Interest Rates and Business Cycles

advertisement

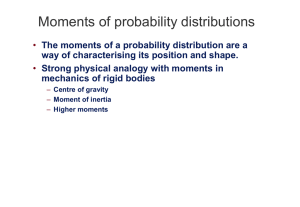

Interest Rates and Business Cycles Fluctuations: a Focus on Higher Moments Andrea Beccarini, University of L’aquila, Italy1. Abstract This work aims at analysing the relationships between market interest rates and the business fluctuations. Asymmetries in the business cycle affect saving decisions of agents and interest rates. The relationships between interest rates and the expected value, the variance, the skewness and the kurtosis of the business cycle are demonstrated. The process for the business cycle variable is estimated by a Markov-switching model which allows explicitly to consider the alternation of the business cycles phases. Afterwards, conditional, time-varying moments of the business cycles are calculated. Then, these conditional moments are used as regressors for interest rates. JEL Classification: D91, E32, E43. Key words: Real Interest Rates, Business Fluctuations, Asymmetry, Markov-switching models. 1 Address for correspondence: Andrea Beccarini, Department of Economic Systems and Institutions, University of L'Aquila, Piazza del Santuario, 19, I-67040 Roio Poggio (AQ), Italy. Tel. Number: +39 0746 483600. E-mail: fpbec@tin.it. 1 Introduction A large literature has documented the presence of non-linearities in the market interest rates. One kind of non-linearities seems to be particularly important and emerges from the presence of the so-called regimes or states which may alternate, for example, according to a Markov-chain process. On the light of the empirical evidences and the theoretical ground which both support the presence of regimes in the interest rates, this paper has a twofold objective. Firstly, it provides a further theoretical foundation for the phenomenon in question which is based on an intertemporal maximisation problem of the representative agent dealing with aggregate consumption (C-Capm). The assumption of rationality embedded in that model suggests to take into account not only the first two moments of consumption but to look at higher moments as well, consistently with the consideration of all relevant information which is implicit in the rationality property. The first-order condition of the above maximization problem is expanded and it has been found that higher moments, with a decreasing weight, affect saving and consumptions decisions, hence interest rates. It has been argued that moments, higher than the second, may be a precious information instrument for rational expectation agents. Secondly, the focus is on how to measure these conditional moments, especially the third moment of a time-series which is a priori, highly suspected to embed switching parameters. In fact, consumption or other related variables may follow the business cycles fluctuations. After having assumed an appropriate Markov-switching model (MSM) for the business cycle variable, consistently with Timmerman (2000), the time-series of the relevant moments are constructed, by the means of the estimated parameters. As stressed in Timmerman (2000), in some models, the variance of time-series which embeds some regimes may not simply be a weighted average of the variances proper to regimes but there is also another term which captures the so-called “jump effect” which occurs when switching among regimes. The focus is also on the importance of both the risk aversion and rationality property of the representative agent who prefers a positive asymmetry of his/her consumption. In the developed context one is able to test the validity of some well-known theories dealing with consumption, that is the Precautionary Saving theory of Leland (1968) and the Permanent Income Hypothesis of Friedman (1957). The related literature is divided in two main strands. The first one focuses on the statistical detection of regimes in interest rates, in particular on the short term interest rates. One may quote Ang and Bekaert (2002a, 2000b), Bansal et all (2002) respectively for short-term interest rates and for the entire term structure; Garcia et all (1996) for the real interest rates. They often detect two or three regimes in the interest rates with a transition probability among regimes which can be constant across time or varying with the level of the lagged interest rate. The second strand provides an economic justification of this phenomenon, searching the causes in other 2 macro-variables. It has been argued that either monetary policy regimes or business cycles phases influence either inflation expectations or real interest rates. A micro-foundation of this phenomenon may rely on the different price flexibility or on transmission channels of the monetary policy in a context of asymmetric information; see, for example, Cover (1992), Garcia et all (1995), Morgan (1993), Ravn et all (1996) and Weise (1999). As regards the literature of higher moments, see Guedhami et all (2005) and the quoted references, in particular for the relationship between the conditional skewness and financial variables. This paper is organized as follows. The first paragraph provides a microeconomic foundation for the presence of asymmetry and kurtosis of the business cycles affecting interest rates. In the second paragraph, a way for constructing the time series of the relevant conditional moments is described. In the third one, empirical evidences for the Euro area are reported. Finally, after an appendix, some conclusions follow.2 1. Technical notes Consider the first-order condition of an optimisation problem of a representative agent who faces a two-periods maximisation problem: u ' (c t n ) E (1 rt ,t n ) 1 u ' ( ct ) Where,u'(.)ctnr, are,respectively,thediscountfactor,themarginalutilityoftherepresentativeagent,consumptionattimetandt+nandtheholdingperiodreturnofa security held n times. Considering a risk-free investment and taking out of the expected value operator what is fixed, then one has: u ' ( ct ) E[ u' (ct n )] Pt , n Now, assuming that the utility function u(.) be indefinitely differentiable, consider the Taylor expansion of u ' (ct n ) around the conditional expected value of consumption ct n : u ' (c t n ) u' (c t n ) u ' ' (c t n )( ct n ct n ) 1 u' ' ' ( ct n )(c t n ct n ) 2 2 This paper is based on a chapter of the author’s PhD dissertation at the university LUISS Guido Carli (Rome). 2 3 1 iv 1 v u ( ct n )(c t n c t n ) 3 u (c t n )( c t n ct n ) 4 6 24 (3) which yields: E[u'(ctn)] u ' ' ( ct n ) E[(c t n c t n )] 1 u' ' ' ( ct n ) E[(c t n ct n ) 2 ] 2 (4) 1 iv 1 u ( ct n ) E[(c t n c t n ) 3 ] u v (c t n ) E[( ct n ct n ) 4 ] 6 24 Now notice that, in equation (4), the term which multiplies the second derivative is zero and the terms multiplying the remaining derivatives are, respectively, the variance of consumption in t+n and higher moments. Equation (4), basically states that the stochastic discount factor is also a function of the variance, the skewness and the kurtosis of future consumption, provided an appropriate shape of the utility function. Substituting into the first-order condition, one obtains: Pt, n u ' ( ct ) 1 u ' ( c ) u ' ' ( c ) E [( c c )] u ' ' ' (c t n ) E[( c t n ct n ) 2 ] t n t n t n t n 2 1 1 u iv ( ct n ) E[(c t n c t n ) 3 ] u v (c t n ) E[( ct n ct n ) 4 ] 6 24 (5) For every maturity n, one can model the relative price as a function of the central moments of consumption at t+n, provided that the partial derivatives of the utility function, up to the fifth order, are different from zero. Equation (5) embeds the precautionary saving theory; in fact, assuming the third partial derivative of u(.) be positive, an increase in the variance of consumption, induces the agent to save more pushing up the bond’s price. This equation states more. The agent may care not only about the expected consumption and the uncertainty (volatility) around it, but also whether the mass probability concentrates more on higher levels of consumption rather 4 than lower levels. When the agent expects an economic recession more likely than an expansion, there is a reason more to save and independently of the perception of the uncertainty of the future, represented by a volatility. Considering the third moment as an indicator of the asymmetry of the probability distribution of the future consumption, the bond’s price must be affected by this measure. Resuming, by testing equation (5) one can implicitly verify the following argumentations: - Rationality of financial markets implicit in the maximization problem and in the use of all available information. - Market risk-aversion which is represented by higher order utility function derivatives, different from zero. - Precautionary Saving Hypothesis which is described by the significance of the second moment. Consider, finally the relationship between equation (5) and the Permanent Income Hypothesis. One of the implications of this theory is that marginal utility of consumption is constant along time3. As can be seen below, this property may be verified in the empirical section by looking at the stability of the parameters in question; in fact, if prices or interest rates are regressed (by the OLS) on conditional moments, then by virtue of equation (5) the derivatives of the utility function correspond to the estimated parameters. Alternatively, a model with time-varying parameters (like a MSM) may be used and the validity of this model may be considered as a proof against the Permanent Income Hypothesis. The meaning of the business cycle variable’s asymmetry As can be seen in equation (5), the third moment is weighted by the derivative of the fourth order of the utility function which is negative if the representative agent is risk-adverse. Hence, according to that equation an increase of the third moment causes a fall in security prices. In order to clarify this relationship, one can think the risk-adverse agent as the one whose sensitivity for strong recessions is higher than for the other states of the economy. Besides, an increase of the third moment implies a redistribution of the mass probability from very low values of the state variable to very high values and from small high values to small low values of the state variable. A graphical representation of this concept is provided in graph 1. Now, risk-aversion implies a preference for a positive third moment of the state variable’s distribution because it implies a preference of swapping between a strong recession in favour of a strong 3 This property implies that higher order derivatives are also constant along time. 5 expansion even though with the renouncement of a low expansion for a low recession. Graph 1. A symmetric and an asymmetric distribution. D1 Strong Recession Distribution D0 D1 D0 Rec. Expans. Expected Value E[x]=0 E[x]=0 Strong Expansion Variance Var[x] Var[x] Third Moment E[(x-E(x))^3]=0 E[(x-E(x))^3]>0 In sum, an increase of the third moment implies a better situation for the risk-adverse agent whose propensity to save decreases, letting prices to fall and interest rates to go up. Notice further, that rationality implies to use of all possible information the agents have at their disposal. Under a statistical point of view, the complete information about a random variable is provided only by its distribution and not only by the first and the second moments, unless in the case of a Gaussian distribution. Nevertheless, the knowledge of the entire set of moments is equivalent to the knowledge of the distribution function. However, considering the presence of alternating phases in the economy, it is implausible to think of the distribution of the state variable as symmetric, hence Gaussian. 2. Statistical models for the business cycle variable One can model the third and the forth moments by an appropriate regimeswitching specification. Following Timmermann (2000),4 one could specify a Markov-switching process for consumption or for other macro4 Notice that, differently from Timmermann (2000), here, the moments are considered as conditional. 6 factors that are eligible to enter the utility function. Two MSMs are performed, namely the model with switches in mean (SM) and the autoregressive (of order 1) model with switches in mean, labelled as SWAR(1). The SM model has the following features: y t st et t 1,2,..., T et iid ( 0, s2t ) with the following specifications: St 1 (1 st ) 2 st S2t 12 (1 s t ) 22 s t (7) st 0,1 Re gime 1,2 P r s 0 | s 0 p P r s 1 | s 1 p t t 1 1 1 t t 1 2 2 where y t is the dependent variable; st is the dichotomous latent variable that allocates observations in the two specified regimes; 1 , 2 are the conditional means of regimes 1 and 2, respectively; 12 , 22 are the conditional variances of regimes 1 and 2, respectively; p11 , p22 are the transition probabilities of remaining in regime 1 and 2 at each time, having assumed the regime 1 and 2 for the previous period, respectively. Furthermore, t will indicate the inferred probability for the process to stay in regime 1, for the time t5. The SWAR(1) model has the following specification: y t st ( y t1 st 1 ) et t 1, 2,..., T (8) et iid ( 0, ) 2 st where is the autoregressive parameter, independent of switches; system (7) also describes the means, the variances and the transition probabilities. 5 In other terms, this is the probability of the latent state variable s t to occur. 7 It has been already stated that, for the two-regimes SM model6 of equations (6) and (7), the unconditional moments (unconditional with respect to regimes and conditional with respect to the remaining information) are the following: t1(1)2 (9) ( 1 ) ( 1 ) ( ) 2 2 t t1 2 t 2 t t 2 1 2 (10) where the third addend captures the so-called “jump effect”; the third central moment (for y) is: 3 2 2 2 2 E [ ( y ) ] ( 1 ) ( ) [ 3 ( ) ( 1 2 ) ( ) ] (11) t t t t 1 2 1 2 t 2 1 Recalling that the approximation by the Taylor series expansion is conceived around the expected value of consumption at time t+n, this quantity is substituted out by observing that: c E [ c ] ( 1 )2 t n t t n t1 t The next step is to substitute the above moments7 into equation (5) in order to obtain: Pt, n u ' (c t ) u ' ( t 1 (1 t ) 2 ) 1 2 2 2 u' ' ' ( t 1 (1 t ) 2 )[1 (1 t ) 2 t (1 t )( 1 2 ) ] (12) 2 1 u iv ( t 1 (1 t ) 2 ) 6 2 2 2 2 [ t (1 t )( 1 2 )[3( 1 2 ) (1 2 t )( 2 1 ) ]] 6 7 For the moments of the SWAR(1) model, the reader may refer to Timmermann (2000). Bearing in mind that they are only valid for the SM model. 8 Which is only a function of the regime-switching parameters and the present consumption. It has been already noticed that, in principle, the derivatives of every order of the utility function are regime-dependent, hence time-varying. So, the model reveals itself to be highly non-linear. However, one may attempt to regress prices or interest rates (by the means of the OLS) on the conditional moments (equations (9), (10) and (11)) and on a constant relying on the assumption that the following ratios (13) are constant: u ' ( ct ) u ' ( t 1 (1 t ) 2 ) 1 u' ' ' ( t 1 (1 t ) 2 ) 2 u ' (c t ) (13) 1 u iv ( t 1 (1 t ) 2 ) 6 u' (c t ) A second approach is based on the observation that the ratios of (13) are all regime dependent, hence one may attempt to regress prices or interest rates on the conditional moments but by a MSM model as well. If these assumptions turn out to be implausible then the Kalman filter may be an alternative methodology to overcome the problem. In this work, the first two approaches are followed. For the empirical part, the real rate of growth of Gdp is assumed to be the variable entering the utility function u(.). This is consistent with its high correlation with consumption and the praxis of substituting out consumption, like in I-CAPM models, in favour of other macroeconomic factors that better represent the economy as a whole. Also, the literature for the regime-switching process of the GDP is huge. A two-regime specification is then consistent with the recession and expansion phases of the economy. Resuming, one can proceed, firstly, by constructing the time-varying moments that derive from the regime-switching specification of the chosen macroeconomic factor; then, these variables are considered as regressors for the interest rates (or bond prices). One potential problem to be faced is the high non-linear relationship between interests rates and the conditional moments; this may cause the instability of the parameters of the interest rate (OLS) regression. To overcome this problem a regime-switching specification also for the first difference of interest rate is used. 9 3. Empirical evidence The Euro area quantities are considered8. The first difference of real interest rates is regressed on the relevant moments of the rate of growth of the real Gdp (quarterly change). Both the OLS and the MSM, for this regression, are attempted. It is important to stress that a reliable verification of the theoretical model depends on a good estimate of the conditional moments since they are used as regressors. That is the reason why two MSMs (SM ad SWAR(1)) are also attempted to estimate the conditional moments of the Gdp. This paragraph is divided in two parts. First, by the OLS, interest rates are regressed on conditional moments obtained by the SM model and then they are regressed on the SWAR(1) moments. The second part also consists of two regressions, but performed by MSMs, of interest rates on conditional moments, assuming, now, a tworegimes process for their parameters9. The following table 1. should clarify this framework. Table 1. Regressions for the Euro area real interest rates. OLS MSM Dependent Interest Rates Interest Rates Interest Rates Interest Rates Variable (First Diff.) (First Diff.) (First Diff.) (First Diff.) Regressors SM SWAR(1) SM SWAR(1) Moments Moments Moments Moments OLS Interest rates regression on SM and SWAR(1) moments Table 2. and table 3. show the estimates of the first difference of the 3months quarterly real interest rate on moments up to the third order, of both SM and SWAR(1) regressions, after having selected the appropriate lags. The second and the fourth moments and any leads or lags of them turned out to be not significant. Table 2. OLS regression of interest rates on SM cond. moments of Gdp. Regression 1: 3-Months Quarterly Real Interest Rate, First Difference Variable Coefficient Std. Error t-Statistic Prob. Constant -0.52 0.14 -3.68 0.0007 First moment 0.70 0.23 3.08 0.0037 Third moment(-1) 30.04 13.83 2.17 0.0358 R-squared Adjusted R-squared S.E. of regression 0.215 0.177 0.342 Sum squared resid Log likelihood Durbin-Watson stat 8 4.785 -13.62 2.068 The source of the data is the ECB. Quarterly data are considered and they range from 1994:2 to 2005:1. 9 The reader may refer to Hamilton et all (1996) for the relationship between financial and real economy regimes. 10 Table 3.OLS regression of interest rates on Gdp SWAR(1) cond. moments. Regression 2: 3-Months Quarterly Real Interest Rate, First Difference Variable Coefficient Std. Error t-Statistic Prob. Constant -0.73 0.22 -3.36 0.0017 First moment 1.28 0.42 3.02 0.0044 Third moment 2.47 1.43 1.72 0.0922 R-squared Adjusted R-squared S.E. of regression 0.244 0.206 0.338 Sum squared resid Log likelihood Durbin-Watson stat 4.57 -12.82 2.26 For both regressions, usual diagnostic tests show no sign of misspecification; the appendix provides the details of the SM and SWAR(1) regressions for the real Gdp. According to the estimated parameters of regression 1, an increase of an expected percentage point of the Gdp rate of growth between quarter t and t-1, implies an increase of 0,7 (and 1,28 for regression 2) of the 3-month real interest rate, over the same period. This is consistent with the first order condition (equation (2)); prices fall and interest rates go up when the ratio of marginal utilities decreases, hence consumption growth increases. This feature is also consistent with the LM relationship: people use short-term notes to finance the increasing purchases. For regression 2, the third moment is significant10 (and the first lag of it for regression 1); their signs are consistent with the market risk aversion (the derivative of even order of the utility function is negative). Once, in time t, agents perceive a strong expansion more plausible than a strong recession11 (implicit in a positive third moment), interest rates between time t and t+1 increase. Again, this should occur because of the more favourable economy’s scenario, hence agents save less and consume more. Further, the first and the second lags of the first difference of interest rates (dependent variable), in both regressions, showed themselves not to be significant while the significance of the other regressor remained unchanged. This confirms the rationality assumption of market participants against the hypothesis of adaptive expectations. Again, the significance of the third moment may be considered as positive response for a market risk-aversion test. The precautionary saving theory seems not to be supported by data since the second moment is not significant in both regressions. The same conclusion has been reached when the standard deviation instead of the variance, were included among regressors. A possible explanation may rely on the small magnitude of the variances within the regimes along with the fact that regimes are very well separated (they mostly occur with probability 0 or 10 11 The third moment-regressor is significant only at the level of significance of 10%. But also a low recession more probable than a low expansion. 11 1). According to equation (10) the jump effect on the unconditional variance (unconditional with respect to regimes) is negligible and the unconditional variance essentially coincides either with the variance or regime 1 , which is 0.057 or with the variance of regime 2: 0.027. However, both variances are very low, suggesting that these are not good indicators as measures of uncertainty of the business cycles. In a certain sense, the significance of the third moment can also be reconducted to precautionary saving motivations. The inclusion of the series of the rate of growth of Gdp neither provides any further useful information nor makes the other regressors not significant12; this suggests that, indeed, decisions of saving and consequently on interest rates are made on the basis of expectations and uncertainty perceptions. Markov–switching Interest rates regression on SM and on SWAR(1) moments Table 4. and table 5. present the estimates obtained by regressing the first difference of interest rates, respectively on the SM and on the SWAR(1) moments, in a two-regimes regression. Table 4. MSM regression of interest rates on SM conditional moments Regression 3: 3-Months Quarterly Real Interest Rate, First Difference REGIME 1 REGIME 2 Coefficient Std. Error Coefficient Std. Error Constant -0.68 0.23 -0.06 0.18 First moment 0.46 1.22 0.62 0.57 Second moment -0.33 18.49 -2.71 7.13 Third moment 7.94 76.95 17.68 32.12 Standard deviation 0.21 0.19 R-squared Sum squared resid Durbin-Watson stat 0.81 1.18 1.98 Log likelihood AIC BIC -18.73 61.46 82.87 Table 5. MSM regression of interest rates on SWAR(1) cond. moments Regression 4: 3-Months Quarterly Real Interest Rate, First Difference REGIME 1 REGIME 2 Coefficient Std. Error Coefficient Std. Error Constant -0.65 0.34 -0.35 0.31 First moment 0.58 1.56 1.07 0.68 Second moment -0.06 4.08 -0.42 1.73 Third moment 0.57 3.66 2.07 1.93 Standard deviation 0.27 0.20 12 Although the multicollinearity with its expected value is detected. 12 R-squared Sum squared resid. Durbin-Watson stat 0.77 1.39 2.27 Log likelihood AIC BIC -25.57 55.15 76.56 Both regressions 3. and 4. present a very high R-squared, also in comparison with their one-regime counterparts. All estimated parameters have the expected signs but, according to their standard errors they are not significant at the usual levels of significance; this is in contrast with the high R-squared. One possible reason may rely on the high correlation (multi-collinearity) within regimes of the regressors, this phenomenon may produce the rejection of regressors when considered singularly even though a test for the joint significance does not lead to a rejection. Leaving some regressors, always produces a significant decrease in the R-squared and a change of the parameters signs, hence the presented results seem to be the most reliable. On the basis of the provided results, it is possible to conclude both for the joint significance of the conditional moments as regressors for interest rates and for a non linear relationship between these moments and interest rates as the theoretical model of equations (5) or (12) predicts. So, the conclusions for regression 1. and 2. are here, basically confirmed: - A positive relationship between the first moment of Gdp and the first difference of interest rates, suggesting a LM relationship. - A negative relationship between the second moment of Gdp and the first difference of interest rates, hence precautionary saving motivations. - A positive relationship between the third moment of Gdp and the first difference of interest rates, hence market-risk aversion. - The importance of the moments (expectations,..) of the Gdp rather than the row time-series. - The evidence of the rational expectation formation rather than the adaptive formation. Furthermore, conditional high moments matter for the determination of interest rates, not only as regressors but also for the determination of the (time-varying) parameters. Notice that, in principle, the time-varying property of the parameters may be due not only to the variability of the arguments the enter the considered derivatives of the utility function13 but also to the changes along business cycle of the specific parameters of 13 That is the expected value of the real Gdp and its present value. 13 u(.).14 If the first hypothesis is accepted, this consists of an evidence against the Permanent Income Hypothesis since this theory implies that marginal utilities (hence their ratios) be constant across time. Graphs 2. and 3. show the Euro area quarterly real interest rates (first difference) along with the inferred smoothed probability obtained, respectively as a by-product of regressions 3. and 4.. Graph 2. Euro area interest rates and the probability of regime1, based on regression 3. 0.8 0.4 0.0 -0.4 -0.8 1.0 -1.2 0.8 0.6 0.4 0.2 0.0 1994 1996 1997 1998 1999 2000 2001 2002 2003 2004 Euro Area real interes t rates (firs t diff.) Probability Regim e 1 14 In both cases there should be a correlation between the probability inferred from the Gdp regressions (which should describe the business cycle fluctuations) and the probability inferred from the interest rates regression. However, financial markets may predict the Business Cycles turning points hence, the regimes embedded in the interest rates may precede the regimes inherent to real quantities. The correlation between the two inferred probabilities is .2; instead when considering the first lag of the probability regarding the business cycle (in order to capture the anticipating property of financial markets) the correlation is .14 . 14 Graph 3. Euro area interest rates and the probability of regime1, based on regression 4. 0.8 0.4 0.0 -0.4 -0.8 1.0 -1.2 0.8 0.6 0.4 0.2 0.0 1994 1996 1997 1998 1999 2000 2001 2002 2003 2004 Euro area real interes t rates (firs t diff.) Probability Regim e 1 Conclusions The proposed model, is based on the observation that, a rational and riskadverse agent considers all the available information of his/her future consumption when deciding about the present amount of saving. Statistically, the complete information regarding a random variable is provided by the density function and not only by the first and the second moments. However, the entire set of moments provides the same information of the density function. If the distribution of the random variable in question is not Gaussian, then the rationality assumption requires, to include in the information set, some moments higher than the second one. The third moment, for example, provides a measure of the asymmetry of the distribution. Asymmetries seem to be present in the conditional distribution of the business cycles variables hence, they are considered by rational agents when choosing consumption and determining saving. In the proposed model, the importance of the riskaversion of agents is expressed by the form of the utility function. The effect of the third moment derives from the existence (and different from 15 zero) of the derivative till the fourth order. All these principles have been used in order to find a relationship between market interest rates and the conditional moments of the distribution of the business cycle. This relationship generalizes the Precautionary Saving theory, in the sense that it extends the uncertainty sources from the volatility to the asymmetry measures. When the third moment decreases, holding the other moments fixed, the probability of a strong recession increases along with the probability of mild expansion; at the same time, the probability of strong expansion decreases along with the probability of mild recession. Assuming market risk-aversion, the increase of the chances of a strong recession is not compensated by an increase of the chances of a mild expansion; hence, this phenomenon consists of a further reason to save, besides the one based on the volatility of the business cycle. This work also proposes an alternative way to estimate conditional moments of the population and to use them to test the precautionary saving and its impact on interest rates. Since a very used specification for business cycle quantities refers to the Markov-switching models which explicitly account for the presence of regimes in the stochastic process, it is reasonable to estimate the relevant conditional moments as a function of the parameters and the probabilities of the inferred regimes to occur. The strategy followed here, consisted of estimating some Markov-switching models for the rate of growth of the real Gdp. Then, the conditional moments are calculated and, their ability of explaining the first difference of the 3months real interest rate is tested in a twofold way. Four regressions for the interest rates are performed. First, two OLS regressions are performed, they consider as regressors the conditional moments derived from the SM and the SWAR(1) models. Then, on the basis of the observation that the ratios of derivatives could be time-varying a two-regime version of the above regressions is attempted. Generally, from the OLS, the significance of the first and the third moments clearly emerges, hence, the importance of the skewness of the business cycle is confirmed. From the regimeswitching regressions it is not possible to ascertain the significance of the single regressors but they yield very high R-squared (.77 and .82), also in comparison to their “one-regime” versions. So, the set of conditional moments, as a whole, is highly important for the determination of interest rates. Also, in all regressions, the parameters have the sign that the theoretical model predicts. A positive relationship is detected between the first difference of interest rates and the first moment; this is consistent with the first order conditions of the maximization problem and with the LM relationship. The second and the third moments have, respectively a negative and a positive coefficient, consistently with the market riskaversion. The usefulness of all the three moments, in both MSM regressions, confirms the rationality assumption: firstly, because it confirms that, indeed, market behave as they solve a maximization problem, in order to decide consumption and saving; secondly, because it consists of an evidence for the importance of a wider set of information 16 that includes higher moments as well. The variability of parameters is an evidence against the Permanent Income Hypothesis since this theory implies that marginal utilities (hence their ratios) be constant across time. So, precautionary saving motivations are confirmed in a twofold way: firstly because some higher moments are significant for saving, hence interest rates; secondly because the alternative PIH is not accepted by the evidence. Furthermore, both the theoretical model and the regimeswitching regressions provide some hints on the relationship between “financial regimes” and “business cycle regimes”: it seems to be that they are slightly correlated. Appendix Model with switches in mean In this part, the estimates of the switching in mean-model (equation (6), (7)) are presented. Recall its main features: gdpt st et t 1, 2,..., T et iid ( 0, s2t ) with the following specification: 17 St 1 (1 st ) 2 st S2t 12 (1 s t ) 22 s t st 0,1 Re gime 1,2 P r s 0 | s 0 p P r s 1 | s 1 p t t 1 1 1 t t 1 2 2 The estimates results are resumed in table 6, with standard errors in brackets: Table 6: SM model for the Euro-area quarterly rate of growth of real Gdp. ˆ 1 .76 (.06) ˆ 2 .23 (.05) ˆ 12 .06 (.02) ˆ 22 .03 (.015) Residual sum of Squares: Log-Likelihood value: 1.417 -20.93 p11 0.8 (.13) p 22 0.71 (.11) DW-statistic: Rsq value: 1.49 0.723 Graph 4. reports the inferred smoothed probability for the economy of been in regime 1, the expansion regime. Shaded area indicates periods of troughs. Graph 4. Smoothed probability of the SM model and the Euro area Gdp. 1.6 1.2 0.8 0.4 1.0 0.0 0.8 -0.4 0.6 0.4 0.2 0.0 94 95 96 97 98 99 Euro Area GDP 18 00 01 02 Probability Regime 1 03 04 Descriptive statistics (table 7) of the estimated conditional moments15 along with their graphs are also reported. Table 7.. Statistics of conditional moments of the SM model. Mean Median Maximum Minimum Std. Dev. Moment 1 0.537 0.648 0.762 0.229 0.238 Moment 2 0.058 0.057 0.114 0.027 0.025 Moment 3 0.002 1.50E-05 0.015 -0.0005 0.004 The following graphs show the estimated conditional moments along with the Gdp series. Graph 5. Conditional moments of the SM model 15 These moments are conditional with respect to all information available at the time they refer to but they are unconditional with respect to regimes. 19 1.6 1.2 0.8 0.4 0.0 -0.4 94 95 96 97 98 99 00 01 02 03 04 Euro Area Gdp First Moment (Expected Value) 1.6 1.2 0.8 0.4 .12 0.0 .10 -0.4 .08 .06 .04 .02 94 95 96 97 98 99 Euro Are Gdp 00 01 02 03 04 Second Moment (Variance) 1.6 1.2 0.8 0.4 .016 0.0 .012 -0.4 .008 .004 .000 -.004 94 95 96 97 98 99 Euro Area Gdp 20 00 01 02 Third Moment 03 04 Autoregressive model with switching in mean, SWAR(1) In this part, the estimates of the autoregressive model, AR(1), with switches in mean, are presented. Recall its main features: gdpt st ( gdpt 1 st1 ) et t 1,2,...,T et iid ( 0, s2t ) with the following specification: St 1 (1 st ) 2 st S2t 12 (1 s t ) 22 s t st 0,1 Re gime 1,2 P r s 0 | s 0 p P r s 1 | s 1 p t t 1 1 1 t t 1 2 2 The estimates are resumed in table 8, with standard errors in brackets: Table 8: SWAR(1) model for the Euro-area quarterly rate of growth of real Gdp. ˆ 1 .62 (.36) ˆ 2 .22 (.30) .73 (.25) ˆ 12 .05 (.004) ˆ 22 .01 (.002) Residual sum of Squares: .9199 Log-Likelihood value: -6.02 p11 .67 (.22) DW-statistic: Rsq value: p 22 .43 (. 32) 2.25 0.816 Graph 6. reports the inferred smoothed probability for the economy of been in regime 1, the expansion regime. Shaded area indicates periods of troughs. 21 Graph 6. Smoothed probability of the SWAR(1) model and the Euro area Gdp. 1.6 1.2 0.8 0.4 0.0 1.0 -0.4 0.8 0.6 0.4 0.2 0.0 1994 1996 1997 1998 1999 Euro Area GDP 2000 2001 2002 2003 2004 Probability Regime 1 Descriptive statistics (table 9) of the estimated conditional moments16 along with their graphs are also reported. Table 9. Statistics of conditional moments of the SWAR(1) model. Mean Median Maximum Minimum Std. Dev. Moment 1 0.525 0.507 1.04 0.04 0.256 Moment 2 0.184 0.186 0.357 0.078 0.067 Moment 3 -0.010 0.006 0.125 -0.236 0.076 The following graphs show the estimated conditional moments along with the Gdp series. 16 These moments are conditional with respect to all information available at the time they refer to but they are unconditional with respect to regimes. 22 Graph 7. Conditional moments of the SWAR(1) model 1.6 1.2 0.8 0.4 0.0 -0.4 1994 1996 1997 1998 1999 Euro Area Gdp 2000 2001 2002 2003 2004 First Moment (Expcted Value) 1.6 1.2 0.8 .4 0.4 .3 0.0 .2 -0.4 .1 .0 1994 1996 1997 1998 1999 Euro Area Gdp 2000 2001 2002 2003 2004 Second Moment (Variance) 1.6 1.2 0.8 0.4 .2 0.0 .1 -0.4 .0 -.1 -.2 -.3 1994 1996 1997 1998 1999 2000 Euro Area Gdp 2001 2002 Third Moment 23 2003 2004 References - Ahrens, R., 2002, Predicting recessions with interest rate spreads: a multicountry regime-switching analysis, Journal of international Money and Finance, vol. 21, pp. 519-537. - Andreou, E., Pelloni, A. and Sensier, M., 2003, The effect of nominal shock uncertainty on output growt’, Centre for Growth and Business Cycle Research Discussion Paper Series, University of Manchester, No. 40. - Ang, A. Bekaert, G., 2002, Regime switches in interest rates, Journal of Business and Economic Statistics, 20, 2, 163-182. - Ang A. Bekaert G., 2002, Short rate non-linearities and regime switches, Journal of Economic Dynamics and Control, 26, 7-8, 12431274. - Bansal, R., Zhou, H., 2002, Term structure of interest rates with regime shifts, The Journal of Finance, 57, 1997-2043. - Berk, J.M., 1998, The information content of the yield curve for monetary policy: a survey, De Economist 146, 303-320. - Campbell, J., Y., Luis, M. Viceira, 2001, Who should buy long-term bonds?, American Economic Review, Vol. 91 (1) pp. 99-127. American Economic Association. - Campbell, J., 1998, Asset prices, consumption, and the business cycle," NBER Working Papers 6485, National Bureau of Economic Research. 24 - Campbell, J. Andrew, W., Lo, A. Craig MacKinlay, 1994, Models of the term structure of interest rates, Working Papers 94-10, Federal Reserve Bank of Philadelphia. - Campbell, J. Clarida, R. H. 1986, The term structure of Euro-market interest rates: an empirical investigation, Cowles Foundation Discussion Papers 772R, Cowles Foundation, Yale University. - Campbell, J., Mankiw, N.G., 1989, Consumption, income and interest rates: reinterpreting the time series evidence, in O.J. Blanchard e S. Fisher eds. NBER Macroeocnomics Annual 4, 185-216. - Campbell, J., Mankiw, N.G., 1991, The response of consumption to income: a cross-country investigation, European Economic Review 35, 723-767. - Campbell, J., 1993, Intertemporal asset pricing without consumption data" American Economic Review. 83, 487-512. - Chan, K., Karolyi, G., Longstaff, F., Sanders, A., 1992, An empirical comparison of alternative models of the short-term interest rate, The Journal of Finance, 47, 1209-1227. - Chauvet, M., Potter, S., 2001, Predicting a recession: evidence from the yield curve in the presence of structural breaks, University of California, Riverside - Department of Economics and Government of the United States of America - Federal Reserve Bank of New York. - Clements, M., Krolzig, H.-M., 2004, Can regime-switching models reproduce the business cycle features of US aggregate consumption, investment and output?, International Journal of Finance & Economics 2004 9 (1)1-14. 25 - Cover, J.P., (1992), Asymmetric effects of positive and negative supply shocks, Quarterly Journal of Economics, vol. 107, 1261-82. - Dynan, K, 1993, How prudent are consumers?, Journal of Political Economy, 101, December, 1104-1113. - Estrella, A., Mishkin, F.S., 1995, The term structure of interest rates and its role in monetary policy for the European Central Bank, Federal Reserve of New York, Research Paper 9526. - Evans, B. D., 2000, Regimes shifts, risk and the term structure, Working Paper, Georgetown University. - Frankel, J. 1995, Financial markets and monetary policy, MIT Press. - Franses, P. H, Van Dijk, V., 2000, Non-linear time series models in empirical finance, Cambridge University Press. - Friedman, M., 1957, A theory of the consumption function. Princeton NJ: Princeton University Press. - Garcia, R., Schaller, H., 1995, Are the effects of Monetary policy asymmetric?, Mimeo Carleton University, Canada. - Garcia, R., Perron, P., 1996, An analysis of real interest under regime shift, Review of Economics and Statistics, 78, 111-125. - Gray, S., 1996, Modelling the conditional distribution of interest rates as a regime-switching process, Journal of Financial Economics, 42 2762. - Guedhami, O., Sy, Oumar, 2005, Does conditional market skewness resolve the puzzling market risk-return relationship? The Quarterly Review of Economics and Finance, 45, 582-598. 26 - Hamilton, J.D., 1988, Rational expectations econometric analysis of changes in regime: An investigation of the term structure of interest rates, Journal of Economics, Dynamic and Control, 12, 385-423. - Hamilton, J.D., 1989, A new approach to the economic analysis of non-stationary time series and the business cycle, march, Econometrica. - Hamilton, J.D., 1990, Analysis of time series subject to changes in regime, Journal of Econometrics, vol. 9 pp. 27-39. - Hamilton, J.D., 1995, Rational expectations and the economic consequences of changes in regime, in K. Hoover, Macroeconometrics: Developments, Tensions and Prospects, Dordrecht, Kluwer. - Hamilton, J.D., Kim, D.H., 2002, A re-examination of the predictability of the yield spread for real economic activity, Journal of Money, Credit, and Banking, vol. 34, pp. 340-360. - Hamilton, J.D., Lin, G. 1996, Stock Market volatility and the business cycle, Journal of Applied Econometrics, Vol. 11, 573-593. - Harvey, Campbell, H. R., 1988, The real term structure and consumption growth, Journal of Financial Economics, 22 305-333. - Leland, H., 1968, Saving and uncertainty: the precautionary demand for saving, Quarterly Journal of Economics 82, August: 465-473. - Morgan, D.P., 1993, Asymmetric effects of monetary policy, Federal Reserve Bank of Kansas City Economic Review, vol. 78(2), 21-33. - Naik, V. M., Lee, H., 1997, Yield curve dynamics with discrete shifts in economics regimes: theory and estimation, Working Paper, University of British Columbia. 27 - Osborn, D., 2002, The prediction of business cycle phases: financial variables and international linkages, The University of Manchester, Discussion Paper Series, No 15. - Psaradakis, Z., Sola, M., Spagnolo, F., 2001, Risk premia with Markov regimes and the term structure of interest rates, School of Economics, Mathematics, Statistics, Birkbeck College, London. - Peel, D., A., Ioannidis, C., 2003, Empirical evidence on the relationship between the term structure of interest rates and future real output changes when there are changes in policy regimes, Economics Letters, 2003, vol. 78, issue 2, pages 147-152. - Ravn, M.O., Sola, M., 1996, Asymmetric effects of monetary policy in the US: positive vs. negative or big vs. small?, mimeo, University of Southampton. - Rothman, P., 1999, Non-linear time series analysis of economic and financial data. Klewer Academic Publishers. - Timmermann, A., 2000, Moments of Markov-switching models, Journal of Econometrics 96, 75-111. Weise, C.L., 1999, The asymmetric effects of monetary policy: a non-linear vector autoregression approach, Journal of Money, Credit and Banking, vol. 31, 85-108. - 28