VI. Explanations of Intraindustry Trade in

advertisement

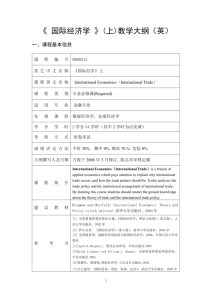

CHAPTER 4 Intraindustry Trade CHAPTER OUTLINE I. II. III. IV. V. VI. VII. Introduction Intraindustry Versus Interindustry Trade Defining Intraindustry Trade intraindustry Trade Index PASSPORT: Intraindustry Trade in U.S. Foreign Trade — Tables 4.1 and 4.2 The Increasing Importance of Intraindustry Trade Table 4.3 developed vs. developing countries Explanations of Intraindustry Trade in Homogenous Products transportation costs services entrepot and re-export trade seasonal products Explanations of Intraindustry Trade in Differentiated Products differentiated products horizontal vertical PASSPORT: Equilibrium with Monopolistic Competition — Figure 4.1 A. Economies of Scale interindustry trade — Figure 4.2 intraindustry trade — Figure 4.3 B. The Product Cycle Figure 4.4 PASSPORT: The Learning Curve C. Overlapping Demands PASSPORT: The U.S. Automobile Market — Table 4.4 The Welfare Implications of Intraindustry Trade Figure 4.5 TEACHING NOTES AND TIPS I. Introduction 75 76 Chapter 4 Notes In the previous chapter, it was mentioned that all trade could not be explained by the factorproportions theory. The purpose of this chapter is to close out the explanation of what “causes” international trade with an explanation of trade among countries in similar products. Teaching Tip Prepare the students for the different “character” of this chapter. Explaining IIT is a messy business compared with the logical tightness of the factor-proportions theory. II. Intraindustry vs. Interindustry Trade Notes The purpose of this section is to show that IIT is logically incompatible with the factorproportions theory. This sets up the later discussions of how to explain IIT. Teaching Tip Interindustry trade and IIT are not incompatible. They are just two parts of the whole (international trade). We’ve explained what causes the former and now we’re moving to an explanation of the latter. III. Defining Intraindustry Trade Notes You don’t have to “measure” interindustry trade: if you export (import) product X then you don’t import (export) it. IIT is not so easy because you are doing both. As a result, you have to explain how the IIT index works. The second part of the section is built around Table 4.3. For virtually all types of economies, IIT is now so important that we have to spend some time explaining why it happens. Teaching Tip Note that by defining the IIT index you are creating a continuum from 0 to 1. Zero defines pure factor-proportions trade and the closer you get to 1 the more things look like IIT. The result is that by trying to define IIT you are also getting a look at factor-proportions trade at the same time. IV. The Increasing Importance of Intraindustry Trade Notes Table 4.3 shows that IIT is important and that it is an increasingly important part of international trade for both developed and developing countries. Tables 4.1 and 4.2 give examples of IIT for industries in the U.S. Teaching Tip IIT is now a pervasive part of world trade. It is also a part of the student’s daily lives. In how many of their consumption decisions do they have the choice of either a domestic or foreign good? In a world with only factor-proportions trade, it would be just one or the other. Intraindustry Trade 77 V. Explanations of Intraindustry Trade in Homogeneous Products Notes The section explains why intraindustry trade can occur in some homogeneous products. The four explanations are border trade, services, entrepot and re-export trade, and seasonal trade. Teaching Tip The factor-proportions theory is concerned with homogeneous products and most IIT occurs in differentiated products. However, you need to dispense with IIT that does occur in homogeneous products to “clear the field” so to speak for the main discussion of trade in differentiated products. VI. Explanations of Intraindustry Trade in Differentiated Products Notes The first part of the section is a brief review of concepts from microeconomic principles. The rest of the section is devoted to the three main theories of IIT: economies of scale, the product cycle, and overlapping demands. Teaching Tip While economists tend to emphasize EOS as an explanation of IIT, the students will be more familiar and comfortable with the product cycle and the idea of overlapping demands. However, the three are not separate boxes and they overlap a good bit. The EOS example is also an overlapping demands example. VII. The Welfare Implications of Intraindustry Trade Notes There are two points to this section. First, imperfectly competitive markets are always troubling from a welfare perspective as price is above marginal cost. However, there are still gains from this type of trade in terms of consumer choice making markets more competitive than they otherwise would be and allowing for greater economies of scale. Finally, it may be easier for firms to adjust to competition with IIT. Teaching Tip Ask the students what would happen to their welfare if the U.S. banned imports of any product that the country exports. If we export the product, then we must have a comparative advantage in that product and don’t “need” to import it. The loss here is a big loss of choices and having choices improves consumer welfare even if there are no quantifiable dollar savings. BRIEF ANSWERS TO PROBLEMS AND QUESTIONS FOR REVIEW 1. Interindustry trade is international trade that occurs when a country either exports or imports goods in different industries. Intraindustry trade is international trade that occurs when a country exports and imports goods within the same industry or product group. 78 Chapter 4 2. Intraindustry trade is measured by the intraindustry trade index. This index indicates the amount of intraindustry trade embodied in a country’s international trade. The index is expressed as1 minus the ratio of the absolute value of exports minus imports divided by exports plus imports. 3. The extent of intraindustry trade is shown in Table 4.3. For the U.S. intraindustry trade is approximately 59.6 percent of trade in manufactured goods. For developed countries it is 62.0 percent and for developing countries it is 46.5 percent. 4. The formula for the intraindustry trade index is as follows: Intraindustry Trade Index = 1 - X -M X + M For a particular industry or product group, X represents the value of exports and M represents the value of imports. The vertical bars in the numerator of the index denote the absolute value of the difference between the amount exported and the amount imported. If the U.S. only imports $100,000 of cloth from India, the second term in the expression reduces to 1 by dividing ($100,000/$100,000), and the whole expression equals 0. This indicates no intraindustry trade in the cloth industry. If the U.S. only exports $100,000 of machines to India, the second term in the expression reduces to 1 by dividing ($100,000/$100,000), and the whole expression equals 0. This indicates no intraindustry trade in machines. If the U.S. exports $50,000 in food to India and imports $50,000 in food from India, the second term in the expression reduces to 0 by dividing (0/$100,000), and the whole expression equals 1, indicating that 100 percent of the trade in the food industry is intraindustry trade. Thus, the intraindustry trade index ranges from 0 (no intraindustry trade) to 1 (100 percent of the trade is intraindustry trade). The closer the index is to 1, the more intraindustry trade there is relative to interindustry trade. The closer it is to 0, the less intraindustry trade there is relative to interindustry trade in the same good or service. 5. The computed intraindustry trade index is .75. 6. Intraindustry trade in homogeneous goods between countries can occur under four possible circumstances. First, an identical and bulky material such as cement for which the cost of transportation is high relative to its value can be a basis for intraindustry trade when individuals buy the product from the closest supplier. Second, homogeneous services also can be the basis of intraindustry trade due to the joint production of the service or peculiar technical conditions. Third, some countries engage in substantial entrepot and re-export trade. Fourth, seasonal or other periodic fluctuations in output or demand can lead to intraindustry trade in homogeneous goods. 7. Horizontally differentiated goods are goods that are perceived to be different in some slight way, although their prices are similar. For example, candy bars may have the same price but contain very different flavors or ingredients. Vertically differentiated goods have very different physical characteristics and different prices. For example, the prices and physical characteristics of new automobiles vary enormously. Intraindustry Trade 79 8. Economies of scale means that as the production of a good increases, the cost per unit falls. This phenomenon also is known as decreasing costs or increasing returns to scale. Scale economies are internal when the firm’s increase in output causes a decline in its average cost. A firm that has high fixed costs as a percentage of its total costs will have falling average unit costs as output increases. When there are external economies of scale, a firm’s average unit cost falls as the output of the entire industry rises. Because the industry may depend on the existence of suppliers or a large pool of labor with the skills necessary in that industry, external economies of scale explain why firms within an industry tend to cluster geographically. 9. Economies of scale can be a basis for trade when an increase in the demand for a product allows a firm to produce more output and take advantage of economies of scale and lower unit costs. With free trade, the firm would be able to export the product to foreign countries. 10. The product cycle is the process where goods are produced and introduced in a developed country requiring heavy R&D expenses and refinement in production, followed by product stabilization in design and production, and finally complete standardization and production in a developing country. In the first stage of the product cycle, manufacturers of a “new” product need to be near a high-income market where they can receive consumer feedback. At this point, the product’s design and production are improved and adjusted to determine the most efficient method of producing it. These design and production enhancements usually require specialized scientific and engineering inputs that are available only in industrialized countries. Aside from serving the domestic market, the firm will begin to export the new product to countries where there is additional demand from high-income consumers. In the second stage, the product matures as it becomes more standardized in terms of size, features, and the production process. At this point, the firm may find it more profitable to produce the product in other high-income markets rather than export it from the domestic country. In the third stage of the product cycle, the product and the production process have become so standardized that profit maximization leads firms to produce in the lowest-cost production site. At this point, the standardized production processes can be moved to developing countries where using semiskilled labor in assembly-type operations keeps production costs low. The innovating country now becomes an importer of the product. 11. Examples of products that have experienced a typical product cycle include radios, TVs, VCRs, and semiconductor chips. While the product may have started as a “new” and somewhat unique product in the first phase, it ends up in the last stage as a standardized product, where factor abundance and low-production cost determine the pattern of production and trade. 12. According to the overlapping demands hypothesis, trade in manufactured goods is likely to be greatest among countries with similar tastes and income levels. Linder argued that firms within a country are primarily oriented toward producing a specific variety of a good for which there is a large home market. As a result, a country’s tastes and preferences determine the specific variety of the product its firms can export to foreign 80 Chapter 4 consumers. The most promising foreign markets for these exports will be found in countries with tastes and income levels similar to those of the country in which the products are produced. Each country will produce products that primarily serve its home market, but part of the output will be exported to other countries where there is a receptive market. 13. The discussion of intraindustry trade and overlapping demands indicates that countries with similar incomes would tend to have a higher percentage of their trade as intraindustry trade. However, developing countries also engage in a substantial amount of intraindustry trade. Some of this trade can be explained as intraindustry trade with other developing countries at a similar level of income. However, it has been observed that there is also a growing amount of intraindustry trade between developed and developing countries. Explaining this trade requires linking vertical product differentiation with overlapping demands. In a developing country there may be a substantial number of consumers with incomes similar to that which prevails in developed countries. The domestic producers who are producing for the majority tastes and preferences within the country may poorly serve these consumers. Satisfying the needs of these high-income consumers may be most profitably accomplished by importing higher-quality versions of the products from developed countries. The reverse is true for developed countries. In these countries there may be less affluent consumers who desire cheaper varieties of a product that are not profitable to produce domestically because the market is too small. The solution may be to import lower-priced versions of the products designed for consumers in low-income countries. The existence of vertical product differentiation and overlapping demands between different groups of consumers in different types of countries helps to explain the growing amount of intraindustry trade between developed and developing countries. 14. Intraindustry trade in differentiated products improves the general welfare of a country to the extent that domestic consumers have more types of the product available from which to choose. Additional types of the same differentiated product lower the prices of those products and improve the range of quality of those products. For example, without Japanese automobile imports as well as automobile imports from other countries, U.S.made automobiles would probably be of lower quality. MULTIPLE-CHOICE QUESTIONS 1. * * Intraindustry trade: a. occurs when a country simultaneously exports and imports the same product. b. cannot be adequately explained using the factor-proportions theory of international trade. c. is measured using the intraindustry trade index. d. all of the above Intraindustry Trade 81 2. * The simultaneous export and import of beer by the U.S. is an example of: a. interindustry trade. b. perfect competition. c. constant returns to scale. d. intraindustry trade. 3. * Intraindustry trade: a. can be explained in the same way we explain trade in wheat or textiles. b. cannot happen if the products in question are differentiated. c. cannot occur if the market is characterized by monopolistic competition. d. all of the above 4. A large amount of international trade: a. involves differentiated products. b. is intraindustry trade. c. is based on imperfect competition. d. all of the above * 5. * A relatively large amount of intraindustry trade would be associated with: a. an index of intraindustry trade close to zero. b. an index of intraindustry trade of .20. c. a large amount of imports in a product category with few exports in the same product category. d. an index of intraindustry trade close to 1.0. 6. * The growth of automobile trade among developed countries is an example of: a. intraindustry trade. b. interindustry trade. c. the factor-proportions theory. d. the Leontief paradox. 7. When there is balanced (exports equal imports) intraindustry trade in a certain product, the index of intraindustry trade is: a. 0.00. b. 0.25. c. 0.50. d. 1.00. * 8. * If in 2002, U.S. automobile exports were $100 billion and imports were $300 billion, the index of intraindustry trade would be: a. 0.25. b. 0.75. c. 0.50. d. 1.00. 82 Chapter 4 9. * A problem associated with measuring intraindustry trade is: a. the industry or product groups are well defined. b. the industries do not have the data to measure trade. c. the trade is two-way trade. d. the products are not counted as exports or imports. 10. * The intraindustry trade index: a. ranges from 0 to 1. b. is 0 when all trade in the industry or product group is intraindustry trade. c. is 1 when all trade in the industry or product group is interindustry trade. d. is calculated by subtracting total imports from total exports. 11. If a country is importing 20 units of a product and exporting 10 units, then the IIT index would be approximately: a. 0.0. b. 1.0. c. 0.67. d. 0.1. * 12. * 13. * 14. * 15. * Country A imports $60 in shirts and exports $40 in shirts. Its intraindustry trade index for shirts is: a. .8. b. .2. c. $10. d. $90. Country A imports $50 in shirts and exports $50 in shirts. Its intraindustry trade index for shirts is: a. 0. b. 1. c. .50. d. $100. The intraindustry trade index is computed using the following formula: a. (X – M) b. (X – M)/(X + M) c. |X - M|/(X + M) d. 1 - |X - M|/(X + M) Intraindustry trade is most common in: a. Latin America. b. developing countries. c. developed countries of Europe. d. all countries. Intraindustry Trade 83 16. * 17. * 18. * 19. * Intraindustry trade in homogeneous products occurs because: a. foreign products are more expensive. b. tariffs make domestic good affordable. c. seasonal fluctuations. d. lower domestic communication costs. Which of following is not a reason for intraindustry trade in homogeneous products? a. Identical and bulky materials b. Joint production of certain kinds of services c. Entrepot trade d. Product differentiation Which of the following is not an explanation of intraindustry trade in homogeneous products? a. Foreign suppliers may be closer along the borders of a country than domestic suppliers. b. Entrepot and re-export trade c. Seasonal fluctuations in output or demand d. Lack of resources to make a product domestically Which of the following is not a reason for IIT in homogeneous products? a. Border trade b. Seasonal trade c. Trade in homogeneous services d. Product differentiation 20. * Horizontally differentiated products are products where: a. the prices are similar but the products differ slightly in some perceived manner. b. both the physical characteristics and the prices of the products differ. c. the physical characteristics of the product are identical but product prices differ. d. the physical characteristics and product prices are identical. 21. Vertically differentiated products are products where: a. the prices are similar but the products differ slightly in some perceived manner. b. both the physical characteristics and the prices of the products differ. c. the physical characteristics of the product are identical but the prices differ. d. the physical characteristics and the prices are identical. * 22. * Which of the following characterizes monopolistic competition? a. Price collusion b. Price discrimination c. Product differentiation b. Price controls 84 Chapter 4 23. * Which of the following market structures is imperfectly competitive? a. Monopoly b. Oligopoly c. Monopolistic competition d. All of the above 24. * Intraindustry trade: a. tends to be associated with differentiated products. b. is never associated with vertically differentiated products. c. rarely occurs between developed and developing countries. d. can be dismissed as a data issue. 25. Firms in imperfectly competitive markets: a. are not able to influence the price of the product. b. can influence the price of the product by changing the quantity offered for sale. c. are not able to differentiate the products within the industry. d. have alliances with foreign countries to avoid double taxation. * 26. * 27. * 28. * 29. * The essential characteristic of a competitive firm is that: a. it is a price maker. b. it is a price taker. c. the market demand for the product does not exist. d. firms produce differentiated products. A competitive firm is one: a. that has a large advertising budget. b. that has monopoly power. c. that has no effect on the market price. d. that can raise prices to increase profits. A monopolist has market power because: a. it is a price maker. b. it produces a unique product. c. it has the ability to alter the market price of the product. d. all of the above In which of the following market structures is there only one firm? a. Monopolistic competition b. Oligopoly c. Monopoly d. Perfect competition Intraindustry Trade 85 30. * 31. * 32. * 33. * 34. * Which market structure is characterized by only a few firms? a. Monopolistic competition b. Oligopoly c. Monopoly d. Perfect competition Which of the following factors could potentially cause intraindustry trade? a. The existence of significant economies of scale b. R&D being an important input into the production process c. The operation of the sunspot cycle d. Both A and B Which of the following is one of the most important determinants of intraindustry trade? a. Physical capital b. Human capital c. Unskilled labor d. Economies of scale Economies of scale: a. are known as decreasing costs or increasing returns to scale. b. are internal to the firm if the expansion of the size of the firm itself is the basis from the decline in its average costs. c. are external to the firm when a firm’s average costs fall as the output of the entire industry rises. d. all of the above If output more than doubles when all inputs are doubled, production is said to occur under conditions of: a. constant returns to scale. b. perfect competition. c. interindustry trade. d. increasing returns to scale. 35. * Economies of scale: a. contributes to the existence of intraindustry trade. b. refers to the tendency for per unit costs to rise with the level of output. c. do not contribute to the existence of intraindustry trade in differentiated products. d. never occur in the production of homogeneous products. 36. A decline in average costs caused by the expansion of a firm is a form of: a. external economies of scale. b. internal economies of scale. c. expansionist economies of scale. d. fixed economies of scale. * 86 Chapter 4 37. * A decline in average costs caused by the expansion of an industry is a form of: a. external economies of scale. b. internal economies of scale. c. expansionist economies of scale. d. industry economies of scale. 38. If the cost of producing a product declines dramatically with increases in the level of output then: a. economies of scale (EOS) may be a source of comparative advantage. b. countries with a large internal market may be more likely to have a comparative advantage in the production of this product. c. the level of output and comparative advantage are unrelated. d. Both a and b * 39. * The product cycle refers to: a. the changing location of production of a particular good over time. b. the changing of the marketing strategy for a particular good over time. c. the changing nature of a particular good over time. d. the changing pattern of comparative advantage over time. 40. The basic idea that certain countries specialize in producing new products based on technological innovation while other countries specialize in producing already wellestablished products is called: a. economies of scale. b. primary and secondary markets. c. product cycle. d. production cost theory. * 41. * Which of the following products would the product cycle least likely be applied to? a. TVs b. Calculators c. VCRs d. Crude oil 42. * According to the product cycle model, comparative advantage: a. may move from one country to another country as the product matures. b. will remain in the country where the product is introduced. c. is based on the income level of the domestic country. d. is based on economies of scale. 43. * Which of the following products would the product cycle most likely be applied to? a. Computers b. Coffee c. Crude oil d. Seasonal fruits Intraindustry Trade 87 44. * The product cycle follows which of the following production strategies? a. high-income domestic market, high-income non-domestic market, developing country market b. developing country market, moderate-income market, high-income domestic market c. high-income domestic market, moderate-income market, developing country market d. high-income domestic market, developing country market 45. A high-income country is more likely to trade with: a. underdeveloped countries. b. high-income countries. c. high population countries. d. developing countries. * 46. * 47. * 48. * 49. * In a high-income country which of the following statements is true with respect to the product cycle? a. The country would tend to export low-priced versions of goods. b. The country would tend to import high-priced versions of goods. c. R&D for high-priced versions of goods would be done in low-income countries where labor is cheaper. d. The country would tend to import low-priced versions and export highpriced versions of goods. Intraindustry trade (IIT): a. is nothing but a trivial data problem. b. can be analyzed in exactly the same way we analyzed interindustry trade. c. has nothing to do with trade in differentiated products. d. can be related to the existence of overlapping demands. Which of the following has not been known to lead to intraindustry trade? a. Overlapping demands b. EOS c. Vertical product differentiation d. Transfer pricing The theory of overlapping demands states that: a. average income levels determine the tastes and preferences of consumers within a country. b. countries with a low average income are more likely to trade with countries with a high average income. c. countries are likely to trade with other countries that have similar income levels. d. both a and c 88 Chapter 4 50. * Linder’s hypothesis that consumers prefer to choose from a variety of goods with slightly different characteristics: a. can explain intraindustry trade. b. means that countries with different standards of living will tend to trade iron for pharmaceuticals. c. is an explanation for factor-price equalization. d. is an explanation for differences in the cost of production among countries. 51. * In the theory of overlapping demands, the gains from intraindustry trade are a result of: a. a greater variety of products. b. increasing return to scale. c. imperfect competition. d. re-export trade. 52. Linder’s hypothesis provides an explanation for: a. interindustry trade. b. intraindustry trade. c. constant returns to scale. d. imperfect competition. * 53. * 54. * 55. * Which of the following would be an example of intraindustry trade based on overlapping demands? a. Bourbon b. Beer c. Volvos d. All of the above Which of the following is not an explanation of intraindustry trade? a. Economies of scale b. The product cycle c. Overlapping demands d. Factor proportions Which gives consumers more product choices? a. No international trade b. Interindustry trade c. Intraindustry trade d. Al of the above TRUE FALSE QUESTIONS 1. T Interindustry trade cannot be explained by the factor-proportions theory. 2. F Intraindustry trade can be defined as trade between countries in very dissimilar goods, e.g., steel and wheat. Intraindustry Trade 89 3. F The factor-proportions theory adequately explains why countries engage in intraindustry trade. 4. T Intraindustry trade is the situation where a country is both importing and exporting in the same industry. 5. F The exchange of automobiles between developed countries is an example of interindustry trade. 6. F The fact that the U.S. both imports tequila from Mexico and exports bourbon to Mexico is an example of interindustry trade. 7. F Interindustry trade is the situation where a country is both importing and exporting the same product. 8. F The intraindustry trade index can never be zero. 9. F Intraindustry trade in the world economy is not growing. 10. F IIT is more important for developing countries than it is for developed countries. 11. T If the intraindustry trade index is close to one for a particular industry this means that there is a lot of intraindustry trade in that industry. 12. F Interindustry trade occurs when a country simultaneously exports and imports the same good. 13. F The most commonly used measure of intraindustry trade is the foreign trade index. 14. T An intraindustry trade index of 0 indicates that 100% of the trade is interindustry trade. 15. F If the IIT index for a product category is .93 then there is very little intraindustry trade occurring in this product category. 16. F Intraindustry trade only occurs in differentiated goods. 17. T Entrepot trade occurs when a good is imported into a country and the same good is later exported to another country. 18. F Intraindustry trade never occurs in homogeneous products. 19. T Intraindustry trade in homogeneous goods could occur because of cross-border trade in goods with a low value/weight ratio such as cement. 20. T Intraindustry trade occurs mostly in differentiated products. 21. F Intraindustry trade occurs only in vertically differentiated products. 90 Chapter 4 22. T Horizontal product differentiation is the situation where the prices and quality of competing products are similar. 23. T The difference between a Ford and a Chevrolet is an example of horizontal product differentiation. 24. T The difference between a Rolls Royce and a Chevrolet is an example of vertical product differentiation. 25. F Vertical product differentiation only occurs in homogeneous products. 26. T In perfect competition, firms have little to no influence over the price of the product they produce. 27. T A critical distinction between imperfect competition and perfect competition is the number of individual firms in the marketplace. 28. T Horizontally differentiated goods are goods where the prices are similar but the goods differ slightly in some perceived manner. 29. T Economies of scale in differentiated products can lead to IIT. 30. F When a firm has external economies of scale, a firm' average costs rise as output of the industry expands. 31. F Economies of scale can only be internal to the firm. 32. F Economies of scale refers to the tendency for unit costs to increase with the level of output of the plant. 33. T Intraindustry trade can be explained in part by economies of scale. 34. F The product cycle model states that new products will be produced throughout its economic life in the country that introduces the production of the product. 35. F The product cycle is explanation for interindustry trade because as the product moves through its product cycle, there will be changes in the geographical location of where and how the product is produced. 36. T With the product cycle model, comparative advantage may move from one country to another as the product matures. 37. F The product cycle has nothing to do with the occurrence of intraindustry trade. 38. F Products subject to the product cycle usually are homogeneous products. Intraindustry Trade 91 39. F According to the product-cycle model, comparative advantage always stays in the country where a product is invented. 40. T The theory of overlapping demands explains why trade often occurs between countries that have similar levels of per capita income. 41. F According to Linder, a country would tend to export goods to countries with very different per capita incomes. 42. F Overlapping demands has nothing to do with IIT. 43. T Linder’s hypothesis says that countries with similar preferences will trade more intensively with one another. 44. F The overlapping of demands between two countries would tend to reduce the amount that the two countries trade with one another. 45. F The minority taste for a particular version of a product in a country has nothing to do with intraindustry trade. 46. F Intraindustry trade is not an effective method of reducing the monopoly power of domestic firms. 47. T With monopolistic competition, price is not always equal to marginal cost. 48. F Since the welfare effects of intraindustry trade are difficult to calculate we can safely presume that they are extremely small. 49. F IIT enhances economic welfare in exactly the same way that trade based on factor abundance enhances welfare. SHORT ANSWER ESSAY 1. Distinguish between interindustry and intraindustry trade. 2. Suppose that a country’s imports of computer chips are $1 billion and its exports of computer chips are $800 million. Calculate the intraindustry trade index for this country. Explain what the results of your calculation mean. 3. List and explain the reasons for intraindustry trade in homogeneous products. 4. Explain the difference between horizontally and vertically differentiated products. 5. What is the relationship between product differentiation and intraindustry trade? 6. What is the relationship between economies of scale and intraindustry trade? 92 Chapter 4 7. What is the product cycle? How is it related to intraindustry trade? 8. Use the Linder hypothesis to explain the fact that the U.S. simultaneously imports and exports automobiles. 9. Why would intraindustry trade occur between developed and developing countries? 10. Discuss the reasons why countries may engage in intraindustry trade. 11. List and explain the welfare effects of intraindustry trade. BRIEF ANSWERS TO SHORT ANSWER ESSAY 1. Interindustry trade is countries trading different goods with one another. For example, the U.S. imports cloth and exports machines, and India imports machines and exports cloth. Because each country has different resource endowments, countries trade very different goods. Intraindustry trade consists of a country exporting and importing the same good. For example, the U.S. imports and exports automobiles, beer, and steel. 2. The calculated intraindustry trade index is 0.88. This indicates that the majority of trade in this product is intraindustry trade. 3. Intraindustry trade in homogeneous goods between countries can occur under four possible circumstances. First, if the cost of transportation is high relative to the product’s value consumers might find it cheaper to buy the good from a foreign supplier if that supplier is closer than the nearest domestic supplier. In such cases, the export and import of the product would show up as intraindustry trade. Second, homogeneous services also can be the basis of intraindustry trade due to the joint production of the service or peculiar technical conditions. The export and import of transportation, insurance, and financing services to move goods between countries would show up as intraindustry trade. Third, some countries engage in substantial entrepot and re-export trade. With entrepot trade, goods are imported into a country and at a later time the same good is exported to another country. With re-export trade, goods are imported into a country and then subjected to some small transformation that leaves them essentially unchanged prior to exporting them to another country. This type of trade is intraindustry trade. Fourth, seasonal or other periodic fluctuations in output or demand can lead to intraindustry trade in homogeneous goods. Examples would include international trade in seasonal fruits and vegetables, electricity, and tourist services. 4. Horizontally differentiated goods are goods that are perceived to be different in some slight way, although their prices are similar. For example, candy bars may have the same price but contain very different flavors or ingredients. Vertically differentiated goods have very different physical characteristics and different prices. For example, the prices and physical characteristics of new automobiles vary enormously. Intraindustry Trade 93 5. Most intraindustry trade is trade in differentiated goods between countries. Differentiated goods have features that make them appear different from competing goods in the same market or industry. In addition, most international trade in differentiated goods occurs under conditions of imperfect competition. A critical distinction between perfect competition and imperfect competition is the number of firms in the marketplace. Under perfect competition, a firm cannot affect the market price because it is only one of many firms that produce virtually identical goods. Under imperfect competition, a firm is able to influence the price of the product by changing the quantity of goods offered for sale. When a firm in an imperfectly competitive market can influence the price of the product, this means that the firm has some degree of market power. Imperfect competition can occur under three different market structures – monopolistic competition, oligopoly, and monopoly. 6. A common explanation of international trade in differentiated products is that this trade is a result of economies of scale. Economies of scale means that as the production of a good increases, the cost per unit falls. To explain intraindustry trade using economies of scale consider a situation where both a U.S. automobile firm and a German automobile firm both produce full-size cars and subcompact cars under identical cost conditions so that they have the same long-run average cost curves (AC). Because cost and price structures are the same, there is no basis for trade. Now, assume that both Germany and the U.S. allow free trade in the automobile market. The total demand for full-size and subcompact cars in the combined German and U.S. markets is now larger, and this combined larger demand for full-size cars and subcompact cars would allow the U.S. firm to produce more full-size cars and take advantage of the economies of scale. The German firm now produces more subcompact cars and would take advantage of economies of scale. With free trade, the U.S. would export full-size cars to Germany, and Germany would export subcompact cars to the U.S. As a result, economies of scale can be used to explain intraindustry trade when initial comparative costs between countries are equal. 7. The basic idea behind the product cycle is that certain countries, primarily industrialized countries, specialize in producing new goods based on technological innovations, while other countries, mostly developing countries, specialize in producing already wellestablished goods. The theory of the product cycle is that as a good moves through its product cycle, there will be changes both in the geographical location of production and how the good is produced. In the first stage of the product cycle, manufacturers of a “new” product need to be near a high-income market, where they can receive consumer feedback on the product. Aside from serving the domestic market, the firm will begin to export the new product to countries where there is additional demand from high-income consumers. In the second stage, the product matures as it becomes more standardized in terms of size, features, and the production process. At this point the firm may find it more profitable to produce the product in other high-income markets rather than export it from the domestic country. In some circumstances, the domestic country, where the product was originally developed, may begin importing the product from other highincome countries where production costs are less. In the third stage of the product cycle, the product and the production process have become so standardized that profit maximization leads firms to produce in the lowest-cost production site. At this point, the 94 Chapter 4 standardized production processes can be moved to developing countries where using semiskilled labor in assembly-type operations keeps production costs low. The innovating country now becomes an importer of the product. In the innovating country, attention moves on to new products at the early stage of the product cycle. The product cycle can be used to explain some of the intraindustry trade both among developed countries and between developing and developed countries. For example, a country may be exporting a new product and at the same time importing a similar product from another country. With the constant flood of “new” products being developed in industrialized countries, intraindustry trade occurs among high-income countries as they exchange these new products with one another. The model also implies that high-income countries will be exporting “newer” versions of the product to developing countries and importing “older” versions of the product from these countries. 8. According to the overlapping demands hypothesis, trade in manufactured goods is likely to be greatest among countries with similar tastes and income levels. Linder argues that firms within a country are primarily oriented toward producing a specific variety of a good for which there is a large home market. In this case, a country’s tastes and preferences determine the specific variety of the product its firms can export to foreign consumers. The most promising foreign markets for these exports will be found in countries with tastes and income levels similar to those of the country in which the products are produced. Each country will produce products that primarily serve its home market, but part of the output will be exported to other countries where there is a receptive market. For example, a U.S. automobile firm will produce an automobile that satisfies the tastes and preferences of most U.S. consumers. However, there will be a small number of consumers that do not prefer the domestic version of the automobile produced by U.S. firms. In Sweden and Germany, automobile producers will produce an automobile that satisfies the tastes and preferences of most Swedish and German consumers respectively, but in both countries there will be a small number of consumers in these markets that do not prefer the Swedish or German automobile. In the U.S., Sweden, and Germany there are some consumers who are not able to purchase the variety of automobile that they prefer. The hypothesis of overlapping demands indicates that in this case, U.S. producers could produce for their domestic market and export automobiles to Swedish and German consumers who prefer the U.S. automobile. In addition, Swedish and German producers would be able to export automobiles to U.S. consumers who prefer German and Swedish automobiles. These sorts of overlapping demands can lead to intraindustry trade. 9. Overlapping demands implies that intraindustry trade would be more intense among countries with similar incomes. In general, the theory of overlapping demands can explain the large and growing amount of trade in similar but differentiated goods. It has been observed that there is also a growing amount of intraindustry trade between developed and developing countries, and the explanation of this trade lies in linking vertical product differentiation with overlapping demands. In a developing country there may be a substantial number of consumers with incomes similar to that which prevails in developed countries. The domestic producers who are producing for the majority tastes and preferences in the country may poorly serve these consumers. Satisfying the needs of these high-income consumers may be most profitably accomplished by importing Intraindustry Trade 95 higher-quality versions of the product from developed countries. The reverse is true for developed countries. In these countries there may be less affluent consumers who desire cheaper varieties of a product that are not profitable to produce domestically because the market is too small. The solution may be to import lower-priced versions of the product designed for consumers in low-income countries. The existence of vertical product differentiation and overlapping demands between different groups of consumers in different types of countries helps to explain the growing amount of intraindustry trade between developed and developing countries. 10. International trade increases world economic output and welfare. Although intraindustry trade results from different associated processes, welfare gains also occur with intraindustry trade. Intraindustry trade occurs in homogeneous products and in horizontally or vertically differentiated products. In the case of intraindustry trade in homogeneous products, the welfare gains for a country are similar to the welfare gains under interindustry trade. In the case of horizontally or vertically differentiated products, welfare gains also occur for the countries involved in this type of trade. The gains from intraindustry trade may be larger and the adjustment costs lower than for interindustry trade. 11. In the case of intraindustry trade in homogeneous products, the welfare gains for a country are similar to the welfare gains under interindustry trade. These gains occur as the traded goods are provided based on lower opportunity costs in the form of lower transportation, insurance, or financing costs or the provision of low-cost seasonal products. In the case of horizontally or vertically differentiated products, welfare gains also occur but there are additional factors to consider: (a) Product differentiation enhances consumers’ choices, but the products are produced in imperfectly competitive markets. In these markets, the price is greater than the marginal cost of producing the last unit of output. Further, imperfectly competitive firms are characterized by excess capacity, which means that they produce somewhat short of the most efficient or least unit cost level of output because of economies of scale. As a result, an imperfectly competitive market tends to have underused plants, and consumers are penalized through having to pay higher than perfectly competitive prices. (b) Intraindustry trade in differentiated products improves the general welfare of a country to the extent that domestic consumers have more types of the product available from which to choose. (c) Intraindustry trade is also effective at reducing the monopoly power of domestic firms. (d) Intraindustry trade makes it possible for companies to produce at higher levels of output. This means firms can enjoy the lower costs due to economies of scale and prices decline not only in the export market but also in the domestic market. (e) The adjustment costs of an economy moving towards free trade with intraindustry trade may well be reduced as the countries have similar incomes and factor endowments.