Present TAFE SA Diploma in Accounting credit into Commerce degree

Present TAFE SA Advanced Diploma in Accounting credit into Commerce degree

Accounting for Business

Communication and Information Systems in Business

Foundations of Business Law (IF you studied Contract Law module(s) at TAFE

SA)

Financial Accounting 1

Management Accounting

Management Principles

6 x Elective courses

= 12 courses credit

This assumes you have also completed the Diploma in Accounting and Cert IV at

TAFE SA

Present TAFE SA Diploma in Accounting credit into Commerce degree

Accounting for Business

Communication and Information Systems in Business

Foundations of Business Law (IF you studied Contract Law module(s) at TAFE

SA)

Financial Accounting 1

Management Principles

3 x Elective courses

= 8 courses credit

This assumes you have also completed the Cert IV at TAFE SA

Present TAFE SA Certificate IV credit into Commerce degree

2 x Elective courses

Regarding credit and lodging a credit application from TAFE SA to UniSA

New students from TAFE SA are asked to have credit settled as soon as possible.

This is especially important in the Commerce degree where we enforce prerequisites in our accounting courses.

Arranging credit is easy to do. Students can either go to Campus Central at the

Yungondi building at the City West Campus on Hindley Street or contact them via e-mail on campuscentral.citywest@unisa.edu.au

Campus Central is a "one stop shop" for all student administrative enquiries.

Students need to supply their TAFE certificate(s) and transcripts and a photocopy of same. The staff at Campus Central will help them complete the required credit application form.

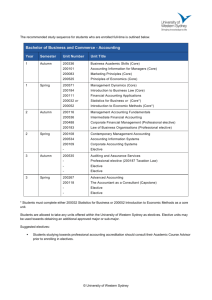

Recommended study plan for 2014 for a student who has completed the Advanced

Diploma in Accounting

Study period 2

Financial Accounting 2

Finance and Investment

Principles of Economics

Business and Society

Study period 5

Financial Accounting 3

Companies and Partnership Law (assuming credit for Foundations of Business Law can be claimed)

Global Issues for Accounting

Contemporary Issues in Accounting

Followed in 2015 with

Study period 2

Quantitative Methods for Business

Marketing Principles: Trading and Exchange

Taxation Law 1 (elective)

Auditing Theory and Practice (elective)

If student wishes to study part time, reduce courses per study period accordingly.

Recommend study plan for 2014 for a student who has completed the Diploma in

Accounting

Study period 2

Financial Accounting 2

Finance and Investment

Business and Society

Management Accounting

Study period 5

Financial Accounting 3

Companies and Partnership Law (assuming credit for Foundations of Business Law can be claimed)

Global Issues for Accounting

Contemporary Issues in Accounting

Followed in 2015 with

Study period 2

Quantitative Methods for Business

Principles of Economics

Taxation Law 1 (elective)

1 Elective

Study period 5

2 Electives

Auditing Theory and Practice (elective)

Marketing Principles: Trading and Exchange

If student wishes to study part time, reduce courses per study period accordingly.

IMPORTANT INFORMATION ABOUT PROFESSIONAL ACCOUNTING

BODY MEMBERSHIPS

Most Commerce degree graduates aim to achieve this.

The professional minor comprises Companies and Partnership Law, Taxation Law

1 and Auditing Theory and Practice. All three courses are classed as electives.

Students need to complete all three courses to be eligible for future membership of The Institute of Chartered Accountants in Australia. Thus, if a student is positioning himself or herself to be a Chartered Accountant by studying the

Chartered Accountants Program, these are required courses.

However, please note that students only need to complete Companies and

Partnership Law to be eligible for future membership of CPA Australia. They would replace Taxation Law 1 and Auditing Theory and Practice with different electives.

Important – where a student chooses to study Taxation Law 1 and Auditing

Theory and Practice for the above reasons, these courses cannot be attempted until final year of study.

INFORMATION ABOUT ELECTIVES

Advice about choosing electives to assist with your study planning

There are nine electives in the Bachelor of Commerce. The nine includes the Future professional accounting body membership electives (please see below).

Prerequisites

You need to have met any prerequisites for electives you study. They will be set out

(where they exist) on the course home page and they are enforced. For instance,

Management Control Systems and Cost Management Systems cannot be studied until the prerequisite Management Accounting has been passed or you have credit/recognition of prior learning for Management Accounting.

We stress the following with your elective choices

We strongly encourage you to study electives from the Business School offerings (this includes the Schools of Commerce, Management, Marketing and Law). You can study

one elective from outside the Business School if you wish, however, this is optional.

Always consider how good (or otherwise) the electives you choose will look on your final transcript and how desirable they’ll be in the employment market. What will your choices add to your degree? Employers want to see evidence of planning and good decision making as to why you chose the electives you chose. How will you market your choices? How will you explain away any easy choices?

If you’re in doubt, imagine an employer is looking over your shoulder and asking,

“What’s that got to do with business?”

Please use the numbering in course codes as a guide to when an elective course should be studied in your degree. For example, “XYZZ 1 000” is designed for first year, “XYZZ

2 000” is designed for second year and so on. This isn’t a strict rule. Instead, use it as a guide.

Minors

When planning your electives, it’s worth looking at UniSA’s minors. The list is useful becoming it summarises courses into themes: http://programs.unisa.edu.au/public/pcms/Home/Majorssubmajorsminorsindex.aspx

Management Accounting, Applied Finance, Management, International Business,

Marketing, Management of Professional Practices, Property and the Small Business

Minor courses are all quality selections (this is not an exhaustive list).

We stress – please ensure that you meet prerequisites.

The following courses must not be studied as electives in the Bachelor of Commerce.

They are core courses

Accounting for Business (replaces the previous core course Accounting,

Decisions and Accountability).

Principles of Economics (replaces the previous core course Microeconomics and its predecessor Economic Principles).

Management Principles (replaces the previous core course Introduction to

Management).

Foundations of Business Law (replaces the previous core course Introduction to

Law.

Companies and Partnership Law (replaces the previous elective Corporations and

Partnership Law).

Business Finance (this is almost identical to the core course Finance and

Investment).