Numerical chapter 2 5. Given data: I 40, G 30, GNP 200, CA –20 NX

advertisement

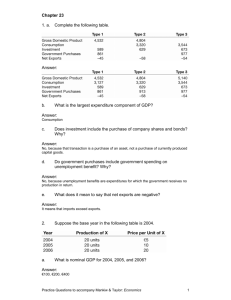

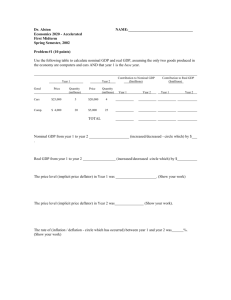

Numerical chapter 2 5. Given data: I 40, G 30, GNP 200, CA –20 NX NFP, T 60, TR 25, INT 15, NFP 7 –9 –2. Since GDP GNP – NFP, GDP 200 – (–2) 202 Y. Since NX NFP CA, NX CA – NFP –20 – (–2) –18. Since Y C I G NX, C Y – (I G NX) 202 – (40 30 (–18)) 150. Spvt (Y NFP – T TR INT) – C (202 (–2) – 60 25 15) –150 30. Sgovt (T – TR – INT) – G (60 – 25 – 15) – 30 –10. S Spvt Sgovt 30 (–10) 20. (a) Consumption 150 (b) Net exports –18 (c) GDP 202 (d) Net factor payments from abroad –2 (e) Private saving 30 (f) Government saving –10 (g) National saving 20 6. Base-year quantities at current-year prices at base-year prices 3000 $3 $ 9,000 6000 $2 $12,000 8000 $5 $40,000 $61,000 3000 $2 $ 6,000 6000 $3 $18,000 8000 $4 $32,000 $56,000 Apples Bananas Oranges Total Current-year quantities at current-year prices Apples Bananas Oranges Total 4,000 $3 $ 12,000 14,000 $2 $ 28,000 32,000 $5 $160,000 $200,000 at base-year prices 4,000 $2 $ 8,000 14,000 $3 $ 42,000 32,000 $4 $128,000 $178,000 (a) Nominal GDP is just the dollar value of production in a year at prices in that year. Nominal GDP is $56 thousand in the base year and $200 thousand in the current year. Nominal GDP grew 257% between the base year and the current year: [($200,000/$56,000) – 1] 100% 257%. (b) Real GDP is calculated by finding the value of production in each year at base-year prices. Thus, from the table above, real GDP is $56,000 in the base year and $178,000 in the current year. In percentage terms, real GDP increases from the base year to the current year by [($178,000/$56,000) – 1] 100% 218%. (c) The GDP deflator is the ratio of nominal GDP to real GDP. In the base year, nominal GDP equals real GDP, so the GDP deflator is 1. In the current year, the GDP deflator is $200,000/$178,000 1.124. Thus the GDP deflator changes by [(1.124/1) – 1] 100% 12.4% from the base year to the current year. (d) Nominal GDP rose 257%, prices rose 12.4%, and real GDP rose 218%, so most of the increase in nominal GDP is because of the increase in real output, not prices. Notice that the quantity of oranges quadrupled and the quantity of bananas more than doubled. Answers to problems assigned on chapter 3 1) (a) To find the growth of total factor productivity, you must first calculate the value of A in the production function. This is given by A Y/(K.3N.7). The growth rate of A can then be calculated as [(Ayear 2 – Ayear 1)/Ayear 1] 100%. The result is: 1960 1970 1980 1990 2000 A 12.484 14.701 15.319 17.057 19.565 % increase in A — 17.8% 4.2% 11.3% 14.7% (b) Calculate the marginal product of labor by seeing what happens to output when you add 1.0 to N; call this Y2, and the original level of output Y1. [A more precise method is to take the derivative of output with respect to N; dY/dN The result is the same (rounded).] 1960 1970 1980 1990 2000 Y1 2502 3772 5162 7113 9817 Y2 2529 3805 5198 7155 9867 . MPN 27 33 36 42 50 2) (a) The MPK is 0.2, because for each additional unit of capital, output increases by 0.2 units. The slope of the production function line is 0.2. There is no diminishing marginal productivity of capital in this case, because the MPK is the same regardless of the level of K. This can be seen below because the production function is a straight line. (b) When N is 100, output is Y 0.2(100 100.5) 22. When N is 110, Y is 22.0976. So the MPN for raising N from 100 to 110 is (22.0976 – 22)/10 0.00976. When N is 120, Y is 22.1909. So the MPN for raising N from 110 to 120 is (22.1909 – 22.0976)/10 0.00933. This shows diminishing marginal productivity of labor because the MPN is falling as N increases. Below this is shown as a decline in the slope of the production function as N increases. 4) MPN A(100 – N) (a) A 1. MPN 100 – N. (1) W $10. w W/P $10/$2 5. Setting w MPN, 5 100 – N, so N 95. (2) W $20. w W/P $20/$2 10. Setting w MPN, 10 100 – N, so N 90. These two points are plotted as line NDa below. If labor supply 95, then the equilibrium real wage is 5. (b) A 2. MPN 2(100 – N). (1) W $10. w W/P $10/$2 5. Setting w MPN, 5 2(100 – N), so 2N 195, so N 97.5. (2) W $20. w W/P $20/$2 10. Setting w MPN, 10 2(100 – N), so 2N 190, so N 95. These two points are plotted as line NDb in Figure above. If labor supply 95, then the equilibrium real wage is 10. 5. (a) If the lump-sum tax is increased, there’s an income effect on labor supply, not a substitution effect (since the real wage isn’t changed). An increase in the lump-sum tax reduces a worker’s wealth, so labor supply increases. (b) If T 35, then NS 22 12w (2 35) 92 12 w. Labor demand is given by w MPN 309 – 2N, or 2N 309 – w, so N 154.5 – w/2. Setting labor supply equal to labor demand gives 154.5 – w/2 92 12w, so 62.5 12.5w, thus w 62.5/12.5 5. With w 5, N 92 (12 5) 152. (c) Since the equilibrium real wage is below the minimum wage, the minimum wage is binding. With w 7, N 154.5 – 7/2 151.0. Note that NS 92 (12 7) 176, so NS > N and there is unemployment. 7) (a) At any time, 25 people are unemployed: 5 who have lost their jobs at the start of the month and 20 who have lost their jobs either on January 1 or July 1. The unemployment rate is 25/500 5%. (b) Each month, 5 people have one-month spells. Every six months, 20 people have six-month spells. The total number of spells during the year is (5 12) (20 2) 100. Sixty of the spells (60% of all spells) last one month, while 40 of the spells (40% of all spells) last six months. (c) The average duration of a spell is (0.60 1 month) (0.40 6 months) 3 months. (d) On any given date, there are 25 people unemployed. Twenty of them (80%) have long spells of unemployment, while 5 of them (20%) have short spells. 9) Since ( Y – Y) /Y 2(u – u ), this can be rewritten as Y – Y 2(u – u ) Y or Y [1 – 2(u – u )] Y , or Y Y/[1 – 2(u – u )]. (a) Using the formula above, this table shows the value of Y , given values for u and Y. Year 1 2 3 4 u 0.08 0.06 0.07 0.05 Y 950 1030 1033.5 1127.5 Y 989.6 1030.0 1054.6 1105.4 b. The first calculation of Y/Y comes from calculating the percent change in Y from part a. The second calculation of Δ Y/Y comes from using Eq. (3.6): Y/Y Y/Y – 2 u, so Y/Y Y/Y 2 u. Year Y/Y Y 1 989.6 — 2 1030.0 0.041 3 1054.6 0.024 4 1105.4 0.048 YY u — — 0.084 –0.02 0.003 0.01 0.091 –0.02 The two methods give close answers. Y/Y — 0.044 0.023 0.051