Imports, Exports and Essential Supplies Act

advertisement

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

(Repealed by Act No 17 of 2006)

The Imports, Exports and Essential Supplies Act

Chapter 502

1-Short title.

2-Interpretation.

3-Appointment of Director, Deputy Director and Assistant Directors of trade and

supplies.

4-Power to prohibit or restrict exportation or importation of goods.

5-Penalty for exportation or importation of goods contrary to order.

6-Director's power to issue and cancel licences.

7-Particulars to be specified in licences.

8-Names contained in licences to be specified in all documents relating to exported

goods.

9-Declaration as to ultimate destination of goods exported.

10-Power to control supplies of essential goods.

11-Power to require returns.

12-Commencement and publication of orders.

13-False statements, etc.

14-Power to enter and search premises under warrant

15-Powers of entry and seizure.

16-Power to search vehicles.

17-Procedure on seizure of goods.

18-Retention and disposal of seized goods.

19-Obstruction of officers.

20-General penalties.

21-Offences committed by company, firm or other association.

22-Legal proceedings and protection of officers.

23-Minister to consult other ministers in certain circumstances.

24-Regulations.

CHAPTER 502

www.kenyalaw.org

1

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

2

IMPORTS, EXPORTS AND ESSENTIAL SUPPLIES ACT

Commencement Date: 1958-12-09

An Act of Parliament to make provision for the control of the

importation and exportation of goods of any description and of supplies

essential to the life or well-being of the community; and for connected

purposes

PART I-PRELIMINARY

Short title

1. This Act may be cited as the Imports, Exports and Essential Supplies Act.

Interpretation.

2. In this Act, unless the context otherwise requires "assistant director" means a person for the time being appointed as an assistant

director of trade and supplies under section 3;

"Deputy Director" means the person for the time being appointed as Deputy Director

of Trade and Supplies under section 3;

"Director" means the person for the time being appointed as Director of Trade and

Supplies under section 3;

"export licence" means an export licence issued under section 6;

"goods" includes all kinds of articles, wares, merchandise and livestock;

"import licence" means an import licence issued under section 6.

Appointment of Director, Deputy Director and assistant directors of trade

and supplies. L.N.303/1964.

3. (1) There may be appointed a Director of Trade and Supplies and a Deputy

Director of Trade and Supplies, and so many assistant directors of trade and supplies

as may be deemed necessary, either for Kenya as a whole or for any specified area

of Kenya.

(2) The Director may, with the approval of the Minister delegate in writing all or any

of his powers, duties or functions under this Act, either generally or in any area in

Kenya, or for such periods or purposes as he may specify, to the Deputy Director or

to any assistant director, and may at any time revoke or vary any such delegation:

Provided that no such delegation shall be deemed to divest the Director of all or any

of his powers or duties or functions, and he may, if he thinks fit, exercise such

powers, duties or functions notwithstanding the fact that he has so delegated them.

PART II-CONTROL OF EXPORTS AND IMPORTS

Power to prohibit or restrict exportation or importation of goods. 11 of

1970, Sch., 13 of 1980, Sch.

Cap. 472.

4. (1) Whenever from time to time it appears to the Minister, after

consultation with such persons as appear to the Minister to represent commercial

and industrial interests in Kenya, to be necessary in the public interest, or for the

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

3

observance or performance by the Government of any of its obligations in respect of

external affairs, so to do, he may by order either prohibit absolutely or restrict, by

means of such conditions and limitations as may be specified in the order the

exportation or importation of all or any specified goods or class or description of

goods, either generally or to or from any specified country or place or to or from any

specified person or class of persons:

Provided that the Minister may dispense with such consultation as aforesaid in any

case which appears to him to be too urgent to permit of such consultation.

(2) Any order made under this section may be varied or revoked by a subsequent

order.

(3) The Minister shall not delegate to any person the powers conferred upon him by

this section.

(4) The provisions of subsection (2) of section 15 of the Customs and Excise Act

relating to prohibition shall not apply to any goods the importation of which is

restricted by an order made under this section which are imported into Kenya in a

manner that is not contrary to any law relating to customs and in respect of which an

import licence is granted whilst such goods are subject to customs control.

(5) This section shall not apply to drugs, poisons or other medical supplies of any

description.

Penalty for exportation or importation of goods contrary to order.

10 of 1988, s. 44.

5. Where the exportation or importation of any goods or class or description

of goods is prohibited or restricted, either generally or to or from any country or

place or to any person or class of persons, by an order made under section 4, any

person who exports or imports, or attempts to export or import, any such goods in

contravention of the provisions of the order otherwise than under the authority of an

export licence or of an import licence (as the case may be), or otherwise than in

accordance with the extent or the conditions of such licence, if any, authorizing such

export or such import, shall be guilty of an offence and liable to a fine not exceeding

one hundred thousand shillings or to imprisonment for a term not exceeding three

years or to both.

Director's power to issue and cancel licences.

6. (1) The Director may either grant or refuse to grant an export licence or an

import licence, authorizing the exportation or importation of any goods the

exportation or importation of which is for the time being prohibited or restricted by

an order made under section 4, or may grant such a licence to such extent or upon

such conditions as he may think fit, and he may likewise from time to time renew, or

at any time vary or cancel, any licence already granted.

(2) The Director may impose additional or different conditions upon the variation or

renewal of any export licence or import licence.

(3) No export licence or import licence issued to any person shall be transferred to

any other person except with the previous written permission of the Director, and

any person who attempts, or purports, to transfer any such licence to any other

person without such permission shall be guilty of an offence and liable to a fine not

exceeding two thousand shillings.

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

4

(4) An appeal shall lie to the Minister against any decision of the Director under this

section, which appeal shall be in writing and shall be lodged with the Minister within

seven days of the communication to the person concerned of the Director's decision;

and the decision of the Minister shall be final.

Particulars to be specified in licences.

7. Every export licence and every import licence shall specify(a) the name of the person to or from whom or the place to or from which, or, as the

case may require, both the name of the person to or from whom and the place to

and from which, exportation or importation of the goods is subject of the licence is

authorized by the licence;

(b) such of the conditions and limitations specified in the order imposing the

restriction on the exportation or importation of the goods the subject of the licence

as may be applicable in the case of such goods, person or place;

(c) the conditions to which the licence is subject in accordance with section 6; and

(d) such other matters as may be prescribed.

Declaration as to ultimate destination of goods exported. Cap.472.

9. (1) Whenever any consignment of goods, the exportation of which is

authorized by an export licence, is entered for exportation in accordance with the

Customs and Excise Act, the Director may require the exporter or any person acting

on his behalf to make a declaration in writing specifying the person for whom and

the country for which the goods are ultimately destined.

(2) Where any such consignment is intended to be exported otherwise than

overseas, references in subsection (1) to the consignment being entered for

exportation shall be construed as references to the consignment being delivered to

the contractor or other person actually effecting such exportation.

(3) The Director may, by notice in writing served upon the person appearing to the

Director to be the exporter of the goods, prohibit the exportation of any such

consignment pending the making and delivery to him of a declaration in any case in

which a declaration is required to be made under subsection (1) or (2).

(4) After the exportation of any consignment of goods, the expiration of which is

authorized by an export licence the Director may, whether or not a declaration has

been made or delivered under the preceding provisions of this section require the

exporter to produce to him, within such period, not being less than fourteen days

after the date upon which the consignment is intended to reach its ultimate

destination, as the Director may specify, satisfactory evidence that the consignment

has reached its ultimate destination as specified in the declaration or, as the case

may be, the export licence.

(5) Any person who (a) refuses or neglects to make or deliver to the Director any declaration required of

him under this sectionor

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

5

(b) knowingly or recklessly makes or delivers to the Director any such declaration

which is false or misleading in a material particular; or

(c) exports or attempts to export any goods in contravention of a prohibition

imposed by the Director under subsection (3); or

(d) refuses or neglects, except for reasons beyond his control, the onus of proof

whereof shall lie on him to produce to the Director satisfactory evidence in

accordance with subsection (4),

shall be guilty of an offence.

PART III - CONTROL OF ESSENTIAL SUPPLIES

Power to control supplies of essential goods 51 of 1960, s. 2,

L.N.303/1964.

10. (1) The Minister, so far as it appears to him, after consultation with such

persons as appear to the Minister to represent commercial and industrial interests in

Kenya, to be necessary in the interests of maintaining, controlling or regulating

supplies of any goods which he considers to be essential to the life or well-being of

the community, or the equitable distribution of such goods, may by order (a) prohibit absolutely or control or regulate the manufacture treatment, acquisition,

keeping, storage, movement, transport, distribution, sale, purchase, disposal ,use

and consumption of such goods;

(b) require any person in possession of any such goods to sell them to a specified

person or class of persons, at a specified price not being less than the price at which

similar goods are normally sold;

(c) provide for any incidental and supplementary matters for which the Minister

thinks it expedient for the purposes of the order to provide;

(d) empower the Director, the Deputy Director and all assistant directors, or any of

those persons, subject to such limitations (if any) as may be specified in the order,

to issue such directions as may seem to them or any of them necessary in the

interests of maintaining, controlling or regulating supplies of any goods which the

Minister considers to be essential to the life or well-being of the community, or the

equitable distribution of such goods, for all or any of the purposes referred to in the

foregoing paragraphs :

Provided that the Minister (i) may dispense with such consultation in any case which appears to him to be too

urgent to permit of such;

(ii) shall not act under paragraph (d) unless he is satisfied that the circumstances

render it impossible for him to exercise the necessary control by means of the

powers conferred by paragraphs (a), (b) and (c).

(2) Any order made under this section may prohibit the doing of anything thereby

forbidden except under the authority of a licence or permit granted, on payment of

fees or otherwise, or may require the doing of anything thereby ordered by such

authority or person as may be specified in such order and may be made so as to

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

6

apply either generally or to any particular goods or class or description of goods and

so as to have effect either throughout Kenya or in any particular area thereof, and

different orders may be made for different goods purposes or circumstances.

(3) Any order made under this section may be varied or revoked by a subsequent

order.

(4) All orders made under this section shall be laid before the National Assembly as

soon as may be after they are made and, if a resolution is passed within the next

twenty days on which the National Assembly sits next after any such order is laid

before it that the order be annulled, it shall thenceforth be void, but without

prejudice to the validity of anything done thereunder, or to the making of any new

order.

(5) Subject to the provisions of paragraph (d) of subsection (1), the Minister shall

not delegate to any person the powers conferred upon him by this section.

(6) Any person who contravenes the provisions of an order made under this section

otherwise than under the authority of a licence or permit, or otherwise than in

accordance with the extent or the conditions of such licence or permit, if any shall be

guilty of an offence.

PART IV - GENERAL

Power to require returns.

11. (1) Whenever it appears to the Minister, after consultation with such

persons as appear to the Minister to represent commercial and industrial interests in

Kenya, necessary so to do for the better carrying out of the provisions of this Act, he

may (a) by notice published in the Gazette, require any person or class of persons

carrying on any trade or business, or any specified trade or business, to complete

and return, periodically or otherwise, to such person as may be specified in the

notice, and within such time and with respect to such date or dates or such period or

periods as may be so specified, such forms and returns relating to the trade or

business, including the goods stocked, required or produced therein or thereby, as

shall be specified in the notice;

(b) serve upon any person whom the Minister has reason to believe may be carrying

on any trade or business notices requiring him to complete and return to such person

as may be specified in the notices, and within such time and with respect to such

date or dates or such period or periods as may be so specified, the like forms and

returns:

Provided that nothing in this section shall empower the Minister to require the

furnishing by any person of any information relating to any agricultural business

carried on by such person.

(2) No person shall be required under subsection (1) to furnish any balance-sheet or

profit and loss account, but this subsection shall not prevent the requiring of

information by reason only that it is or might be contained as an item in such a

balance-sheet or account.

(3) Any notice authorized to be served under paragraph (b) of subsection (1) on any

person believed to be carrying on a trade or business shall be deemed to be duly

served if it is addressed to him by the description of "the occupier" of the premises

upon which the trade or business in question is believed to be carried on and

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

7

delivered to some person, not appearing to be merely a subordinate employee, on

the premises.

(4) No information relating to any particular trade or business obtained under this

section shall be published or otherwise disclosed without the previous consent in

writing of the person by whom the information was furnished:

Provided that nothing in this section shall restrict the disclosure of information –

(i) to any Minister responsible for, or any officer of, any department of the

Government;

(ii) to any person or any authority having any functions in relation to the

development or regulation of trade or business in Kenya; or

(iii) to any person for the purpose of legal proceedings,

or the use of such information in any manner which the Minister thinks necessary or

expedient in connexion with the objects of this Act.

(5) Any person who fails to furnish information in compliance with a requirement

under this section shall be guilty of an offence.

(6) If any person (a) in purported compliance with a requirement imposed under this section

knowingly or recklessly furnishes any information which is false or misleading in any

material particular; or

(b) publishes or otherwise discloses any information in contravention of the

provisions of subsection (4),

he shall be guilty of an offence.

Commencement and publication of orders.

12. Every order made under this Act shall come into operation on the day on

which the same is made unless another date is therein specified, and every such

order shall be published in the Gazette as soon as circumstances permit after the

making thereof.

False statements, etc

13. Any person who for any of the purposes of this Act (a)knowingly or recklessly makes or presents any statement or declaration, orally or

in writing, which is false or misleading in any material particular; or

(b) produces to the Minister, the Director, the Deputy Director, an assistant director

or any officer concerned with any of the purposes of this Act any document which is

false or misleading in any material particular or was not made or given by the person

by whom it purports to have been made or given, or which has been in any way

altered or tampered with,

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

8

shall, without prejudice to any penalty or liability imposed by any other law in force

or the taking of proceeding for or in respect of any such penalty or liability, be guilty

of an offence:

Provided that a person producing such a document as aforesaid shall not be guilty of

an offence if he proves that he was unaware, and could not by the taking of

reasonable steps have become aware, that the document was false or misleading as

aforesaid.

Power to enter and search premises under warrant.

14. If a magistrate is satisfied by information on oath that there is reasonable

ground for suspecting that an offence has been committed under this Act and that

evidence of the commission of the offence is to be found on any premises specified in

the information, he may grant a search warrant authorizing any police officer to

enter the premises at any time within one month from the date of the warrant and to

search the premises and to seize any goods found on the premises which the person

so authorized has reasonable ground for believing to be evidence of the commission

of such offence as aforesaid.

Powers of entry and seizure.

15. The Director or the Deputy Director or an assistant director, or any police

officer of or above the rank of Inspector, if he has reasonable cause to believe that

any offence under this Act is being committed on any premises, or if he has

reasonable cause to believe that any goods, in respect of which there is reasonable

ground for suspecting that such an offence has been committed, are in or upon any

premises and that the delay which would occur in obtaining a search warrant as

provided in section 14 would, or would tend to, defeat the purposes of this Act, he

may enter and search such premises without a search warrant for the purpose of

ascertaining if such an offence is being committed or whether or not such goods are

in or upon such premises, and may inspect such goods and any documents relating

to them. and may seize any such goods or documents on such premises which the

person so searching or inspecting has reasonable cause to believe to be evidence of

the commission of such an offence.

Power to search vehicles.

16. (1) If the Director or the Deputy Director or an assistant director or any

police officer has reason to believe that any vehicle contains any goods which are

being transported in contravention of any of the provisions of this Act, or of any

order made thereunder or of any licence issued, or requirement or condition

imposed, under any such order or licence, he may order such vehicle to stop, and

may examine the contents thereof, and if any such person fails to stop he shall be

guilty of an offence.

(2) Where any vehicle has been stopped under subsection (1), the person stopping

such vehicle may take it with its contents to the nearest police station, and the

officer in charge of such police station may thereupon seize any goods found therein,

being goods which such officer has reasonable cause to believe are goods in respect

of which an offence under this Act is being or has been committed.

Procedure on seizure of goods.

17. Where any goods have been seized under section 14,15 or 16, the person

who has seized such goods shall forthwith report to a magistrate the fact of such

seizure, and, if a magistrate is satisfied that such goods are of a perishable nature or

that by reason of the fact that the market for such goods is seasonal or that to delay

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

9

the disposal of the same would otherwise unduly prejudice the owner thereof, he

may authorize the Director to sell or otherwise dispose of such goods.

Retention and disposal of seized goods.

18. (1) Where any goods have been seized under section 14,15 or 16, the

goods may be retained for a period not exceeding one month or, if within that period

proceedings are commenced for any offence under this Act in respect of such goods,

until the final determination of those proceedings.

(2) Where proceedings are taken for any offence under this Act, the court by or

before which the alleged offender is tried may make such order as to the forfeiture of

the goods in respect of which such offence was committed or as to the disposal of

such goods as the court shall see fit.

(3) In this section, references to "goods" shall be construed as including the

proceeds of the sale of any goods where such goods have been sold in accordance

with section 17.

Obstruction of officers.

19. Any person who obstructs or hinders any officer lawfully exercising any

powers, duties or functions under this Act shall be guilty of an offence.

General penalties.

10 of 1988, s. 44

20. Any person who is guilty of an offence under this Act for which no specific

penalty is provided shall be liable to a fine not exceeding twenty thousand shillings

or to imprisonment for a term not exceeding two years or to both.

Offences committed by company, firm or other association.

21. Where any offence under this Act is committed by a corporation or

company, or by a firm, syndicate or other association of individuals, every person

who at the time when the offence was committed was a director or an officer of the

corporation or company, or, as the case may be, a partner or an officer of the firm,

syndicate or association, or concerned in the management of the affairs of such

corporation company, firm, syndicate or association, shall severally be liable to be

prosecuted and punished for the offence as if he had himself committed the offence,

unless he proves that the act or omission constituting the offence took place without

his knowledge, consent or connivance and that he exercised all such diligence to

prevent the commission of the offence as he ought to have exercised, having regard

to the nature of his functions as a director, partner, officer or person concerned and

to all the circumstances.

Legal proceedings and protection of officers.

L.N.303/1964.

22. (1) In any proceedings under this Act, the onus of proving the place of

origin of any goods shall lie upon the person prosecuted or claiming anything seized

under this Act and if in any such proceedings any question arises as to the lawfulness

or otherwise of the exportation or importation of any goods, then the onus of proving

the circumstances of such exportation or importation shall lie upon such person.

(2) Any person charged with any offence under this Act may be proceeded against,

tried and punished in any place in which he may be in custody or charged for that

offence as if the offence had been committed in such place; and the offence shall for

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

10

all purposes incidental to, or consequential upon, the prosecution, trial or

punishment thereof be deemed to have been committed in that place:

Provided that nothing in this subsection shall preclude the prosecution, trial and

punishment of such person in any place in which, but for the provisions of this

section, such person might have been prosecuted, tried and punished.

(3) Any officer of the Government may appear and prosecute on its behalf in any

prosecution for an offence under this Act.

(4) Where any proceedings are brought against any officer of the Government on

account of any act done, whether by way of seizure of any goods or otherwise, in the

execution or intended execution of his powers or duties under this Act and judgment

is given against such officer, then, if the court before which such proceedings are

heard is satisfied that there were reasonable grounds for such act, the plaintiff shall

be entitled to recover anything seized or the value thereof, but shall not otherwise be

entitled to any damages and no costs shall be awarded to either party.

Minister to consult other Ministers in certain circumstances.

23. The Minister shall not exercise any power conferred upon him by this Act

in respect of any goods which are or may be controlled or regulated by any other Act

unless he has previously consulted the Minister for the time being responsible for the

matter in question.

Regulations.

24. The Minister may make regulations generally for the purpose of carrying

this Act into effect, and, in particular but without prejudice to the generality of the

foregoing, may make regulations with respect to any of the following matters (a) the forms to be used and the particulars to be furnished for any of the purposes

of this Act;

(b) the procedure on application for and the issue of, and the determination of

questions in connexion with, the grant, variation, renewal and cancellation of

licences;

(c) the issue of duplicate licences in the case of licences lost or destroyed;

(d) the means by which goods intended for exportation are to be identified in relation

to export licences;

(e) the custody of licences, and the production, return and cancellation of licences on

expiration or cancellation;

(f) the fees to be payable upon the grant, variation, renewal and cancellation of

licences; and

(g) anything which is to be or may be prescribed under this Act,

and different regulations may be made for different classes or descriptions of goods

or for different purposes or circumstances.

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

11

L.N.104/1978

L.N.112/1984.

SUBSIDIARY LEGISLATION

Orders under section 4

THE IMPORTS, EXPORTS AND ESSENTIAL SUPPLIES (EXPORTS) ORDER

1. This Order may be cited as the Imports, Exports and Essential Supplies (Exports) Order.

2. Subject to paragraphs 3 and 4, the export to any country of any of the goods described in

the Schedule is prohibited except under and in accordance with an export licence granted

under the Act.

3. Nothing in this Order shall –

(a) allow any person to dispense with any requirement of any written law relating to the

exportation of goods;

(b) require any person to obtain a licence for –

(i) the export of trade samples to any place; or

(ii) ship's stores.

4. Nothing in this Order shall prohibit the export without a licence of(a) goods transhipped on through bills of lading or entered for transit under the

Customs and Excise Act or any regulation made thereunder;

(b) a parcel which the Commissioner of Custom and Excise is satisfied –

(i) contains only an unsolicited gift; and

(ii) does not contain any goods intended for resale; and

(iii) does not exceed 20 kg. in gross weight;

(c) used personal and household effects accompanying the owner thereof or exported by or on

behalf of the owner within a period of six months from the date of his departure from Kenya;

or

(d) foodstuffs as part of the accompanied baggage of a person to whom subparagraph (c)

applies.

SCHEDULE

(para. 2)

EXPORT FOR WHICH AN EXPORT LICENCE IS REQUIRED

1. Military equipment and ammunitions of war.

2. Engines vessels, aviation and transportation equipment and automotive vehicles possessing

or built to current military specifications differing materially from normal specifications and

components or parts thereon.

3. Antiques and works of art.

4. Precious stones of all kinds, which are mounted, set or strung or otherwise incorporated in

jewellery.

5. Any article made wholly or partly of gold, platinum or silver.

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

12

6. Fertilizers containing water soluble P201.

7. Stockfeeds.

8. Paddy and rice.

9. Live animals other than domestic pets.

10. Sugar.

11. Scrap metal.

12. Beans, dried rose coco, dried Canadian wonder, dried white haricot, dried Madagascar

butter, dried mixed Lima.

13. Millet, all varieties.

14. Mtama, all varieties.

15. Njahi, all varieties.

16. Shellfish, crustacea and molluscs, fresh, chilled, frozen, salted or dried.

17. Castor seed.

18. Charcoal.

19. Archives.

20. Shell, cowries and corals.

21. Metals, minerals and their manufactures, as follows: antifriction bearings; magnetic

materials of all types; alloys containing a percentage of molybdenum, cobalt, columbium;

tantalum or nickel-bearing steels; cobalt; columbium; germanium and compounds;

magnesium base alloys; mercury metal; molybdenum; nickel; tantalum; titanium metal;

tungsten wire and filament; and minerals mined in Kenya.

22. Electronics (including radio and radar) and precision instruments and equipment other

than domestic radio receiving sets.

23. Empty (new or used) bags of "B" or "L" type construction manufactured from jute or sisal

fibre or a combination of those fibres or from any substitute for jute fibre.

24. Electrical and power generating equipment.

25. Timber.

26. Raw cotton.

27. Bones.

28. Bloodmeal.

29. Barley.

30. Green, black and yellow grams.

31. Potatoes, other than sweet potatoes.

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

13

32. Salt.

33. Jaggery.

34. Cement,

35. Edible oils.

36. Hides and skins.

L.N. 80/1978,L.N.103/1978,L.N.41/1985, Cap. 472, Cap.308.

THE IMPORTS, EXPORTS AND ESSENTIAL SUPPLIES (IMPORTS) ORDER

1. This Order may be cited as the Imports, Exports and Essential Supplies (Imports) Order.

2. The importation of the goods specified in the Schedule is prohibited except under and in

accordance with a licence granted under the Act.

3. Notwithstanding the provisions of paragraph 2 the following classes of goods may be

imported without an import licence (a) goods in transit or for transhipment transported in sealed wagons or containers or by

means of any other mode of transportation authorized by the Director;

(b)bona fide personal baggage being the goods e defined as duty free in item 8 of Part B of

the Third Schedule to the Customs and Excise Act;

(c) goods subject to diplomatic privileges as defined in item 7 of Part A of the Third Schedule

to the Customs and Excise Act;

(d) accompanied commercial travellers samples;

(e) trade samples not imported as merchandise which in the opinion of the Commissioner of

Customs and Excise have no commercial value and in respect of which no expenditure of

foreign currency (on either purchase, freight, postage or insurance) has been incurred; and

(f) goods imported by any person on proof, to the satisfaction of the Commissioner of

Customs and Excise, that they are for his own personal or household use or are unsolicited

free gifts and are not for re-Sale; or

(g) goods imported by a person engaged in petroleum operations as defined in section 2 of the

Petroleum (Exploration and Production) Act.

SCHEDULE

(para. 2)

Code

001400

011300

011400

012101

012102

012901

013300

013400

013801

013809

Division Number, Group Names, Codes and Items

DIVISION 00-LIVE ANIMALS

Poultry, live day-old chicken, ducklings and turkeys

Meat of swine (pork).

Poultry, killed or dressed.

Meat, dried, salted or smoked, including ham, bacon and pork luncheon meat.

Smoked pig meat.

Salted or dried pig meat.

Meat extracts and essences.

Sausages.

Canned beef.

Other prepared or preserved meat.

DIVISION 02-DAIRY PRODUCTS

www.kenyalaw.org

Rev. 1990]

022101

022101

022211

022220

022230

023001

023002

024000

031300

042000

043000

045901

045909

048120

048410

048421

048429

048309

048820

051100

051200

051400

051500

051509

051990

053301

053302

053309

053502

053502

053509

053620

053901

053909

054200

054501

054503

054509

054600

054620

055500

055510

055521

055529

061101

061109

061200

061201

061201

071300

073001

073002

Imports, Exports and Essential Supplies

Cap. 502

Skimmed milk in liquid form.

Cream (liquid)

Whole milk and cream in solid or powder form

Skimmed milk in solid form or powder form

Human milk substitutes

Butter

Ghee

Cheese

DIVISION 03-FISH AND FISH PREPARATIONS

Crustacea and molluscs fresh, chilled, frozen, salted or dried

DIVISION 04-CEREAL PREPARATIONS

Rice

Barley

Millet and grain sorghum

Cereals, meal flour and oats

Cornflakes only

Bread and other ordinary bakers’ ware

Biscuits including “cookies”, infant feeding rusks and “crisps bread”.

Cakes, pastries and other fine bakers' ware.

Macaroni, spaghetti, noodles and vermicelli and similar products.

Custard powder, blancmange powder, Horlicks, Milo and Ovaltine.

DIVISION 05-FRUIT AND VEGETABLES

Orange, tangerine or mandarines.

Other citrus fruits.

Apples, fresh.

Grapes, fresh.

Fresh pears and quinces.

Fresh fruit n.e.s.

Jams.

Marmalades.

Fruit jellies.

Pineapples juice.

Tomato juice.

Other fruit and vegetable juices.

All frozen fruits.

Pineapple, tinned.

Tinned plums, tinned strawberries, tinned fruit salad.

Beans, rose coco, Canadian wonder, white haricot, mixed and Lima beans,

dry, including split and peas, whole, skinned or split only, green grams.

Onions.

Fresh garlic.

Fresh peas and capsicum.

Vegetables, frozen.

Vegetables in temporary preservatives for immediate consumption.

Onion dehydrated.

Tinned tomatoes preserved by vinegar or acetic acid.

Tomato puree.

Tinned peas, tinned beans (of all kinds), tinned carrots, beans in tomato

sauce.

DIVISION 06-SUGAR PREPARATIONS AND HONEY

Jaggery.

Other raw sugar, beet and cane (not including syrups).

Chewing gum manufactured from natural and synthetic base material by

whatever name called, boiled sweets, toffees, caramels.

Refined sugar and other products of refined beet and cane sugar (not

including syrups).

Sugar confectionery not containing cocoa.

DIVISION 06-SUGAR PREPARATIONS AND HONEY

Coffee extracts, essences, concentrates and similar preparations of coffee.

Chocolate confectionery.

Chocolate couverturie

www.kenyalaw.org

14

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

074100

Tea.

074101

Chillies and dried capsicum.

074200

Mate.

DIVISION 08-FEEDING STUFF FOR ANIMALS (EXCLUDING MILLED CEREALS)

081301

Cotton seed cake.

081302

Coconut cake.

081303

Groundnut cake.

081304

Sesame seed cake.

Other oil seed cake and meal and vegetable oil residues.

Prepared animal foods.

DIVISION 09-MISCELLANEOUS FOOD PREPARATIONS

091310

Lard and other rendered pig fat.

091410

Margarine.

091429

Other prepared edible fats except tallow.

099040

Tomato sauce and tomato ketchup.

099049

Sauces n.e.s., mixed seasoning.

099050

Soups and broths.

099099

Ice cream powders and ice cream substitutes, oils and fats, emulsified in any

milk or skimmed milk.

099099

Jelly crystals.

DIVISION 11-BEVERAGES

112110

Grape must, in fermentation or with arrested, otherwise than by addition of

alcohol, wine or fresh grapes, still wines and grape must with fermentation

arrested by addition of alcohol.

112112

Still wines not in bottle.

112122

Still wines in bottle.

112123

Champagne.

112124

Other sparkling wines.

Vermouths and other wine flavoured with aromatic extracts not in bottle.

112131

112132

Vermouths and other wines flavoured with aromatic extracts in bottle.

112200

Cider and other fermented beverages n.e.s.

112309

Beer (including ale, stout, porter).

112401

Brandy.

112402

Gin and Geneva.

112403

Whisky.

112404

Rum.

112409

Other potable spirits n.e.s.

112406

Liqueurs and other spirituous beverages.

DIVISION 12-TOBACCO MANUFACTURES

122100

Cigars and cheroots.

122200

Cigarettes.

122301

Snuff.

122303

Other manufactured tobacco.

122304

Tobacco extracts and essences.

DIVISION 21-HIDES, SKINS AND FUR (UNDRESSED)

211101

Dried.

211102

Pickled.

211103

Wet salted.

Wet blue chrome (calf skins and kid skins).

211104

211201

Dried.

211102

Pickled

211403

Wet blue chrome

211600

Sheep and lamp skins with the wool on. (Sheep and lamb skins without the

wool.)

211701

Dried

211702

Pickled.

211703

Wet blue chrome

211909

Hides and skins n.e.s.

DIVISION 25-PULP AND WASTE PAPER

251300

Pulp and waste paper 9raw materials only)

DIVISION 26-TEXTILE FIBRE (NOT MANUFACTURED AND THEIR WASTE)

www.kenyalaw.org

15

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

264000

Jute (including jute cuttings and waste)

267010

Second-hand clothing of all descriptions

DIVISION 27-CRUDE FERTILIZERS AND CRUDE MINERALS (EXCLUDING COAL,

PETROLEUM AND PRECIOUS STONES)

275100

Industrial diamonds

276300

Salt put up for retail sale

276300

Salt other

DIVISION 29-CRUDE ANIMAL AND ANIMAL VEGETABLE MATERIALS N.E.S.

292500

Vegetable seeds

DIVISION 33-PETROLEUM AND PETROLEUM PRODUCTS

332101

Aviation spirit

332102

Motor spirit

332201

Jet fuel

332202

Lamp oil and white spirit (kerosene illuminating oil).

332301

Heavy black diesel fuel for low speed marine and stationary engines

332302

Light amber diesel fuel for high speed engines

332400

Residual fuel oils

332513

Lubricating greases

332960

Mastic asphalt in blocks or drums for use as roofing, flooring or tanking

purposes and bitumen emulsion in drums or pails only

DIVISION 34-GAS (NATURAL AND MANUFACTURED)

341100

Liquid petroleum gas

DIVISION 41-ANIMAL AND VEGETABLE OILS AND FAT

411321

Tallow (not refined)

411390

Animal oils, fats and greases (excluding lard) n.e.s.

DIVISION 42-FIXED VEGATABLE OILS AND FATS

422909

Fixed vegetable oils.

DIVISION 53-DYEING, TANNING AND COLOURING MATERIALS

533200

Printing inks

533320

Manufacturing paint, water colours, and glass paint

533320

Sandtex malt (all types of masonry paint)

533321

Paint, enamel, lacquers only except water colours and glass colours

533322

Distempers, water pigments except cement paints and the like

DIVISION 54-MEDICINAL AND PHARMACEUTICAL PRODUCTS

541101

Medicines and vaccines

541102

541109

541300

541401

541402

541409

541501

541509

541610

541620

541630

541701

541702

541703

541709

DIVISION 55-ESSENTIAL OILS AND PERFUMED MATERIALS: TOILET POLISHING AND

CLEANING PREPARATIONS

553001

Toothpaste (medicated)

553001

Toothpaste (non-medicated)

553005

Pharmaceutical shampoos

553009

Perfumery and cosmetics (including drula bleaching wax).

554101

Other toilet preparations including “Joss sticks”.

554101

Soap, toilet

554109

Soap other (except medicated)

554202

Washing preparations (raw materials).

554203

Organic surface acting agents

www.kenyalaw.org

16

Rev. 1990]

Imports, Exports and Essential Supplies

554301

554301

554302

Cap. 502

Shoe polishes

Suede cleaner, tile polishes, floor polishes and furniture polishes

Scouring powder

DIVISION 56-FERTILIZERS (MANUFACTURED)

561101

Sulphate of ammonia

561102

Ammonium sulphate-nitrate

561103

Urea, containing not more than 45 per cent of nitrogen.

561109

Other nitrogenous fertilizers, urea and all compounds or mixtures, containing

nitrogen elements.

DIVISION 58-PLASTIC MATERIALS REGENERATED CELLULOSE AND ARTIFICIAL

RESINS

581201

P.V.A. emulsions (raw materials0

581203

Cellulose film wrappers whether printed or not for manufacturers

581209

Plastic film for food wrap, in rolls including “Glad wrap” and “Alcan wrap”

DIVISION 59-CHEMICAL MATERIALS AND PRODUCTS N.E.S.

599203

Mosquito coils and aerosol incecticidal sprays for household use

599591

P.V.A. adhesives

DIVISION 62-RUBBER MANUFACTURES N.E.S.

621041

Sponge rubber, in sheet form

629111

Tyres for road motor vehicles

629112

Tyres for pedal cycles (except size 28” X 1½”)

629113

Bicycles tyres of sizes 28” X 1¼”).

629115

Tyres for tractors, bulldozers, graders and the like.

629116

Tubes for road motor vehicles (sizes locally manufactured).

629117

Bicycle tubes 28” X 1¼”.

629117

Tubes for tractors, bulldozers, graders and the like

629119

Tyres and tubes n.e.s.

DIVISION 63-WOOD AND CORK MANUFACTURERS (EXCLUDING FURNITURE)

629121

Plywood and veneered panels in-laid wood

631410

Imported wood

631420

Reconstituted wood (particle boards).

631800

Wood simply shaped or worked n.e.s.

632420

Soft boards

632731

Manufactures of wood for domestic or decorative use including wood carvings.

632739

All types of clothes pegs, including those made of metal and plastic materials

632800

Manufactured articles of wood n.e.s.

632899

Wood coat hangers

633001

Cork materials

DIVISION 64-PAPER, PAPERBOARD AND MANUFACTURES THEREOF

641319

Newsprint and mechanical glazed printing paper for printing purposes

641319

Super calendered printing paper M.G. white poster, M.G. sulphite and paper

containing not less than 5 per cent rag pulp, and other special grade printing

and writing paper (machine made rolls, or sheets, uncoated),

641319

Cream laid woven woodfree wrting and printing offset cartridge litho,

duplicating, airmail, bank bond paper aerogramme paper, azure laid/woven,

typewriting and other printing and writing papers, machine made rolls and

other sheets, uncoated varying not less than 35 grams per sq. metre,

commonly used for writing and printing purposes other than s/c and M.G.

papers.

641320

Kraft paper and Kraft paperboard including fluting medium Kraft linerant sack

and bag craft.

641520

Machine made paper, paperboard, simply finished in rolls or sheets, n.e.s. but

including coated paper or paperboard, in rolls or sheets and not specified

under 641319 above.

641520

Cigarette paper tissues, currency paper, black and red paper for packing

photo-sensitized materials, chart paper recorders used in conjunction with

instruments, straw paper, indicators papers for laboratories, filter paper,

manifold paper (not exceeding 35 grams/m 2 fluting medium and paperboard of

and above 250 grams sub. Or 0.33 caliper and substocks in reels).

641910

Parchment or greaseproof paper of paperboard

641920

Composite paper and paperboard

641930

Corrugated paper and paperboard containers

www.kenyalaw.org

17

Rev. 1990]

Imports, Exports and Essential Supplies

641940

641950

Cap. 502

Ruled or squared paper or paperboard

Impregnated or coated paper and paperboard other than printing or writing

paper

641950

Cumined paper

641960

Filterblocks of paper pulp

641970

Wall paper and lincrusta

642112

Seed paper container and bags

642116

Paperbags, paperboard boxes and other packing container except seed paper

container and bags

642119

Filing containers of paper and paperboard

642109

Writing blocks, letter pads and similar paper stationery of the kind used in

correspondence

642300

Exercise books

642300

Registers, albums, diaries, memorandum blocks and other stationery or paper

and paperboard

642920

Carbon papers

642930

Other paper and paperboard cut to size excluding ice cream cups, paper

tumblers and other paper containers

642939

Ice cream paper cups, tumblers and other paper containers

642990

Other articles and paper pulp paper, paperboard or cellulose wadding n.e.s.

DIVISION 65-TEXTILE YARN FABRICS, MADE UP ARTICLES AND RELATED PRODUCTS

651200

Knitting yarn made out of wool fibre for hand knitting and hand operated

machines

651200

Cotton fabrics, woven, grey unbleached not for printing

651701

Yarn and synthetic fibre and mixtures thereof for factory knitting, or weaving

machines

652120

Cotton fabrics woven (unbleached)

652132

All types of canvas (including textile, flax or ramie, hemp, etc.)

652209

All types of toweling

652211

652221

Cotton fabrics woven bleached

652229

Cotton fabrics woven other than grey bleached not for printing

652230

Lining materials only

652253

Dyed khaki drill and twill

652254

Cotton fabrics, dyed other

652255

Printed cotton fabrics

653210

Woolen fabrics woven (including fabrics of fine hair)

653401

Jute fabrics woven

653409

Hessian and sacking (excluding matting)

653501

Suiting fabrics woven, synthetic/woven, Synthetic/Viscose, crepe, nylon satin,

653502

nylon crepen, nylon fancy, all nylon piece goods, including nylon taffeta, nylon

653503

crepe, crepe-de-chine, Tetron filament, shautung fabrics of cotton, synthetic

653504

mixtures, polyester and synthetic materials knitted or crocheted fabrics, not

653509

elastic or rubberized, knitted or crocheted fabrics, not elastic or rubberized.

653601

653602

653603

653604

653605

653609

653700

654009

Fabric labels (woven)

654900

Shoe laces of sizes 14”, 17”, 20” 36” and 48” (excluding shoe laces imported

with ready made shoes).

655101

Jute bags and sacks

655101

Bituminous felt only, felt coated with plastic materials for down proofing

purposes

655109

Roofing felt

655109

Felt and felt articles n.e.s.

655410

Textile fabrics, P.V.C. coated or impregnated (excluding narrow fabrics)

655500

Elastic webbings

655621

Fishing nets and netting

www.kenyalaw.org

18

Rev. 1990]

655811

656102

656103

656109

656200

656611

656611

656612

656620

655691

656912

656929

656931

656932

656933

656939

656951

657420

657600

661209

663110

663319

664800

665118

665119

666400

666500

667200

673911

674412

674511

678300

691101

691202

692310

693201

693209

694111

694112

694211

695100

695102

695109

695231

695239

696031

695239

697120

697129

69721

697212

Imports, Exports and Essential Supplies

Cap. 502

Sanitary towels except tampons (e.g. tampax).

Sisal bags and sacks

Bags and sacks of mixed fibre (e.g. jute/sisal bags)

Bags and sacks of other textile materials

All types of tarpaulins and tents

Baby blankets not exceeding size 36” X 36”.

Wollen blankets

Traveling rugs, woolen

Cotton blankets and traveling rugs

Other blankets n.e.s.

Towels including face towels

Other textiles n.e.s.

Bedsheets, bedspreads, bed covers and table cloth

Curtains and furnishing articles

Linoleum and similar floor covering

Rubber car mats

DIVISION 66-NON-METALLIC MINERAL MANUFACTURES N.E.S.

Cement except colour cement

Grinding and polishing wheels and stones

Asbestos fibre in sheets or rolls (raw materials)

Toughened glass mirrors

Glass tumblers

Porcelain or china tableware other than bone china, including all sizes of

plates, tea, coffee cups and saucers, tea and coffee pots and milk jugs and

bowls with or without decoration, whether in sets or single.

Tableware made of other ceramic materials

Diamonds not set or strung

DIVISION 67-IRON AND STEEL

Mild steel angles, flats and shapes of iron or steel cold formed or cold finished

(excluding high tensile steel angles and flats and shapes).

Corrugated iron sheet and plates, ungalvanised coated

Corrugated sheets and plates galvanized or coated of thickness of .014” or

less.

Black and galvanized tube and pipes of iron or steel (other than cast iron and

high pressure hydroelectric conduits), round, square and rectangular, of a

diameter up to 4”

DIVISION 69-MANUFACTURERS OF METAL N.E.S.

Steel windows and steel doors including louvers

Aluminium windows and doors including louvers and part thereof

Gas cylinders (domestic)

Barbed wire of iron or steel

Other fencing wire of iron or steel

Round wire nails

Roofing nails, tacks and fencing staples (excluding round wire nails).

Mild steel, bolts and nuts and washers (other than those covered by

Manufactures Part No. and high tensile steel bolts and nuts).

All types of hoes (jembes).

Machetes (pangas)

Shovels and spades

Charcoal irons

Screwdrivers, other

Razor blades

Domestic gas cookers of iron or steel

Butt hinges only

Domestic gas cookers or copper

Domestic utensils of stainless steel

Tinned enamel tea trays, servicing trays, household insecticide sprays,

www.kenyalaw.org

19

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

domestic insecticide spray guns

Household buckets of iron or steel (except enameled or stainless).

Metallic coat hangers

Sufurias alias “chattels” or “topes” and tiffin carriers including cooking pans.

Steel pot scourers and polishing pads of iron or stainless steel.

Padlocks, locks, including bicycle furniture locks, and keys thereof of base

metal but excluding motor cars locks and keys for dealer firms

698120

Tower bolts, brass and aluminium

698120

Window stays, brass window handles and knife blanks

698122

Other hinges not butt hinges except those for motor cars

698500

Shoe eyelets

698500

Pant hooks and frames

698511

Crown corks

698859

Bottle caps, bungs, lids, seals stoppers, etc., of base metal

698871

Are welding electrodes

698911

Earthpans (karais)

698919

Bead wire rings

DIVISION 71-MACHINERY OTHER THAN ELECTRIC

712100

Plough Ploughs, tractor mounted (sizes 2,3,4,5 disc ploughs); harrows tractor drawn,

mounted, semi-mounted or trailed (including harrows of up to 32” and 34”

diameter).

712900

Single furrow and hand ploughs and parts thereof

712991

Plate mills, and hammer mills both hand and power driven

712999

Rotary cutters, tractor mounted or semi mounted rotary cutters up to and

including 72” cut.

715100

Machine-tools for working materials

715100

Hydraulic pipe benders

715210

Converters, ladies, ingot moulds and casting machines

715220

Rolling mills and rolls thereof

715230

Gas operated welding, cutting, etc., appliances

717110

Spinning, extruding, etc., machines

717121

Weaving, knitting, etc., machines (industrial0

717129

Other

717140

Machines for the manufacture or finishing of felt

717200

Machinery (excluding sewing machines) for preparing, tanning or working

hides, skins or leather

717301

Sewing machines, heads or complete machines (industrial).

717302

Other.

718110

Machinery for making or finishing cellulosic pulp, paper or paperboard.

718210

Bookbinding machinery.

718229

Type making and setting machinery, etc., other (not for use in offices).

718299

Other printing machinery n.e.s.

718299

Other (not for use in offices).

718310

Machinery for milling grain, etc.

718391

Sugar manufacturing or refining machinery, industrial.

718392

Other food processing machinery, industrial.

718399

Other, n.e.s.

718420

Construction and mining machinery, n.e.s. (excavating, leveling, boring, etc.)

718510

Mineral crushing, sorting and moulding machinery.

718510

Concrete mixers (assembled).

718520

Glass-working machinery.

719130

Furnace burners, mechanical stokers, etc

719140

Industrial furnaces and ovens, non-electric.

719211

Air compressers.

719310

Hydraulic jacks not mechanical for cars and workshops

719310

Mounted minicranes.

719311

Hydraulic elevating tables, motor and hand driven

719319

Other, n.e.s.

719320

Hydraulic fork lifts.

719421

Domestic refrigerators, non-electrical (complete)

719429

Domestic refrigerators (parts thereof).

697213

697219

697239

697910

698111

www.kenyalaw.org

20

Rev. 1990]

719510

719628

719632

719801

719802

719803

719804

719804

719805

719910

722200

724101

724102

724201

724202

724999

725011

725051

725059

729111

729119

729121

729129

729201

729500

732100

732899

732899

732899

732899

733100

733323

733331

733331

821019

821031

821091

821093

831011

831011

831019

831011

841119

841119

841119

841132

841139

841141

Imports, Exports and Essential Supplies

Cap. 502

Machine-tools for working wood, plastics, etc.

Machines for cleaning, or filling bottles or other containers, packaging

machinery, etc., other, industrial.

Metric weights

Cigarette, cigar and tobacco making machines

Crushers and mills for oil seeds or oleaginous fruits, industrial (for extraction of

oil, etc.)

Soap cutting or moulding machine.

Tea machinery

Hydraulic presses.

Other n.e.s.

Moulding boxes for metal foundry and moulds, other than ingot moulds.

DIVISION 72-ELECTRICAL MACHINERY APPARATUS AND APPLIANCES

Electrical distribution boards and consumer units.

Television broadcast receivers whether or not combined with gramophone or

radio

Unassembled television sets.

Radio broadcast receivers, whether or not combined with gramophone

Unassembled radio broadcast receivers whether or not combined with

gramophone.

Other telecommunication equipment, n.e.s.

Domestic refrigerations, electrical.

Electrical space heating equipment, n.e.s.

Other n.e.s.

Batteries and cells for flashlights (torches) and transistor radios.

Other batteries and cells, n.e.s.

Motor vehicles batteries

Other electrical accumulators (storage batteries)

Filament lamps with bulb diameter of 60 mm, 70 mm, or 80 mm, designed to

operate on voltage of 100 to 250 volts of 200 watts or less, having clear inside

white finish only.

Water meters.

DIVISION 73-TRANSPORT EQUIPMENT

Passenger motor cars (other than buses or special vehicles).

Motor vehicle brake linings

Motor vehicle brake pad sets.

Exhaust pipes and silencers for Volkswagen vehicles

Exhaust pipes and silencers, n.e.s.

Bicycles and bicycle components excluding bicycle spokes, forks and frames

for sizes 22 and 24

Complete low speed agricultural trailers (other than road trailers).

Wheelbarrows (assembled).

Wheelbarrows wheels

DIVISION 82-FURNITURE

Plastic chairs, seats and parts thereof.

Mattresses, matterres support and similar stuffed furnishings

Furnishing and pars thereof, n.e.s. metal beds (excluding hospital beds).

Metal furniture, n.e.s. and parts thereof (domestic or office)

DIVISION 83-TRAVEL, GOODS, HANDBAGS AND SIMILAR ARTICLES

Suitcases

Travel goods

Handbags and similar articles

DIVISION 84-CLOTHING

Suits for men

Jackets, trousers, slacks and jeans made of worsted, woolen and mixed

woolen and synthetic materials

Outer garments for boys

Shirts for men, whether knitted, crotched or woven fabrics

Under garments for men and boys

Baby napkins

www.kenyalaw.org

21

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

841149

Under garments for women and girls excluding baby napkins and pants, but

including ladies brassieries, slips and briefs, etc

841152

841153

841154

841155

841160

841420

841441

841441

841442

841442

841444

Outer garments for women and girls

Infants wear

Stockings and socks excluding woolen makes

Cardigans, jerseys, jumpers, pullovers and sweaters

Cardigans, jerseys, jumpers, pullovers and sweaters (woolen makes only).

Socks and stockings of woolen makes only

Socks and stockings excluding woolen makes, and panthoses

Panthoses, hooks and bars

DIVISION 85-FOOTWEAR

851011

Footwear and slippers with soles and uppers of rubber or plastic materials

851061

Leather footwear and slippers with soles of any description

851099

Slippers and house wear other.

DIVISION 86-PROFESSIONAL, SCIENTIFIC AND CONTROLLING INSTRUMENTAL

PHOTOGRAPHIC AND OPTICAL GOODS, WATCHES AND CLOCKS

863000

Cinematographic film developed

DIVISION 89-MISCELLANEOUS MANUFACTURED ARTICLES N.E.S.

891201

Gramophone records

890202

Pre-recorded video tapes and cassettes only.

891209

All types of cassettes used for sound recording purposes and pre-recorded

cassettes excluding computer tapes.

892910

Self-adhesive labels in rolls or sheets, plain or printed.

893001

Plastic coat hangers.

893000

PVC electrical conduits

893024

Polythene bags only.

893034

Plastic toilet seats and covers.

893034

Plastic louvers, windows and parts thereof.

893034

Floor tiles of plastic materials.

893039

Ceramic tiles excluding coloured, decorated or embossed.

893040

Plastic tableware, etc.

894242

Any automatic machine or any mechanical device intended for the purpose of

gambling, wagering or betting, including coin operated machines for

amusement.

894420

Footballs.

894420

Other requisites for outdoor sports except footballs.

895110

Filing cabinets rack, similar office equipment (excluding furniture of base

metal).

895210

Ballpoint pens and parts thereof.

895230

Pencils.

895990

Staples, pins, paper pins, and inked ribbons for typewriters

897110

897120

899230

899241

Jewellery of gold, silver and platinum group metal, gold smiths and

silversmiths and ware including set gems

Brooms and brushes of vegetable materials not mounted in a head

Hand scrubbing brushes and footwear cleaning brushes of natural fibre

mounted or backed by wood.

899242

Paint distemper, varnish and similar brushes, flat.

899249

Tooth brushes.

899249

Brooms and brushes, n.e.s. paint roller, etc.

899321

Matches in packing of less than 25 matches per container.

899322

Matches in packing of 25 matches or more but less than 50 matches per

container except book matches.

899520

Buttons (excluding metal).

899530

Zip fasteners.

899590

Toilet paper rolls and paper serviettes.

DIVISION 99-COMMODITIES AND TRANSACTIONS NOT CLASSIFIED ACCORDING TO

www.kenyalaw.org

22

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

23

KIND

991110

991130

991160

Gold bullion

Gold partly worked.

Gold coin.

L.N. 19/1983, L.N. 42/1985, Sub. Leg, Cap 179, Cap 472, Cap 308.

THE IMPORTS, EXPORTS AND ESSENTIAL SUPPLIES (IMPORTATION OF MOTOR CARS)

(RESTRICTION) ORDER

1. This Order may be cited as the Imports, Exports and Essential Supplies (Importation of Motor Cars)

(Restriction) Order.

2. In this Order, "motor car" means a motor vehicle having seating accommodation for not more than ten

passengers excluding the driver, but does not include a motor cycle.

3. Notwithstanding paragraph 3 of the Imports, Exports and Essential Supplies (Imports) Order, no person

shall import a motor car into Kenya from any foreign country without written authority issued by the Director

under this Order.

4. The written authority referred to in paragraph 3 shall be applied for and obtained by the importer prior to

the shipment or loading for shipment of the motor car to Kenya.

5. The restriction imposed under paragraph 3 shall not apply to—

(a) a motor car imported by persons subject to diplomatic privileges under the Privileges and Immunities Act;

or

(b) a motor car imported as part of passenger's baggage as defined in item 8 of Part B of the Third Schedule

to the Customs and Excise Act.

(c) a motor oar imported by persons engaged in petroleum operations as defined in section 2 of the

Petroleum (Exploration and Production) Act.

THE IMPORTS, EXPORTS AND ESSENTIAL SUPPLIES (PROHIBITION OF THE EXPORT OF MAIZE)

ORDER

L.N. 111/1984

1. This Order may be cited as the Imports, Exports and Essential Supplies (Prohibition of the Export of

Maize) Order.

2. The export of maize, maizemeal and maize by-products including germ and bran, to any country is

prohibited.

3. Nothing in this Order shall be deemed to prohibit the export of not more than 2 kilogrammes of maizemeal

as part of accompanied baggage of a person leaving the country by air or sea.

Order under section 10 (1) (d)

THE IMPORTS, EXPORTS AND ESSENTIAL SUPPLIES (ESSENTIAL SUPPLIES) (DELEGATION OF

POWERS) ORDER

L.N. 81/1961, L.N. 633/1961, L.N. 649/1961, L.N. 186/1980

1. This Order may be cited as the Imports, Exports and Essential Supplies (Essential Supplies) {Delegation

of Powers) Order.

2. The Director of Trade and Supplies, the Deputy Director of Trade and Supplies and every assistant

director of trade and supplies may issue such directions as they may deem necessary in the interests of

maintaining, controlling or regulating supplies of the goods to which this Order applies, being goods which

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

24

are considered to be essential to the well-being of the community, for all or any of the purposes referred to in

paragraphs (a), (b) and (c) of subsection (1) of section 10 of the Act.

3. The goods to which this Order applies are—

(a) all processed and manufactured sugar;

(b) new bags of "B" and "L" type construction manufactured from jute or sisal fibre or a combination of those

fibres or from any substitute for jute fibre;

(c) all petroleum products;

(d) within the Nairobi area only, aviation fuels;

(e) tea, processed, partly processed or unprocessed.

Regulations under section 24

THE IMPORTS, EXPORTS AND ESSENTIAL SUPPLIES REGULATIONS

L.N. 483/1958, L.N. 142/1963, L.N. 70/1965

1. These Regulations may be cited as the Imports, Exports and Essential Supplies Regulations.

2. (1) Every application for an import licence of goods other than gold bullion shall be made by delivering to

the Director the indent in triplicate relating to the intended import.

(2) Every indent shall state clearly and fully—

(a) the name and address of the applicant;

(b) the name and address of the supplier;

(c) the description of the goods to be imported, showing the quantity and price per unit;

(d) the total cost, insurance and freight value of the goods at the place of importation expressed in sterling;

(e) the country of origin of the goods;

(f) the place from which the goods are intended to be consigned, and the intended date of consignment; and

(g) the method of payment for the goods.

(3) Every application for an import licence of gold bullion shall be made in writing in triplicate to the Director,

and shall state—

(a) the name of the applicant and the registered title and full address of his goldsmith's business;

(b) the name and date of the applicant's current goldsmith's trading licence;

(c) the name and father's name of each of the artisans fully employed by the applicant in his goldsmith's

business and the date from which each artisan has been continuously so employed.

(4) Notwithstanding the provisions of paragraphs (1) and (2), a person desiring to import goods within the

following categories—

(a) unsolicited free gifts;

(b) personal baggage;

(c) goods for which no foreign exchange is to be made available (either for their cost or for freight or

insurance),

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

25

for which an import licence is required may apply for an import licence to the Director by letter in triplicate,

giving full particulars of the goods, and, in the case of an unsolicited free gift, the relationship of donor and

donee.

3. (1) Import licences, in the case of gold bullion, shall be in Form A in the Schedule.

(2) Import licences in the case of other goods shall be in the form of an endorsement stamped upon the

indent or letter of application:

Provided that, if the applicant so requires, the import licence may, at the discretion of the Director, be in the

form of a book licence in Form C in the Schedule.

(3) Except in the case of an import licence in the form of a book licence, import licences shall be delivered to

the applicant in duplicate, and a further copy shall be kept by the Director.

4. Where the laws of the country from which the goods are to be imported require a certificate that the

importer has undertaken to import the goods into Kenya, the Director, on application being made to him and

on being satisfied as to the facts of the case, may give to the importer a certificate to such effect in Form D

in the Schedule.

5. All import licences and export licences shall be valid for the period expressed therein or, if no period is

expressed, for a period of one month.

6. Any application for the renewal of an import licence or export licence shall be made to the Director at least

fifteen days before the licence is due to expire.

7. Where an import licence or export licence has been lost or destroyed, the Director may, on application

being made to him in writing and on a copy of the licence being supplied, issue to the holder a duplicate

licence.

8. Every application for an export licence (other than one for the export of timber) shall be made to the

Director in triplicate in Form E in the Schedule.

9. Every application under the Act shall be typewritten or written indelibly without alteration or addition.

SCHEDULE

(rr. 3, 4 and 8)

(In triplicate)

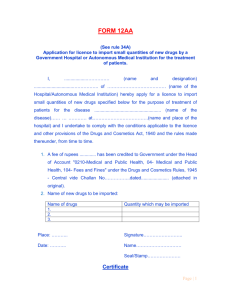

Form A

No. ………………..

NOT TRANSFERABLE

IMPORT LICENCE

This Licence authorizes ………………………………….

………………………………………………………………

to import GOLD shown under the headings “Quantity”

and “Description”.

Name and address of supplier …………………………………

………………………………………………………………….

Quantity

Description

…………………………………………………………………………………………………………….

…………………………………………………………………………………………………………….

…………………………………………………………………………………………………………….

Date and Office Stamp

………………………………………….

for Director of Trade and Supplies

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

26

[BACK]

NOTES

1. Goods imported MUST conform to the description on this licence.

This licence is not valid for any other goods.

2. In no circumstances may the goods imported exceed the quantity

shown on the licence.

3. If the importation of Gold specified on this licence is, for any reason,

no longer required, please return the licence to the Department of

Trade and Supplies, P.O. Box 30430, Nairobi.

SCHEDULE OF CLEARANCES

Customs Ref.

Date

Quantity

Description

Value

Form B (Deleted by L.N. 142/1963).

IMPORT LICENCE

Form C

No.

B.

Date ……………………………………

Issued to ………………………………

Address …………………………………

In the event of this licence being lost, will the finder please place in the nearest Post Box in order that it may

be returned to the Department of Trade and Supplies, P.O. Box 30430, Nairobi.

This licence must be retained by the importer, and presented at the time of clearance of the goods specified

herein.

Conditions of Issue

This Import Licence is issued for a specific value, which may be varied from time to time at the discretion of

the Director of Trade and Supplies. Any attempt to clear goods in excess of the value, or balance of value,

authorized by this Licence will be regarded as an offence. This licence is not transferable and is only valid

on the condition that the relative goods are not ordered before the date of issue of this licence.

Should extension of the validity period of this licence become necessary, application in this regard must be

made to the office of issue NOT LESS than 15 DAYS BEFORE the expiry date. Application should clearly

show what foreign currency payment has already been made and what balance remains to be paid.

Goods imported MUST conform to the description on this licence. The licence is not valid for any other

goods.

In no circumstances may the goods imported exceed the C.I.F. value shown on the licence.

Notwithstanding any value shown as maximum C.I.F. value, Banks MUST NOT make available foreign

currency in excess of the amount entered on the opposite page.

If this licence is, for any reason, no longer required, please return it to the Department of Trade and

Supplies, P.O. Box 30430, Nairobi.

This licence authorizes:—

Name ……………………………………………………………………….

Address …………………………………………………………………….

www.kenyalaw.org

Rev. 1990]

Imports, Exports and Essential Supplies

Cap. 502

27

to import goods to the value of …………………………………………….

of the description of ………………………………………………………….

From ………………………………………………………………………………..

of ……………………………………… origin …………………………….

for the period of …………………………………………………………………..

Payment must be by a method appropriate to ……………………………………..

…………………………………………

for Director of Trade and Supplies.

Foam C—(Contd.)

BANK ENDORSEMENTS: --

Import entry

number

Date

Value

Officer’s

signature

This licence is a very important document the loss of which may cause a considerable amount of

inconvenience to the importer concerned. Importers are therefore advised to exercise the greatest care for

its safe keeping.

IMPORT CERTIFICATE

Form D

No. …………………

Issued by the Department of Trade and Supplies.

P.O. Box 30430, Nairobi, Kenya

It is hereby certified to the export licensing authorities of …………………………..that

…………………………………………of …………………………………… has undertaken to import into Kenya

the goods specified below.