Tax - Rayner Essex

advertisement

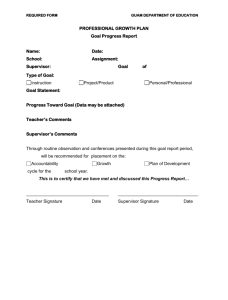

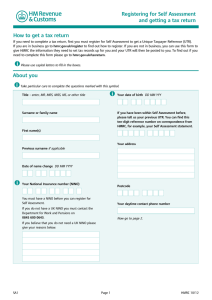

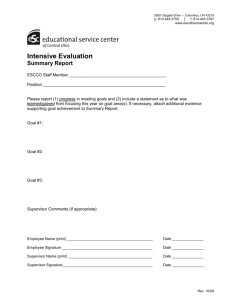

Role Profile Role Title: Role Holder: Department: Responsible to: Personal Tax Apprentice Vacancy Tax – London office Adela Cebotari, Tax Supervisor (London office) Role Profile: The main duties for this position will be entering information onto our tax preparation software and calculating the tax liability thereon. Reporting directly to the Tax Supervisor for all tasks. Key tasks: Learn to use tax software packages such as CCH, Glasses Guide online, Tax View and Lexis Nexis. Enter client tax information provided by the tax team and produce a draft Tax Return on the tax software CCH. Study for ATT qualification and Apprenticeship Learn to file, photocopy, undertake general office duties and assist colleagues within the tax department as a whole. Participate in the prioritisation of the tax department’s workload in order to meet deadlines and maintain high standards at all times. Learn to be aware of the time spent carrying out work and learn to complete a timesheet for each week. Learn to check PAYE client codes issued by HMRC and take action necessary for required amendments Learn to check client self-assessment accounts on HMRC gateway for tax payments made and maintain client details Learn to deal with general HMRC correspondence both written and on the telephone, i.e. tax calculations and summaries for client enquiries. With the support of the Tax Supervisor and tax team members, learn to carry out tax research and summarise findings Attend and participate in team meetings and attend training such as tax webinars and CPD updates as necessary Occasionally, it will be a requirement to travel to the firm’s St Albans office to help with the team projects. Travel costs on these occasions will be covered in full be the firm. Key Skills, Abilities Good standard of written and spoken English Essential Criteria √ Good verbal communication and listening skills √ Ability to communicate information clearly, concisely and √ Desirable Criteria accurately, both in person and when using the telephone and email √ Ability to check for accuracy and give attention to detail Ability to organise self to complete tasks fully and on time √ Good keyboard skills √ Education & Qualifications 5 GCSE’s at grade C (Maths and English grade B or above) √ 2 ‘A’ level’s grade C or above preferably in Maths and Business √ Studies, or level 3 qualification (AAT preferred) Knowledge/Experience Good knowledge of Word and Excel applications √ Understanding of a customer focussed service √ √ Previous employment either paid or voluntary Personal Attributes Team worker √ Career aspirations to become ATT qualified and progress to at least a Tax Junior position √