Brinker Case

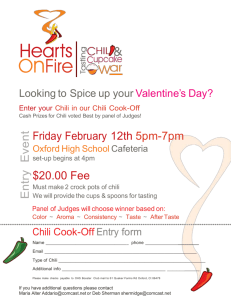

advertisement

Intro: Brinker International has many different restaurant chains under its operations such as, Chili’s Bar & Grill, Romano’s Macaroni Grill, Corner Bakery Café, Big Bowl Asian Kitchen, Rockfish Seafood Grill and On the Border. Chili’s is the largest restaurant and makes up the most profits for Brinker International. There are approximately 975 Chili’s Bar & Grills that make up 70 percent of Brinker’s profits. We see that there is an opportunity for Brinker to flourish but, they may be restricted by some of the current holdings. As strategic managers, we need to determine, “How can Brinker International increase its profit margin by changing the company structure?” Answering this question will allow us to focus on where we want to see this company three years from now. Alternatives: In order for Brinker International to increase its profit margin through change in the company structure, the correct strategic decision must be made. We believe that we have developed three strong alternatives from which to choose. First, we propose that Brinker International sell all of their entity’s except for Chili’s and focus all efforts to better Chili’s. Our second proposal is to combine three restaurants at a single location; the three that we chose are Chili’s, Romano’s Macaroni Grille, and Rockfish Grille. The final alternative is to close the three worst performing restaurants and incorporate their most popular dishes in the menus of the stronger restaurants. The first alternative would allow Brinker International to increase their profit margin by solely focusing on their strongest performing asset. Although it is a drastic decision, we believe that taking full advantage of Chili’s profitability potential will prove beneficial. Our second proposal is innovative and we believe it will increase profit margins by offering the consumer something no other (non-fast food) restaurant chain has done before. Combining three fundamentally different restaurants in one location will not only provide convenient eating alternatives, it will also increase the amount of patrons at Romano’s Macaroni Grille and Rockfish Grille. Criteria: To be able to make a strategic decision we must create a set of criteria for selecting an option. The four criteria that will reflect the differences of each option are time, cost, level of risk, and competitive benefit. We feel that these are the most appropriate choices because the criteria best support a business decision to change the company’s structure and improve profit margins. The parameter of time is, “the option will be completed by year three.” We are looking towards the future and want to determine where we can see Brinker three years from now. The parameter for level of risk is, “the option must have a low opportunity cost.” We don’t want to take such a large risk that the company cannot survive if the option doesn’t succeed to resolve the issue. The parameter for cost is, “the cost of implementation, or setup costs, should not exceed the revenue produced by the company’s top earner.” We need to weigh the pros and cons and see if we can afford to implement the option and, if we can’t pay for the new plan with our top earner then the plan doesn’t seem feasible. The parameter for competitive benefit is, “the option must increase revenue by adding the most value for customers.” We want people to find that the decision we made has added value to the company, and gives them a reason to dine with Brinker. This will increase revenues and hopefully make Brinker a more profitable company. Application: Assessing the alternatives by using the criteria we have set forth will help us determine which decision is the best overall for our company. Our first option is to sell off all entities except for Chili’s. This option depending on demand of the other entities should meet our expectation set for time. Current trends show that Chili’s is the “bread and butter” for Brinker, but selling off the other entities could possibly hurt the company if something would happen to Chili’s in the future. Costs for implementing Option 1 are relatively minimal. The competitive benefit would be more for the shareholders because liquidating the smaller entities will bring immediate payoffs, but for Chili’s customers there will be little change. Current employees of the smaller entities will ultimately lose there jobs but the number of laid off employees will be so minuet that it will not effect the appearance of Brinker. The second proposed alternative will be combing three restaurants into a single location (much like Outback and Carabas). The three year guideline will not be met in this option, only a few test sites will be up and functional in this time period. Full launch of this implementation would be effective in closer to a 10 year range. The level of risk is moderate but will be decreased by running a couple test sites to see if the combination restaurants will be effective. This option is relatively expensive because combining three restaurants will mean a lot of construction work but should have its payoffs by serving the customer base better. This option we believe has the highest level of competitive advantage because the variety of food and restaurant atmospheres offered. For example, if a couple goes out to Chili’s to eat and they encounter a long wait they now have two viable choices of restaurants to eat at without leaving the establishment. The last proposed alternative will be closing the three worst performing restaurants and incorporating their most popular dishes in the menus of the stronger restaurants. This solution is a quick fix, and can be implemented well under the 3 year time range. The level of risk of this proposal is small because nothing is really changed with the strong restaurants only a few additions to their menus. This option is inexpensive because no drastic measures are needed only addition of a few menu items and closing of low performance entities. Competitive benefit will be larger because Chili’s and other strong restaurants will now have a broader menu that will reach out to a much broader range of consumer. Recommendation: As a result of our analysis of the alternatives, Option Three seems to be the best fit for our set parameters. The third alternative utilizes the S.W.O.T. analysis by focusing on our strengths by eliminating our weaknesses and taking advantage of opportunities. The company would be overall more profitable because they have eliminated the restaurants that are the weakest performers. Incorporating the most popular menu items of the old restaurants will better the menus of the stronger restaurants. In addition, it should attract the patrons of the old restaurants into the stronger performers to get their favorite dishes.