File

advertisement

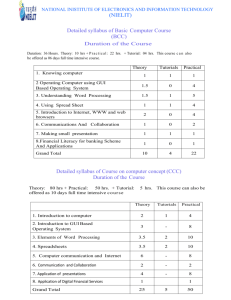

TUMKUR UNIVERSITY Proceedings of the meeting of Board of Studies in Business Management (B.B.M.) held on 18.07.2009 from 11-00 a.m. onwards at Dr. B.R. Ambedkar Bhavan, M.G. Road, Tumkur University, Tumkur. Member Present : 1. Prof. B.R. Ananthan - Chairman 2. Prof. R. Srinivasa putty - Member 3. Prof. R.G. Srinivasa - Member 4. Prof. M. Shivalinge Gowda- Member 5. Dr. B. Shekar Special Invitee 6. Prof. C. Nandisha - - Special Invitee The Chairman Welcomed all the members and tanked them for their effort and co-operation in the Successful conduct of workshop on “ Reengineering of commerce and Management” Courses. The draft Syllabus framed by the several working groups was discussed and was fine tuned keeping in mind the interest of different stake holders. The Board passed the following resolutions : a. To accept the subject matrix for both B.Com and B.B.M. Courses. b. To Continue the project work in the Sixth Semester of B.B.M. Course. c. To start the work connected with project work in the fifth semester itself and to submit the report before the commencement of the sixth semester – end examination. d. To allot 20 marks for internal assessment per subject for both B.Com and B.B.M. Courses. This 20 marks can be allotted to tests, Seminars, attendance (10 Marks) and 10 marks for the skill development activity report. However in case of B.B.M. Programme 20 marks be allotted for project viva voce. e. To give 2 Hours per week work load concession to teachers guiding project work of the students. f. To submit to the University the approved B.Com & B.B.M. Syllabus for the first two years. (Up to 4th Semester). g. To finalize the Syllabus of 5th & 6th Semesters in a Separate meeting to be convened for the specific purpose with in one month. h. To request the hon’ble Vice-Chancellor to initiate appropriate measures to introduce the new syllabus from the current academic year 2009-10. i. To request the University to include Dr. B. Shekar as a full fledged member as he is the only Senior faculty member in the Department of Commerce in the University. j. To Request the University to circulate the new Syllabus for B.Com and B.B.M. Courses at the earliest to enable the colleges to plan the teaching Programme for the current academic year. k. To request the University to prepare a gradation list of teachers of Commerce and management to enable the Board to suggest the panel of examiners for the ensuing examination. l. To request the University to constitute a Separate Board of Studies for Commerce and management SEM NO. I II III IV B.B.M. COURSE : SUBJECT MATRIX PAPER LECTURE TITLE OF THE PAPER NO. HOURS 1.1 LANGUAGE : KANNADA 04 1.2 ENLGISH 04 1.3 BUSINESS MANAGEMENT 04 1.4 FUNDAMENTALS OF ACCOUNTING 04 1.5 BUSINESS ENVIRONMENT 04 1.6 QUANTITATIVE ANALYSIS-I 04 1.7 BUSINESS DECISIONS 04 TOTAL 28 2.1 LANGUAGE – KANNADA 04 2.2 ENGLISH 04 2.3 ORGANIZATIONAL BEHAVIOR 04 2.4 FINANCIAL ACCOUNTING 04 2.5 LAW & PRACTICE OF BANKING 04 2.6 QUANTITATIVE ANALYSIS-II 04 2.7 ENVIRONMENTAL STUDIES 04 TOTAL 28 3.1 LANGUAGE – KANNADA 04 ENGLISH PART A, 04 3.2 BUSINESS COMMUNICATION – ENGLISH PART-B 3.3 CORPORATE ACCOUNTING 04 3.4 HUMAN RESOURCE MANAGEMENT 04 3.5 FINANCIAL MANAGEMENT 04 SOFT SKILLS FOR PERSONALITY 04 3.6 DEVELOPMENT 3.7 COMPUTER FUNDAMENTALS 04 TOTAL 28 4.1 LANGUAGE – KANNADA 04 ENGLISH – PART A, 04 4.2 BUSINESS COMMUNICATION –II` PART-B 4.3 COST ACCOUNTING 04 4.4 MARKETING MANAGEMENT 04 PRODUCTUION & OPERATIONS 04 .45 MANAGEMENT 4.6 CORPORATE LAW 04 MARKS UE I/A 80 20 80 20 80 20 80 20 80 20 80 20 80 20 560 140 80 20 80 20 80 20 80 20 80 20 80 20 80 20 560 140 80 20 80 20 TOTAL 100 100 100 100 100 100 100 700 100 100 100 100 100 100 100 700 100 100 80 80 80 80 20 20 20 20 100 100 100 100 80 560 80 80 20 140 20 20 100 700 100 100 80 80 80 20 20 20 100 100 100 80 20 100 4.7 INDIAN CONSTITUTION TOTAL V 5.1 5.2 5.3 5.4 5.5 5.6 5.7 6.1 6.2 VI 6.3 6.4 6.5 6.6 6.7 SERVICES MANAGEMENT TAX MANAGEMENT MANAGEMENT ACCOUNTING BUSINESS RESEARCH METHODS ENTERPRENTURSHIP AND SMALL BUSINESS MANAGEMENT ELECTIVE – PAPER –I ELECTIVE – PAPER -II TOTAL INTERNATIONAL BUSINESS E-BUSINESS AGRICULTURE BUSINESS MANAGEMENT BUSINESS LAW ELECTIVE PAPER – III ELECTIVE PAPER –IV PROJECT REPORT & VIVA-VOCE 80+20 TOTAL ELECTIVES H R M Specialization 1. HUMAN RESOURCE DEVELOPMENT 2. INDUSTRIAL RELATIONS 3. LABOUR WELFARE AND SOCIAL SECURITY 4. LABOUR LAWS MARKETING MANAGEMENT : 1. PRODUCT AND BRAND MANAGEMENT 2. SALES AND DISTRIBUTION MANAGEMENT 3. ADVERTISING & MEDIA MANAGEMENT 4. SERVICES MARKETING FINANCIAL MANAGEMENT : 1. FINANCIAL DECISIONS 2. WORKING CAPITAL MANAGEMENT 3. FINANCIAL SERVICES 4. PORT FOLIO MANAGEMENT 04 28 04 04 04 04 04 80 560 80 80 80 80 80 20 140 20 20 20 20 20 100 700 100 100 100 100 100 04 04 28 04 04 04 80 80 560 80 80 80 20 20 140 20 20 20 100 100 700 100 100 100 04 04 04 80 80 80 20 20 20 100 100 100 28 560 140 700 20 MARKS INTERNAL ASSESMENT : 1. ASSIGNMENTS 2. INTERACTIONS, UNIT TESTS, INDUSTRIAL VISITS. I Sem BBM 1.3 BUSINESS MANAGEMENT 4 Hours Unit– I :Introduction – Meaning & Definitions of Business – Nature & Scope of Business (Commerce, Trade, Aids to trade) – Objectivies of Business – Forms of Business ownership. 12 Hours Unit – II : Introduction to Management :- Meaning & Definitions – Nature of Management – Scope and functional areas of management – Management as a Science, Art Profession – Administration V/s Management – Principles of Management – contribution of F.W. Taylor, Henry Fayol, P.F. Drucker, recent management thinkers (in brief). 10 Hours Unit – III : Planning :- Meaning & Definition – Significance – Planning Process – Types of plan – Decision Making – Forecasting – MBO & MBE 12 Hours Unit – IV : Organizing & staffing : Meaning & Definitions – Principles of Organizing – Organizational Hierarchy – Types of Oraganisation Structures – Line, Staff, Functional – Committees – Formal & Informal Organizations – Departmentation – Centralization & Decentralization – Span of Control – Authority & Responsibility – Delegation of Power – chain of Command – Co-ordination. Staffing : Process of Staffing – Recruitment & selection – Training, Promotion, Transfer. 10 Hours Unit –V : Directing : Meaning & Definitions of Directing – Leadership styles Co-ordination : Meaning & Definitions – Importance – Techniques of Co-ordination. 06 Hours Unit –VI : Controlling : Meaning – Steps in control – Essential of a sound control system – Techniques of Control. Skill Development 1. Compare various form of Business Ownership 2. Prepare a Diagram of Decision making in any organization 3. Prepare an organization chart of any concern 4. Collect the information on recent management thinkers. Book for reference : Koontz & r’Donnell Management Reddy & Appannaiah L.M. Prasad J.S. Chandan Sharma & Gupta Chunavalla & Srinivasan T.N. Chobra R.S. Davar B.R. Ananthan and B.G. Satyaprasad - Essential of Management Principle of Management Management Concepts & Strategies Principle of Management Management Principle & Practice Principles of Management The Process of Management Business Management BBM I Semester 1.4 BBM I Semester – Fundamentals of Accounting Unit 1. Meaning of accounting - accounting concepts and conventions – basic concepts of double entry system of book-keeping- preparation of journal and ledger 10 Hours Unit 2. Subsidiary books – purchase book – sales book – purchase returns book – sales returns book – bills receivable book – bills payable book – cash book (problems on purchase book, sales book and three column cash book only) 10 Hours Unit 3. Bank Reconciliation Statement (excluding over draft). 10 Hours Unit 4. Preparation of Trail balance – types of errors – rectification of errors – adjustment entries (Problems on preparation of trial balance only 5 Hours Unit 5. Preparation of final accounts of sole trading concerns – trading account – profit and loss account & balance sheet 15 Hours Unit 6. Depreciation accounting – meaning – causes – methods – problems on straight line method and reducing balance methods only 10 Hours Skill Development : Collection of invoice and drafting of invoice with imaginary figures Identifying the nature and type of accounts Preparation of debit and credit notes with imaginary figures Preparation of correct trial balance from the given wrong trial balance Preparation of bank reconciliation statement with imaginary figures Prepare a chart showing suitability of different methods of depreciation in relation to different assets Books Recommended : 1. Advanced Accountancy - Shukla and Grewal 2. Basic Financial Accounting - S.P. Jain & Narang 3. Fundamentals of Accounting - S.N. Maheswari 4. Fundamentals of Accounting - B.S. Raman 5. Fundamentals of Accounting - Appannaiah and Srinivasa Putty .R BBM I Semester 1.5 BUSINESS ENVIRONMENT UNIT 1 10 Hours Business Environment – meaning & Definition, Scope & Nature. Significant for economic policies, Decisions in Origination. UNIT 2 10 Hours Global Environment Nature of Globalization, Manifestations of Globalization, Challenges of Globalization, Strategies for going global, WTO, Trading blocks, Regional Integration. UNIT 3 10 Hours Natural Environment – Impact of natural environment on business, climatic conditions, Topography, Geographical factors. UNIT 4 8 Hours Technological Environment – Meaning & features, Impact of Technology, Technology & Society, Management & Technology. UNIT 5 12 Hours Social & Political Environment – Social values, Tradition & customs, Culture. Political institutions, Legislature, Executive, Judiciary. Role of Government in Business. Rationale & Extent of state Intervention. UNIT 6 10 Hours Economic Environment – characteristics of Indian economy. Factors affecting economy, economic recourses – natural, Industrial & Technological. Impact of LPG on Indian Business. UNIT 7 4Hours Government policies – Impact of Fiscal, monetary, EXIM policy & Industrial policy on business (latest policy measures) REFERENCE BOOKS: 1. Business Environment - FRANCHIS CHERINULLUM 2. Business Environment - Dr. K. ASWATHAPPA 3. Business Environment - S. ADIKARI 4. Business Environment - K. CHIDAMBARAM 5. Business Environment - ROSY WALIA BBM I Semester 1.6 Quantitative Analysis Unit 1. Set Theory Definition of set – representation of sets – types of sets – laws of sets – set operations – venn diagrams – business application of set theory 08 Hours Unit 2. Matrices & Determinants Meaning and types of matrices – addition, subtraction, multiplication of two matrices – transpose of a matrix – minors and co-factors – inverse of a matrix – properties of determinants – evaluation of determinants (simple problems) – solving equations by Cramer’s Rule 14 Hours Unit 3. Progressions Arithmetic Progressions - finding nth term of an AP – sum to ‘n’ terms – arithmetic mean – geometric progression – finding nth Term of a G.P. – sum to ‘n’ terms’ – geometric mean. 12 Hours Unit 4. Commercial Arithmetic Simple interest – Compound interest – bills discounting – true discount – bankers discount – banker gain – ratio & proportions 12 Hours Unit 5. Theory of Equations: Linear equations – quadratic equations – solutions of linear and quadratic equationssolutions of systems of linear equations in the two variables – business applications equations 14 Hours Skill Development Application problems on set theory Draw venn diagram of possible sets considering different features of your class Application problems on matrix algebraic Application problems on progressions Calculation of interest on monthly, quarterly and half yearly and annual basis Calculation of true discount, bankers discount and bankers gain assuming a certain amount Collecting information about calculation of interest in banks on various types of deposits Books for reference : 1. Business Mathematics - Sanchetti & Kapoor 2. Business Mathematics - Madappa & Sreedhara Rao 3. Business Mathematics - Dorai Raj 4. Quantitative Techniques - B.H. Suresh 5. Commercial Arithmatic - Aggarwal BBM – I Semester 1.7 BUSINESS DECISIONS Unit -1 10 Hours Introduction : Meaning of Decisions – Features & Importance – Basic Concepts of Business decisions – factors influencing business decisions Unit -2 10 Hours Demand Forecasting : Meaning and significance Methods : a. Survey of Buyer’s intention. b. collective opinion c. Trend projection d. Economic indicator Demand forecasting for a new products – Demand forecasting least square methods (problems) Unit -3 12 Hours Production and cost analysis : Concepts of production function - Laws of returns of scale – Economics of scale. Cost concepts : Fixed and variable cost, Explicit an implicit cost Marginal and average cost opportunity cost - Problems on cost behavior Unit -4 8 Hours Market structure : Perfect competition, Monopoly, Monopolistic competition, Oligopoly, Duopoly – features. Unit -5 10 Hours Pricing : Pricing policies – cost plus pricing, Marginal cost pricing – Illustrations & problems Unit -6 10 Hours Business cycles : Stage of Business cycles – Effects of Business cycles – Measures to control business cycles. Skill Development 1. An Illustration on Calculations of opportunity cost and economic profit. 2. Preparation of Questionnaire to elicit the opinion consumer durables and FMCG. 3. Construction of Return of Scale curve. 4. Separation of fixed and variable cost from total cost and deriving marginal cost from total cost. Book for reference 1. Managerial Economics - Varsheney & Maheswari 2. Pricing strategies - Oxenfeidt 3. Economic theory and operations - Baumol 4. Marketing - Philip Kotler 5. Cost Accounting - Nigam & Sharma 6. Marketing - Rajan & Naiv 7. Principles of Management - C.M. Prasad 8. Financial Management - Khan & Jain II Semester 2.3 ORGANIZATIONAL BEHAVIOUR Unit - 1 Organizational Behavior : Meaning and Definition – Significance – scope – Nature of OB-Application of OB in Management – contributions of other disciplines. 08 Hours Unit – 2 Perception of Attitude : Meaning and definitions – perceptual process-factors in influencing perceptionAttitude : Meaning & Definition – components of Attitude – Attitude and Behavior – Attitude formation & its measurements. 10 Hours Unit – 3 Learning : Meaning & definition – Principles of learning – Reinforcement – observational learning – Cognitive learning OB modification Process – Reward systems. 10 Hours Unit -4 Motivation : Meaning and definition – Nature – process – theories of Motivation – Maslow’s need Hierarchy theory – Herzberg’s two factor theory – Mcgregor’s x and y theory – Financial and Non-Financial incentives – Job Enrichment. 12 Hours Unit – 5 Personality and Leadership : Determinants of Personality – Personality attributes influencing organization Behaviour – Leadership styles – Types of Leadership. 10 Hours Unit – 6 Group Dynamics and organizational change & Development : Meaning and definition of group – Types of group – Group and individual Behavior – Organizational change – Change process – types of changes – Factors influence change – Organizational Development & its techniques. 10 Hours Skill Development List out the determinants of Personalities. List out the Determinants of perception. Out line the attributes of an Ideal leader. Reference Books 1. Organizational Behavior – V.S.P. Rao and Narayan 2. Organizational Behavior – K. Aswathappa 3. Organizational Behavior – Sharma and Gupta 4. Organizational Behavior Behavior – Subba Rao BBM II Semester 2.4 Financial Accounting Unit 1. Consignment Meaning of Consignment– proforma – accounts sales – problems on consignment (at cost price only) – normal loss and abnormal loss 15 Hours Unit 2. Royalty accounts – meaning – concepts – minimum rent – short workings – recoupment of short workings – sublease – problems on royalty accounts (Excluding sub lease) 10 Hours Unit 3. Hire Purchase – meaning – features – sale Vs Hire purchase – problems on hire purchase (excluding hire purchase & installment system – problems on installment system 10 Hours Unit 4. Insurance claims – calculation of loss of stock including average clause – preparation of statement of claims (excluding abnormal loss). 10 Hours Unit 5. Accounting Standards – Meaning – features - Listing of Indian & International accounting standards 5 Hours Skill Development : Collection of proforma invoice and preparation of account sales with imaginary figures Collection of hire purchase agreement and filling the same Calculation of cash price and interest under installment account Collection of specimen of fire insurance claim form Books Recommended : 1. Advanced Accounts Volume 1 - B.S. Raman 2. Advanced Accounts - S.N. Maheshwari 3. Financial Accounting - Anil Kumar, Mariyappa and Rajesh Kumar 4. Basic Financial Accounting - S.P. Jain & Narang 5. Advanced Accountancy - Shukla & Grewal 6. Financial Accounting - R. Srinivasa Putty and H.R. Appannaiah II Sem B.B.M. 2.5 LAW & PRACTICE OF BANKING OBJECTIVES : UNIT -1 : Banker and Customer Introduction- Meaning of the terms – Banker and customer. General and Special relationship between banker and customer. (6) UNIT-2 : Types of Customers and Accounts Holders – Procedure and Practice in Opening and Operation the accounts of customers : Minors, Joint account Holders HUF. Partnership firms, Joint Stock Companies. (15) UNIT – 3 Paying Banker : Meaning and Functions of Paying Banker – Protection to the paying Banker – Dishonour of cheques and consequence of Wrongful dishonor. (12) UNIT – 4 Collecting Banker Meaning and functions of collecting Banker, Collecting Banker as Holder for value – payment – in due course. Different types of Endorsement and Forged Endorsements, Crossing of Cheques (12) UNIT – 5: SERVICE TO CUSTOMERS Remittance of funds by Demand Drafts, Mail Transfers, Core banking facilities. Safe Deposit Lockers – Standing Instructions – Credit and Debit Cards (5) UNIT – 6 BANK ADVANCES : - Principles of Bank Ledning , - Forms of Bank Advances, Un secured and Secured Advances, - Non performing Assets (10) Skill Development - Collect (Photo copy) of A/c opening form for SB a/c & current a/c. - Collect pay-in-slip for SB A/c & current A/c. - Draw a specimen of a cheque and a Demand Draft, - Draw different types of ‘Endorsements’ of cheques, - List customer Services offered by atteast 2 banks of your choice. Books for Reference 1. Maheshwari .S.N. : anking Law & Practice 2. Lan Nigam .R.M. : aw & Practice of Banking 3. Shekar .K.C. : Banking Theory Law & Practice 4. Indian Institute of Publications : Commercial Banking Vol. 1,2 &3 II BBM Semester 2.6 Quantitative Analysis –II Unit -1 : Statistics – Meaning – Definition – Scope – Importance – Function (2 hrs) Unit-2 : Collection of data – Method of Collecting primary data. Classification and Tabulation. Graphs – Histogram, Ogive curves and pie chart (6 hrs) Unit-3 : Measures of central Tendency – Types of averages – A.M. (Simple and weighted) – Median – Mode (without grouping ) – G.M. & H.M. (individual observations only) (14 hrs) Unit -4 : Measures of Dispersion – Range – Q.D. – M.D. & S.D. Co-efficient of skewness (Karl peason’s & Bowley’s Methods only) (14 hr) Unit -5 : Correlation analysis – Meaning – Utility – Types – Karl Pearson’s Coefficient correlation – Spearman’s Rank Correlation. Regression Analysis : Meaning , equations. (14 hr) Unit – 6 : Index Numbers – Meaning – Uses – Steps in construction of index Numbers – Simple and weighted Index Lasperres paasches fishers TRT & FRT. Construction of consumer price index – Aggregate expenditure method & family budget method. (10 hr) Skill Development 1. Preparation of statistical table of students of your college showing course wise, class wise, section wise and sex wise. 2. Preparation of pie chart for central and state budgets. (5 heads) 3. Taking the previous semester’s result of the student’s own class and finding mean & median marks in two subjects and making comparison. 4. Refer recent newspaper and take the stock prices of any two companies for a period of 10 days & find which companies share is (1) More variable (2) More consistent Visit agricultural department and collect data about production of agriculture products for the last 10 years and fit a straight line tend on a graph sheet. Books for Reference 1. Statistical Method : S.P. Gupta 2. Statistics : Sanchetti & Kapoor 3. Statistics : D.N. Elbence 4. Statistics : Pillai & Bagavathi 5. Statistics : S.C. Gupta III Semester BBM 3.2 BUSINESS COMMUNICATION-1 UNIT –I 02 hrs. Introductory : Meaning of Communication and Business Communication. Objectives of communication, Methods of communication ; Media of communication; Channels of communication; Barriers to communication. UNIT –II 06 hrs. Essential of a Business Letter : The qualities of a good business letter. The structure of a Business Letter; Layout of a Business Letter ;the indent form; the full block form the modified block form; the Semi-Block form; the hanging paragraph form; the NOMA form; types of business letters. UNIT-III 12 hrs. Purchase Letters : Enquiries – Replies to Enquiries – Orders – Replies to Orders – Complaints and adjustments. UNIT-IV 10 hrs. Sales Letters : Drafting of sales letters, Circular Letters and Status Enquiries, Circulars regarding : a) Opening of a new branch b) Shifting the business to a new premises c) Obtaining an agency d) Changes in constitution of a firm e) Admission an retirement of a partner. SKILL DEVELOPMENT A minimum of 5 exercises to be record on Purchase and Sales correspondence. BOOKS FOR REFERENCE : 1. R.O. Sharma and Krishna Mohan : 2. Ramesh and Pattana Setty 3. Majumbar 4. Urmila Rai 5. Pink and Thomas 6. Madhukar : : : : : Business Communication and Report Writing. TMH, NEW DELHI. Effective Business English and Correspondence Commercial Correspondence Commercial Correspondence English Grammars, Composition and Correspondence Business Communication. BBM – III Semester 3.3 CORPORATE ACCOUNTING Unit 1. JOINT STOCK COMPANIES : Meaning , Essential Features – shares and Debentures (theory only) 04 hrs. Unit 2. ISSUE OF SHARES : Problems on issue and allotment of shares including issue to the vendors and promoters. Forfeiture and re-issue of shares. 10 hrs. Unit 3. FINAL ACCOUNTS OF JOINT STOCK COMPANIES : (Both manufacturing and trading companies). Preparation of final accounts as per the new regulations. 12 hrs. Unit 4. ACCOUNTING FOR AMALGAMATION (as per AS-14): Accounting under purchase and Merger Methods. Purchase consideration under Net Assets and Net Payments Method only. Journal Entries, and Ledger Accounts; preparation of Balance sheet after amalgamation (excluding inter company holdings) 24 hrs. Unit 5. INTERNAL RECONSTRUCTION : Meaning, Forms of Reconstruction, Capital Reduction Journal Entries for capital Reduction, Preparation of the Balance sheet after reconstruction. 10 hrs. SKILL DEVELOPMENT : 1. Collection of share application form. 2. Collection of final accounts of a company. 3. Chart showing different types of companies. 4. Preparation of company Final Accounts with imaginary figures. 5. Calculation of purchase consideration and its discharge under Net Assets and Net payments Method. Books Recommended 1. Corporate Accounting - S.N. Maheswari 2. Corporate Accounting –II - B.S. Raman 3. Company Accounts - R.L. Gupta and Radhaswamy 4. Corporating Accounting - Jain and Naragg 5. Advanced Accounting - Shukla and Grewal 6. Corporate Accounting - R. Srinivasa Putty, Appannaiah and Reddy 7. Corporate Accounting - Anil Kumar, Rajesh Kumar and Mariyappa BBM III Semester Paper : 3.4 HUMAN RESOURCE MANAGEMENT OBJECTIVES : The objective of the subject is to help students to understand basic elements of Human Resource Management. UNIT –I HUMAN RESOURCE MANAGEMENT Meaning, importance, objectives, functions of HRM – Role HR managers – Evolution of HRM, - HR organizational set up – HR systems. UNIT -2 10 hrs Recruitment – Meaning, sources and methods. Steps in selection – Types of tests and interviews. Induction and Placement – meaning and objectives. UNIT -3 10 hrs Training – Meaning, objectives, need and methods. Identification of training needs. Promotion – Meaning, purpose, basis for promotion. Transfer – Meaning, reasons and types. UNIT -4 10 hrs Performance appraisal – Meaning, Objectives, methods and limitations. Wage and salary – Meaning – Techniques of wage fixation. Factors affecting wage and salary administration, Incentives – meaning and methods of calculation, Fringe benefits; meaning, types and objectives. UNIT -5 10 hrs Job evaluation – meaning, advantages, methods of job evaluation. Meaning of job design, job rotation, Job description, job specification, Job enlargement, Job enrichment, Grievance. Absenteeism and labour turnover, - causes and remedies. Meaning of separation, Layoff, Retrenchment, Dismissal and suspension. UNIT -6 12 hrs Fatigue, monotony and boredom – meaning, causes and remedies. Industrial accidents – causes and remedies. Morale – methods to measure, morale and productivity, ways to increase morale. Industrial disputes – causes, methods to resolve. SKILL DEVELOPMENT : Visit any organization and analyze the personnel policies prevalent in the organization and analyze the pros and cons. Students can go for a survey to understand the satisfaction level of employees on HR policies in any organization and can submit a mini project. Draft a nage sheet of an organization with imaginary figures. Books for reference 1. Personnel Management - C.B. Mamoria 2. Personnel Management - Ashwathappa 3. Personnel Management and industrial relations - P.C. Tripathi 4. Human Resource Management - P. Subbarao 5. Human Resource Management - G.B. Gupta 6. Human Resource Management - S.S. Khanka 7. Personnel administration and Industrial relation - Dah Yoder 8. Personnel administration and Industrial relation - Edwin flippo III Sem BBM 3.5 FINANCIAL MANAGEMENT Unit – 1 Financial Management : Meaning and Definition, Nature and Scope – Objectives of Financial Management Role / functions of Financial manager. 10 hrs. Unit – 2 Time Value of Money : Present value – Future value (Simple problems only) 8 hrs. Unit – 3 Risk and Return : Meaning – types of Risks – Risk & Return Relations – Decisions areas involving risk and return (Theory only) 8 hrs. Unit – 4 Source of Finance : Short term and long term sources – Merits and Demerits of each source. 8 hrs. Unit – 5 Leverages : Meaning, importance, types – simple problems on operating, financial and combined leverages. 16 hrs. Unit – 6 Capitalization : Meaning, Theories of capitalization. Over capitalization and under capitalization – meaning, causes and remedies. 10 hrs. BOOKS for references: Fundamentals of Financial Management : James C. Van Horne Fundamentals of Financial Management : Kahn and Jain Fundamentals of Financial Management : Maheswari .S.N. Fundamentals of Financial Management : I.M. Pundey Fundamentals of Financial Management : R.K. Sharma & Shashi, K. Gupta Skill Development 1. Visit an organization & discuss and record functions of financial manager of that organization. 2. With the help of imaginary figures ascertain P.V. and F.V. 3. List out the areas where decisions are based on risk and return. 4. With the help of imaginary figures compute operating, financial and combined, operating, financial leverage. 5. With the help of financial statements of an organization identify whether it is over capitalized or under capitalized. BBM III Semester 3.6 SOFT SKILLS OF PERSONALITY DEVELOPMENT Unit -1 5 hrs. Attitudes :Types of Attitudes, Formation – importance of positive attitudes – steps in developing positive attitudes Unit -2 10 hrs. Goal Setting and Time Management : Goals – importance of goal setting periodicity in goal setting – short, medium, long term-methods to achieve set goals – Activity in goal setting techniques of Time management – prioritization of activities – awareness of time wasters and how to avoid them. Unit -3 10 hrs. Creativity : The Creative mind-importance of creativity-Elements of Creativity – Influence of Flexibility – Factors influencing creativity – Methods of enhancing creativity –techniques of creativity – Brainstorming – attributes listing etc. General ideas in creative problem solving – creativity exercises and games. Unit -4 5 hrs. Stress Management : Definition – General Principles of Stress Management – linkage between stress and time management – identification of the sources of stress – measure to manage stress. Unit -5 20 hrs. Communication Skills: Definition – Significance – disasters of non- communication – communication Gap – process of communication – forms of communication – listening skills – active and attentive listening – benefit of listening – Body Language – Right Posture – its importance – effects of right body language. Unit -6 10 hrs. Emotional Intelligence : Emotional Intelligence – concepts and definitions – Elements of EI-Organizational Application audience – Exercises and analysis – conflict Management. Interpersonal Relationships : Significance of interpersonal relationships in personal life – Tips to enhance interpersonal relationships / cross culture, ethnic groups, Team Building, Group dynamics. Skill Development : Extempore speeches, just a minute. Conducting Stress Interviews. Creative Exercise, Role play. Books for Reference : 1. Public Speaking – Collins. 2. Your Personal Pinnacle of Success - D.D. Sharma 3. Self development - Devesh. IV Semester BBM 4.2 BUSINESS COMMUNICATION - II Unit -I 10 hrs. Business Letters A) Collection Series _Letters to Customers Regarding Dues_Following. B) Letters to Banks Regarding Overdrafts. C) Letters to Insurance Companies Regarding Payment of Premium, Renewal of Insurance Policy Claims and Their Settlement. Unit -II 5 hrs. Personnel Correspondence : A) Job Applications : Preparing Bio-Data / C V and Resume : Covering Letter for A Job application. B) Letters Calling Candidates for Written Test, Drafting Interview Letters ; Appointment Letters. C) Employee Disciplinary Matters; Show Cause Notice : Charge Sheets : Letters of Dismissal And Discharge. Unit -III 5 hrs. Inter-Departmental Communication : Internal Memos, Office Circulars, Office Orders Office Notes, Communication with Regional / Branch Offices. Unit -IV 5 hrs. Modern Communication Devices : Internet – Tele Conferening – Cellular Phones – E-Mail – Computers – Laptops – Wonr Processing – DTP – E – Commerce – Photo Copies. SKILL FOR REFERENCE : 1. R.O. Sharma and Krishna Mohan :Business Communication and Report Writing. TMH, NEW DELHI. 2. Ramesh and Pattana Setty : Effective Business English and Correspondence 3. Majumdar : Commercial Correspondence 4. Urmila Rai : Commercial Correspondence 5. Pin and Thomas : English Grammars, Composition and Correspondence 6. Madhukar : Business Communication. BBM IV Semester 4.3 Cost Accounting Objective : To familiarize the students with the costing terminology, principles and applications of costing methods, techniques to the business enterprises. Unit 1. Function, Scope, Cost concepts : 12 Hours Definition of cost, costing, cost accounting, and cost accountancy – limitations of financial accounting – distinctions between financial accounts and cost accounts – classification of cost – cost unit, cost centre – preparation of cost sheet – tender & quotations. Unit 2. Materials : 10 Hours Classification of materials – purchasing procedure – material control – Levels setting – EOQ – ABC Analysis – perpetual inventory system – periodical inventory system – JIT – function of stores department – bin card. Methods of pricing of material issues FIFO, LIFO, simple average and weighted average methods. Unit 3. Labour Cost : 12 Hours Direct & indirect labour – time keeping and time booking – methods of remunerating labour – time rate and piece rate systems – Halsey and Rowan’s premium plan – idle time and over time : Meaning and treatment. Unit 4. Overheads : 14 Hours Classification of overheads – allocation and apportionment of overheads – basis of apportionment – primary distribution summary – secondary distribution summary (Repeated distribution method only) - Absorption of overheads (Machine hour rate only) Unit 5. Methods of Cost Accounting 16 Hours a. Process Costing (excluding inter process profits, equivalent production, joint and by – products ) b. Contract Costing (simple problems only) Skill Development : List methods of costing adopted by industries located in your region List materials consumed in any tow organizations of your choice Draw a specimen of purchase requisition format Draw specimen of bin-cards Draw specimen of stores ledger Draw specimen of wage sheet / pay roll with imaginary figures Books for reference : 1. SP Jain & KL Narang, Cost and Management Accounting 2. Prabhu Dev, Cost Accounting 3. Nigam, Theory and Techniques of Cost Accounting 4. MY Khan & PK Jain, Management accounting 5. B.M. Lall Nigam & I.C. Jain, Cost Accounting Principles and Practices 6. Dr. S.N. Maheswari, Elements of Management accounting 7. Edward B Deakin & Michael W Maher, Cost Accounting 8. Jawahar Lal, Cost Accounting 9. M.N. Arora, Cost Accounting 4.4 MARKETING MANAGEMENT UNIT -1 1. Introduction : Meaning – definition – Nature – Scope – Function of Marketing – Concepts of Marketing – Approaches to study of Marketing – Marketing mix. 8 hrs. 2. Marketing Environment : Elements of Micro and Macro Environment – Market Segmentation – Basis for Segmentation. 8 hrs. 3. Consumer Behavior : Consumer concept – Buyer – Customer – factors influencing consumer Behavior Buying decision making process. 8 hrs. 4. Product : Types of Products – Product Mix – Product – Life cycle – New Product development – Packaging Branding, Labeling (for meaning only) 10 hrs. 5. Pricing : Price – Factors influencing pricing – pricing policy – methods of pricing. 8 hrs. 6. a. Promotion : Promotion mix – Advertising – Sales Promotion publicity – personnel selling – Public Relations. b. Channels of distribution : Physical distribution – Types of channels – factors in influencing channel decision. 18 hrs. Reference : 1. Principles of Marketing - Philiph Kotler 2. Marketing Management - Ramaswamy and Namakumari 3. Marketing Management - Karunakaran 4. Marketing Management - Chunawala 5. Marketing Management - J.C. Gandhi Skill Development 1. Survey a Retail outlet to analyze the selling approach. 2. Scan the market environment for IT solutions in your area. 3. Segment Mobile phone market. 4. Visit a rural area study the brand awareness of a product of your choice. 5. Examine the users / buyers response for price hike in the market. 6. Evaluate the distribution channel of any organization. VI Semester BBM 4.5 Production & Operations Management Chapter – 1 : Introduction : Meaning & Definition, Scope Nature of Production & Operations Management. (4 hours) Chapter – 2 : Plan Location & Plant Layout : Meaning and definitions Factors affecting Location. Principles of plant location. Cost factor in Location – rural & urban criteria. Principles of Plan Layout : Space requirement Organization of Physical facilities : Building, Sanitation, Lighting, Air Conditioning, Safety, etc. Industrial Automation : Meaning & advantage, CAD, CAM, CIM (Concepts only) (12 hrs) Chapter -3 : Production Planning & Control : Meaning & Definition. Objectived of PPC, Process of PPC, Capacity Planning, Controlling, Schedulling, Routing. (10 hours) Chapter – 4 : Quality Control : Meaning & Definition of Quality & Quality Control. Quality Management. Control charts, Acceptance Sampling Procedures. Quality circle, Total Quality Management., ISO criterias. PERT & CPM (in brief) Time & Motion study : (Meaning only) (12 hours) Chapter -5 : Materials Management : Meaning & Definition. Purchasing, Selection of Suppliers, Inventory Mgt. Materials Handing, equipments Selection. Criterias : Standardization, Codification, Simplification. Inventory Control, Value anlaysis, Value Engineering & ergonomics. (12 hours) Chapter – 6 : Maintenance Mgt. : Meaning & Definition, Types Break down, Spares Planning & Control, preventive roution relative advantages. Maintenance scheduling. Modern Scientific Maintenance methods Industrial Waste Management : Scrap Surplus disposal, solvage & recovery. (10 hours) Skill Development : 1. Visit a Factory & observe the PPC & Report it. 2. Bringout the Foundation of Quality Circle. 3. Write note on : ISO specifications. 4. Write note on waste disposal of a concern. 5. Observe the Pollution Control Techniques. Books for Reference : Production & Operation Management : S.N. Chary Production & Operation Management : K. Aswathappa Production Management : K.K. Ahuja Production Management : L.N. Agarwal Production Management : C.N. Sonhaki IV Sem BBM CORPORATE LAW Paper 4.6 UNIT – 1 : Joint – Stock Companies a) Nature of Company, Meaning & Definition of Company – Characteristics of Company, Scope of Corporate Law, Salient Features. b) Kinds of Companies :- Limited & Un Limited, Private & Public, Statutory Companies. (8 hours) UNIT -2 : Formation of Company a) Formation of Company : Promotion, Incorporation, Capital Subscription, Shares – Law relating to transmission of Shares & transfers. Commencement of Business b) Basic Documents : Memorandum of Association, Articles of Association, Preparation prospectus – statement in liers of prospectus, Certificate of Incorporation, Certificate of Commencement of Business. UNIT -3 : Corporate Law on Meetings Requisites of a valid meeting, statutory meeting Annual General Body Meeting. Extra – ordinary Meeting. - Meetings of Board of Directors. - Resolutions – Ordinary & Special. UNIT – 4 : Securities & Exchange Board of India Objects, Provisions, Establishment of the SEBI Guidances on Issue of Shares & Debentures. UNIT – 5 : Winding up Proceedings, Modes of Winding up. Skill Development : 1. Drafting of Memorandum of Association, Share certificate, Resolution, Minutes, Meeting Notice. 2. Organizing mock – meeting of Board of Directors, Recording of Proceedings. 3. Prepare a list of SEBI Guidelines with regard to IPO, Listing of Securities. Book for Reference : 1. Elements of Co., Law - Reddy & Appannaiah 2. Principles of Co., Law - M.C. Shukla 3. Lectures on Company Law - Shah 4. Business Law - N.D. Kapoor 5. Company Law - S.C. Kuchhel ********************************************** SEM NO. I II III B.COM. COURSE SUBJECT MATRIX : SEMESTER SCHEME OF EXAMINATION : B.COM. COURSE MARKS PAPER LECTURE TITLE OF THE PAPER NO. HOURS UE I/A LANGUAGE :I 04 80 20 KANNADA / SANSKRIT / URDU / 1.1 TAMIL / TELUGU / ADDITIONAL / ENGLISH / MARATHI / HINDI 1.2 LANGUAGE –II : ENLGISH 04 80 20 1.3 PRINCIPLES OF MANAGEMENT 04 80 20 1.4 FINANCIAL ACCOUNTING –I 04 80 20 1.5 BUSINESS ENVIRONEMNT 04 80 20 1.6 QUANTITATIVE ANALYSIS -I 04 80 20 TOTAL 24 480 120 LANGUAGE : I 04 80 20 KANNADA / SANKSRIT / URDU / 2.1 TAMIL / TELUGU / ADDITIONAL / ENGLISH / MARATHI / HINDI 2.2 LANGUAGE – II : ENGLISH 04 80 20 2.3 MARKETING 04 80 20 2.4 FINANCIAL ACCOUNTING –II 04 80 20 MARKET STRUCTURE & COST 04 80 20 2.5 ANALYSIS 2.6 QUANTITATIVE ANALYSIS –II 04 80 20 2.7 ENVIRONMENTAL STUDIES 04 80 20 TOTAL 28 560 140 LANGUAGE : I 04 80 20 KANNADA / SANKSRIT / URDU / 3.1 TAMIL / TELUGU / ADDITIONAL / ENGLISH / MARATHI / HINDI ENGLISH AND BUSINESS 04 80 20 3.2 COMMUNICATION 3.3 CORPORATE ACCOUNTING –I 04 80 20 3.4 INDIAN CORPORATE LAW 04 80 20 3.5 INDIAN FINANCIAL SYSTEM 04 80 20 COST AND MANAGEMENT 04 80 20 3.6 ACCOUNTING-I 3.7 COMPUTER FUNDAMENTALS 04 80 20 TOTAL 28 560 140 TOTAL 100 100 100 100 100 100 600 100 100 100 100 100 100 100 700 100 100 100 100 100 100 100 700 4.1 4.2 IV 4.3 4.4 .45 4.6 4.7 5.1 5.2 5.3 V 5.4 5.5 5.6 5.7 VI 6.1 6.2 6.3 6.4 6.5 6.6 LANGUAGE : I KANNADA / SANKSRIT / URDU / TAMIL / TELUGU / ADDITIONAL / ENGLISH / MARATHI / HINDI (INCLUDING COMMUNICATION) ENGLISH AND BUSINESS COMMUNICATION CORPORATE ACCOUNTING –II COMPUTER APPLICATION IN BUSINESS FINANCIAL MANAGEMENT COST AND MANAGEMENT ACCOUNTING –II INDIAN CONSTITUTION TOTAL INCOME TAX –I LAW AND PRACTICE OF BANKING ENTREPRENEURIAL DEVELOPMENT SOFT SKILLS FOR PERSONALITY DEVELOPMENT AUDITING ELECTIVE PAPER –I ELECTIVE PAPER –II TOTAL INCOME TAX –II INTERNATIONAL BUSINESS BUSINESS LAWS PRINCIPLES OF INSURANCE ELECTIVE PAPER –III ELECTIVE PAPER - IV TOTAL UE – UNIVERSITY EXAM I/A – INTERNAL ASSESMENT 04 80 20 100 04 80 20 100 04 04 80 80 20 20 100 100 04 04 80 80 20 20 100 100 04 28 04 04 04 80 560 80 80 80 20 140 20 20 20 100 700 100 100 100 04 80 20 100 04 04 04 28 04 04 04 04 04 04 28 80 80 80 560 80 80 80 80 80 80 560 20 20 20 140 20 20 20 20 20 20 140 100 100 100 700 100 100 100 100 100 100 700 ELECTIVE PAPERS ELECTIVE – I : ACCOUNTING GROUP ELECTIVE –II : FINANCE GROUP ELECTIVE – III : MARKETING GROUP ELECTIVE – IV : TAXATION GROUP ELECTIVE – V : ACCOUNTING AND FINANCE GROUP ELECTIVE – VI : INSURANCE GRUOP ELECTIVE – I : ACCOUNTING GROUP - ADVANCED FINANCIAL ACCOUNTING MANAGEMENT ACCOUNTING ACCOUNTING INFORMATION SYSTEM ACCOUNTING THEORY ELECTIVE –II : FINANCE GROUP - SECURITES ANALYSIS AND PORTFOLIO MANAGEMENT FIANANCIAL MARKETS CORPORATE FINANCIAL POLICY FIANCIAL SERVICES ELECTIVE –III: MARKETING GROUP - RETAIL MARKETING - AGRICULTURAL BUSINESS MANAGEMENT - SERVICES MARKETING - ADVERTISING AND MEDIA MANAGEMENT ELECTIVE – IV : TAXATION GROUP - DIRECT TAXES - COMMERCIAL TAXES - CENTRAL EXCISE AND CUSTOMS - TAX MANAGEMENT ELECTIVE – V : ACCOUNTING AND FINANCE GROUP 1. ADVANCED FINANCIAL ACCOUNTING 2. ADVANCED FINANCIAL MANAGEMENT 3. MANAGEMENT ACCOUNTING 4. FINANCIAL MARKETS & SERVICES ELECTIVE – VI : INSURANCE GROUP 1. 2. 3. 4. PRINCIPLES OF GENERAL INSURANCE PRINCIPLES OF LIFE INSURANCE LEGAL ASPECTS OF INSURANCE BUSINESS MARKETING OF INSURANCE SERVICES Ist Semester B.Com. 1.3 : Principles of Management Objectives : To familiarize the students with concepts and principles of Management . Unit – I : Management : 14 Hrs Introduction – Meaning, Nature & Characteristics of Management- Scope and Functional areas of Management – Management as a Science, Art or ProfessionManagement & Administration- Principles of Management – Social responsibility of Management and Ethics (meaning only) Unit – II : Planning : 12 Hrs. Nature, importance and purpose of planning or Objectives – Types of Plans (meaning only) – Decision Making -importance & steps. Unit – III : Organizing : 12 Hrs. Nature & Purpose of Organization, Types of organizations (Line, Staff & functional) Centralization Vs De-centralization of authority and responsibility. Span of control MBO and MBE (meaning only). Meaning and importance of HR – Process of selection and recruitment; training (meaning only) Unit – IV : Directing : 12 Hrs. Meaning and Nature of directing – Leadership styles – Motivation theories (Maslows, Herzberg, Mc. Gregors X & Y theory) Co- ordination : Meaning and importance Unit – V : Controlling : 10 Hrs. Meaning & Steps in controlling – essentials of sound control system. Skill Development 1. 2. 3. 4. 5. Type of organization chart (structure) Chart on staffing Chart on source of recruitment Graphic representation of Maslow’s theory Control process chart Books for reference 1. Essential of Management 2. Principle of Management 3. Principle of Management 4. Principle of Management5. Principle of Management - S.C. Saxena L.M. Prasad C.B. Gupta Davar Reddy & Appannaiah I Semester B.Com. 1.4 Financial Accounting –I Objective : To familiaries the students with basic concepts of Accounts, Application & skills in different areas. Unit –I 06 Hrs. Introduction to Financial Accounting Meaning and Importance – Principles of Double Entry system Accounting Principles (GAAPs) concepts and conventions. Unit –II : Amalgamation of Firms 12 Hrs. Meaning, Objectives – Journal Entries and Ledger accounts in the books of amalgamating firms. Opening Journal Entries in the books of New Firm. Treatment of assets and liabilities not taken over, unrecorded assets and liabilities. Unit – III Sale of a firm to a limited company : 1 2 Hrs. Introduction – need for conversion ; meaning of purchase consideration (P.C.) – calculation of PC – net asset method, net payment method – mode of discharging PC. Journal entries and ledger accounts in the books of vendor firm-treatment of unrecorded assets and liabilities, assets and liabilities not taken over by the purchasing company. Incorporating entries in the books of purchasing company. Unit – IV Hire purchase and installment purchase system 18 Hrs. Introduction, Meaning of hire purchase agreement, hire purchase price, cash price, Hire purchaser, Hire seller. Calculation of interest- when both the cash price and the rate of interest are given – when cash price is not given but rate of interest is given, when both cash price and the rate of interest is given cash price and the rate of interest is not given. Calculation of cash price and installment amount, Journal entries and ledger accounts in the books of hire purchaser (asset accrual method only) (excluding default repossession) Installment purchase method- meaning differences between hire purchase system and installment purchase system. Journal entries and ledger accounts in the books of installment buyer (interest suspense method only). Unit – V : Royalty accounts 12 Hrs. Meaning of royalty, lessor, lessee, minimum rent, short working, re-coupment of short workings. Preparation of minimum rent account. Journal entries and ledger accounts in the books of lessee (including minimum rent account and excluding sub Lease) Skill Development 1. Drafting of amalgamation conditions in a given situation 2. Calculation of PC under different method 3. Collection and recording of Hire Purchase agreement 4. Ascertainment of interest and cash price under hire purchase System 5. Collection and recording of royalty agreement. Book for reference 1. 2. 3. 4. 5. 6. 7. Jain & Narang – Financial Accounting B.S. Raman – Financial accounting Anil Kumar, Mariyappa & Others – Financial accounting R. Srinivas Putty, HR Appannaiah & Reddy – Financial Accounting –I P.C. Thulasian- Introduction to accounting R.L. Gupta & M. Radaswamy – Advanced accounting Financial Accounting – B.R. Ananthan, R. Srinivas Putty, H.R. Appannaiah B.Com I Semester 1.5 Business Environment Objective : The Objective of this topic is to acquaint the students with the dynamics of business scenario in India. Unit –I 08 Hrs. Business : Meaning, Scope & Objectives of business. Business environment – Micro & Macro environment of business (Socio cultural, economic, political, technological and natural) Significance for decision making in organization. Unit -2 : Natural Environment Meaning & influence on Business 10 Hrs. Unit – 3 : 10 Hrs. Economic environment: Characteristics of Indian economy, factor affecting economy, economic resources Impact of LPG,on Indian business Unit- 4 : 12 Hrs. Legal environment : Impact of fiscal, monetary policy, exim policy & industrial policy on business (latest policy measures) Unit – 5 : Technological Environment : 10 Hrs. Meaning, features; impact of technology on business; management of technology Unit – 6 : Global Environment : 10 Hrs. Nature of Globalization, challenges of international business. Strategies, for going global, W.T.O. & Trading block (in brief) Skill development 1) Identify natural / economic features of your region & analyze how do they aeffect the business. 2) Identify various regulatory authorities affecting the business. 3) List out the MNCs operating in your state 4) State the highlights of recent union budget affecting the business 5) List the social & cultural factors impacting the business in your area. Books for References : 1. Business environment – Francis cherunilum 2. Essentials of Business environment – Ashwathappa 3. Business environment & policy – J. Madegowda 4. Economic environment of Business – Adhikari 5. Business environment – P. Subba Rao I Semester B.Com. 1.6 Quantitative Analysis –I Objective : To provide basic knowledge of quantitative tools are to enable students to take business decisions. Unit -1 : 10 Hrs. Meaning, Definitions, Functions &Limitations of Statistics. Collection of Primary & Secondary data, Classification & formation of Frequency Distribution. Unit – 2 : 20 Hrs. Measures of Central Tendency : Mean, Median, Mode, G.M. &H.M. (only Individual observation in case of GM and HM) Unit -3 : Measures of variation : Range, Q.D., M.D. & S.D., Coefficient of variation. Unit -4 : a) b) 15 Hrs. 8 Hrs. Number system : Natural numbers, Integers, Rational numbers, Irrational numbers, Real number, Prime number, HCF and LCM, Relation between LCM & HCF. Theory of Equations : Meaning, Degree of an Equation, Quadratic Equations, Linear Equations, Solutions of Linear Equations in two variables (simple problems only) Unit – 5 : 7 Hrs. Progressions : Arithmetic progressions, Geometric Progression, Formulae for ‘n’ term of an A.P. & G.P. Sum of a number of terms in A.P. & G.P. – Simple problems. Note : Weightage for subject Business Statistics - 70 % & Mathematics 30%. Skill Development 1. Preparation of Model Questionnaire. 2. Charts showing classification of data. 3. Collection of data and computation of averages 4. Analysis of data by computing – S.D. & Co. Efficient of variation. 5. Problems on commercial Applications of equations, AP & GP Books for reference : 1. S.P. Gupta – Statistical Methods 2. Dr. B.N. Gupta – Statistics 3. C.B. Gupta – Statistics 4. Dr. Sanchti Kapoor – Business Mathematics & Statistics 5. Chikkodi & B.G. Sathyaprasad – Business Statistics 6. Saha – Mathematics for Cost Accountants. II Semester B.Com. 2.3 MARKETING Objective : To help students to understand the concepts of marketing & its applications. Also expose the students to the latest trends in Mtkg. Unit – 1 : 14 Hrs. Introduction to Marketing : Definition, nature, scope and importance of marketing. Approaches to the study of Marketing. Traditional and modern concepts of marketing. Functions of Marketing, Marketing mix-Elements of Marketing mix. Market segmentation – Bases, requisites of sound marketing segmentation. Unit – 2 : 14 Hrs. Product : Classification, product mix, product line, product addition, diversification and deletion. Product life cycle, product planning, New Product development process. Branding and packaging (Meaning). Unit – 3 : 7 Hrs. Pricing – Objectives, price determination, factors influencing pricing, methods of pricing, pricing policies and strategies. Unit – 4 : 10 hrs. Channels of Distribution – Definition, need – types and selection, channel decision, factors affecting channels. Unit – 5 : 9 Hrs. Promotion – Nature & Importance of promotion, promotional methods, Advertising decisions, sales promotion, public relations, Direct selling, Advertising copy, evaluation of advertising, Personal selling & Sales promotion. Unit – 6 : 6 Hrs. Recent Trends in Marketing – e- business, event Management (Meaning) – TeleMarketing, M-Business, relationship Marketing, retailing (meaning). Skill Development 1. Identify the product of your choice & describe in which stage of the product life cycle it is positioned. 2. Suggest strategies for development of a product. 3. State the policy needed for fixing a minimum support price for an agricultural product. 4. Develop an advertisement copy for a product. 5. Prepare charts for distribution network for a product of your choice. Books for References 1. Philip Kotler – Marketing Management 2. J.C. Gandhi – Marketing Management 3. R.S. N. Pillai & Bhagwathi – Modern Marketing 4. Neelamegham – Marketing in India 5. P.N. Reddy & Appannaiah – Essential of Marketing Management. 6. Rajan & Nair – Marketing 2.4 FINANCIAL ACCOUNTING –II Objective : To familiarize the students with accurating methods & applications in different areas. Unit –I 10 Hrs. Fire Insurance Claims : Loss of stock – preparation of statement to ascertain insurance claims – Trading account of previous year to ascertain GPR – Memorandum trading account up to the date of fire to ascertain estimated closing stock – treatment of salvaged goods to find out actual loss of stock and calculation of fire claims under average clause policy (excluding abnormal line of goods). Unit –II 12 Hrs. Conversion of account from incomplete records into complete accounting records : Preparing opening statement of affairs, total debtors account, total creditors account, cash and bank account, B/R account, B/P account, Trading and profit and loss account and Balance sheet. Unit –III 20 Hrs. Branch Account : Meaning and types of Branches – objectives of preparing Branch Accounts by the Head office – Dependent Branches – features of Dependent Branches – Problems on Dependent Branches under Cash Debtors System & final Accounts system ( Treatment of Cost and Invoice Price) Unit –IV 12 Hrs. Departmental Accounts : Need for preparing departmental accounts – Allocation of joint expenses on suitable basis (Calculation of departmental purchases) Inter – departmental transfer of goods at cost and invoice price – preparing departmental trading and profit and loss account and Balance Sheet. Unit – V 06 Hrs. Accounting Standards : Meaning and objectives. Authorities to issue accounting standards – Listing of Indian accounting standards and International accounting standards. Skill Development : 1. Collection of the specimen of fire insurance claims form and preparation of fire claim statement with imaginary figures. 2. Preparation of Final accounts of Sole traders from the information collected from them. 3. Collection of proforma invoice of any Branch and also collecting transactions of such Branches. 4. Listing of Departmental Stores that you have visited and show the basis of apportionment of expenses under departmental accounts. 5. Make a list of Important accounting standards. Books of References : 1. 2. 3. 4. 5. 6. 7. Dr. S.N. Maheswari – Financial Accounting B.S. Raman – Financial Accounting Grewal & Gupta – Advanced Accounting Radhaswamy & R.L. Gupta – Advanced Accounting Jain & Narang – Financial Accounting S. Kr. Paul – Advanced Accounting Financial Accounting –II – B.R. Ananthan R.Srinivasa Putty & H.R. Appannaiah Reddy 2.5 MARKET STRUCTURE AND COST ANALYSIS Unit -1 Market Structure : Types of Markets – Features of Perfect and imperfect Markets. 08 hrs. Unit – 2 Demand : Meaning – Law of Demand – Demand Schedules – Demand Curve – Kinky Demand Curve – Exceptions to law of demand – Demand determinants. Demand forecasting : Meaning – Objectives – Factors involved in Demand forecasting – survey method – Moving average – Semi average and Least square method (Including problems) 12 hrs. Unit – 3 Production and cost Analysis : Concept of Production function – Laws of Returns of scale Economies of scale – cost concept – fixed and variable cost – Explicit and implicit cost – Marginal and average cost- cost Behaviour and its measurement (Including problems) 14 hrs. Unit – 4 Pricing Policies : Practices and Strategies – cost plus pricing or Markup pricing – Marginal cost pricing – Multiple product pricing – Competitive bidding of prices – Market skimming and penetration- price leadership 12 hrs. Unit – 5 Cost of Capital & Capital Budgeting : Cost of Capital – Meaning – Types (theory only), Capital budgeting : Meaning and importance – Techniques – Pay back method &NPV method ( Simple Problems only). 6 Hrs Skill Development 1. Listing of Markets for consumer and industrial goods. 2. Problems of Demand Forecasting using semi average, Moving average and least square method with imaginary figures. 3. Calculation of opportunity cost and economic profit- incremental cost and incremental Revenue with imaginary figures. 4. Preparation of questionnaire to elicit response on consumer durables / non durables. Reference : 1. Marketing – S.A. Sherlekar 2. Modern Marketing – R.S.N. Pillai & Bhagawathi 3. Cost Accounting – Jain & Narang 4. Business Economics – Mithani 5. Managerial Economics – Varshney and Maheswari 6. Financial Management – Khan & Jain II Semester B.Com. 2.6 QUANTITATIVE ANALYSIS –II Objectives : Provide a basic knowledge of quantitative tools and to enable students to take business decisions. Unit -1 16 hrs. Correlation and Regression Analysis : Meaning & Differences : Types : Karl Pearsons – Coefficient of Correlation and Spearmen’s Rank Correlation ; Probable error Regression Equations, Regression Co- efficient & Estimations. Units – 2 12 hrs. Index numbers : Meaning, types : Methods of constructing Index numbers : Simple Average and Aggregative method ; Weighted Aggregative : Laspeyres method, paasches method & Fisher’s Ideal method : TRT & FRT ; Consumer Price Index – Family Budget Method & Aggregative Expenditure method. Unit – 3 14 hrs. Interpolation & Extrapolation : Meaning and differences; Assumptions, Utility & Limitations; Types : Binomial Expansion Method and Newtons Advancing Different method (Simple problems only) Unit – 4 10 hrs. Ratios and Proportions, Meaning, Expression of a ratio as a Fraction, Inverse ratio, Duplicate, Triplicate, Compound ratios (simple problems) Proportions : Direct Proportion, Inverse Proportions, Continued proportions (simple problems). Unit – 5 8 hrs. Commercial Arithmetic, Simple &Compound Interest, Percentage, Bills Discounting. Note : Weightage for Business Statistics is 70% Mathematics -30%. Skill Development 1. Comparing & Correlating Data 2. Construction of Index number from the collected data 3. Interpolating & Extrapolating values under different situations. 4. Prepare a Bank Statement using S.I. & C.I. Books for Reference 1. S.P. Gupta – Statistical Method. 2. Sacheti & Kappor – Business Mathematics & Statistics 3. Chikkodis Sathyaprasad – Statistics 4. K. Malappa – Business Mathematics 5. Dorairaj – Business Mathematic III Semester B.Com. 3.2 BUSINESS COMMUNICATION –I Unit - I 02 Hrs. Introductory : Meaning of Communication and Business Communication objectives of communication, Methods of communication; Media of communication ; Channels of communication ; Barriers to communication. Unit –II 06 hrs. Essentials of Business Letters : the qualities of a good business letter ; The structure of a Business Letter ; layout of a Business Letter; The indented from ; The full block from ; The modified block form ; The Semi – Block form ; The hanging paragraph form; The NOMA form, Types of business letters. Unit – III 12 hrs. Purchase Letters : Enquiries_ Replies to Enquiries _ Orders_ Replies to Orders_ Complaints and adjustments. Unit – IV 10 hrs. Sales Letters : Drafting of sales letters, Circular Letters and Status Enquiries, Circulars Regarding : a) Opening of a new branch b) Shifting the business to a new premises c) Obtaining an agency d) Changes in constitution of a firm e) Admission and retirement of a partner. Skill Development A minimum of 5 exercises to be recorded Purchase and Sales correspondence. Books for References : 1. R.O. Sharma and Krishna Mohan : Business Communication and Report Writing. TMH, NEW DELHI. 2. Ramesh and Pattana Setty : Effective Business English and Correspondence 3. Majumdar : Commercial Correspondence 4. Urmila Rai : Commercial Correspondence 5. Pink and Thomas : English Grammars, Composition and Correspondence 6. Madhukar : Business Communication. B.Com. III Semester Paper 3.3 – Corporate Accounting Objective : Enables the students to develop awareness about Corporate Accounting in conformity with the provisions of Companies Act. Unit – 1. Underwriting of shares : 10 hrs. Meaning – terms used in underwriting – marked and unmarked applications – underwriting commission – SEBI guidelines for underwriting – determination of the liability of underwriters in the case of both pure and firm underwriting – accounting entries in the books of issuing company. Unit 2. Redemption of preference shares 12 hrs. Meaning of redemption – legal provisions regarding redemption – treatment regarding premium on redemption – creation of capital redemption reserve – redemption out of profit and redemption from fresh issue of shares and preparation of balance sheet after redemption. Unit 3. Valuation of Goodwill 10 hrs. Meaning & definitions of goodwill – factors determining value of goodwill – methods of valuation of good will : Average profit method, super profit method, annuity method and capitalization method. Unit 4. Valuation of Shares 8 Hours Meaning and need for valuation of shares – factors affecting valuation of shares – methods of valuation of shares ; net asset method and yield method. Unit 5. Company Final Accounts 20 Hours Legal requirements relating to the preparation of final accounts of a company – preparation of final accounts as per the requirements of Companies Act. Skill Development : Collection of shares application forms of a company. Collection of prospectus of a company and deciding whether or not to invest in the shares of that company Visit an underwriter’s office and collect the information regarding underwriting of shares Collection of annual reports of a company Evaluate the goodwill based on the balance sheet of a company. Books for references 1. Corporate Accounting – Jain & Narang 2. Advanced Accounting – R.L. Gupta & Radhaswamy 3. 4. 5. 6. Corporate Accounting – Anil Kumar, Mariyappa and Rajesh Financial Accounting – S.N. Maheswari Advanced Accounting – S.P. Iyengar Corporate Accounting –I – R. Srinivasa Putty , H.R. Appannaiah Reddy Paper 3.4 – Indian Corporate Law Objective : To enable the students to get familiarize with the existing corporate law. Unit 1. a. Nature of company and corporate law: Meaning and definitions of company – characteristics of company- salient features & Scope of corporate law b. Kinds of companies – limited & unlimited companies, private and public companies, statutory companies. 8 Hours Unit 2. a. Meaning and definitions of company secretary – qualifications, appointments, rights, duties, liabilities and removal of company secretary b. Directors and Managing Director – qualifications, appointments, rights and responsibilities. 10 Hours Unit 3. Formation of Companies : promotion – incorporation – capital subscription – commencement of business Basic documents : Memorandum of Association – Articles of Association (contents only) – prospectus and statement in lieu of prospectus – certificate of incorporation – certificate of commencement of business. 12 Hours Unit 4. Corporate Law on Meetings : Requisites of valid meeting – statutory meeting – annual general meeting – meeting of Board of Directors – resolutions – ordinary and special 15 Hours Unit 5. Winding up of companies – Meaning – types – procedures 5 Hours Unit 6. Securities and Exchange Board of India Act, 1992 : constitution of Securities and Exchange Board of India – objectives – functions – guidelines on issue of shares and debentures 10 Hours Skill Development Visiting company office, collecting and filing of annual reports, prospectus, share application form etc. Drafting of share certificate Drafting of notice of company meetings Listing the functions of a company secretary of the company students have visited Drafting of agenda and minutes of a meeting Books for references 1. Principles of Company Law – M.C. Shukla & Gulshan 2. Company Law and Secretariat Practice – N.D. Koopor 3. Company Law and Secretariat Practice – S.C. Kuchehal 4. Essential of Company Law and Secretariat Practice – Dr. P.N. Reddy and H.R. Appannaiah 5. Business Law – Tulsion Paper 3.5 – Indian Financial System Objective : The objective is to acquaint the students about the functioning of Indian Financial System with reference to its structure, organization, instruments and regulating authorities Unit 1. Financial System, Institutions and Markets : Money market and capital market – components of money market – primary and secondary capital market – functions and significance – instruments of money market & capital market (brief reference only) 12 Hours Unit 2. Commercial banks in India : Functions – structure – recent development after 1991 – technology adoption – core banking 10 Hrs. Unit 3. Co- operative Banks & Regional Rural Banks : Origin – capital structure – functions – problems faced by RRBs – consolidation and merger of RRBs – NABARD – SIDBIEXIM Bank 12 Hours Unit 4. Non-Banking Financial Intermediaries : Characteristics – role – regulation of NBFIs – a study on hire purchase and finance companies – Chit Funds – Nidhis 12 Hours Unit 5. Mutual Fund & Venture Capital – Meaning – objectives – features – types 06 Hours Unit 6. Regulatory institutions – RBI – Organization Regulation of RBI – monetary policy of RBI – SEBI- organization and objectives 8 Hours Skill Development Prepare a chart showing Indian Financial System Prepare a chart showing instruments traded in the Indian Financial Market Prepare a list of Non- Banking Financial Intermediaries located in your area / town Books for reference : 1. Indian Financial System – Gordon & Natraj 2. Indian Financial System – V.A. Avadhani 3. Financial Institutions & Markets – L.M. Bhole 4. Indian Financial System – Vasanth Desai III Semester B.Com. Paper 3.6 – Cost and Management Accounting Objective : To familiarize the students with various concepts & applications of cost and management accounting Unit 1. Cost Accounting 14 Hours Meaning of cost, costing and cost accounting – objectives and importance of cost accounting – comparison between cost accounting and financial accounting – elements of cost and its classification – problems on preparation of cost sheet – tenders and quotations Unit 2. Material Costing 14 Hours Meaning and classification of materials – purchase procedure – store keeping : bin card & stores ledger – techniques of inventory control : periodic and perpetual inventory control, ABC analysis, EOQ-methods of pricing of issues – problems on FIFO & LIFO only Unit 3. Labour Costing 8 Hours Meaning of time keeping and time booking – idle time, causes and treatment – overtime – methods of wage payment : Time rate system, piece rate system, incentive schemes, Halsey premium plan and Rowan bonus plan – problems on Halsey and Rowan plan only. Unit 4. Introduction of Management Accounting 8 Hours Meaning & definitions, objectives of management accounting – differences between cost accounting and management accounting, financial accounting and management accounting – scope – limitations of management accounting. Unit 5. Financial Statement Analysis 16 Hours Meaning of financial Statements – objectives of financial statement analysis – tools of financial statement analysis – problems on comparative financial statements, common size financial statement analysis and trend percentage analysis Skill Development : Classify the elements of cost incurred in the production of a product Make a list of materials use din any two organizations Collect different formats for material requisitions, purchase requisitions and bin card Preparation of wage sheet with imaginary figures Collect financial statements of a joint stock company and prepare comparative and common size financial statements Books for reference : 1. Cost Accounting – S.N. Maheshwari 2. Management Accounting – S.N. Maheshwari 3. Cost Accounting – Jain & Narang 4. Cost Accounting – Nigam & Sharma 5. Management Accounting – Shashi K. Gupta 6. Cost Accounting – Das Gupta IV Semester B.Com. 4.2 BUSINESS COMMUNICATION -II Unit –I 10 Hrs Business Letters A) Collection Series_ Letters to Customers Regarding Dues_ Following. B) Letters to Banks Regarding Overdrafts. C) Letters to Insurance Companies Regarding Payment of Premium, Renewal of Insurance Policy Claims and Their Settlement. Unit –II 10 Hrs Personnel Correspondence : A) Job Applications : Preparing Bio-Data / C V and Resume ; Covering letter for A Job Application. B) Letters Calling Candidates for Written Test, Drafting Interview Letters; Appointment Letters. C) Employees Disciplinary Matters. Show Cause Notice ; Charge Sheets ; Letters of Dismissal and Discharge. Unit – III 5 Hrs Inter Departmental Communication : Internal Memos, Office Circulars, Office Orders Office Notes, Communication with Regional / Branch Offices. Unit – IV 05 Hrs Modern Communication Devices : Internet_ Tele Conferening_ Cellular Phones_EMail_Computers_Laptops_Word Processing_DTP_E-Commerce_Photo Copies. Skill Development : A Minimum of 5 Exercises on the above Units Books for Reference: 1. R.O. Sharma and Krishna Mohan: Business Communication and Report Writing. TMH, NEW DELHI. 2. Ramesh and Pattana Setty : Effective Business English and Correspondence 3. Majumdar : Commercial Correspondence 4. Urmila Rai : Commercial Correspondence 5. Pink and Thomas : English Grammars, Composition and Correspondence 6. Madhukar : Business Communication. CORPORATE ACCOUNTING -II Objective : To enable the Students to develop awareness about corporate Accounting in conformity with provisions of Companies Act. Unit – I : 10 Hrs. Profit Prior to Incorporation : Meaning and objectives of calculation of profit prior to and after incorporation – Treatment – Calculation of time sales ratio and combined ratios for the allocation of expenses and incomes – Preparation of profit and loss account. Unit –II : 15 Hrs. Amalgamation of Companies – Meaning of amalgamation, objectives – Calculation of purchase consideration under : net assets and net payments methodTypes of amalgamation : Amalgamation in the nature of Merger and Amalgamation in the nature of purchase as per Accounting Standard 14. Problems on amalgamation in the nature of merger – Journal entries and ledger accounts in the books of transferor companies. Unit – III : 10 Hrs. Amalgamation of companies in the nature of purchase – Journal and ledger accounts in the books of both purchasing and vendor companies. Unit –IV 10 Hrs. Internal Reconstruction : Meaning and objectives – Reduction of capital – legal provisions relating to capital reduction – Accounting procedure for capital reduction – Journal entries a preparation of capital reduction account and Balance sheet after capital reduction. Unit – V : 15 Hours Accounts for Liquidation of Companies : Meaning of liquidation – Different methods of winding up-Liquidator, liquidator’s remuneration – Preferential creditors, preference dividends, calls in advance, debentures interest-preparation of liquidator’s final statement of account. Skill Development : 1. List any five cases of amalgamation of companies 2. Identify the legal provisions with respect to their reconstruction 3. Prepare SWOT analysis of a company 4. Arrange mock court to discuss the need for internal reconstruction 5. Arrange mock court to discuss the need for Mergers and acquisitions. Book for Reference : 1. Corporate Accounting – Jain and Narang 2. Advanced Accounts : R.L. Gupta and M. Radhaswamy 3. Corporate Accounting – Anil Kumar, Mariyappa, Rajeshkumar. 4. Financial Accounting – S.N. Maheswari 5. Corporate Accounting –II – R. Srinivasa Putty, H.R. Appannaiah Reddy 6. Advanced Accounting – Shukla and Grewal B.Com. IV Semester Paper 4.4 COMPUTER APPLICATIONS IN BUSINESS Objectives : To enable the students to understand the application of computers in Business environment with an emphasis on Accounting. Unit – 1 : 5 Hours Introduction to Windows – Basics, Windows Accessories, Using file and Program Manager Unit -2 : 10 Hours Introduction to MsWord – Editing a Document – Move and Copy text – Formatting text and paragraph – Finding and Replacing text and spelling checking – Using tabs, Tables, and other features, Enhancing document – using mail merge and other features. Unit -3 10 Hours Introduction to Worksheet – Getting started with excel – Edition Cells and using commands and functions – Moving and Coping, Inserting and Deleting Rows and Columns – Getting help and formatting a worksheet – Printing the worksheet – Creating Charts – using formulae and functions in excel. Unit – 4 5 Hours Introduction to Power Point Presentation, & Ms-Outlook Unit – 5 : 5 Hours Introduction to Desktop publishing, Computer Viruses, securing and usage of e-mail, Designing Web Page Unit – 6 : 15 Hours Accounting Software – Using Tally Software : introduction and installation, Required Hardware, Preparation for installation of tally software, installation. Working in Tally: Opening new company, Safety of Accounts or Password, Characteristics, Making Ledger Accounts, writing voucher, Voucher entry, making different types of voucher, correcting sundry debtors an sundry creditors accounts, preparation of Trail Balance, Accounts books, Cash Book, Bank Books, Ledger Accounts, Group Summary, Sales Register and Purchase Register, Journal Register, Statement of Accounts, & Balance Sheet. Skill Development : Maintain a Record on Practicals. Books for Reference : 1. Craig Stinson “Running Microsoft Windows-98” – Mcirosoft press. 2. Joshua C. Nossiter. “Using Excel – 5 for Windows” 3. Vishnu Priya Singh & Meenakshi Singh “Computerized Financial Accounting” 4. “Working with Word” – Aptech Computer Education 5. “Power Point Presentation” – Aptech Computer Education. 6. Malthotra, Computer Applications in Business Note : A minimum of 12+ [4 hours of Tally] practical classes should be conducted in second semester and practical internal assessment marks will be given based on the student performance in practical classes by the concerned teacher and no separate practical examination is recommended. IV Semester B.Com. 4.5 FINANCIAL MANAGEMENT Objectives : To give insight into financial decision making Unit – I 10 Hrs Financial Management – Meaning, Definition – Goals of financial management – Scope of Financial Management – Financial decisions – financial planning – objectives and principles of sound financial planning – long term and short term financial plan – factors affecting financial plan. Unit – II : 10 Hrs Financial Decisions, Sources of Capital – Capital structure – factors influencing capital structure – EBIT, EBT, EPS – analysis – leverage – simple problems Unit – III : 20 Hrs Investment Decision – Capital budgeting – significance – techniques of evaluation of investment proposals – Payback method – Return on investment method, Net present value method (simple problems only) Unit – IV : 5 Hrs. Divided Decisions – Dividend policy – Determinants of divided policy – Types of dividend policy – Forms of dividend. Unit – V : 15 Hrs Working Capital Management – meaning – importance of adequate working capital – excess or inadequate working capital – determinants of working capital requirement, Source of working Capital. Cash Management, receivable management and inventory management (Meaning only) Skill Development : 1. Identify the decision areas in which a financial manager has a role to play. 2. Prepare a Capital Estimate for your new Business. 3. Evaluate the NPV of investment made in any one of the capital project with imaginary figures for 5 years. 4. Capital structure analysis of companies in different industries. 5. Study of dividend policy practices of certain companies in India. Books : 1. I.M. Pandey : Financial Management 2. Khan and Jain : Financial Management 3. S.N. Maheshwari : Financial Management 4. Prassannachandra : Fundamentals of Financial Management 5. P.N. Reddy and Appannaiah : Financial Management IV Semester B.Com. 4.6 COST AND MANAGEMENT ACOUNTING -II Objective : To familiarize the students with various concepts and application of cost and management Accounting. Unit – I 10 Hours Overheads Costing : Meaning and classification of overheads – Allocation – Apportion and Absorption of overheads – Problems on Machine hour rate – Repeated Distribution method and Simultaneous Equation methods. Unit – II 14 Hours Reconciliation of Cost and Financial Accounts : Need for reconciliation – reasons for differences in profits – problems on preparation of reconciliation statement. Unit – III 8 Hours Methods of Costing – 1 : Various methods of costing (Theory) – problems on contract costing – Process costing – Preparation of process accounts – treatment of normal loss, abnormal loss and abnormal gain (Excluding equivalent production and inter process). Unit – IV 16 Hours Ratio Analysis : Meaning and significance of ratio analysis – Classification of ratios (a) profitability ratios – GPR, OPR, NPR, ROCE, EPS (b) Turnover ratios – STR, DTR, CTR (c) Financial ratios – CR, LR, DER, PR and capital geanng ratio Unit – V 12 Hours Cash Flow Statement Analysis : Meaning and importance of cash flow statement – preparation of cash flow statement as per AS-3. Skill Development : 1. Collection and Classification of overheads incurred in an organization. 2. Prepare Reconciliation statement with imaginary figures. 3. Make a list of several industries established in your area and Indicate the method of costing adopted by them. 4. Collect financial statement of a company and compute important ratios. Books for Reference : 1. Cost Accounting : S.N. Maheswari 2. Cost Accounting : Jain and Narang 3. Management Accounting : S.N. Maheswari 4. Cost Accounting : Nigam and Sharma 5. Management Accounting : Shashi K. Gupta 6. Cost Accounting – Das Gupta