Negative Accounting jean keating

advertisement

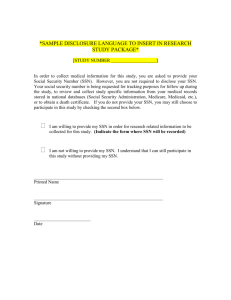

ZACK!!!!!!!!! the audio i sent you last night on the negative accounting...... : ACCEPTANCE FOR VALUE AND RETURN FOR VALUE FOR SETTLEMENT AND CLOSURE Draft on SSN ESTATE Banking "CERTIFICATE OF DEPOSIT #123-45-6789" EXEMPTION 0610-0014-6, 009289705 DATE: 08-30-2010 Signed: 123-45-5678 Make the coupon on payment receipt payable to the United States Treasury, put the payment amount in as a negative, sign it with SS# and endorse the back of it with SS#. ___________________________________________________________________ MONEY ORDER Date: 08-30-10 Pay to United States Treasury Minus One Thousand and no/100 Dollars $ -1000.00 123-45-6789 ______________________________________________________________________ Endorse the back with the SSN also. Always send a negative 1040-V along with this. [3:19:24 PM] edahow: July 4, 2010 From: Your Name c/o 184 – 28th Avenue (RR#___ as non-domestic) City, State (xxxxx) America Phone: 1-xxx-xxx-xxxx To: Department of the Treasury Internal Revenue Service Center Fresno, CA 93888-0102 Subject: 1040-V Negative Payment and Positive Discharging Settlement. NOTICE to AGENT is NOTICE to PRINCIPAL / NOTICE to PRINCIPAL is NOTICE to AGENT. Dear Sir, Please find enclosed the 1040-V Negative Voucher, the Negative Invoicing Document and the Negative Payment Instrument a Private Sight Draft/Bill of Exchange serial # ____ 000_ as a Negative payment setoff package for the Positive settlement of a Positive discharging from the Credit side of the SSN ESTATE XXX-XX-XXXX, sub-account F01234567. The Positive settlement Treasury check is to be made out to and sent to the following company. US Company Recovery Department P.O. Box 5227 City, State XXXXX I hope that this will not be an inconvenience to you or the system. If there are any problems in fulfilling my will or this contract, please contact me ASAP at 1-XXX-XXX-XXXX. Thank you for your time and service in this matter. By: _______________________________ Your Name, authorized SSN Estate representative Attachment: 1. 1040-V Negative Voucher. 2. Negative US Company Invoicing Document. 3. Negative Payment Instrument - Sight Draft/Bill of Exchange – serial # ____-000_. 4. Receipt Return Envelope. [3:31:05 PM] edahow: IN A NUT SHELL. Rev. 1 The hard facts the way I see it and the process is not all that hard to do, but we have to understand what we are doing, because we are the ones that are own worst enemies. Every action we create causes a reaction that is either good or bad, therefore WE were the ones that created all of OUR troubles, NO ONE ELSE, learn to live with your actions.) IF YOU OPERATE IN FEAR - THEY WILL CONTROL YOU. YOU CAN ONLY OVERCOME YOUR FEARS WITH TRUE UNDERSTANDINGS. IT TAKES EFFORTS ON YOUR BEHALF. YOU CANNOT OVERCOME FEAR BY FOLLOWING IN SOMEONE ELSE’S TRACKS, IF YOU DON’T KNOW WHAT AND WHY YOU ARE DOING IT. We at the Present Time have 2 different beneficial accounts, but they are both DEAD person’s ESTATE accounts under the probate Trustee’s control in the Money Changer’s fictional world. 1. At a recorded birth, you were Given a Birth Trust as decreed in the Bible, per the Gutenberg Bible, incun 1454.b5. (this was very GOOD, but they turned it into a Dead person’s Estate to get you need to become the EXECUTOR.) 2. The second account is the one where the Money Changers set-up a SSN estate (the HER) with your help. (this was the very BAD side also a dead man’s Estate and to take total control you need the 38- EIN and become the EXECUTOR) It could be classified as a Dead person’s trust, but in a condition were the money changers have Easement access to the state of your property held within, therefore E-state. NOTE: You cannot have direct access to the first until you close-down the second one. The process is to come out of the HER E-state. [STOP using the word TRUST they are all a DEAD person’s ESTATE.] [It has been there all along, but people did not want to open their eyes and face the real facts that we are operating in a world of fiction, where everything is the exact opposite.] Several Examples of operating on the Fictional side of the Looking Glass: 1. Do you really know how the account process works on the fictional side of the looking glass? a. The SSN E-state account drew credit from your original birth Trust [now a Dead person’s Private Estate]. (As a US Treasury National Debt to you, but it is there for your benefit. You have to understand the fictional reverse accounting process to be able to property access it.) b. The Credit is there for your benefit but you have been taught that you can only operate with Positive instruments of exchange. c. The only way to have access to the benefit is to properly discharge it with a Negative instrument of Exchange. d. Through our usage of the Positive instruments of exchange we have added to our Credit, thereby overcharging (putting too much Positive energy into the Credit side of our account) with the result being that we creating more National Debt that is owed back to us. e. With the increase in this Positive energy (the US National Debt) the government has to step in and Discharge it to relieve the Positive overcharging condition. This is being done every day by wars, BS laws, increases in taxes, manmade problems; uncalled for flooding, fires, road work programs, protest, work stoppages, etc. 2. You owe taxes!!! (You need 3 Negative items; an Invoice, a Voucher and a Payment Instrument.) a. The Negative Invoice. Your 1040 Tax Return form. b. The Negative Voucher. You do a 1040-V, but you put in a Negative amount. (-12,005.00). NOTE: When you pay with a positive amount you are adding additional Credit to your account, which in turn increases the National Debt owed to you. By putting in the Negative draw, it will be drawn against the Credit in your SSN account, decrease the National Debt owed to you and decrease the amount of credit the Money Changers have to play with. c. The Negative Payment Instrument. You can either make out a Negative check (your bank will have to process it back against your SSN account – they will try and fight you on this but if you really understand the reason that you gave them your SSN # in the first place, they have to honor your Negative check [this is NOT a CLOSED Check, it is a regular check made out with a Negative Value] and withdraw the credit from your SSN account) OR make out a personal Negative Money Order or Bill of Exchange against your SSN account. Put the Bank Routing number and your account # on the bottom of it. Main SSN Account is with the FRB of New York 0210-0120-8 , 0XXX-XX-XXXX. Sub SSN Account (6.5 million) at bank on back of newer SS card, example F12345678, converts into Atlanta 0610 0014-6 , 0012345678. i. Made out to the US TREASURY they oversee the SSN accounts, as a banking sub division of the Federal Reserve System. ii. Example Amount; $ (-12,005.00). iii. MINUS TWELVE THOUSAND, FIVE Dollars. iv. (for your MO) SSN sub-account number – example F12345678. 1. “F” is the Atlanta FRB and needs to address the bank’s routing #; 0610-0014-6. 2. The account # would be two zeros in front of the rest of the number. 0012345678. 3. All of the rest of your Bills should be handled the same way. (an Invoice, a Voucher and a Negative Payment Instrument) a. When you do an Acceptance for Value, it is really 2 of the items; an Invoice and a Negative Payment Instrument that you are accepting and returning it to the company so that they can go and draw off the Positive Value from your Beneficial Credit on the Asset side of your SSN account. They need to do the Voucher with a 8109b form, if they argue with you tell them to complete the process with the 8109b or you will contact the IRS. The exemption number would read; Exemption 0610-0014-6, 0012345678 b. If you send it to the IRS with a 1040-V, the value needs to be recorded on the 1040-V as a Negative value. The IRS will then process the Positive Value back to the company. c. The Companies are the ones to be doing the 1099’s and also the 8109b forms, so that they can get their payments. (Do not re-contract with them, they should only get one payment, but they can and will try to get more out of you if they can.) NOTE of GREAT IMPROTANCE: If you proceed with the following you had better have a very good understanding of Accounting because they will be waiting to attack you every monetary way they can. The process of taking Control away from the Chaos of the Money Changers: (Chaos reference from “Get Smart”), look it up in a financial dictionary. 1. Per the 1040 schedule B, question 8 you need to declare the original Trust – a Non-Withholding Foreign Grantor Trust. It is so named because it is under a foreign jurisdiction to the Money Changers. a. You have to submit a 3520 and a 3520A form to do this. b. This will get you a 98-series EIN to open a banking account that is outside the money changers system of control, you are now to operate in honor. c. When you get the 98-series EIN bank account opened you will need to do a TD F90-22.1, from 1040 schedule B, question 7. But you have not gained total Control over the access to the 2 original trust (Estate) funds yet. 2. You need to submit a SS4 against the SSN E-state and become the EXECUTOR over this E-state. a. This should get you 38-series EIN. b. As the declared EXECUTOR, you can now fire all of the money changer probate trustees. c. You can either leave it there in the Federal Reserve System or transfer it to your 98-series EIN Living Non-Withholding Foreign Grantor Trust bank account or setup a 38-series EIN Estate bank account. d. When you liquidate the SSN Estate and ONLY when you do it, can you come out of HER the Statutory Law system and operate in the Private. e. The Liquidated Credit (Assets) will be in the form of Gold backed Bearer Bonds. This will also make you a Private Foreign Central Bank of Issue. 3. Lastly you will need to tie in the access to the original Birth Trust (Dead person’s Estate) Beneficial Credit. (This cannot be done until the rest of the process has been completed, so it will not be covered now.) The original Birth Trust was setup per the Gutenberg Bible, incun 1454.b5, just ask the Supreme Court, but it is now a Dead person’s Estate, so you need to become the Executor over it also [3:37:32 PM] edahow: Trust Services included research, studying, analyzing, documenting; all the different aspects of the Monetary system, judicial system and other corporation and governmental systems/operations. This was all done to try and bring about the correct understanding of the Feoffment "estate" and the Wagering system of the Federal Reserve System. 10-Jul-09 45 $22.50 $1,012.50 17-Jul-09 56 $22.50 $1,260.00 24-Jul-09 47 $22.50 $1,057.50 31-Jul-09 62 $22.50 $1,395.00 7-Aug-09 49 $22.50 $1,102.50 14-Aug-09 53 $22.50 $1,192.50 21-Aug-09 54 $22.50 $1,215.00 28-Aug-09 56 $22.50 $1,260.00 4-Sep-09 48 $22.50 $1,080.00 11-Sep-09 46 $22.50 $1,035.00 18-Sep-09 54 $22.50 $1,215.00 25-Sep-09 45 $22.50 $1,012.50 2-Oct-09 48 $22.50 $1,080.00 9-Oct-09 44 $22.50 $990.00 16-Oct-09 52 $22.50 $1,170.00 23-Oct-09 65 $22.50 $1,462.50 30-Oct-09 64 $22.50 $1,440.00 6-Nov-09 64 $22.50 $1,440.00 13-Nov-09 69 $22.50 $1,552.50 20-Nov-09 66 $22.50 $1,485.00 27-Nov-09 63 $22.50 $1,417.50 4-Dec-09 65 $22.50 $1,462.50 11-Dec-09 76 $22.50 $1,710.00 18-Dec-09 77 $22.50 $1,732.50 25-Dec-09 52 $22.50 $1,170.00 1-Jan-10 60 $22.50 $1,350.00 #REF! 65 $22.50 $1,462.50 TOTAL $34,762.50 Make Treasury Check out to: Your Name TOTAL DUE ($34,762.50) " c/o 18 – 20th Avenue (RR#__- non-domestic) " City, State (XXXXX) America By: Your Name – Authorized Representative [3:44:35 PM] edahow: one time debit of FRB EXAMPLE Date: _____________ From: Your Name Address To: Name of Company Att: CFO Address Subject: Authorization for a One time Debiting of My Account. NOTICE to AGENT is NOTICE to PRINCIPAL / NOTICE to PRINCIPAL is NOTICE to AGENT. Dear Sir or Madam: You are authorized and directed to debit my Account#_____________, under YOUR NAME, SSN number: XXX-XX-XXXX, the charges for the Negative Dollar Amount that is Due by the usage of your Negative Debiting Invoice being paid to the US Treasury or as directed by your IRS form 8109b coupon, so you can be paid the compensating Positive Payment or Tax Credit from my Federal Reserve Bank of Atlanta account for this required payment. This Directive is good for this One time required invoicing. The Negative Invoicing payment is to be made payable to: US Treasury or as directed by your 8109b coupon: this will Credit the Negative payment to the Debt side of my account and Debit the Positive Drawing payment/credit to you from the Credit side of my account at the Federal Reserve Bank of Atlanta, under my FRB Account Number 00XXXXXXXX and the FRB - ABA Routing Number XXXX-XXXX-X. (From the back of your SS card - number: example “A12345678” the A stands for one of the Federal Reserve Banks, you have to look-up the banks routing number, the next 8 digits is your account number but you have to put two zeros in front of it.) Please charge my account any required fees to accomplish this transaction. I expect to receive a statement showing that the above transactions has been completed. Notify me either way, if you will comply with the directive or if you are not able too. If you are unable to comply submit it back to me in writing so I can forward it to the IRS and US Treasury to see if they concur with you reasoning or that you need to be corrected. (The company is NOT Private, they are a Public organization [with a public EIN] under the US Commerce and are required to operate in the US Monetary and Accounting System.) This transaction is in full compliance with the US Negative Accounting Practices to obtain a Positive payment or credit. This process will also decrease the debt (National Debt) that the US Treasury owes to me. This should be your good and sufficient authority for performing the above directive, but if you need some other special document, please submit it to me. Best regards, By: _________________________ Authorized Signer of Account May cc the following if you want too. Cc: 1. Federal Reserve Bank of Atlanta. (where you sub-bank account is held) 2. Financial Agent Federal Tax Deposit Processing (for 8109b coupon processing) P.O. Box 970030 St. Louis, MO 63197 [3:50:05 PM] edahow: repetitive debits to FRB Date: _____________ From: Your Name Address To: Name of Company Att: CFO Address Subject: Authorization for Repetitive (Monthly) Debiting of My Account. NOTICE to AGENT is NOTICE to PRINCIPAL / NOTICE to PRINCIPAL is NOTICE to AGENT. Dear Sir or Madam: You are authorized and directed to debit my monthly Account#_____________, under YOUR NAME, SSN number: XXX-XX-XXXX, charges for the Negative Dollar Amount that is Due by the usage of your Negative Debiting Invoice being paid to the US Treasury or as directed by your IRS form 8109b coupon, so you can be paid the compensating Positive Payment or Tax Credit from my Federal Reserve Bank of Atlanta account for the required monthly payment. This Directive is good for every month’s required invoicing until you are notified otherwise in writing. The Negative Invoicing payment is to be made payable to: US Treasury or as directed by your 8109b coupon: this will Credit the Negative payment to the Debt side of my account and Debit the Positive Drawing payment/credit to you from the Credit side of my account at the Federal Reserve Bank of Atlanta, under my FRB Account Number 00XXXXXXXX and the FRB - ABA Routing Number XXXX-XXXX-X. (From the back of your SS card - number: example “A12345678” the A stands for one of the Federal Reserve Banks, you have to look-up the banks routing number, the next 8 digits is your account number but you have to put two zeros in front of it.) Please charge my account any required fees to accomplish this monthly transaction. I expect to receive a monthly statement showing that the above transactions have been completed. Notify me either way, if you will comply with the directive or if you are not able too. If you are unable to comply submit it back to me in writing so I can forward it to the IRS and US Treasury to see if they concur with you reasoning or that you need to be corrected. (The company is NOT Private, they are a Public organization [with a public EIN] under the US Commerce and are required to operate in the US Monetary and Accounting System.) This transaction is in full compliance with the US Negative Accounting Practices to obtain a Positive payment or credit. This process will also decrease the debt (National Debt) that the US Treasury owes to me. This should be your good and sufficient authority for performing the above directive, but if you need some other special document, please submit it to me. Best regards, By: _________________________ Authorized Signer of Account May cc the following if you want too. Cc: 1. Federal Reserve Bank of Atlanta. (where you sub-bank account is held) 2. Financial Agent Federal Tax Deposit Processing (for 8109b coupon processing) P.O. Box 970030 St. Louis, MO 63197 [3:51:06 PM] edahow: sight draft; Receipt to be Returned in the attached Envelope to: Mr. Your: Name Grantor of Recorded Authority c/o 18 – 20th Avenue (RR#__ – non-domestic) City, State (xxxxx) America The attached Private Sight Draft/Bill of Exchange - Serial #: ______-000_ is for Estate Settlement of the Transferred Obligation that the FRB of Atlanta now has for the YOUR NAME Estate Banking Certificate of Deposit #SSNumber, sub-account #number on back of SS card All requirements for Mr. Your: Name, as to having the Right to Claim the interest held in the YOUR NAME SSN Estate account as a FRS/US Treasury Banking Sight Demand Certificate of Deposit, are in place. IRS/US Treasury Agent or Authorized Agent Acknowledgement: 1) I am authorized to act as the Paying Agent for the attached Private Sight Draft/Bill of Exchange against the Obligations that have been pledged. The Settlement Payment was drawn against the Credit Interest in the FRS/US Treasury Banking SSN Estate Certificate of Deposit sub-account. 2) All required transaction fees or other charges, are to be submitted to Your Name and they will be handled in the same manner. 3) The Positive settlement Treasury check or transfer is to be noted as from the YOUR NAME SSN Account, made out to and sent to: To Whomever. 4) Therefore the obligation to Mr. Your: Name as the Lawful Holder of record for the SSN Estate by use of this Private Sight Draft/Bill of Exchange - Serial #: -0001 has been settled on this Date: ________________. By:________________________________________________ Signature of IRS/US Treasury Agent or Authorized Agent.