California Labor Code

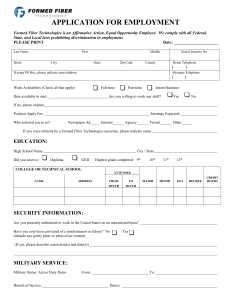

advertisement