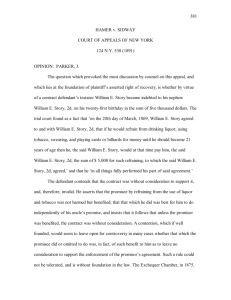

unexpected circumstances in contract law

advertisement