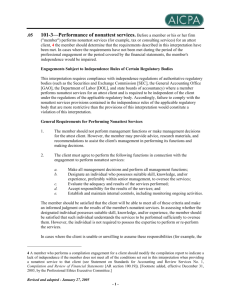

Basis for Conclusion Document for NonAttest Services

advertisement