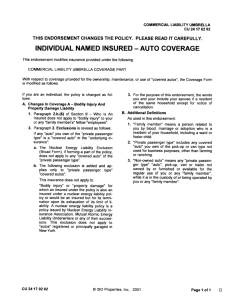

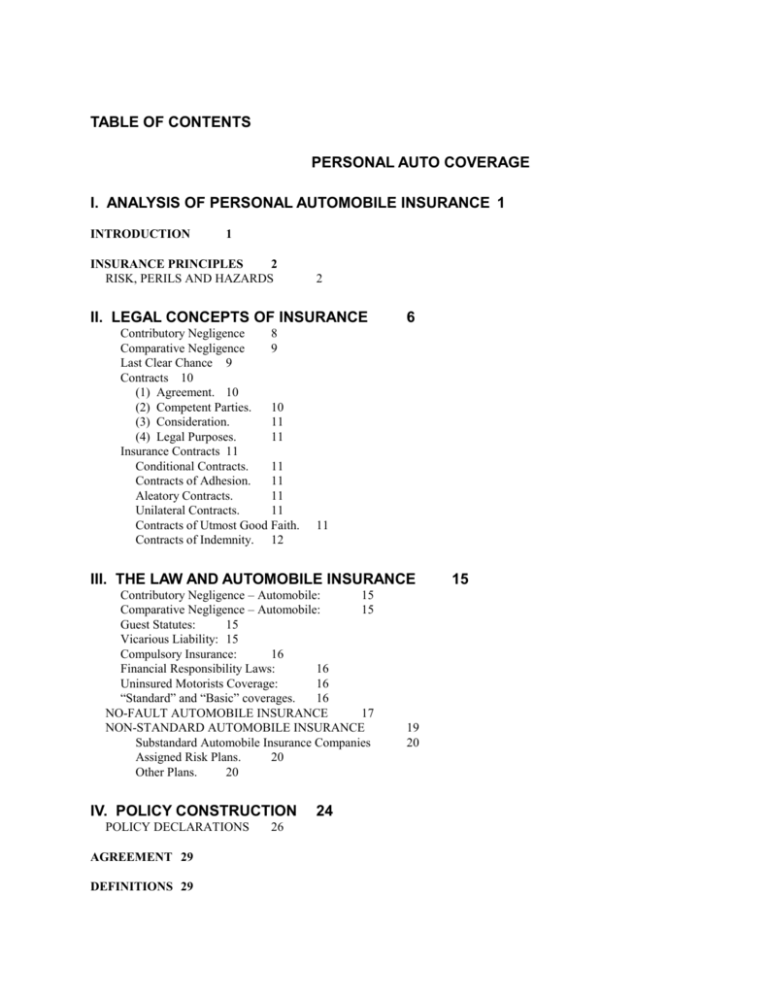

analysis of personal automobile insurance

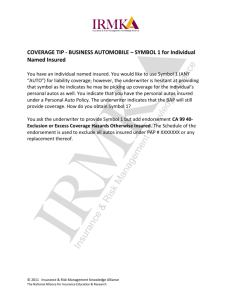

advertisement