File - Helping Material Of MBA

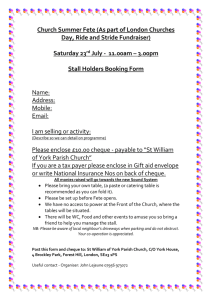

advertisement

INTRODUCTION What is a Bank? Bank is a Pipeline through which currency moves into and out in a circulation. Bank is a dealer in money. It is an intermediate party between borrower and lender. History of Banking. This has not been so far decided that how word “Bank” was originated. Some authorities say that this has been derived from the words “Bancus” or “Banqne” which means “Bench”. However there exist another opinion regarding it that this word has derived from Greek word “Bank” that means “Joint Stock of Fund”. Since it is not possible to decide which theory is correct and holds the true validity. Banking infact is as ancient as human society. As men came to realize the importance of money as a medium of exchange, the necessity of a controlling and regulation agency or institution was needed. Perhaps there were Babylonians who developed Banking system as early as 2000 B.C. FORMAL DEFINATION Banking is an institution transacting the business of accepting for the purpose of money from public, repayable on demand or otherwise draft, order and includes any post office saving bank”. There are following types of banks: Central Bank Commercial Bank Industrial Bank Exchange Bank Saving Bank Mortgage Bank COMMERCIAL BANKS: Commercial Banks are companies “Which transact business of banking in Pakistan. Commercial banks have constituted the most important source of institutional credit in the economy of Pakistan. BANKING IN PAKISTAN. Pakistan inherited a week banking system at the time of independence in 1947. at that time there were 38 Scheduled banks with 195 offices in “Pakistan”. But by December 31,1973 there were 14 Scheduled Pakistani Commercial Banks with 3,233 offices all over Pakistan and 74 offices in the foreign countries. There were 19 foreign banks with the status of small branch offices, which were engaged in export of crop from Pakistan while there were only two Pakistani institutions, Habib Bank and Australia Bank. Customers were unsatisfied due to uncertain conditions. Reverse Bank of India was also not in the favor of Government of Pakistan. However the Government of Pakistan decided to establish a full-fledged bank. Consequently the Governor General of Pakistan, Father of Nation Quaid-eAzam Muhammad Ali Jinah, inaugurated the “State Bank of Pakistan” on July 1, 1984. Thus a land mark was made in the history of banking. The state Bank of Pakistan helped the Government in the establishment of other financial institutions and banks. The banking structure in Pakistan comprises of following types. 1. State Bank of Pakistan. 2. Commercial Banks of Pakistan. 3. Saving Banks. 4. Co-operative Banks. 5. Specialized Financial Institutions. The commercial banks were more effective. Up to December 31,1973 there were 14 Pakistani commercial banks which functional all over the country. All these were nationalized in January 1,1974 by the Government of Pakistan and were merged and recognized into following five banks. 1. United bank Limited (UBL) 2. National Bank Limited (NBL) 3. Muslim Commercial Limited (MCB) 4. Habib Bank Limited (HBL) 5. Allied Bank Limited (ABL) State Bank of Pakistan was the central bank. Separation of Pakistan caused a lot of problems and difficulties in banking sector of Pakistan. Government of Pakistan, in late1990, introduced the need for privatization. The state Bank of Pakistan issues the shares of these banks periodically. Bank employees and ordinary people can also purchase the shares and can earn profits. Throughout the period of bank in history, the banks have been expanded rapidly and have achieved desired goal of progress. The Government approved and permitted the establishment of 10 new private banks in August 1991. hence many new private banks have incorporated since then. Askari Commercial Bank Limited is also one of newly established private scheduled Banks. It is a branch of Army welfare organization. (AWT). AN INTRODUCTION TO ASKARI COMMERCIAL BANK, LIMITED ASKARI COMMERCIAL BANK LIMITED was incorporated on October 09, 1991 as a Public Limited Company and is listed on Karachi, Lahore and Islamabad Stock Exchanges. Its main Sponsors are Army Welfare Trust (AWT). Army Welfare Trust (AWT) shareholding in bank are approximately 45 %. Initial paid-up capital of Askari Bank was Rs.300M. It went public on January14, 1992 with initial public offering (IPO) of Rs. 120M, which was over subscribed 16 times. The bank obtained its business commencement certificate in February 23, 1962. Its core business is Foreign Trade Financing. The bank, since its inception has achieved and sustained an increasing trend of profitability and growth by focusing on the basis essentials of banking. The Head Office of Askari commercial Bank Limited is at AWT Rawalpindi. The Head office leads and supervises all the branches scattered in the far off areas. The departmentalization of Head office has been done on the basis of functions. In order to perform various functions there are eight divisions of the Head office. PRESIDENT SECRETARIAT The president supervises all the working of the branches. He holds meeting with the branch managers and makes the policies in coordination with Board of Directors. 1. Audit Division. The head is called Audit Chief. This division audits the various branches and certifies that their working is flow less. 2. Credit Division Credit Division supervises the credit department of different branches. It sanctions the various credit advises sent to it by different branches and monitors the loan. 3. corporate and planning division. This division is responsible for the corporate affairs and the various planning schemes of Askari Commercial Bank Ltd. 4. Financial Bank The financial Division makes the financial statements and look after monetary affairs of the bank. 5. Business Development Division The international division is responsible for managing international relations with other foreign banks. All sorts of internationals affairs are settled here. HUMAN RESOURCE DIVISION This department coordinates all the divisions. All the divisions are bridged together through this department. ACCOUNTS DEPARTMENT. The Accounts Department checks the entire working of all the department of the bank. Salary payment is also a job of this Department. FUNCTIONS OF ACCOUNTS DEPARTMENT 1. PREPARATION OF DAILY BANK POSITION STATEMENT Accounts Department has the job of preparing Bank’s daily position. What actually happens is that at the end of the day is posted in the computer. The next day is printouts are taken and given to Accounts Department. These computer printouts are called “End of the Day.” The “End of the Day” of previous day and two statements i.e UNIDOO 100 and UNIDDO 170 are consulted while making Bank position Statement. UNIDOO 100 A statement that shows the assets and liabilities of the branch at the particular data. UNIDOO 170 (STATEMENT OF DEPOSITS) This statement shows the details deposits in local and foreign currency. After preparing the statement the in charge of the department signs it and then it is countersigned by Operation Manager. Then it is faxed to Head office. 2.CHECKING BANK’S DAILY ACTIVITY The job of Accounts Department is to check the entire working of the Branch. All the vouchers that have been posted in computers are scrutinized in Accounts Department. The “End of the Day Statement” i.e the computer printout of the whole day activities of previous day is taken. The vouchers of that date are sorted out head wise. Then the vouchers are checked against the entries in the statement. Any abnormally, if occurs, is immediately dealt with. After checking of activity it is signed by department in charge and operation Manager. 2. Payment of Salaries One another function of Accounts Department is payment of salary. Head office provides the Salary schedules to each branch. According to schedule Salaries are given and Salary statement is prepared. PAY/ SALARY STRUCTURE There are three types of pay/ salary strucrure. a) Basic Salary b) Gross Salary c) Net Salary a) Basic Salary It is a salary is provided in salary schedule. b) Net Salary When provided fund is deducted from Gross Salary, it becomes Net Salary. Net Salary = Basic Salary + Allowances- Deductions. At ASKARI COMMERCIAL BANK the pays are dispatched on 26th of each month all over the country. The maintenance and record keeping of Allowances is done by the Accounts Department. ALLOWANCES (i) Medical Allowances. Medical allowances is 10 % of basic salary. (ii) House Rent Allowances It is 45 % of the basic salary. (iii) Electricity allowances This allowances is 10 % of basic salary. (iv) Provided Fund One basic salary in one year (Deducted from the employee’s salary). One basic salary in one year (provided by Bank). 4.PREAPRATION OF STATEMENTS. Accounts department prepares different statements and send them to Head office. Some statements are: Statement of Expenditures Salary Statement. Petty cash Statement. Accounts department also prepare statements that are sent to state Bank of Pakistan(SBP) e.g. MONTHLY STATEMENT OF SBP. A monthly statement known as “statement of Assets and liabilities is prepared as on 30th of month (last day of month) and send to SBP.” HALF YEARLY STATEMENT TO SBP A statement showing details of assets and liabilities on 30 th June and then on 31st December (i.e after half year) are prepared and send to SBP. Some other statements like classification of deposits, advances, bills purchased and discounted and classification of Investment in securities and shares are prepared by Accounts dept. VOUCHERING OF BANKS EXPENDITURES Accounts department also deals with expenditure occurring in the branch. Different kinds of bills are dealt with in Accounts Department. For example if some examples occur on computer maintenance. Then the bill of bank is brought to Account Department. A debit and credit vouchers are made here. e.g. Debit – Expense Account computer Stationary. Credit- Bills payable pay slip issued. Both vouchers are attached with the bill and are signed by both head of accounts dept and Operation Manager. 5. CALCULATION OF DEPARTMENTATION Depreciation on asset at Askari commercial Band Ltd Multan branch is calculated through, “Straight-line Method”. Depreciation is calculated both manually and on computer. 6.MAINTENANCE OF LEDGER. Working at Accounts Dept. is computerized but some ledgers are also maintained manually. For example, Leave Record Register. Furniture and Fixtures. Bank Vehicles Register. Computer Register. Office Supplies Register. Medical Allowance Register. 7. OPERATING THE LOCKER. Accounts Dept. deals with lockers Askari Bank has also provided the facility of lockers to its customers. WHAT IS LOCKERS? Locker is an individual safe that a customer has for his personal use. People hesitate to keep their important things like sewellary, documents etc so the bank gives the facility to use the lockers. These are assigned on individual and joint basis and customers operate them without any hesitation or problem rather in a safe manner. TYPES OF LOCKERS 1. Large sized lockers. 2. Medium size lockers. 3. Small size lockers. 1. LARGE SIZE LOCKERS. Large size lockers have more capacity. Customer having large size locker at ACBL is charged 2500 per year for locker. The charges of extra large locker is 3000. while of extra-extra large is 5000. 2. MEDIUM SIZE LOCKER At Askari Commercial Bank charges for medium size locker is 1500 per year. 3.SMALL SIZE LOCKER. At ACBL charges for small size locker is 1000 per year. For key deposit charges are 1000/locker while Breaking charges are 2000/locker while Late payment charges are 50/locker. KINDS OF LOCKERS Two kinds of lockers are there at ACBL. 1. Single 2. Joint 1. Single. Only an individual can operate this type of locker. No other person is allowed. If person that own locker, dies then locker can be operated by permission of the court. 2. Joint. This kind of locker is opened on the basis of either or survivor. Any one f the holders can operate the locker in this case. HOW TO OBTAIN A LOCKER For having the locker following requirements are fulfilled at ACBL Multan Branch. 1. Account The customer must have the account in the concerned bank. 2. ID-Card. A photocopy of ID-Card is needed. 3. Application form for lockers Application form containing all necessary in formations about the customer is filled for have locker at bank. 4. Security. The customer should deposit the security fee to the bank. This is refundable and customer can get it when he/she closes his/ her locker in bank. OPERATING THE LOCKER Accounts department deals with lockers. The head of accounts department has keys to locker room. The person having with Accounts Department manager during banking hours. The person is checked personally by the manager and his/her. Signatures are also verified on the locker register where other in formations are also recorded like Current data Time of opening Time of closing After verifying signatures Accounts department manager gives keys of locker to the customer and he/she can visit his/her locker in the locker room. After visiting the locker keys are returned to the accounts department manager. CLOSING OF LOCKER If customer want to close the locker then kept that is payable by the customer is received by the bank. Key is also taken over and the security of the locker is refunded to the customer and account on the locker register is also closed. AUDIT DEPARTMENT Audit is done for checking whether the activities in the banking are going in the right direction or not. Audit Department in the bank checks whether everything in the bank is according to rules and regulation or there is violation in performing the activities according to rules and regulation. Therefore audit department tells whether activities in the bank are going in right or wrong direction. TYPE OF AUDITS Two types of audits are there: (i) Pre Audit (ii) Post Audit 1. Pre Audit This audit is normally done by the internal auditors of the bank. The purpose of pre audit is to check the activities before they are completed. Pre audit is done for completing the activities according to rules and regulation. Before the activities are completed, they are checked that whether they are in right or wrong direction. If they are not according to rules and regulations then they are corrected. The benefit of pre audit is to ensure that activities will complete in right where correction and guidance is needed. Mostly the internal auditors in the branch do pre audit so that to ensure the completion of activities in right way before the external auditors audits the branch. 2. Post Audit Post audit is done after completion of activities. Pre audit checks that whether active s. pre audit checks have been completed according to the rules or not. Mostly Post Audit is done by the external auditors of the bank like State Bank of Pakistan etc. Post audit is done for knowing that whether activities are completed in right or wrong direction. The activities not performed in right way are identified. Post audit shows where correction is needed. Normally for internal auditing every bank has its own policies, regulation and instruction. For external auditing State Bank regulations i.e prudential regulation are there. In banks three types of Audit is there. (i) Internal audit (ii) State Bank audit (iii) Statuary audit I. INTERNAL AUDIT Internal audit is within the bank and is done by the bank. Internal audit is done so that the weakness should be corrected before the external audit is done. At Askari Commercial Bank Ltd Multan, branch Mr. Shafiq Khalid is the internal auditors of the branch. He checks all the activities performed in the branch. He checks that whether everything going on are according to policies, regulations and instruction of the bank of not. He identify the place where correction is needed and ensures that every activity will be completed according to rules. II. STATE BANK AUDIT State Bank Audit can be done by State Bank of Pakistan at any time. State Bank audit is in public is properly deled or not. III. STATUARY AUDIT Under the companies act every bank is bounded to have audit from chartered Accountant firms/ agencies. Statuary Audit is done at 31 December I-e at the end of the year. The statuary Audit of Askari Commercial Bank Ltd is done by Taseer Hai Khalid and co chartered Accounts. Statuary Audit is done for checking Assets of banks Deposits of banks Liabilities of banks Investment etc of the banks. The Auditor’s Report 2001 for Askari Commercial Bank Ltd shows that the auditors (Taseer Hadi Khalid & co) have audited the balance sheet of ACBL at 31st December 2001, related profit and loss accounts, cash flow of changes in equity etc for the year ended. The auditors report in the auditing report that (a) Proper books of accounts have been kept by the bank as required by companies ordinance 1984. (b) The balance sheet and profit and loss accounts together with notes are in accordance with Banking Companies Ordinance 1962 and the companies ordinance 1984. (c) The expenditure occurred during year was for the purpose of the Bank’s business. (d) The business conducted, investments made and the expenditure incurred during the year were in accordance with the objectives of the bank and the transactions of the bank have been within the powers of the bank. (e) The balance sheet, profit and loss account, cash flow statement and statement of changes in equity together with the notes can form with approved accounting standards as applicable in Pakistan and give the information required by the Banking companies ordinance 1962 and companies ordinance 1984 in manner so required fair view of the Bank’s affairs as at 31 December 2001 and its true balance of profit, its cash flows and changes in equity for the year ended. (f) Zakat deductible at source under Zakat and user ordinance 1980 was deducted by bank and deposited in the central Zakat Fund established under Section 7 of that ordinance. Some other types of Audits are Income tax audit and Excise audit etc. The main purpose of each Audit to keep the activities of the bank on right track and to ensure that everything is according to rules, policies and regulations. CASH DEPARTMENT Cash department deals in cash and cheques. The cash department at ASKARI COMMERCIAL BANK LTD MULTAN is being operated by six persons. Mr. Bilal is the in charge of the department while other members include Mr. Rahmat, Mr. Abid, Mr. Ali, Mr. Zahid and Miss Noreen. As cash department deals in cash and cheque, so it is necessary to understand what is cheque. CHEEQUE Cheque is a financial instrument. It is basically an order. Under section 6 of Negotiable instruments Act 1881 cheque is defined as: THE REQUIREMENTS OF A CHEQUE It should be in writing The drawer must not put any condition for the payment of the cheque. Drawn on a specified banker only Payable on demand. A certain sum of money Payable to a specified person Signed by the drawer. TYPES OF CHEQUES: There are two types of cheques. (1) Open cheque. (2) Cross cheque. (1) OPENCHEEQUE Open cheque is that cheque whose payment is through cash. (2) COSS CHEQUE Cross cheque is the cheque where the payment is not through cash but is through account. Cross cheque has two types a) Simple crossing. b) Special crossing. (a) SIMPLE CROSSING In case of simple crossing any body who is the bearer / holder of the cheque can get6 amount through his //her Account on simple crossing is on the cheque. Crossing stamp is like this. (b) SPECIAL CROSSING In case of special crossing bearer is no more important. In special crossing only payee or beneficiary can get amount through. His // her account. In case of special crossing bea4rer is crossed and stamp of payees A/C only is there on the face of the cheque. PAYEES A/C ONLY. BOOK KEEPING IN CASH DEPT. In cash dept amount of cash is recorded through. (I) Receiving cashier’s Book (II) Paying cashier’s Book (III) Daily cash position Book (i) RECEIVING CASHIER’S BOOK The receiving cashier’s book is used to write down the details of the incoming cash. There are two receiving cashier’s book. One is for foreign currency and other is for Pakistani Rupees. (ii) PAYING CASHIER’S BOOK The paying cashier’s book is used to note the details of the outgoing cash. Paying cashier’s book is also of two types. One is for foreign currency while other is for Pakistani Rupees. (iii) DAILY CASH POSITION BOOK The daily cash position book is used for recording the daily ending balance f the cash on hand. Daily ash position books for foreign currency and for Pakistani Rupees are separate. Functions Of Cash Department Cash Department performs following important functions (i) cash Deposit/ cash Receipt. (ii) Cash payment. (iii) Calculation of daily cash position. (iv) Cash management (i) Cash Deposit/cash Receipt. When a customer comes to cash department for depositing cash in his/her account then in cash department following procedure takes place. (i). The customer fills the pay-in-ship. There are two types of pay-in – slips, red and green. The cashier receives the pay-in-slip and cash. (ii) And check with the amount written on the pay-in-slip. (iii) Then cashier signs the pay-in-slip. (iv) Cashier writes the entries in the receiving cashier’s book i.e. serial No, account type, A/c number, cheque number and amount. The cashier puts the stamp of the “ Cash Received” on the pay-in- (v) slip. (vi) The pay-in-slip receipt is given to the customer and the amount is posted in the computer. Cash Payment (ii) When a customer comes to withdraw a certain amount from his/her account, he/she brings a cheque with him/her. In this case, the following steps are taken. (1) The cashier receives the cheque and checks it whether it is posted or predated. Cheque can be cashed within Six months. There fore the date on the cheque should be six month prior and not be of the next day. A repeated cheque cannot be cashed. (2) It is also checked that cheque is of the same branch or of any other. (3) Type of cheque is also checked that whether it is bearer, order or cross cheque. (4) It should be checked that there is no over writing on cheque. (5) The signatures are verified which are present one on the front of the cheque and two on the back of the cheque in case of bearer cheque. (6) The amount in figure and in words is also checked. (7) After verification of signatures, date and other particulars, the cheque is given a token number. Customer receives the token against the cheque. (8) Now the cheque is forward to computer section for “posting”. (9) In computer section, the balance within the account is checked. Other instructions are also received e.g. blocked, frozen etc. in case balance is present in the account, the account is debited by the account is debited by the amount on the cheque and posted on the cheque and posted cheque is handed over to cashier. (10) The signature of the drawer are verified from the signature specimen cards already feeded in computer system. (11) The cashier counts the cash and the cash in paid to the person and token is received back. (12) Cheque is stamped “Cash paid” immediately. (13) The entry is made in the paying cash book and the serial number is written on the cheque. (14) In case of any invalid cheque, the officer in the computer section returns the cheque to the customer along with a slip that carries the reason that why the cheque is returned. This returned cheque is also recorded in the “Cheque Return Register” (iii) Calculation of Ending Cash Balance. The official time for receiving deposits and payments at ASKARI COMMERCIAL BANK LTD Multan is till 1:35 p.m. however some important customers are accommodated after wards. For calculation of ending cash balance at the end of the day following steps are taken. (1) The cash in hand is counted. It contains the cash at the counter and cash in the strong room. (2) The opening balance is taken i.e. the ending balance of the previous day. (3) The cash receipts are added. (4) The cash payment is deducted. (5) This daily cash position is written on the daily cash position Bank. The cash position books for Pak Rupees and foreign currency are Separate. Then these balances are matched with the amounts on the computer. Cash in hand is calculated in such a way. Cash Receipt + Cash in hand (Of Last Day) – Cash paid = Cash in Hand. (iv) Cash Management. Cash management is a technique of managing cash according to the requirements of the bank on daily basis. The operation Manager, manages this aspect of cash. There is cyclic variation in business in Multan city. The bank keeps more cash in cotton season. Bank during the rest of the year, normal level is maintained. Askari has accountant at state bank of Pakistan just like other branches. A 5% total deposits are maintained at 5BP. So there are two main sources of cash. 1. State Bank of Pakistan. 2. Head office. If the branch borrows cash from Head office it has to pay an interest of 13% on the other hand, if the cash is remitted to head office, the branch gets profit at 12.75%. vouchers are separated. (5) Cr suspense A/C cash in transit Dr suspense A/C cash in transit Cr SBP A/C. LIQUIDITY MAINTENANCE the Askari Commercial Bank Ltd has to maintain 35% liquidity at state Bank of Pakistan. Every branch has to maintain 5% of its deposits at local State Bank of Pakistan. The other 30% is kept in form of approved securities e.g. foreign investment bills and Treasury Bills. SWOT ANALYSIS STRENGTHS 1- Askari Bank has achieved a lot of awards which shows that it is the bank of first choice in the region. 1) Askari Commercial Bank Ltd. is declared as “Best Bank in Pakistan” by “Euromony” magazine in 1995. 2) Asia money magazine is declared as “Commercial Bank of the year” in Pakistan for 1994 and 1996. 3) Askari Bank is rated for A1+ for short term and at for long term by Pakistan credit. Rating Agency (PACRA) which is affiliated to IBCA Ltd. of U.K. 4) Askari Bank won 2nd prize for the best presented annual accounts of 1996 in the financial sector by the Sought Asian Federation of accountants (SAFA). 5) Askari bank is declared as “Best Bank in Pakistan” by Global finance in 2001. 2- Askari Bank Ltd. is one of the first private banks in Pakistan to offer innovative products and services to its customers like 24 hour telephone banking. 3- Askari Bank, being a leading bank of Pakistan has been quick to introduce ATM (Automated Teller Machine) services to customers. Electronic cash dispensing facilities are now available at major centers like Karachi, Lahore and Rawalpindi. All these ATMs are linked through a state of art satellite based communications system offering read-time 24 hours service. 4- Askari Commercial Bank is the only private sector bank that has been approved by the world bank as a participating financial institution for the US$200 million line of credit sanctioned to the government of Pakistan for the financial sector deepening and intermediation project. 5- Askari Bank is operating with 36 branches locate through Pakistan. most of the branches are connected through state of art, online communications network, which gives the bank a competitive edge in providing instant service to its clients. They also offer direct access to the latest foreign exchange rates through their online communications system. 6- Interest rate of Askari Bank is better than its competitors. 7- Askari Bank offers value plus A/C that have insurance and tide facility. Privilege card is free with it. 8- Staff of ACBL is highly educated and trained. They work hard and follow rules and regulations of bank. WEAKNESSES Some weaknesses of ACBL are: i. Online services are not free as compared to other banks like Alfalah. ii. Number of branches of ACBL are limited. iii. Number of ATMs are limited and are not easily accessible to to customers. iv. Mostly work load on employees increases and they remain in office till 8-9 P.M. To decrease this load appropriate number of employees should be there in each department. OPPORTUNITIES Technology is rapidly changing. It plays a pivotal role in enhancing customer expectations, particularly with respect to speed and quality of service. So ACBL may enjoy more customers. If they update their technology with changing world. Because it will create more opportunities of growth for them. THREATS Branch network of other competitors banks is spread not only over the country but also in foreign countries. Askari bank has 36 branches all over the Pakistan and no branch outside the country so it may create threat for future earnings. Technology in banking sector is also changing so it is necessary to update technology according to the changes taking place in market for future growth. If steps are not taken accordingly, it may threat in future. SUGGESTIONS AND RECOMMENDATIONS 1) It is highly necessary to promote the bank through aggressive advertising campaigns in order to capture considerable share in the banking sector. 2) The bank should provide advances on easier conditions to attract more and more customers, also sanctioning process should be made more efficient and some authority should be given to the branch manager to sanction loans within certain limits. 3) Number of branches should be increased. 4) ATM machines should be accessible to customers. 5) There should be marketing department. 6) Concept of front office and back office should be there. 7) Customer service counter should be there. The concept of greater should be introduced in braches. Greater means receiving customer and guiding them to concerned department. 8) The authorities of bank should take necessary actions to raise the salaries of their employees giving bounces and other privileges to them for motivating them to increase their efficiency. 9) Working hours of bank are from 9-00 A.M. to 5-00 P.M. but staff members remain in office till 8 or 9 P.M. This is because of extra burden of work on them and a desire to fulfill the goals of branch. For avoiding this problem all departments should have appropriate staff members. AFS-1: FINANCIAL ANALYSIS The importance of financial statement lines in their utility to satisfy the question in the mind of different stakeholders. Different classes of people are interested in the financial statement analysis with a view to assessing the economic and financial position of any business or industrial concern in terms of profitability, liquidity or solvency etc. For example, the commercial banks are mainly interested in short term liquidity and profitability while prospective investors may be interested in long terms profitability and solvency. Financial statements, among other things, include balance sheet and income statement. Balance Sheet presents assets & liabilities of the business at a given date. Besides, showing the ability of the business to service the loans on the strength of its financial structure and on the history of its profitability, it helps in judging the impact of financial and fiscal support and in evolving secured basis for extending such support. Likewise, apart from showing the progress and profitability of a business, income statements disclose how the business has been conducted and determines factors behind a rise or decline in the net worth. The purpose of analysis of Financial Statements (FS ) is to examine past and current financial data so that a company’s performance and financial position can be evaluated and future risk and potentials can be estimated. The analysis can yield valuable information about trends and relationship, the quality of a company earnings, and its financial strengths and weaknesses. The analysis would answer questions like: Is the business expanding or contracting? Is it more profitable than last year or less profitable? How efficiently is the capital employed in the business being utilized? Does the business has any financial problem? And much more To evaluate financial statements, an analyst must: Be acquainted with business practices; Understand the business and accounting terminology; Be aware of accounting conventions and limitations of accounting; Be acquainted with the tools of analysis of FS TOOLS OF ANALYSIS Financial summary and comparative review: The analyst would like to compare the financial date of the company with prior years results as well as with other companies in the same industry or with the industry in which company operates. Vertical Analysis Another useful way of analyzing statement is to convert them ito common size statement by expressing absolute rupee amounts into percentage of a base figure. The income statement would thus exhibit expense as percentage of sales and each asset/liability as a percentage of total assets and total liabilities. Statements so prepared are called common size statements. The analysis facilitates the comparison with prior periods and also highlights the relative significance of each item. The analysis can be equally useful for inter firm comparison. Horizontal Analysis The computation of percentage changes in the same items over time is referred to as horizontal or trend analysis. This spotlights trends and establishes relationships between items that appear on the same row of a comparative statement thereby disclosing changes on items in financial statements over time. Ratio Analysis: The figures in financial statements, do not tell the whole truth. To obtain meaningful information relationship between relevant figures must be examined. For instance: 1. Relationship which help find the liquidity of the business. 2. Relationship which reflect the effectiveness of the financial policies adopted and the potential fund raising ability. 3. Relationships which help evaluate the effectiveness of operational policies. To achieve the aim, we undertake Ratio Analysis. Ratios provide the means of showing the relationship which exists between figures on the Balance Sheets and Income Statements. The analysis is undertaken to assess important characteristics of business like liquidity, solvency and profitability. A study on these aspects enables drawing conclusions as to financial requirements and capabilities of business units. Ratios may be classified in a number of ways to suit any particular purpose. Different kinds of ratios are selected fro different types of situations. Balance sheet ratios: These ratios are also called financial ratios. The components for computation of these ratios are drawn from the Balance Sheet. Example, Current Ratio, Liquid Ratio, Debt Equity Ratio etc. Profit & loss account ratios: Theses ratios are also called operating ratios. The items used for the calculation of these ratios are usually taken out from the profit and loss statement. Example Gross profit Ratio, Operating Ratio etc. Inter-statement or combined ratios: The information required for the computation of these ratios I normally drawn from both the Balance Sheet and Profit & Loss Accounts. Examples: Debtors Turnover Ratio, Stock Turnover Ratio, Net Profit to Fixed Ratio etc. The bankers to arrive at a definite conclusion concerning liquidity and solvency of the business club these ratios as follows: Liquidity Ratios: These ration are used to measure the ability of the business to meet his maturing obligations or current liabilities. Example: current ratio, Acid Test Ratio 1. LEVERAGE . RATIO: These ratios help to measure the financial contribution of the owners compared with that of the creditors, as also the risk of debt financing. They are also know as capital structure ratio. Example : Debt Equity Ratio, fixed Assets to net worth, interest coverage ratio. 3 Turnover or Activity Ratio: These ratios enable measurement of the effectiveness of the resources at the command of the concern. Exemple : Fixed Assets Turnover Ratio, Inventory Turnover etc. 4 Profitability ratio: These ratios are intended to measure the end result of business operations. Example Gross profit Ratio, Return on Capital Employed, operating Ratio. 5 investor ratios. These ratios helps prospective investors in making their decision about purchase or sell of shares of a particular company. Example per share, dividend per share. Price earning ratio, yield per share, etc. Formulas for calculating different ratios. 1. Current Ratio = 2. Acid Test Ratio Current liabilities 3. Working Capital Assets-Inventory) Turnover Ratio = 4. Debtors Turnover = Current Assets Liquid Assets (Current Current liabilities Net Sales RATIO Average Accounts Receivable 5. Creditors Turnover Ratio = Credit Purchases Average Account = account Payable 6. Average age of bills receivable 365 x Sales 7. Stock Turnover Ratio, it can be calculated by employing any one of the following formulae. A cost of good sold Average inventory at B Net sales Average inventory at C number of units sold Average number of cost cost units in stocks 8. Raw materials turn over ratio consumed Over Ratio = Material = Average Stocks Of units in stocks 9. Finished Good Turn Over = = Cost of goods sold Average stock of = Cost = Average = Total cash + cheque = Gross Profit finished goods 10. Work in process Turn work Over of completed work in process. 11. Cash Turnover Ratio payments 12. Gross Profit Ratio Net sales x 100