WG1 case study. Russian integration in the Baltic Sea Region

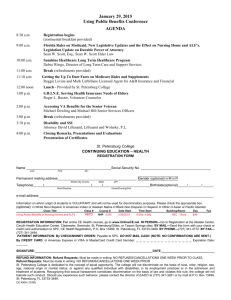

advertisement