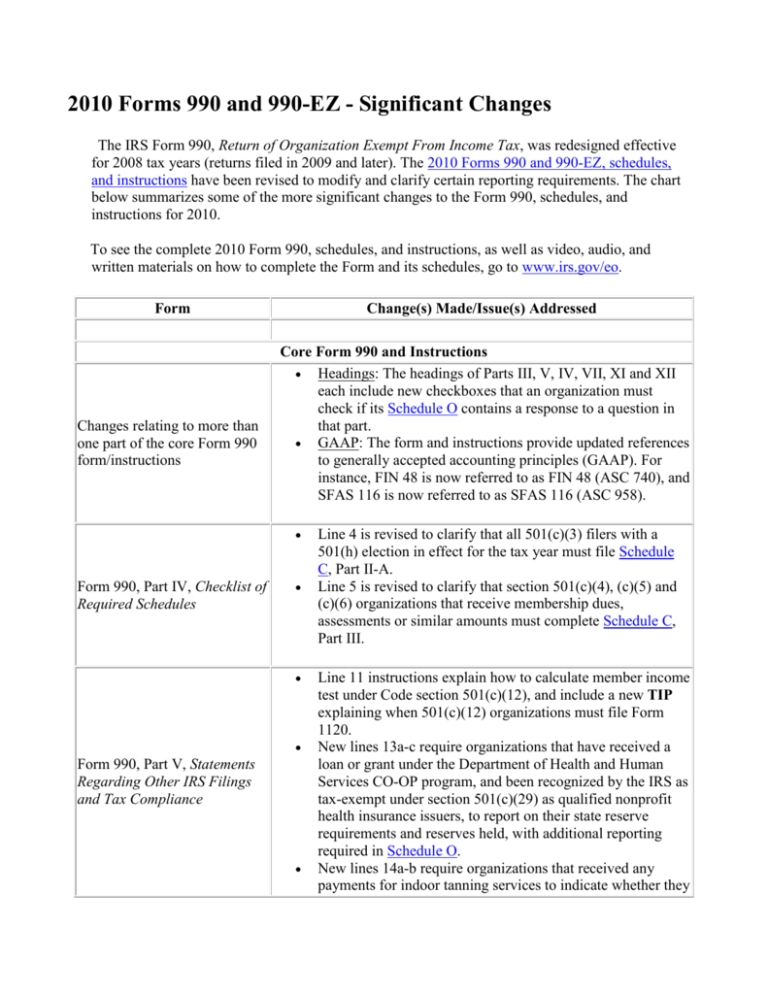

2010 Forms 990 and 990-EZ - Significant Changes The IRS Form 990, Return of Organization Exempt From Income Tax, was redesigned effective for 2008 tax years (returns filed in 2009 and later). The 2010 Forms 990 and 990-EZ, schedules, and instructions have been revised to modify and clarify certain reporting requirements. The chart below summarizes some of the more significant changes to the Form 990, schedules, and instructions for 2010. To see the complete 2010 Form 990, schedules, and instructions, as well as video, audio, and written materials on how to complete the Form and its schedules, go to www.irs.gov/eo. Form Changes relating to more than one part of the core Form 990 form/instructions Change(s) Made/Issue(s) Addressed Core Form 990 and Instructions Headings: The headings of Parts III, V, IV, VII, XI and XII each include new checkboxes that an organization must check if its Schedule O contains a response to a question in that part. GAAP: The form and instructions provide updated references to generally accepted accounting principles (GAAP). For instance, FIN 48 is now referred to as FIN 48 (ASC 740), and SFAS 116 is now referred to as SFAS 116 (ASC 958). Form 990, Part IV, Checklist of Required Schedules Form 990, Part V, Statements Regarding Other IRS Filings and Tax Compliance Line 4 is revised to clarify that all 501(c)(3) filers with a 501(h) election in effect for the tax year must file Schedule C, Part II-A. Line 5 is revised to clarify that section 501(c)(4), (c)(5) and (c)(6) organizations that receive membership dues, assessments or similar amounts must complete Schedule C, Part III. Line 11 instructions explain how to calculate member income test under Code section 501(c)(12), and include a new TIP explaining when 501(c)(12) organizations must file Form 1120. New lines 13a-c require organizations that have received a loan or grant under the Department of Health and Human Services CO-OP program, and been recognized by the IRS as tax-exempt under section 501(c)(29) as qualified nonprofit health insurance issuers, to report on their state reserve requirements and reserves held, with additional reporting required in Schedule O. New lines 14a-b require organizations that received any payments for indoor tanning services to indicate whether they Form Change(s) Made/Issue(s) Addressed Core Form 990 and Instructions have filed a Form 720 to report such payments Form 990, Part VI, Governance, Management, and Disclosure Form 990, Part VII, Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors Instructions clarify that an organization should answer Yes to any question that asks whether it has a particular policy only if its governing board adopted the policy by the end of its tax year. Line 2 instructions clarify that only business and family relationships between the organization’s current (not former) directors, trustees or key employees should be reported. Line 10 instructions include two new examples to clarify the meaning of local chapters, branches and affiliates. Line 11 instructions clarify that an organization should answer No if it redacted or removed any information (e.g., names and addresses of contributors listed on Schedule B) from the copy of its final Form 990 that it provided to its governing body members before filing the form. Schedule J-2 is eliminated as a continuation schedule for Part VII, Section A. Instead, if filers need more space for listing additional persons and their compensation, they should use duplicate copies of Part VII, Section A as continuation sheets. The instructions clarify that the box in Section A, line 1a should be checked if neither the organization nor any related organizations compensated any current officer, director or trustee of the organization. The instructions clarify that if a related organization was related to the filing organization for only a portion of the tax year, then the filing organization may choose to report compensation paid by the related organization only during the time it was related. The instructions clarify that reportable compensation for officers, directors, individual trustees and employees includes both compensation reported in Form W-2, box 5 and in Form 1099-MISC, box 7, if they are compensated in more than one capacity. The compensation table in the instructions clarifies how certain contributions to and amounts deferred under qualified and nonqualified plans should be reported in Part VII and Schedule J. Section A, line 1a, column (B) notes that filers must describe in Schedule O the average hours per week that any person Form Change(s) Made/Issue(s) Addressed Core Form 990 and Instructions listed in line 1a worked for any related organizations. The Total line for the Section A table has been subdivided into three lines: line lb (sub-total for all persons listed in lines (1) through (28) of the Section A table), 1c (total from continuation sheets, if any) and 1d (total of lines 1b and 1c). Form 990, Part VIII, Statement of Revenue Form 990, Part IX, Statement of Functional Expenses The instructions for column (B) clarify that costs incurred to secure grants, or contracts, to provide program services to the grantor or other contracting party should be reported in column (B), whereas costs incurred to secure grants to provide services to the general public should be reported in column (D). The instructions clarify that filers should report in lines 5-10 payments to reimburse payroll agents, common paymasters and other third parties for compensation paid to the filing organization’s officers, directors, trustees and employees, and should report payments to a third party for that party’s services in line 11g. Line 24 (other expenses) states that miscellaneous expenses not reported in lines 24a through 24e should be reported on line 24f, and that if the line 24f amount exceeds 10 percent of the line 25, column (A) amount, the organization must itemize the type and amount of line 24f expenses on Schedule O. Line 6 is revised to require reporting of receivables from contributing employers and sponsoring organizations of section 501(c)(9) voluntary employees’ beneficiary organizations (VEBAs). A new Part XI, Reconciliation of Net Assets, is added to reconcile beginning-of-year and end-of-year net assets. The former Part XI, Financial Statements and Reporting, is now Form 990, Part X, Balance Sheet Form 990 Parts XI, Reconciliation of Net Assets, and XII, Financial Statements Instructions clarify that neither donations of services (including the value of donated advertising space or broadcast air time) nor donation of the use of materials, equipment or facilities may be reported in Part VIII, even if such donations are considered revenue under GAAP. Instructions clarify how to report donations of certain items sold at auction, in a revised example for line 8c. Form and Reporting Change(s) Made/Issue(s) Addressed Core Form 990 and Instructions Part XII. A new Part XI, Reconciliation of Net Assets, is added to reconcile beginning-of-year and end-of-year net assets. The former Part XI, Financial Statements and Reporting, is now Part XII. Form 990 Glossary Form 990, Appendix K, Contributions A revised definition of control clarifies that a person’s beneficial interest in a trust shall be determined in proportion to that person’s actuarial interest in the trust, for purposes of determining whether a trust is related to the filing organization. A revised definition of related organization: o Includes contributing employers and sponsoring organizations of section 501(c)(9) VEBAs; o Clarifies that if the filing organization is a trust, and has a bank or financial institution trustee that is also the trustee of another trust, the other trust is not a brother/sister related organization. A new appendix discusses certain federal tax rules that apply to tax-exempt organizations and donors with respect to charitable contributions and other contributions. Form 990-EZ and Instructions Changes relating to more than one part of the core Form 990EZ form/instructions/ schedules Revised to add new sub-lines for reporting income from fundraising events and gaming separately. The threshold for filing Part II of Schedule G is now $15,000 of gross income and contributions from fundraising events, and the threshold for filing Part III of Schedule G is now $15,000 of gross income from gaming Revised to clarify that if an organization maintained any donor advised fund or operated a hospital, then it must complete Form 990 instead of Form 990-EZ. New lines 44c and 44d require organizations that received any payments for indoor tanning services to indicate whether they have filed a Form 720 to report such payments. Line 6 Line 44 New line 45a is added to clarify that controlled entities that received certain payments from, or engaged in any transactions with, a controlled entity within the meaning of section 512(b)(13) must complete Form 990 and Schedule R instead of Form 990-EZ. Line 46 regarding political campaign activities has been moved from Part VI to Part V, so that all Form 990-EZ filers—not just 501(c)(3) organizations—must answer this question. If an organization answers Yes, it must complete and file the applicable parts of Schedule C, Part I. Line 45 Line 46 Filing thresholds increased: The gross receipts and total assets thresholds for Form 990-EZ filers have been lowered for the 2010 tax year to $200,000 and $500,000, respectively. In other words, an organization can file a Form 990-EZ (rather than a Form 990) if its annual gross receipts for tax year 2010 are less than $200,000 and if its total assets at the end of tax year 2010 are less than $500,000. Schedule O, rather than separate attachments, should be used to provide narrative responses, as applicable, to lines 8, 10, 16, 20, 24, 26, 31, 33, 34, and 35. Schedule O may also be used to supplement or explain the organization’s responses to other questions in the core Form 990-EZ. What were formerly referred to as special events are now referred to as fundraising events throughout the form and instructions. Changes relating to more than one schedule Instructions explain how to report a loss on an uncollectible pledge that was reported as public support on a prior year’s Schedule A. Instructions direct not to attach substitutes for Schedule B, and clarify that Parts I, II and III of Schedule B may be duplicated as needed to provide adequate space for listing all contributors. Instructions for Part II-A clarify that this Part needs to be completed by all Form 990 filers for which the 501(h) lobbying expenditure election was valid and in effect during the 2010 tax year, whether or not the organization engaged in lobbying activities during that tax year. Instructions for Part X clarify that a filer that included a FIN 48 footnote in its financial statements should complete Part X and provide the full text of its FIN 48 footnote in Part XIV, even if it did not report any liability for uncertain tax positions under FIN 48 in that footnote. Schedule A, Public Charity Status and Public Support Schedule B, Schedule of Contributors Schedule C, Political Campaign and Lobbying Activities Schedule D, Supplemental Financial Statements Schedule Changes Schedules F-1, I-1, J-1, N-1 and R-1 are all eliminated; filers may duplicate the applicable tables if they need space to report additional information. New narrative parts have been added to Schedules E, G, K, L and R. These parts, rather than Schedule O, should now be used to supplement responses to questions on those schedules. Schedule O should be used only to supplement responses to questions on the Core Form 990. Schedule F, Statement of Activities Outside the United States Schedule G, Supplemental Information Regarding Fundraising or Gaming Activities Schedule Changes Part I, Line 3, column (c) is revised to clarify that the number of independent contractors in a foreign region should be reported, along with the number of employees and agents in that region. Part I, line 3, column (f) is revised to require reporting of the total book value of investments in a foreign region. Instructions for Part I, lines 3a-3c, columns (b) and (c) clarify how to report total number of foreign offices, agents, employees and independent contractors. Part I, column (f) instructions clarify that types of indirect expenditures for foreign activity that do not have to be reported if they are not separately tracked include expenses for listing study abroad programs on a school website or in a paper catalog. Part II instructions clarify that foreign program related investments are reportable in Part II. Part II instructions state that a filer should report not only grants and other assistance to foreign organizations or entities, but also to U.S. organizations or entities for foreign activity. Parts II and III instructions clarify that organizations using the accrual method of accounting that make foreign grants to be paid in future years should report the grants’ present value in Part II and report any accruals of additional value in future years. Parts II and III instructions clarify that the filing organization should report foreign grants regardless of the source of the grant funds (whether restricted or unrestricted) or whether the filing organization selected the grantee. A new Part IV requires reporting of whether the organization engaged in foreign activities that require filing of other IRS forms. Part I, line 2b table is revised to require reporting of professional fundraisers’ addresses. Schedule H, Hospitals Part I, line 4 is revised to require reporting of severance or change-of-control payments from both the filing organization and related organizations. Parts I-IV are revised to allow reporting of four tax-exempt bond issues per page rather than five; instructions provide that Schedule K should be duplicated to report additional issues. Part I includes a new column (i), Pooled financing. Part II includes new lines 1 (Amount of bonds retired), 2 (amount of bonds legally defeased), 5 (capitalized interest from proceeds), 8 (credit enhancement from proceeds)and 12 (other spent proceeds). Part IV includes new lines 3d (Was the hedge superintegrated?) and 3e (Was the hedge terminated?). Schedule J, Compensation Information Schedule K, Supplemental Information on Tax-Exempt Bonds Part IV Instructions clarify that business transactions include insurance contracts, and that interested persons include entities controlled by family members of current or former officers, directors, trustees or key employees. Former lines 4a and 4b from the 2009 Schedule N, Part I, which asked whether the organization had requested or received a letter from the IRS that the organization’s exempt status was terminated, are deleted. Schedule L, Transactions With Interested Persons Schedule N, Liquidation, Termination, Dissolution, or Significant Disposition of Assets Schedule Changes Part V includes a new Section B for reporting, on a hospital facility-by-hospital facility basis, information concerning the hospital facility’s community health needs assessment, financial assistance policy, billing and collections, emergency medical care policy, and charges for medical care. The organization must complete a separate Section B for each of its hospital facilities listed in Part V, Section A. Completion of Part V, Section B, lines 1-7 is optional for tax year 2010. Completion of Part V, Section B, lines 8-21 optional if the organization’s 2010 tax year began on or before March 23, 2010. Organizations filing Schedule H with their 2010 Forms 990 should not file their 2010 Forms 990 prior to July 1, 2011. See Announcement 2011-20 on IRS.gov. Schedule O, Supplemental Information to Form 990 Schedule R, Related Organizations Schedule Changes Instructions clarify that Schedule O should only be used to supplement responses to questions on the Core Form 990, not other schedules. New column (g) in Part II asks whether each related taxexempt organization is a section 512(b)(13) controlled entity of the filing organization. New column (k) in Part III asks for the filing organization’s percentage ownership interest in each related partnership. New column (d) in Part V asks how the organization determined the amount of each type of related party transaction reported in Part V. Instructions provide examples to illustrate how the filing organization can control or be controlled by multiple persons, and how multiple nonprofit organizations can be directly and indirectly related to one another.