Shree Digvijay Cement Company Ltd

advertisement

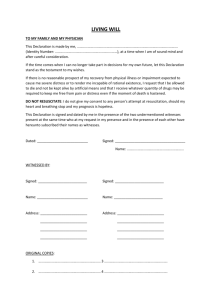

2 BRIEF FACTS OF THE CASE: M/s Shree Digvijay Cement Company Ltd., Second Floor, Amola Chambers, C.G.Road, Ahmedabad (hereinafter referred to as “M/s SDCCL”) is the marketing office of the manufacturing unit of Shree Digvijay Cement Company Ltd., Sikka, Jamnagar. As per Rule 2(1)(d) (v) of the Service Tax Rules, 1994 (herein after referred to as the “said Rules”) the liability to pay the service tax has been transferred to recipients of ‘‘Goods Transport Agency’ Service’. M/s SDCCL, being a recipient of ‘‘Goods Transport Agency’ Service’, are holding Service Tax Registration Certificate No. AADCS0957JST002 under Section 69 of the Finance Act, 1994. Hence, they are required to comply with the provisions of the Finance Act, 1994 (herein after referred to as the “said Act”) and the rules framed there under. 2. Notification No. 32/2004-ST, dated 3.12.2004 (rescinded on 1.3.2006), and Notification No. 1/2006-ST, dated 1.3.2006, exempts the taxable service provided by a ‘Goods Transport Agency’ to a customer in relation to transport of goods by road, in a goods carriage, from so much of service tax leviable thereon as is in excess of the service tax calculated on the value which is equivalent to twenty-five percent of the gross amount charged from the customer by such ‘Goods Transport Agency’, subject to the following conditions:(i) the credit of duty paid on inputs or capital goods or the CENVAT credit of service tax on input services, used for providing such taxable service has not been taken under the provisions of the CENVAT Credit Rules,2004; or; (ii) the ‘Goods Transport Agency’ has not availed of the benefit under the Notification No. 12/2003-ST, dated 20.6.2003. 3. The Ministry under circular No. B1/6/2005/TRU dated 27.7.2005 clarified that declaration by ‘Goods Transport Agency’ in the consignment note issued to the effect that neither credit on inputs/capital goods has been taken nor benefit of Notification No. 12/2003-ST dated 20.6.2003 has been taken by them, may suffice for the availment of exemption by the person liable to pay service tax. 4. During the course of audit, it was observed that M/s SDCCL has availed abatement of 75% of freight value under Notification No.32/2004-ST dated 3-122004 and 1/2006-ST dated 1-03-2006. Thus, M/s SDCCL has paid service tax on 25% value of freight charges paid. Further, on verification of Consignment Notes issued by the Goods Transport Agencies, it was observed that the goods transport agencies have not given such mandatory/prescribed declaration on consignment notes to the effect that they have neither availed CENVAT Credit nor availed the benefit of Notification No.12/2003-S.T. In some cases, the Goods Transport Agencies have given declaration as under on the Consignment Notes issued by them:4.1 Declaration on L.R.No.108 dated 10-11-2006 issued by M/s R.K.Builders: “We hereby declare that we have never availed the benefit under Notification No.12/2003-ST dated 20th June 2003”. 4.1.1 Thus, on the body of Consignment Note, they have declared nonavailment of benefit of Notification No.12/2003-ST dated 20-06-2003 only, whereas the declaration is silent regarding non- availment of CENVAT credit on input or capital goods or input services. 4.2 Declaration on L.R.No.3103 dated 24-02-2008 issued by M/s Jay Ambe Transport. “We hereby declare that we have availed the benefit under Notification No.12/2003-ST dated 20th June 2003” 3 4.2.1 M/s Jay Ambe Transport, Digvijaygram has given declaration on the body of consignment note No.3103 dated 24-02-2008 to the effect that they have availed benefit of Notification No.12/2003-ST dated 20-06-2003. The GTA has availed benefit of Notification No.12/2003-ST and hence they have not fulfilled the condition of Notification No.32/2004-ST dated 3-12-2004. Thus, M/s SDCCL is not entitled for the abatement under Notification No.32/2004-ST in respect of transport of goods by road service received from M/s Jay Ambe Transport. 4.3 Declaration on L.R.No.1277 dated 5-12-2006 issued by M/s Jay Ambe Transport. “We hereby declare that we have never availed the benefit under notification No.12/2003-ST dated 20th June, 2003.” 4.3.1 On the body of consignment note the ‘Goods Transport Agency’ i.e. M/s Jay Ambe Transport has declared that they have never availed benefit of Notification No.12/2003-ST dated 20-06-2003. They have not given declaration on the consignment note regarding non availment of CENVAT credit on input or capital goods or input services 5. M/s SDCCL vide their letter dated 29-07-2009 produced some copies of declarations dated 25-07-2009 obtained from the following transporters declaring that they have not availed CENVAT Credit under CENVAT Credit Rules,2004 and have not availed benefit of Notification No.12/2003.: 1. M/s Raj Transport Corp.(Guj.), Sikka, Jamnagar. 2. M/s Jay Ambe Transport, Digvijaygram, Jamnagar. 3. M/s Riddhi Infrastructure, Sikka, Jamnagar. 4. M/s Jaydeep Transport, Digvijaygram, Sikka. 5. M/s Ketan Transport, Sikka. 6. M/s R.K.Builders, Sikka. 7. M/s Ashish Roadways, Sikka. 8. M/s Shree Momai Transport, Sikka. 9. M/s Swaminarayan Vijay Carry Trade Pvt Ltd, Bhuj. 6. The exemption under Notification No.32/2004-ST dated 3-12-2004 or 1/2006-ST dated 1-03-2006 is conditional and available only if the conditions given in the said notification are fulfilled. To ascertain as to whether the Goods Transport Agencies who have provided Goods Transport service have fulfilled the conditions of the said notification, the Ministry vide Circular No. B1/6/2005/TRU dated 27-072005 has prescribed procedure that the ‘Goods Transport Agency’ should give declaration in the Consignment Note issued to the effect that neither credit on inputs/capital goods/input service has been taken nor benefit of Notification No.12/2003-ST dated 20-06-2003 has been availed. It appeared that, if such declaration in the consignment note is not given by the ‘Goods Transport Agency’, benefit of conditional notification No.32/2004-ST or 1/2006-ST is not available to the recipient of transport of goods by road service. 7. Further, M/s SDCCL had obtained general declarations on letter head of GTA from above Goods Transport Agencies who have provided services to them declaring that they had neither availed CENVAT Credit under CENVAT Credit Rules,2004 nor availed benefit of Notification No.12/2003-ST dated 20-06-2003. It appeared that such type of general declarations given on the letter head of the GTA cannot be accepted and it should be on the body of the consignment note as prescribed by the Ministry vide Circular No. B1/6/2005-TRU dated 27-07-2005. 8. From the facts detailed herein above, it appeared that M/s SDCCL had wrongly availed abatement under Notification No.32/2004-ST dated 3-12-2004 or 1/2006-ST dated 01-03-2006 deliberately without verifying the fact that Goods 4 Transport Agencies who have provided services have followed procedure prescribed vide Circular No.B1/6/2005-TRU dated 27-07-2005 regarding giving declaration in the consignment notes to the effect that they have neither availed CENVAT credit under CENVAT Credit Rules, 2004 nor availed benefit of Notification No.12/2003ST dated 20-06-2003. In some cases declaration given by GTA in consignment note are silent about whether they have availed CENVAT credit on input or capital goods or input services and only declared that they have not availed benefit of Notification No.12/2003-ST dated 20-06-2003. M/s Jay Ambe Transport, a GTA has given declaration in some consignment notes declaring that they have availed benefit under Notification No.12/2003-ST dated 20-06-2003. However, M/s SDCCL has availed abatement under Notification No.32/2004-ST dated 3-12-2004. Further most of the Goods Transport Agencies who have provided services to M/s SDCCL have not given said declaration in the consignment notes issued by them. Any exemption notification has to be construed strictly and it is the obligation of the tax payers to fulfil all pre requisites before availing any such benefit. M/s SDCCL has not taken any pains to fulfil conditions of the notification. The notice has wrongly availed abatement and paid service tax on 25% value of freight and shown in the ST-3 returns filed by them before the Service Tax department without having evidence of fulfilment of conditions as prescribed under Notification No.32/2004-ST dated 3-122004 or 1/2006-ST dated 1-03-2006 with an intent to evade payment of correct service tax. By this way M/s SDCCL has mis-declared in ST-3 returns that they have “assessed and paid the service tax and/or availed and distributed CENVAT credit correctly as per the provisions of the Finance Act, 1994 and the rules made there under” which is factually incorrect, and such mis-declaration is with an intent to evade payment of correct service tax. 9. In view of the above, M/s SDCCL was not entitled for abatement of 75% value of freight charges under the above notifications and were required to pay service tax amounting to Rs.5,62,98,601/- calculated on the 100% value of freight charges during the period Feb’2005 to March’2008 . 10. Accordingly, M/s Shree Digvijay Cement Company Ltd., Second Floor, Amola Chambers, C.G.Road, Ahmedabad were issued Show Cause Notice F.No. STC/4-01/ O & A /2010 dated 1.4.2010 whereby they were required to show cause as to why:(i) the exemption/abatement under Notification No.32/2004-ST dated 312-2004 or 1/2006-ST dated 1-03-2006 should not be disallowed and total freight value of Rs.64,06,39,658/- should not be considered as taxable value for the purpose of payment of service tax; (ii) the Service Tax , Education Cess and Higher Edu. Cess on the services provided outside India but received in India totally amounting to Rs.5,62,98,601/- (Rs.Five Crore Sixty Two Lakhs Ninety Eight Thousand Six Hundred and One Only ) for the period from February, 2005 to March, 2008 as detailed in para 6 of the Show Cause Notice should not be demanded / recovered from them under the first proviso of sub-Section (1) of Section 73 of the Finance Act, 1994, by invoking extended period. (iii) interest at the appropriate rate should not be demanded and recovered from them on the total amount of Service Tax as mentioned at (i) above under the provision of Section 75 of the Finance Act, 1994, from the due date of payment upto the actual date of payment. (iv) penalty under Section 76 of the Finance Act, 1994, should not be imposed upon them for failure to pay Service Tax within the period prescribed under Section 68 of the Finance Act, 1994, read with the Rule 6 of the Service Tax Rules,1994. 5 (v) Penalty under Section 78 of Finance Act, 1994 should not be imposed upon them for mis-declaring of value of taxable service with intent to evade payment of Service Tax. DEFENCE REPLY & PERSONAL HEARING: 11. M/s SDCCL in their defence reply dated 29.4.2010 to the Show Cause Notice F.No. STC/4-01/O&A/2010 dated 01.04.2010 interalia submitted that their Ahmedabad office was registered with the Service Tax authority under Section 69 of the Finance Act, 1994 as Input Service Distributor, in order to transfer the CENVAT credit of Service Tax accumulated in their office. They have been receiving invoices, bills, challans of various service providers addressed to their Ahmedabad office and after making payments they have been issuing proper invoices, bills and challans under Rule 4-A of the Service Tax Rules, 1994 to their manufacturing unit viz: M/s Shree Digvijay Cement Company Ltd., Digvijaygram for transfer of CENVAT credit of Service Tax, as permitted under Rule 2(m) of CENVAT Credit Rules, 2004. The said ‘‘Goods Transport Agency’ Services’, were utilised by them, for transportation of their Raw Materials, Packaging Materials, Capital Goods, Lubricating Oils, Greases, etc., from the place of their procurement to their manufacturing unit and also for transportation of finished goods, produced in their Factory, when sold on F.O.R. Destination Sale basis. Under "Reverse Charge" or "Tax Shift Mechanism", as per the provisions of Rule 2(1)(d)(v) of the Service Tax Rules, 1994, they being a Limited Company, incorporated within the meanings of the Companies Act, 1956, were liable to pay Service Tax, at appropriate rate, on the Freight Charges paid by them to the ‘Goods Transport Agency’. They submitted that the said abatement, is available to them, and they have to see that the Goods Transport Agencies have neither opted for CENVAT Credit Rules, 2004 nor for the provisions under Notification No. 12/2003 dated 20.6.2003. They submitted that in their case, the Goods Transport Agencies, have neither opted for the CENVAT Credit Rules, 2004 nor for the provisions of Notification, 12/2003-S.T., dated 20.6.2003 and hence, the said Abatement is available to them. They further submitted that they did not fall under any of the seven cases, specified under Rule 2 (1) (d)(v) of the Service Tax Rules, 1994, it is the ‘Goods Transport Agency’, which becomes liable to pay Service Tax and if, the said ‘Goods Transport Agency’, has enjoyed the provisions of Notification, 12/2003-S.T., dated 20.6.2003 or has taken CENVAT Credit, under CENVAT Credit Rules, 2004, the ‘Goods Transport Agency’, will pay Service Tax, on the gross amount of Freight and if, it has not enjoyed the said provisions, then it will pay the Service Tax, on 25% of the Freight and charge the same, to the Customer and recover from him. It is to be noted that the Notification, 32/2004-S.T., dated 3.12.2004, is applicable to both the Service Enjoyer or Service Provider, that is, to the Customer or to the ‘Goods Transport Agency’, depending upon the facts and circumstances of each case. They submitted that demand of differential Service tax, is unsustainable. Consequently and accordingly, the proposals, made for recovery of Interest and imposition of penalty, are out of place. 11.1 They further submitted that they have been filing Half Yearly S.T.-3 Service Tax Returns, with proper Central Excise/Service Tax Officer, wherein, it has been manifestly declared that they have been paying Service Tax, at appropriate rate, only on 25% of the gross amount of Freight Charges, paid by them, to a ‘Goods Transport Agency’ and therefore, allegation of suppression of fact, cannot be sustained. Exactly for the same period of dispute, two Show cause notices, have been served upon them, namely, (1) Show cause notice, vide F. No., STC104/0&A/SCN/ADC/SDC/R-9/D-II/09-10, dated 22.1.2010, involving the period from 2005-2006 to 2007-2008 for recovery of differential duty of Rs.20,16,526.00, to be adjudicated by the Joint Commissioner of Service Tax, Ahmedabad Commissionerate and (2) Show cause notice, vide F. No., STC/4-1/0&A/2010, dated 1.4.2010, involving the period, from February, 2005 to March, 2008, for recovery of 6 differential duty of Rs.5,62,98,601/- to be adjudicated by the Commissioner of Service Tax, Ahmedabad Commissionerate. This means that there are two Show cause notices, overlapping same period of dispute. This is something foreign to the provisions of the Finance Act, 1994, in as much as, both the Show cause notices, alleging wilful mis-statement or suppression of fact, on their part, which is not possible. They submitted that demand covered by the Show cause notice No., STC104/0&A/SCN/ADC/SDC/R-9/D-II/09-10, dated 22.1.2010, is already covered in the Show cause notice No., STC/4- 01/O&A/2010, dated 1.4.2010. This means that one of the two Show cause notices, is required to be set aside. Since, SCN F.No. STC- 104/0&A/SCN/ADC/SDC/R-9/D-II/09-10, dated 22.1.2010 is the earlier one , the second Show cause notice No., STC/4-01/0&A/2010, dated 1.4.2010, is certainly hit by limitation and is required to be set-aside, in toto. 11.2 a. b. c. d. e. f. g. h. i. j. k. They relied on the following judgements in support of their defence: Order-in-Appeal No. 12/2008/Commr.(A)/Raj, dated 22.l.2008 passed by Commr., C. Ex., & Cus. (Appeals), Rajkot, in respect of Electrotherm (India) Ltd. C.C.E., Rajkot V/S Advance Diesel Engineering (P) Ltd. reported in 2008 (10) S.T.R. 201 (Tri.-Ahmd.) C.C.E., Vapi V/S Neral Paper Mills P. Ltd. reported in 2009 (14) S.T.R. 374' (Tri.-Ahmd.) C.C.E., Vapi V/S Unimark Remedies Ltd. reported in 2009 (15) S.T.R. 254 (Tri.-Ahmd.) Maharaja Sathyam Industries (P) Ltd. v/s C.C.E., Salem reported in 2009 (16) S.T.R. 79 (Tri.-Chennai) Hero Cycles Ltd. V/s C.C.E., Ghaziabad reported in 2009 (16) S.T.R. 333 (Tri.-Del.) C.C.E., RAJKOT V/S Sunhill Ceramics Pvt. Ltd. reported in 2008 (9) S.T.R. 530 (Tri.-Ahmd.). C.C.E., Visakhapatnam V/S A.P. Paper Mills Ltd. reported in 2010 (17) S.T.R. 242 (Trt-Bang.) New Swadeshi Sugar Mills v/s C.C.E., & S.T., Patna. Reported in 2010 (17) S.T.R. 446 (Tri.-Kolkata). Bharat Sugar Mills v/s C.C.E., & S.T., Patna reported in 2010 (17) S.T.R. 507 (Tri.-Kolkata) Nandini Tex V/s C.C.E., Trichy. Reported in 2010 (18) S.T.R. 41 (Tri.Chennai) 11.3 A personal hearing was held on 10.2.2011 which was attended by Shri Dhawal K Shah, Advocate on behalf of M/s SDCCL. During the course of personal hearing he reiterated the submission already made by them in their reply dated 29.4.2010. He also relied upon the Gujarat High Court decision in the case of M/s Neral Paper Mills reported at 2010(20)STR 601 (Guj). Since, M/s SDCCL had submitted only nine general declarations vide their letter dated 29.7.2009 as mentioned in the show cause notice, they were requested to provide transporter wise figures of freight payments made by them during the period from February’2005 to March’2008 duly certified by their Chartered Accountants. The personal hearings fixed for 28.6.2011 and 13.7.2011 were not attended by M/s SDCCL. Hence, the personal hearing was refixed for 26.7.2011. Shri Dhaval K Shah, Advocate appeared for the personal hearing. He stated that since, the company was presently not doing any business, he could not gather the required information and requested for a month’s time for submission of the same. Accordingly, personal hearing was fixed for 26.8.2011. Shri Dhaval K Shah, Advocate vide letter dated 25.8.2011 submitted copy of a certificate dated 19.8.2011 issued by a Chartered Accountants, S. Boradia & Associates, Jamnagar and requested for fifteen days time for submission of declarations. Personal Hearing was then held on 14.9.2011 which was attended by 7 Shri Dhaval K Shah, Advocate. He gave a list of 24 transporters along with details of freight in respect of each of them. In respect of parties at Sr.No 1 to 18 of the list, he also produced copies of declarations about non-availment of cenvat credit as well as non-availment of benefit of Notification No. 12/2003-ST dated 20.6.2003 by the transporters. He requested for decision on merits. Shri Dhaval K Shah, Advocate again vide letter dated 23.9.2011 submitted total nine original declarations along with the original certificate dated 19.8.2011 issued by a Chartered Accountants, S. Boradia & Associates, Jamnagar giving the names of 24 transporters along with details of freight paid to them for the period 1.2.2005 to 31.3.2008. DISCUSSION & FINDINGS: 12. I have carefully gone through the subject show cause notice, the defence reply filed by M/s SDCCL and the submissions made by them during the course of personal hearing. 13. I find that the issue involved in this case is whether abatement of 75% from the taxable value of the taxable service of ‘Transport of goods by Road’ for the purpose of payment of Service Tax, as provided under Notification No. 32/2004-ST dated 03.12.2004 and Notification No. 1/2006-ST dated 01.03.2006, is available to M/s SDCCL when the Consignment Notes issued by the concerned transporters (GTAs) did not contain mandatory/prescribed declaration to the effect that neither credit on input or capital goods used for provision of service has been taken by them nor the benefit of Notification No. 12/2003-ST dated 20.06.2003 has been taken by them. 14. I observe that Government vide Notification No. 32/2004-ST dated 03.12.2004 and 1/2006-ST dated 01.03.2006 has exempted the taxable service provided by a Goods Transport Agency to a customer, in relation to transport of goods by road in a goods carriage, from so much of the service tax leviable thereon under Section 66 of the Finance Act, 1994, as is in excess of the service tax calculated on a value which is equivalent to twenty-five per cent of the gross amount charged from the customer by such Goods Transport Agency for providing the said taxable service. However, it is provided that this exemption shall not apply in such cases where :(i) the CENVAT credit of duty on inputs or capital goods or the CENVAT credit of service tax on input services, used for providing such taxable service, has been taken under the provisions of the CENVAT Credit Rules, 2004; or (ii) the service provider has availed the benefit under the Notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 12/2003-Service Tax dated the 20th June, 2003 [G.S.R. 503 (E), dated the 20th June, 2003]. 15. It is true that the M/s SDCCL themselves are not ‘Goods Transport Agency’ but have availed the services of goods transport agency for carrying their goods. In Rule 2(1)(d)(v) of Service Tax Rules, 1994, the person liable for paying service tax in relation to taxable service provided by a ‘Goods Transport Agency’ are enumerated as follows :(a) (b) (c) (d) (e) any factory registered under or governed by the Factories Act, 1948 (63 of 1948); any company established by or under the Companies Act, 1956(1 of 1956); any corporation established by or under any law; any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any law corresponding to that Act in force in any part of India; any co-operative society established by or under any law; 8 (f) any dealer of excisable goods, who is registered under the Central Excise Act, 1944 (1 of 1944) or the rules made there under; or (g) any body corporate established, or a partnership firm registered, by or under any law. Thus, in view of the above, as M/s SDCCL is a factory registered under Factories Act, 1948, they are the person liable for paying service tax on freight paid for transportation of goods. 16. In case where the consignor or consignee of goods is any person specified under Rule 2(1)(d)(v) of Service Tax Rules,1994, who pays or is liable to pay freight either himself or through his agent for the transportation of such goods by road in a goods carriage, he would be the person liable for paying service tax in relation to taxable service provided by a goods transport agency. I observe that admissibility of abatement of 75% in taxable value of goods transport by road to consignor or consignee who is liable for paying service tax, is dependent on fulfillment of the aforesaid two conditions prescribed under the said notifications, by the goods transport agency. Under this peculiar mechanism of payment of service tax where admissibility of abatement to one person (consignor or consignee) is dependent on the fulfillment of conditions by the other person (goods transport agency), the C.B.E.C. was requested to prescribe the procedure as to how it should be confirmed by such consignor or consignee that the goods transport agency has not availed credit or benefit of Notification No. 12/2003-ST dated 20.6.2003. C.B.E.C. vide Para 31.1 of the Instruction letter No. B1/6/2005/TRU dated 27.07.2005 clarified that in such cases, a declaration by the goods transport agency in the consignment note issued, to the effect that neither credit on inputs or capital goods used for provision of service has been taken nor the benefit of Notification No. 12/2003-ST dated 20.6.2003 has been taken by them may suffice for the purpose of availment of abatement by the person liable to pay service tax. The said para is reproduced as under: “31.1 An abatement of 75% in taxable service of goods transport by road is available on the condition that the goods transport agency has not availed credit on inputs and capital goods used for providing taxable service and has also not availed benefit of notification No. 12/2003-Service Tax, dated 20.6.2003 (vide Notification No. 32/2004-Service Tax, dated 3.12.2004.) It has been requested that in cases where liability for tax payment is on the consignor or consignee, the procedure as to how it should be confirmed by such consignor or consignee that the goods transport agency has not availed credit or benefit of notification No. 12/2003-Service Tax may be prescribed. In such cases it is clarified that a declaration by the goods transport agency in the consignment note issued, to the effect that neither credit on inputs or capital goods used for provision of service has been taken nor the benefit of notification no. 12/2003-Service Tax has been taken by them may suffice for the purpose of availment of abatement by the person liable to pay service tax.” 17. I find that M/s SDCCL vide their letter dated 25.8.2011 and 23.9.2011 have submitted a certificate issued by Chartered Accountants, S.Boradia & Associates, Jamnagar giving names of the 24 transporters and the amount of freight to each of them totalling to Rs. 64,06,39,658/- i.e. the freight amount as per the show cause notice. The said certificate is scanned and reproduced below: 9 17.1 I find that it is mentioned in the show cause notice that M/s SDCCL vide their letter dated 29-07-2009 has submitted copies of the required declarations with regard to the transporters listed at Sr.No. 1 to 9 above. Out of these 9 declarations, there is no dispute with regard to 8 declarations which are listed at Sr No. 1 and 3 to 9 in the above certificate. The dispute is with regard to the declaration of the transporter M/s Jay Ambe Transport listed at Sr.No 2 of the above certificate as there was contradiction with regard to availment of benefit under Notification No. 12/2003-ST dated 20.6.2003 in two Lorry Receipts cited at para no. 4.2 and 4.3 above. On the body of the one it was mentioned that they had availed the benefit of Notification No. 12/2003-ST dated 20.6.2003 whereas on the body of the other it was mentioned that they had not availed the benefit of Notification No. 12/2003-ST dated 20.6.2003. Both the LRs were also silent about the availment/non-availment of Cenvat credit. M/s SDCCL eventhough had furnished photo copy of the declaration given by the said transporter on his letter head, they could not clarify the said contradiction in their submissions. In absence of the same, the said declaration is not accepted and therefore, I find that M/s SDCCL has failed to comply with requirements of the above said Instruction letter No. B1/6/2005/TRU dated 27.07.2005 with regard to the freight amount of Rs. 3,52,06,116/- pertaining to the said transporter. The freight amount pertaining to the 8 transporters which are listed at Sr No. 1 and 3 to 9 in the above Chartrered Accountants certificate is Rs. 10 45,00,97,143/-. I further find that M/s SDCCL vide their letter dated 23.9.2011 have submitted such declarations in original given by the transporters on their letter heads, listed at Sr No. 10 to 18. The freight amount pertaining to these 9 transporters listed at Sr No. 10 to 18 as shown in the above Chartrered Accountants certificate is Rs. 14,20,52,296/-. I find that requirements of the above said Instruction letter No. B1/6/2005/TRU dated 27.07.2005 have been substantially complied with regard to the freight amount of Rs. 59,21,49,439/- out of the total freight amount of Rs. 64,06,39,658/- in the show cause notice. In view of the above, the conditions of the Notifications also stand fulfilled and M/s SDCCL are thus eligible for abatement on the freight amount of Rs. 59,21,49,438/- as provided under Notification No. 32/2004ST, dated 03.12.2004 and Notification No. 1/2006-ST, dated 01.03.2006. 17.2 I also find that M/s SDCCL could not furnish any declarations from the transporters listed at Sr No. 19 to 24. The freight amount pertaining to these 6 transporters listed at Sr No. 19 to 24 as shown in the above Chartrered Accountants certificate is Rs. 1,32,84,104/-. Therefore, M/s SDCCL has failed to comply with requirements of the above said Instruction letter No. B1/6/2005/TRU dated 27.07.2005 with regard to the freight amount of Rs. 4,84,90,220/- (Rs. 1,32,84,104/+ Rs. 3,52,06,116/- ) out of the total freight amount of Rs. 64,06,39,658/- in the show cause notice. In view of this M/s SDCCL are not eligible for abatement on the freight amount of Rs. 4,84,90,220/- as provided under Notification No. 32/2004-ST, dated 03.12.2004 and Notification No. 1/2006-ST, dated 01.03.2006 and the said freight amount is the taxable value of the ‘Goods Transport Agency Service’ for the purpose of payment of service tax. 18. In this regard, I place reliance on the judgment in the case of Commissioner of Central Excise, Vapi V/s. Neral Paper Mills P. Ltd. [2009 (14) S.T.R. 374 (Tri. – Ahmd.)]. In the aforesaid judgment, Hon’ble CESTAT has referred to Para 7 and 8 of the Commissioner (Appeals) order, wherein he has held as under :“7. The appellants have mainly argued that declaration made by the GTAs on their letter heads were sufficient to meet the requirement of the notification. In this respect I find that in Notification No. 32/2004-S.T. dt. 3-12-2004, abatement of 75% has been provided to the appellants subject to the condition that Goods Transport agency has not availed credit on inputs and capital goods used for providing taxable service and has also not availed the benefit of Notification No. 12/2003-S.T. dt. 20.6.2003. No procedure or manner has been prescribed in the notification to see whether the said conditions are being complied with or not, however the board has clarified vide its circular No. B1/6/2005-TRU dt. 27-7-2005 (Para 31) that a declaration by the GTA on the body of the consignment note may be suffice in this regard. I find that Board’s above circular is only clarificatory in nature and does not prescribe anything not even the procedure / requirement for availing the said credit. It only clarfies that a declaration by the GTA to this effect in consignment note may suffice for the purpose of availment of abatement. It does not mean that the said declaration cannot be given by other means. The said requirement is not mandatory. From the show cause notice itself I find that the unit had the copies of separate declaration on the letter head of GTAs and the same were produced to the Audit party. Thus I find that the appellants can be said to have sufficiently met with the Board’s above said clarification. 8. I also find that exemption is provided by way of notification and the Board can prescribe the procedure for availing the benefit of the said exemption notification. Further in a catena of decisions, Hon’ble Tribunal has held that substantial benefit cannot be denied for minor procedural lapses. Also, I find that nowhere in the impugned order, it has been alleged or held by the adjudicating authority that the GTA in this case has availed credit on 11 inputs and capital goods used for providing taxable service or has availed benefit of Notification No. 12/2003-S.T., dated 20.6.2003. Therefore, I conclude that the impugned order denying the benefit of Notification No. 32/2004-S.T., dated 3-12-2004 is not correct in law.” 18.1 After referring to the order of the Commissioner (Appeals), Hon’ble CESTAT held that the requirement of declaration is only procedural and there is substantial compliance with the requirement of the Notification and it did not find any reason to interfere with the order of the Commissioner (Appeals). 18.2 I further observe that Hon’ble Gujarat High Court in the case of Commissioner of Central Excise, Customs & Service Tax V/s. Neral Paper Mills Pvt. Ltd. [2010 (20) S.T.R. 601 (Guj.)] dismissed the appeal filed against the aforesaid decision of the Hon’ble CESTAT. Hon’ble Gujarat High Court has also observed that the Commissioner (Appeals), in his order, at length discussed this issue and found that the exemption is provided by way of notification and the Board can prescribe the procedure for availing the benefit of the said exemption notification. Further, the said order of the Honourable Gujarat High Court has been accepted by the Department as reported by the Assistant Commissioner of Central Excise, Customs and Service Tax, Vapi vide letter F.No.V(Ch.48)Vapi-09/Law/09-10 dated 17.03.2011. 19. I also place reliance on the two orders, both dated 18.2.2011 of Hon’ble High Court of Gujarat in the matter of Tax Appeals No. 523/2010 and 524/2010 in the case of Commissioner of Service Tax Ahmedabad V/s Sirhind Steel Ltd and Shah Alloys Ltd respectively. Vide the aforesaid two orders, the appeal filed by the department has been dismissed and both the orders have been accepted by the department. The issue in both the above referred cases was the same as that of the present show cause notice. Joint Commissioner of Service Tax had confirmed the demand of service tax along with penalty. The Commissioner (Appeals) however, had allowed the respective appeal of the aforesaid two assessees when they produced some invoices containing endorsement and in some cases produced general declarations on the letterheads of the goods transport agencies. Being aggrieved, the Department had filed appeals in the Hon’ble CESTAT, Ahmedabad, which were rejected vide Order No. A/1814/WZB/AHD/09 dated 6.8.2009 and Order No. A/1890/WZB/AHD/09 dated 13.8.2009. The Department had not accepted the above referred orders and preferred the appeal with the Hon’ble High Court of Gujarat which were dismissed as discussed above. 20. I also place reliance on the judgment of Hon’ble CESTAT in the case of Commissioner of Central Excise, Vapi V/s Unimark Remedies Ltd. [2009 (15) S.T.R. 254 (Tri.-Ahmd.)] and in the case of Sri Venkata Balaji Jute (P) Ltd. V/s. Commissioner of Central Excise, Visakhapatnam [2010 (19) S.T.R. 403 (Tri.-Bang.)] Andhra Pradesh Paper Mills Ltd V/s CCE Vishakhapatnam [2010 (19) S.T.R. 557 (Tri. - Bang.)], wherein it has been held that if the declaration is filed, to the effect that neither credit has been taken nor the benefit of notification No. 12/2003-Service Tax has been taken, though not in consignment notes consignment-wise, the benefit of Notification can not be denied for a technical lapse. 21. From the aforesaid decisions, it is evident that since the exemption is provided by way of notification subject to fulfillment of conditions provided under the said notification, the Board can prescribe the procedure for the purpose of availing the benefit of the said exemption notification. However, the requirement under which the goods transport agency is to give declaration on each consignment note to the effect that neither credit has been taken nor the benefit of notification No. 12/2003Service Tax has been taken, is not mandatory. The said declaration to the effect that neither credit has been taken nor the benefit of notification No. 12/2003-Service Tax 12 has been taken, can be given by other means, such as on letter head of Goods Transport Agency. There is no allegation in the show cause notice that the GTA in this case have availed credit on inputs or capital goods used for providing the taxable service or have availed the benefit of Notification No. 12/2003-ST dated 20.6.2003. 22. I also find that, the C.B.E.C. vide letter F.No.137/154/2008-CX.4 dated 21.08.2008, in partial modification of the instructions contained in Circular No. B1/6/2005-TRU dated 27.07.2005, has clarified that the benefit of availment of abatement may also be extended in past cases if the taxpayers produce a general declaration from the GTA to the effect that neither credit on input or capital goods used for the provision of service has been taken nor the benefit of Notification No. 12/2003-ST has been taken by them. 23. In view of the above facts, Case laws relied upon by me as well as by M/s SDCCL, CBEC Instructions/circulars and the Notifications aforesaid, I find that the demand of service tax against M/s SDCCL on the freight amount of Rs. 59,21,49,438/cannot be sustained to this extent and consequently, the proposals for penalty and interest to that extent also would not survive. The demand on the freight amount of Rs. 4,84,90,220/- is only sustainable. Since M/s SDCCL could not give the year wise bifurcation of freight amount, the service tax of Rs. 59,93,391/- required to be recovered from them under proviso to Section 73(1) of the Act is calculated on the above value by applying the rate of 12.36%. 24. As regards the allegation of suppression of facts and invoking the extended period with regard to the short payment of service tax is concerned, the phrase implies that withholding of information is suppression of facts. P. Ramanatha Aiyar’s Concise Law Dictionary [1997 Edition Reprint 2003 – page 822] defines the phrase lucidly and accurately as – Where there is an obligation to speak, a failure to speak will constitute the “suppression of fact” but where there is no obligation to speak, silence cannot be termed “suppression”. It is manifestly clear from this that intention to evade payment of duty is implied in the suppression of facts. Since M/s SDCCL are liable to self assess the liability to pay service tax, they had an obligation to furnish the correct and complete information and the value of services whether taxable or otherwise. I find that despite clarifications by the Board, M/s SDCCL the said service recipients have contravened the provisions of Section 67 of the Finance, Act, 1994 in as much as, they failed to determine the correct value of taxable services received by them and Section 68 of the Finance Act, 1994 read with Rule 6 of the Service Tax Rules, 1994, in as much as they failed to determine and pay the correct amount of service tax. 25. I further observe that in the present system of self-assessment documents like invoices and other transaction details are not supplied to the Department. Moreover, the said assessee did not furnish the required details such as consignment notes etc. showing the taxable value to the Department, the intention will have to be believed as that of evasion. The ST-3 returns are arithmetical in nature and once the details/documents are not submitted to the Department, it amounts to mis-declaration or suppression which is rightly invoked in the case before me. It is also the contention of M/s SDCCL that for the same peiod of dispute two show cause notices invoking the extended period have been issued one dated 22.1.2010 for the period 2005-06 to 2007-08 by the Additional Commissioner and the second this present one dated 1.4.2010 for the period from February’2005 to March’2008 and therefore, the present show cause notice is hit by limitation and is required to be set aside. The aforesaid contention is not correct as the show cause notice issued by the Additional Commissioner is based on the reconciliation of expenditure on account of freight charges shown in the balance sheet/freight ledger with the expenditure declared in the corresponding ST-3 returns for the period 2005-06 to 2007-08. Whereas, the present show cause notice is issued for withdrawal of abatement benefit 13 claimed by M/s SDCCL and the demand is based on the figures of ST-3 returns. Thus facts of both the show cause notices are different and issuance of one cannot lead to non issuance of the other. I, therefore, conclude that the element of suppression with intent to evade payment of service tax is conspicuous by the peculiar facts and circumstances of the case as discussed above. In view of the above discussion and findings, the ratio of cases relied upon by the said service provider can not be applied in the case before me. 26. I am convinced that had the short payment of service tax not been detected by the service tax authorities, it would have gone undetected. Therefore, this is a case of improper assessment amounting to deliberate non-declaration and suppression of vital information with a willful intention to evade payment of service tax. Accordingly, the invoking of extended period under proviso to Section 73(1) of the Act in the case before me is fully justified. 27. I now take up the issue of imposition of penalty under section 76, and 78 of the Act. 28. As regards the issue of imposition of penalty under Section 76 of the Finance Act, 1994, I observe that penalty under Section 76 of the Act is for failure to pay service tax within the stipulated time period as prescribed under Section 68 of the Finance Act, 1994 read with Rule 6 of the Service Tax Rules, 1994. M/s SDCCL has failed to pay service tax on the freight amount of Rs. 4,84,90,220/- within the stipulated time period.I hold them liable to penalty under Section 76 of the Finance Act, 1994. 29. As regards imposition of penalty under Section 78, I find that as M/s SDCCL has suppressed the facts with intention to evade payment of service tax, penalty under Section 78 of the Finance Act, 1994 is mandatorily imposable as has been held by the Apex court in the case of Dharmendra Textile Mills Ltd-2008 (231) ELT 3 (SC) and Rajasthan Spinning & Weaving Mills Ltd-2009 (238) ELT 3 (SC). Therefore, I hold that penalty is imposable on the said assessee under Section 78 of the Finance Act, 1994. 30. As regards imposition of simultaneous penalty, I place my reliance on the judgment of Hon’ble High Court of Kerala in the case of Assistant Commissioner of Central Excise v. Krishna Poduval as reported at [2006] 3 STT 96 (KER) which is aptly applicable to the present case. I find that the imposition of penalty under sections 76 and 78 of the Act is for non payment of service tax and suppression of value of taxable service respectively which are two distinct and separate offences attracting separate penalties. I find that M/s SDCCL has committed both the offences and therefore penalties under section 76 and 78 of the Finance Act, 1994 are imposable on M/s SDCCL. 31. In view of the foregoing discussion, I pass the following order: ORDER i. I order to consider amount of Rs. 4,84,90,220/- (Rupees Four crore, eighty four lakh ninety thousand two hundred and twenty only) of freight amount as taxable value under the category of “Goods Transport Agency Service”; ii. I confirm the demand of service tax of Rs. 59,93,391/- (Rupees Fifty nine lakh ninety three thousand three hundred and ninety one only) on the above taxable value and order to recover the same from M/s SDCCL under proviso to Section 73(1) of the Finance Act,1994; 14 iii. I order to recover interest on the above confirmed demand of Rs. 59,93,391/(Rupees Fifty nine lakh ninety three thousand three hundred and ninety one only) at the prescribed rate from M/s SDCCL under Section 75 of the Finance Act, 1994; iv. I impose penalty of Rs.200/- (Rupees Two hundred only) per day for the period during which failure to pay the tax continued, upon M/s SDCCL under Section 76 of the Finance Act, 1994, for the period upto 17.4.2006; I impose penalty of Rs.200/- (Rupees Two hundred only) per day from 18.4.2006 to 31.3.2008 during which failure to pay the tax continued, or at the rate of 2% of such tax, per month, whichever is higher, starting with the first day after the due date till the date of actual payment of the outstanding amount of service tax upon M/s SDCCL under Section 76 of the Finance Act, 1994; provided further that the amount of penalty payable in terms of this section shall not exceed Rs. 59,93,391/- (Rupees Fifty nine lakh ninety three thousand three hundred and ninety one only) the service tax payable by M/s SDCCL. v. I impose penalty of Rs. 59,93,391/- (Rupees Fifty nine lakh ninety three thousand three hundred and ninety one only) on M/s SDCCL under section 78 of the Finance Act, 1994. In the event of M/s SDCCL opting to pay the amount of service tax along with all other dues as confirmed and ordered to be recovered, within thirty days from the date of communication of this order, the amount of penalty liable to be paid by them under Section 78 of the Finance Act, 1994 shall be 25% of the said amount. However, the benefit of reduced penalty shall be available only if the amount of penalty is also paid within the period of thirty days from the communication of this order, otherwise full penalty shall be paid as imposed in the above order. vi. I drop the demand of service tax of Rs.5,03,05,210/- (Rupees Five crore three lakh five thousand two hundred and ten only) on the income of Rs. 59,21,49,438/- (Rupees Fifty nine crore, twenty one lakh forty nine thousand four hundred and thirty eight only). -SD/- 27.10.11 (A.K.Gupta) Commissioner Service Tax, Ahmedabad. F.No. STC/4-01/O&A/2010-11 By RPAD Date: 27.10.2011. To, M/s Shree Digvijay Cement Company Ltd., Second Floor, Amola Chambers, C.G.Road, Ahmedabad Copy to: 1. 2. 3. 4. The Chief Commissioner, Central Excise & Service Tax, Ahmedabad Zone, Ahmedabad. The Assistant Commissioner, Service Tax Division II, Ahmedabad. The Superintendent, Service Tax, Range IX, Division II, Ahmedabad. Guard file.