Case 1: DuPont Has Designs On Fashion

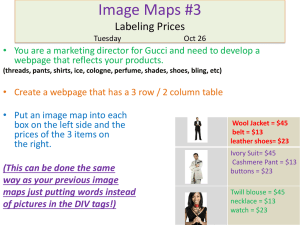

advertisement