chapter 19 - governmental accounting principles

advertisement

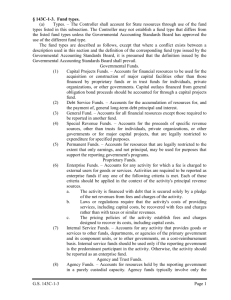

CHAPTER 19 - GOVERNMENTAL ACCOUNTING PRINCIPLES PURPOSE The purpose of this section is to introduce the user to basic accounting concepts and principles as they relate to governmental accounting in general and to Rusk County in particular. Rusk County is independently audited each year and as such, is required to follow generally accepted accounting principles, which are discussed briefly in this section. For a more detailed discussion of generally accepted accounting principles, refer to the publication GOVERNMENTAL ACCOUNTING, AUDITING, AND FINANCIAL REPORTING (GAAFR), which is available in the County Finance Department. FUND ACCOUNTING One of the integral parts of governmental accounting is the use of funds to account for its activities. Rusk Count utilizes fund accounting. A fund is defined as "an independent fiscal and accounting entity with a self balancing set of accounts recording cash and other financial resources, together with all related liabilities and residual equities, and changes therein, which are segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with regulations, restrictions, or limitations." Each fund operates independently under normal "double entry" accounting rules TYPES OF FUNDS The following is a description of each major category of funds or account groups used in Rusk County. A. GOVERNMENTAL FUNDS General Fund. The General Fund is the general operating fund of Rusk County. It is used to account for all financial resources except for those required to be accounted for in another fund. These start with the number 100-xx-xxxxx. Special Revenue Fund. The Special Revenue Funds are used to account for the proceeds of specific revenue sources (other than major capital projects) that are legally restricted to expenditures for specified purposes. These start with the numbers 2xx-xx-xxxxx. Debt Service Fund. The Debt Service Funds are used to account for the accumulation of resources for, and the payment of, general long-term debt principal, interest, and related costs. These start with the numbers 300-xxxxxxx. Page 19-1 Capital Projects Fund. The Capital Project Funds are used to account for the purchase or construction of major capital facilities which are not financed by proprietary funds, Special Assessment Funds, or Trust Funds. These start with the number 400-xx-xxxxx. B. PROPRIETARY FUNDS Enterprise Funds. The Enterprise Funds are used to account for operations (a) that are financed and operated in a manner similar to private business enterprises where the intent of the County is that the costs (expenses, including depreciation) of providing goods or services to the general public on a continuing basis be financed or recovered primarily through user charges, or (b) where the County has decided that periodic determination of revenues earned, expenses incurred, and/or net income is appropriated for capital maintenance, public policy, management control, accountability, or other purposes. An example of this fund is the Hospital/Nursing Home. These funds start with the numbers 50x-xx-xxxxx. C. FIDUCIARY FUNDS Trust and Agency Funds. The Trust and Agency Funds are used to account for assets held by the County in a fiduciary capacity as trustee, custodian or agent for individuals, other governmental units and non-public organizations. Examples of this would be amounts collected for the state for the DNR, traffic fines, licenses and for other governments for special assessments. These funds start with the numbers 7xx-xx-xxxxx. (In 2003, these funds were moved to the general fund, fund 100.) D. FIXED ASSETS AND LONG-TERM LIABILITIES ACCOUNT GROUPS Fixed Assets. Fixed assets used in governmental fund type operations are accounted for in the General Fixed Assets Account Group, rather than in the governmental funds. All fixed assets are valued at historical cost or estimated historical cost if actual historical cost is not available. Donated fixed assets are valued at their estimated fair value on the date donated. A listing of the fixed assets is kept by the Industrial Appraisal group and updated by departments yearly. Long Term Liabilities. Long term liabilities expected to be financed from governmental funds are accounted for in the General Long Term Debt Account Group, not in the governmental funds. Examples of this are the bond issues for construction and the unfunded pension liability with the state pension board. The two account groups are not "funds." They are concerned only with the measurement of results or operations. BASIS OF ACCOUNTING Page 19-2 The modified accrual basis of accounting is followed by the governmental funds, expendable trust funds, and agency funds. Under the modified accrual basis of accounting, revenues and other governmental fund financial resources are recognized in the accounting period in which they become both measurable and available to finance expenditures of the fiscal period. Available means collectible within the current period or soon enough thereafter to be used to pay liabilities of the current period. Expenditures other than interest on general long-term debt are recorded as liabilities when they are incurred. BUDGET The budget is the primary tool of local government for monitoring financial resources. Contained in the budget are decisions regarding its operation. When the budget is adopted, it represents the financial plan for operating the government in the coming year. See Chapter 10. The major difference between a government and a business budget is the government is adopted into law and therefore legally binding. Expenditure budgets or appropriations represent the upper limit for government spending in a given year. Because the budget is legally binding, budgetary control is essential. Like other governments, Rusk County adopts a budget. Each year budgets are developed for all county departments. Budgets are reviewed by liaison committees and the Finance committee before forwarding the recommended budget to the County Board of Supervisors. The County Board considers the Finance Committee's proposed budget and adopts a budget in November of each year. The adopted budget sets both revenue and appropriation levels along with the amount of taxes that are to be levied in the county and apportioned to its municipalities. BUDGETARY ACCOUNTING Budgetary accounting and control is essential because of the legal aspects of the budget. In the county, appropriation accounts are maintained to control expenditures in accordance with the adopted budget. The department must obtain a transfer if a purchase will cause an account to become overdrawn. The Finance Department monitors overdrawn expense accounts and informs the Finance Committee. Approved by the County Board, January 27, 2004 Page 19-3