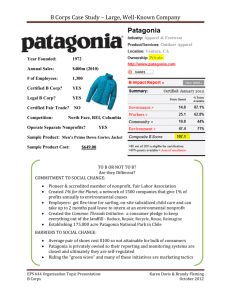

Corporations

advertisement