Problems and Solutions

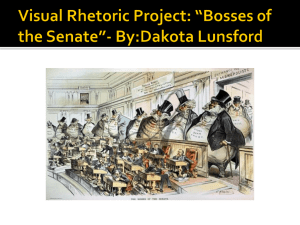

advertisement

Problems Microeconomic Theory – Monopoly and Market Power University of Zagreb Christopher Avery SESSIONS 1 and 2 (Monopoly Pricing) 1. Geometry of the Cost and Demand Functions in Monopoly Pricing Consider a monopolist facing linear demand P(Q) = 16 – Q. (a) Find the monopolist’s profit-maximizing choice of price and quantity if C(Q) = 8Q so that marginal cost is constant at 8. (b) Find the monopolist’s profit-maximizing choice of price and quantity if instead C(Q) = 2Q2. Note that this cost function yields exactly the same total cost as the original cost function C(Q) = 8Q for the monopolist’s optimal quantity in (a). Explain why the monopolist’s optimum quantity, however, is not the same in (a) and (b). (c) Now return to the original cost function C(Q) = 8Q. Find the monopolist’s profitmaximizing choice of price and quantity if the demand function P(Q) = 16 – Q2 / 4. Note that this demand function yields exactly the same quantity as the original demand function P(Q) = 16 – Q for the monopolist’s optimal price in (a). Explain why the monopolist’s optimal price, however, is not the same in (a) and (c). 2. Elasticities and the Price-Cost Margin (adapted from MWG 12.B.2) Consider a monopolist with marginal cost c per unit produced with c > 0. The total demand is give by q(p) = αp-ε, where ε > 0. (a) Show that if ε < 1, then the monopolist’s optimal price is not well defined. Explain the nature of the demand function in this case and why this occurs. (b) Assume that ε > 1. Derive the monopolist’s optimal price, quantity, and price-cost margin (pm – c) / pm. SESSIONS 3 and 4: (Price Discrimination) 3. Price Discrimination with Two Types of Consumers Adapted from MWG 12.B.7 Consider the widget market. The total demand for men is give by pm(qm) = 30 – qm and total demand for women is given by pw(qw) = 24 – 2qw. The cost of production is c = 4 per widget. (a) Suppose the widget market is competitive. Find the equilibrium price and quantity sold. (b) Suppose instead that firm A is a monopolist in the widget market. If it must charge the same price to both men and women, what is its profit-maximizing price? Under what conditions do both men and women consume a positive level of widgets in this solution? (c) If firm A has produced total level of output X, what is the welfare maximizing way to distribute it among men and women (with the goal of maximizing Marshallian aggregate surplus)? (d) Suppose that firm A is allowed to charge different prices to men and women. What prices does it charge? (e) Now consider the same problem but with marginal cost c = 20. What is the monopolist’s optimal quantity and price under this assumption? (f) What is the price-discrminating outcome with c = 20, as in (e)? Does price discrimination increase social surplus in this case? 4. Domestic Monopoly and Exports Consider a firm that has a domestic monopoly and that also exports goods for sale in a competitive world market. The firm chooses two quantities: y for the domestic market and z for the world market. Its total cost is C(Q) = F + Q2/4, where Q = y + z and F is a known constant. Suppose that the price in the local market is given by p(y) = 80 – y, while the price in the world market is equal to 30. (Since the world market is competitive, this firm’s choice of z will not affect the world price.) (a) Assume that the firm’s profit-maximizing choice (y*, z*) has both y* > 0 and z* > 0. Use the first-order conditions for profit-maximization to identify y* and z*. (b) What is the optimal choice of z if y* = 0 (i.e. if the firm only produces on the world market)? (c) What is the optimal choice of y if z* = 0 (i.e. if the firm only produces on the domestic market)? (d) Compare the firm’s profits for the production plans you identified in (a), (b), and (c). Explain in words why the firm increases its profits by selling in both markets. (e) Explain in words how the monopolist’s maximization problem is analogous to a consumer problem with quasilinear utility. (f) For what values of F can the firm operate profitably? What is the firm’s average total cost as a function of F? (g) Identify a range of values for F such that (1) the firm makes a profit with y*, z* > 0; and (2) the firm’s average total cost is greater than 30, the price in the world market. Could the firm be accused of "dumping" its product on the world market when F is in this range of values and it sells in both markets? SESSION 5: Oligopoly 5. Cournot vs. Monopoly. (a) Solve MWG 12.C.9. b) Consider Cournot competition between two firms with different cost functions. Firm 1 has cost function c1(q1) = q12 / 2, while firm 2 has cost function c2(q2) = c q2, where and c are known constants. Market demand remains p(Q) = A - BQ, where Q is total quantity, q1 + q2. What are the first-order conditions for the optimal quantities chosen by firms 1 and 2 in this case? (c) Suppose that firm 1 would produce a larger quantity as a monopolist than firm 2 would produce as a monopolist. Is it possible that the total quantity produced by the two firms in Cournot competition would be greater than firm 2's monopoly quantity, but less than firm 1's monopoly quantity? Use the first-order conditions from part (b) and for firm 1 as a monopolist to explain your answer. 6. Differentiated Products Duopoly Firms 1 and 2 produce differentiated products. Let q1 be the quantity produced by firm 1, and q2 be the quantity produced by firm 2. Let p1 and p2 be the prices of the two products. Inverse demand for each good is given by: p1 = 1 – q1 + z q2 p2 = 1 – q2 + z q1 For simplicity, assume that each firm has zero marginal cost and no fixed costs. In this question, you are asked to apply the logic of the Cournot duopoly model to analyze the competition between these two firms. a) Under what circumstances are goods 1 & 2 substitutes? Under what circumstances are they complements? b) Suppose that each firm takes the quantity produced by the other firm as given and chooses its own quantity in order to maximize its profit. Derive each firm’s best response function. What are the equilibrium quantities and prices in this model? c) Solve the two inverse demand curves above for q1(p1, p2) and q2(p1, p2). Your answer should look like q1(p1, p2) = a – b p1 + c p2 and q2(p1, p2) = d – f p2 + g p1, where you supply the values of a, b, c, d, f, and g. d) Now, suppose that each firm takes the price set by the other firm as given and chooses its own price in order to maximize its profit. Derive each firm’s best response function (which gives the price it charges as a function of the other firm’s price). What are the equilibrium prices and quantities in this model? e) Compare the equilibrium prices and quantities under quantity competition (part b) and price competition (part d). Which type of competition results in higher prices? Which results in higher quantities? f) Relate your answer in part e to the difference between Cournot and Bertrand competition when products are homogeneous.