Syllabus - Saint Louis University

advertisement

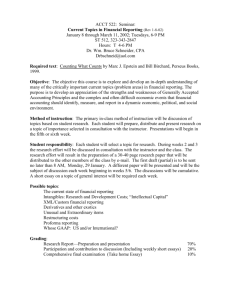

Saint Louis University ACCT 614 School of Business and Administration Syllabus 1. Course Number and Title Accounting 614 - Seminar in Accounting and Society Credit Hours - 3 Prerequisite(s) - ACCT 501 (or equivalent) 2. Course Description A study of the role of accounting in society: past, present, and future with particular emphasis on the extension of accounting measurement, reporting, and attestation in areas of increasing social importance. Specific topics include: the historical significance of accounting; the professional nature and responsibilities of accounting, ethical considerations in accounting, the current regulatory environment of accounting, including but not limited to: Sarbanes-Oxley, the Public Accounting Oversight Board, responsibilities of audit committees, corporate governance issues, forensic accounting, evolution of international reporting standards, and corporate sustainability reports. Instructor’s Web Page: Course materials and other information will be available on the instructor’s web page at http://www.slu.edu/departments/accounting/keithleyj The course syllabus will be available at this site, along with PowerPoint lecture slides (indicated within the detailed topical assignments), a message board and other items. Students should print out the lecture slides and bring them to class! Use your own judgment in printing slides. In most cases handouts of three to six per page would be most appropriate, however in some instances, you may want to print only two per page. If you need assistance printing slides from PowerPoint or accessing the web page, go to the CSB Computer Lab located in DS 473. This web page will be the primary method of group communication (outside of regular class sessions) between the instructor and students, and it should be checked on a regular basis. 3. Procedures The subject matter will be presented in a series of seminars which will be conducted on an informal basis with major emphasis on participation by all members of the class. Some of these seminars will be led by the instructor; others will be conducted by the students as discussion leaders; and, presentations may be arranged by outside speakers. 4. Assignments Specific assignments will be made by the instructor, however they will include any or all of the following: Reading assignments from the text(s) or additional sources covering a specific area of the subject matter. Much of this material will be placed on reserve in the library (in both electronic and hardcopy form) and some may be distributed by the instructor in the form of handouts. In order to obtain the electronic reserve material, go to the following link: http://eres.slu.edu/eres/courseindex.aspx?error=&page=search and search for our course number, ACCT B614-01. The password for the electronic reserve material is: notdrscrs Student presentations. In some situations students (either individually or in groups) may be assigned class presentations. Specific guidelines for these presentations will be given by the instructor. Makeup of student teams will attempt to provide a diversity of academic and business experience, gender, and ethnic backgrounds. Written assignments or papers. Specific written assignments will be determined by the instructor. Class participation Class participation will be evaluated based on a student’s preparation for the discussion of individual topics, and a demonstration of this preparation through meaningful dialogue during class sessions or active participation during in-class exercises. 5. Tests and Examinations The timing, nature, and content of examinations will be determined by the instructor. 6. Supplementary Materials None 2 7. Topical Outline History and Cultural Significance of Accounting Professional Stature and Obligations Ethics in Business: An Overview Ethics in Business: Analysis of specific business cases Accounting in the New Age of Regulation Sarbanes-Oxley: An Overview Public Company Accounting Oversight Board Auditor Independence & Audit Committees Reporting on Internal Controls Corporate Responsibility Forensic Accounting Enhanced Financial Disclosures Globalization of Financial Reporting Standards Future Role of Accounting in Society 8. Textbook(s): Duska, Ronald F. and Brenda Shay Duska, Accounting Ethics, Blackwell Publishing, 2005. (DUSKA) Mintz, Steven M. and Roselyn E. Morris, Ethical Obligations and Decision Making in Accounting: Text and Cases, McGraw-Hill Irwin, 2008. (MINTZ) Prentice, Robert and Dean Bredeson, Student Guide to the Sarbanes-Oxley Act, Second edition, SOUTH-WESTERN, 2010. (PRENTICE) 3 Dr. John P. Keithley ACC B614 Office: DS 106 Schedule of Assignments Phone: Office: 314-977-3856 Home: 314-569-1916 Spring 2009 Fax: 314-977-1473 Email: keithley@slu.edu Office Hours: 10:00 - 12:00 MW 1:00 - 2:00 MW (beg. on 3/23) OR BY APPOINTMENT Date Mar. 23 Orientation Topic Written or Team Assignments 25 History and Cultural Significance of Accounting Short paper: Functions of Accounting 30 Ethics in Business: A Professional Viewpoint Speaker: Mike Zychinski (Deloitte) Apr. 1 Is Accounting a Profession? Team presentations - Debate on Professionalism 6 Ethics in Business: A Framework for Analysis Speaker summary: Zychinski 8 Accounting in the New Age of Regulation: Sarbanes-Oxley Team presentations: WorldCom 13 Public Company Accounting Oversight Board 15 Auditor Independence & Audit Committees 20 SOX – Section 404 22 Fraudulent Financial Reporting & Forensic Accounting 27 Enhanced Financial Disclosures Globalization of Financial Reporting Standards 29 Presentation of Term Projects Short paper: SOX Speaker: Jim Castellano (RubinBrown) Speaker summary - Castellano Speakers: Rick Nicoletti (EY) & Kelvin Westbook (KRW) Speaker summary – Nicoletti & Westbrook Speakers: Dana Plonka (Sigma Aldrich) & Rick Andrews (KPMG) Speaker summary – Plonka & Andrews Speaker – Tom Hilton (AMD) Speaker summary – Hilton Speakers – Bo Butters (PWC) Final Papers Due Presentation of Term Projects May 4 The Future of Professional Accounting May 6 FINAL EXAM 4 2:00 – 3:50 p.m. GRADING SYSTEM Grades will be based on the following evaluations (approximate percentages): Short papers 15% 2 Short papers Speaker Summaries 10% 5 or 6 Summaries Team presentations 15% 1 Team presentation Final term paper 20% Class participation 25% Final exam 15% Letter grades will be based on the following percentage scale: Grading Scale (Graduate) A = 92 and above B+ = 88 thru 91 B = 82 thru 87 B- = 78 thru 81 C = 70 thru 77 F = Below 70 Grade Point Equivalent 4.0 3.5 3.0 2.5 2.0 0.0 5 FINAL PAPER Each student will prepare a term paper on the general topic, “Future Challenges For the Accounting Profession.” This paper should include: 1. 2. 3. A brief summarization of major events impacting the accounting profession during this the last five to ten years. Your view as to what you see as the most significant challenges for the accounting profession in the next few years. You should focus on one (or possibly two) challenge(s) and also make recommendations as to how the profession should prepare for these challenges. In this paper, the term “accounting profession” should be considered broadly to include all areas of accounting. This paper should be well researched, clearly organized and supported by logical thinking. A general outline for this paper must be submitted NO LATER THAN APRIL 15, 2009. THE INSTRUCTOR MUST APPROVE THE TOPIC! The maximum length on the term paper will be 15 pages. 6 TOPIC # 1 HISTORY AND CULTURAL SIGNIFICANCE OF ACCOUNTING March 25, 2009 The purpose of this topic is to examine the history of accounting. We will discuss the various roles which accounting has played throughout history, and the relationship of accounting to economic, social and political developments. This examination should provide the background for an evaluation of the current significance of the field of accounting and its future directions. 1. Readings for Topic # 1: (DUSKA) Introduction; Chapter 1 Enthoven, Adolf J. H., "The Changing Role of Accountancy," Finance and Development, June 1969. Ma, Ronald, “Accounting as a Social Force.” The Pakistan Accountant, December, 1965. Giautier, M.W.E., "The Idea of Accounting: A Historical Perspective, " The Accountants Magazine, August, 1973. NOTE: On electronic reserve, this article is combined with the Enthoven article. Kam, Vernon, Accounting Theory, Second edition, John Wiley & Sons, 1990, Chapter 1. . 2. Short Paper – “Functions of Accounting” (Due on March 25, 2009): Students should prepare a paper outlining the primary societal functions performed by accounting during its evolution. In preparing the list, students should NOT include specific accounting specialties (i.e., auditing, cost accounting, tax, etc.) but the social functions accomplished by accounting. This list should be accompanied by a brief explanation of the historic, cultural, economic, and political events leading to the emergence of each function. The focus should be on “Western Civilization” but is not strictly limited to this area. This assignment should be typed (maximum of 5 pages) and submitted at the beginning of class. Students should be ready to discuss their conclusions. 7 TOPIC # A ETHICS IN BUSINESS A PROFESSIONAL VIEWPOINT March 30, 2009 The purpose of this session is to provide an overview of the importance of ethics in business and discuss the current state of the accounting profession in the years following the SarbanesOxley Act. 1. Readings for Topic # A: (DUSKA) – (pp. xlviii – li) & Chaps. 5 through 10. (MINTZ) – Chaps. 4-6 These specific chapters in the textbooks should be reviewed to obtain an overall perception of the professional responsibilities of accountants. Specific sections as will be discussed as part of future assignments. * Buckhoff, Thomas A. and LeVon E. Wilson, “Ethical Lessons for Accountants,” The CPA Journal, November 2008. * Verschoor, Curtis C., “Why Has AIG Had So Many Problems?,” Strategic Finance, December 2008. * These two articles are posted under Topic 3 on the electronic reserve materials from Pius XII library On March 30, 2009, Mr. Mike Zychinski (Partner and Chief Ethics and Compliance Officer for the Deloitte US Firm) will make a presentation concerning business and accounting ethics as well as the current state of the accounting profession. Based on our readings, students should be prepared to ask relevant questions and participate in meaningful discussion. 2. Speaker summary – (Due on April 6, 2009): Students should prepare a brief (one-page) summary of the speaker’s main points. The summary should meet the writing guidelines shown within the syllabus. 8 TOPIC # 2 IS ACCOUNTING A PROFESSION? April 1, 2009 The purpose of this topic is to examine the extent to which accounting can be classified as a "profession;" and, if so, how such classification shapes its role in society. We will first focus on an examination of the characteristics of a profession and a comparison of accounting to these characteristics. The discussion will continue by reviewing the changes in the practice of accounting in the U.S. since 1930 and an evaluation of whether the status of accounting has been altered. In both sections of the discussion, students should consider all accounting areas (public accounting, management accounting, governmental accounting, etc.). 1. Readings for Topic # 2: (DUSKA) – Chap. 4 (MINTZ) – Chap. 4 Paton, W.A., "Earmarks of a Profession and the APB," Journal of Accountancy, January, 1971. Zeff, Stephen A., “How the U.S. Accounting Profession Got Where It Is Today: Part I,” Accounting Horizons, September 2003. Zeff, Stephen A., “How the U.S. Accounting Profession Got Where It Is Today: Part II,” Accounting Horizons, December 2003. Wyatt, Arthur R., “Accounting Professionalism – They Just Don’t Get It!,” Accounting Horizons, March 2004. Newman, Bernard H. and Mary Ellen Oliverio, “Perceived Flaws in Sarbanes-Oxley Implementation,” The CPA Journal, September 2006. While this article deals with SOX, focus on the comments relating to accounting as a profession at this point. We will deal more specifically with Sarbanes-Oxley in a later topic. Silvers, Damon A., “The Current State of Auditing as a Profession: A View from WorkerOwners,” Accounting Horizons, December 2007. 9 2. Team presentations - “Debate on Professionalism” (Due on April 1, 2009): Two teams will be assigned to debate the issue, “Is Accounting a Profession?” One team will argue that “Accounting Is a Profession,” and the other team should be ready to argue that, “Accounting Is Not a Profession.” At the beginning of class, the instructor will specify which argument each team will present and who will go first. Both teams should be ready to argue either side of the issue and for an appropriate rebuttal. All other students should prepare a list of characteristics, which identify a discipline as a "profession" (to be submitted at the beginning of class) and be prepared to discuss the overall issue as well as vote on the results of the debate. 10 TOPIC # 3 ETHICS IN BUSINESS: AN OVERVIEW & FRAMEWORK FOR ANALYSIS April 6, 2009 This topic is designed to summarize the study of ethics in relation to business organizations. The importance of ethics in today's business world and different approaches to ethical analysis will be examined. Implications for professional accountants will be discussed. 1. Readings for Topic # 3: (DUSKA) – Chaps. 2 & 3 (MINTZ) – Chaps. 1-3 Cavanagh, Gerald F., Dennis J. Moberg, and Manual Velasquez, "The Ethics of Organizational Politics," Academy of Management Review, 1981, Vol. 6 No. 3, pp. 363-374. Cooke, Robert Allen, "Business Ethics: A Perspective," Ethics in Business: A Perspective (Chicago: Arthur Andersen & Co., 1990). Verschoor, Curtis C., “Do The Right Thing: IMA Issues: New Ethics Guidance,” Strategic Finance, November 2005. 2. Discussion Assignments: Ethics Cases – To be distributed and discussed in class 3. Team presentations – Ethics Case (Due on April 8, 2009): Zekany, Kay E., Lucas W. Braun, and Zachary T. Warder, “Behind Closed Doors at WorldCom: 2001,” Issues in Accounting Education, February 2004. THIS MATERIAL WILL BE DISTRIBUTED IN CLASS. Teams may use any additional sources they deem necessary. Specific team assignments will be determined by the instructor. 11 TOPIC # 5 (Note: There is no Topic # 4) ACCOUNTING IN THE NEW AGE OF REGULATION: SARBANES-OXLEY April 8, 2009 The purpose of the session is to provide an overview of the Sarbanes-Oxley Act, discuss its individual provisions, and explore strengths and weaknesses of the bill. 1. Readings for Topic # 5: MINTZ: Chaps. 5 & 6 PRENTICE – Review entire volume. http://www.aicpa.org/info/Sarbanes-Oxley2002.asp Students will want to follow links for additional information and recent changes. Czaja, Rita, “Should Sarbanes-Oxley Reforms Extend to Nonpublic Companies?,” The CPA Journal – Special Auditing Issue: Innovations in Auditing, November 2005. Newman, Bernard H. and Mary Ellen Oliverio, “Perceived Flaws in Sarbanes-Oxley Implementation,” The CPA Journal, September 2006. Kranacher, Mary-Jo, “The Future of Sarbanes-Oxley: An Exclusive Interview with Former U.S. Senator Paul S. Sarbanes,” The CPA Journal, October 2008. 2. Written assignment (Due on April 13, 2009): Students will prepare a short paper summarizing the reasons for the passage of the SarbanesOxley bill and their opinions about its major strengths and weaknesses. This assignment should be typed (maximum of 5 pages) and submitted at the beginning of class. Students should be ready to discuss their findings. 12 TOPIC # 6 PUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD April 13, 2009 This session will provide an in-depth discussion of the PCAOB with particular attention to its creation, structure, history, as well a review of strengths and weaknesses of the organization. 1. Readings for Topic # 6: PRENTICE – Title I. http://www.pcaob.org Students will want to follow links for additional information and recent changes. Carmichael, Douglas R., “The PCAOB and the Social Responsibility of the Independent Auditor,” Accounting Horizons, June 2004. Alles, Michael, Alexander Kogan, Miklos Vasarhelyi, and J. Donald Warren, Jr., “ Guarding the Auditing Guards,” Strategic Finance, February 2006. Kranacher, Mary-Jo, “The PCAOB’s Primary Mission: Improving Confidence in Financial Reporting,” The CPA Journal, January 2008. Kranacher, Mary-Jo, “An Interview with Charles D. Niemeier, Public Company Accounting Oversight Board Member,” The CPA Journal, December 2008. 2. Discussion assignment: On April 13, 2009, Mr. James Castellano (Chairman of the Board and Partner, RubinBrown) will make a presentation concerning the Public Company Accounting Oversight Board. Based on our readings, students should be prepared to ask relevant questions and participate in meaningful discussion concerning the PCAOB. 3. Speaker summary – Castellano (Due on April 15, 2009): Students should prepare a brief (one-page) summary of the speaker’s main points. The summary should meet the writing guidelines shown within the syllabus. 13 TOPIC # 7 AUDITOR INDEPENDENCE & ROLE OF AUDIT COMMITTEES April 15, 2009 This topic is designed to review the current rules regarding the independence of external auditors. Significant attention will be given to the evolution of these new standards and specific non-audit services which are prohibited under the current rules. Students should consider the impact of the new standards on the future of auditing and public accounting. 1. Readings for Topic # 7: MINTZ – Chaps. 5 & 6 PRENTICE – Title II & III Baker, C. Richard, “The Varying Concept of Auditor Independence,” The CPA Journal, August 2005. Goff, John, “Fractured Fraternity,” CFO, September 2005. Pandit, Ganesh M., Vijaya Subrahmanyam, and Grace Conway, “Audit Committee Reports Before and After Sarbanes-Oxley,” The CPA Journal, October 2005. Smith, Douglas L., and Frank C. Minter, “Independence: Perception or Reality?,” Strategic Finance, December 2005. Allen, Catherine, “Ethics Rules Get Tighter,” Journal of Accountancy, December 2006. Hermanson, Dana R., “How Consulting Services Could Kill Private-Sector Auditing,” The CPA Journal, January 2009. 2. Discussion Assignment: On April 15, 2009, Mr. Rick Nicoletti (Audit Partner, Ernst & Young) and Mr. Kelvin Westbrook (KRW Advisors, LLC) will make a presentation concerning these topics. Based on our readings, students should be prepared to ask relevant questions and participate in meaningful discussion concerning auditor independence and the role of the audit committee. 3. Speaker summary – Nicoletti & Westbrook (Due on April 20, 2009): Students should prepare a brief (one-page) summary of the speaker’s main points. The summary should meet the writing guidelines shown within the syllabus. 14 Topic # 9 SOX – SECTION 404 April 20, 2009 This topic is designed to review the evolution of corporate responsibility in light of new regulations following Sarbanes-Oxley, etc. Discussion will include the heightened responsibilities of corporate management and the Board of Directors. Special attention will be given to the assessment of internal controls by management and the independent auditor (Section 404), and the certification of the financial statements by management. The session will also cover recent auditing standards regarding internal control. 1. Readings for Topic # 9: PRENTICE – Title III & IV PCAOB – Review Auditing Standards No. 2 & No. 5 - http://www.pcaob.org Campbell, David R., Mary Campbell, and Gary W. Adams, “Adding Significant Value with Internal Controls,” The CPA Journal, June 2006. Gupta, Parveen P. and Jeffrey C. Thomson, “Management Reporting on Internal Control,” Strategic Finance, September 2006. Archambeault, Deborah S., F. Todd DeZoort, and Travis P. Holt, “The Need for an Internal Auditor Report to External Stakeholders to Improve Governance Transparency,” Accounting Horizons, December 2008. Hermanson, Dana R., Daniel M. Ivancevich, and Susan H. Ivancevich, “Tone at the Top: Insights from Section 404,” Strategic Finance, November 2008. Hermanson, Dana R., Daniel M. Ivancevich, and Susan H. Ivancevich, “SOX Section 404 Material Weaknesses Related to Revenue Recognition,” The CPA Journal, October 2008. 15 2. Discussion Assignment: On April 20, 2009, Mr. Rick Andrews (Audit Partner, KPMG) and Ms. Dana Plonka (Director of Internal Auditing, Sigma Aldrich), will make a presentation concerning these topics. Based on our readings, students should be prepared to ask relevant questions and participate in meaningful discussion concerning SOX 404. 3. Speaker summary – Andrews & Plonka (Due on April 27, 2009): Students should prepare a brief (one-page) summary of the speaker’s main points. The summary should meet the writing guidelines shown within the syllabus 16 Topic # 8 FRAUDULENT FINANCIAL REPORTING & FORENSIC ACCOUNTING April 22, 2009 This session is designed to cover field of forensic accounting and discuss the responsibility of accountants and auditor in regard to detecting irregularities and fraudulent financial reporting. 1. Readings for Topic # 8: . MINTZ – Chaps. 5 – 7 Wolfe, David T. and Dana R. Hermanson, “The Fraud Diamond: Considering the Four Elements of Fraud,” The CPA Journal, December 2004. Wells, Joseph T. and John D. Gill, “Assessing Fraud Risk,” Journal of Accountancy, October 2007. Apostolou, Nicholas and D. Larry Crumbley, “Auditors’ Responsibilities with Respect to Fraud: A Possible Shift?, The CPA Journal, February 2008. Radin, Arthur J., “A Practical Approach to Finding Management Override,” The CPA Journal, October 2008. Silver, Stephen E., Arron Scott Fleming, and Richard A. Riley, Jr., “Preventing and Detecting Collusive Management Fraud,” The CPA Journal, October 2008. Churyk, Natalie Tatiana, Chih-Chen Lee, and B. Douglas Clinton, “Can We Detect Fraud Earlier?,” Strategic Finance, October 2008. 2. Discussion Assignment: On April 22, 2009, Mr. Tom Hilton (Partner, AMD) will make a presentation related to this topic. Students should be prepared to ask relevant questions concerning fraudulent financial reporting and forensic auditing. 3. Speaker summary – Hilton (Due on April 27, 2009): Students should prepare a brief (one-page) summary of the speaker’s main points. The summary should meet the writing guidelines shown within the syllabus 17 Topic # 10 ENHANCED FINANCIAL DISCLOSURES & GLOBALIZATION OF FINANCIAL REPORTING STANDARDS April 27, 2009 This topic is to explore the enhancement of financial disclosures contained in annual reports, particularly in regard to issues and corporate sustainability and discuss the globalization of financial reporting standards. Specific emphasis will be given to the harmonization of U.S. GAAP with International Financial Reporting Standards (IFRS). 1. Readings for Topic # 10: Ballou, Brian, Dan L. Heitger and Charles E. Landes, “The Future of Corporate Sustainability Reporting,” Journal of Accountancy, December 2006. Leibs, Scott, “Earth in the Balance Sheet,” CFO Magazine, December 2007. Epstein, Marc J., “Implementing Corporate Sustainability: Measuring and Managing Social and Environmental Impacts,” Strategic Finance, January 2008. Gupta, Parveen P., Cheryl Linthicum, and Thomas G. Noland, “The Road to IFRS,” Strategic Finance, September, 2007. Bellandi, Francesco, “Dual Reporting Under U.S. GAAP and IFRS,” The CPA Journal, December 2007. “Change Agent,” Journal of Accountancy, February 2008, pp. 30-33. This is an interview of FASB Chairman, Robert Hertz by the Journal’s editorial staff. Stuart, Alix, “A New vision for Accounting,” CFO Magazine, February 2008. 2. Discussion Assignment: Speaker – TBA On April 27, 2009, Mr. Bo Butters (Partner, PWC) will make a presentation related to this topic. Students should be prepared to ask relevant questions concerning international financial reporting standards. 18 Supplementary Reference Sources HISTORY & CULTURAL SIGNIFICANCE OF ACCOUNTING Weis, William L. and David E. Tinus, “Luca Pacioli: Accounting’s Renaissance Man,” Management Accounting, July 1991. Elliott, Robert K. and Peter D. Jacobson, “The Evolution of the Knowledge Professional,” Accounting Horizons, March 2002. IS ACCOUNTING A PROFESSION? Briloff,Abraham J.,"Accountancy and Society, A Covenant Desecrated,"Critical Perspectives on Accounting, 1990, Vol. 1, pp. 5-30. Zeff, Stephen A., “The Evolution of U.S. GAAP: The Political Forces Behind Professional Standards. Part I: 1930 – 1973, Harnessing Capital Markets and Driving Growth,” The CPA Journal, January 2005. Zeff, Stephen A., “The Evolution of U.S. GAAP: The Political Forces Behind Professional Standards. Part 2: 1974 - 2004, Controversial Standards Trigger Special-Interest Lobbying,” The CPA Journal, February, 2005 “Professional Ethics,” Chapter 3 (pp. 28-35), Ethics and Professionalism For CPAs, Armstrong, Mary Beth, Southwestern Publishing Co., 1993. ETHICS IN BUSINESS: AN OVERVIEW Seglin, Jeffrey L., “Good For Goodness’ Sake,” CFO Magazine, October 2002, pp. 75-78. Baker, Sherry, “Ethical Judgement,” Executive Education, March 1992, pp. 7-8. Haywood, M. Elizabeth and Donald E. Wygal, “Corporate Greed vs. IMA’s Ethics Code,” Strategic Finance, November 2004. SARBANES-OXLEY Sarbanes-Oxley: A Closer Look, KPMG LLP, January 2003. McConnell Jr., Donald K. and George Y. Banks, “How Sarbanes-Oxley Will Change the Audit Process,” Journal of Accountancy, September 2003. 19 PUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD Morris, Thomas W., “A New Vision of Oversight: The Accounting Credibility Crisis, The CPA Journal, May 2003. Rosario, Ric R. and Suzanne M. Holl, “Stay Out of Trouble,” Journal of Accountancy, August 2005. AUDITOR INDEPENDENCE & ROLE OF AUDIT COMMITTEES Brazel, Joseph F., Christopher P. Agoglia, and Richard C. Hatfield, The CPA Journal, September 2005. “Review Methods Matter,” McCartney, Laton, “Nothing To Hide,” CFO-IT, Summer 2003 Osterland, Andrew, “No More Mr. Nice Guy,” CFO Magazine, September 2002. Quinn, Lawrence Richter, “Strengthening the Role of the Audit Committee,” Strategic Finance, December 2002. Quinn, Lawrence Richter, “Strengthening the Role of the Audit Committee,” Strategic Finance, December 2002. FRAUD Wells, Joseph T., “Sherlock Holmes, CPA – Part 1, “ Journal of Accountancy, August 2003. Wells, Joseph T., “Sherlock Holmes, CPA – Part 2,” Journal of Accountancy, September 2003. Peterson, Bonita K. and Paul E. Zikmund, “10 Truths You Need to Know About Fraud,” Strategic Finance, May 2004. Hall, John J. “Answer Please: Fraud-Based Interviewing,” Journal of Accountancy, August 2005. Madray, J. Russell, “New Fraud Guidance,” Journal of Accountancy, January 2006. Adams, Gary W., David R. Campbell, and Michael P. Rose, “Fraud Prevention: An Investment No One Can Afford to Forego,” The CPA Journal, January 2006. 20 GENERAL GUIDELINES FOR TEAM PRESENTATIONS 1. The coordination of the team’s presentation will be an important part of the evaluation. Advance planning is a critical part of these presentations – you cannot wait until the night before the presentation is due!! This planning should allow team members to handle any portion of the assignment in the event of an unexpected absence of a team member! 2. EACH MEMBER OF THE TEAM MUST PARTICIPATE IN A MEANINGFUL WAY! NO “FREE RIDERS” WILL BE ACCEPTED! If “free ridership” occurs, the group should talk to the members first and try to resolve the problem. If that doesn’t solve the problem, the entire group should schedule a meeting with the instructor to work out the problem. 3. Appropriate use of visual aids is required (PowerPoint slides on the projector, chalkboard, transparencies, handouts, etc.). Both visual aids and handout materials will greatly improve most presentations because of the detailed nature of the assignments. 4. Presentations should focus on the logic (reasoning) behind the solutions or judgments presented in addition to the specific answers! Each presentation should include a sufficient introduction and summary which links the specific assignment to the overall topics discussed. All team members should be prepared to answer questions from the class and the instructor regarding any portion of the assignment. In many cases the instructor’s questions will add new assumptions to the problem covered in the presentation! 5. Evaluations from the other class members will be collected and returned to the team members, but only the instructor’s evaluation will become a part of the team’s formal evaluation. 6. All members of the team will receive the same score. It is the responsibility of the team to assure equitable participation of all members! If a team member misses a team presentation with an EXCUSED ABSENCE the instructor will substitute an alternate assignment for that individual, and the grade will be based on the results of the team presentation. An unexcused absence from a team presentation will result in a grade of “0” for the presentation. 7. A specific evaluation form (including detailed guidelines) will be distributed. 21 WRITING GUIDELINES FOR PAPERS & RESEARCH ASSIGNMENTS 1. The assignments must be typed and should be double-spaced. Papers should be of a high professional quality. Assume you are submitting it for publication or to the CEO of your organization. Significant reductions in credit will be made for technical writing errors! 2. References should be included where appropriate (a separate reference page should be included). Any normally recognized reference style is acceptable. While appropriate research is important in the completion of these assignments, simple repeating the material in references is not sufficient. Your own evaluation of the reference material is the key element which will be evaluated! 22 ACADEMIC INTEGRITY The following is a statement of minimum standards for student academic integrity at Saint Louis University: The University is a community of learning, whose effectiveness requires an environment of mutual trust and integrity, such as would be expected at a Jesuit, Catholic institution. As members of this community, students, faculty, and staff members share the responsibility to maintain this environment. Academic dishonesty violates it. Although not all forms of academic dishonesty can be listed here, it can be said in general that soliciting, receiving, or providing any unauthorized assistance in the completion of any work submitted toward academic credit is dishonest. It not only violates the mutual trust necessary between faculty and students but also undermines the validity of the University’s evaluation of students and takes unfair advantage of fellow students. Further, it is the responsibility of any student who observes such dishonest conduct to call it to the attention of a faculty member or administrator. Examples of academic dishonesty would be copying from another student, copying from a book or class notes during a closed-book exam, submitting materials authored by or editorially revised by another person but presented as the student’s own work, copying a passage or text directly from a published source without appropriately citing or recognizing that source, taking a test or doing an assignment or other academic work for another student, tampering with another student=s work, securing or supplying in advance a copy of an examination without the knowledge or consent of the instructor, and colluding with another student or students to engage in an act of academic dishonesty. Where there is clear indication of such dishonesty, a faculty member or administrator has the responsibility to apply appropriate sanctions. Investigations of violations will be conducted in accord with standards and procedures of the school or college through which the course or research is offered. Recommendations of sanctions to be imposed will be made to the dean of the school or college in which the student is enrolled. Possible sanctions for a violation of academic integrity include, but are not limited to, disciplinary probation, suspension, and dismissal from the University. Approved by the Council of Academic Deans and Directors, September 20, 2000. 23 Saint Louis University – John Cook School of Business THE LEARNING ENVIRONMENT: SHARED EXPECTATIONS EXPECTATIONS FOR STUDENTS Students will treat their classroom obligations as they would treat any serious professional engagement. That includes: 1. PREPARING THOROUGHLY for each session in accordance with the instructor’s requests; 2. ARRIVING PROMPTLY AND REMAINING until the end of each class meeting, except in unusual circumstances; 3. PARTICIPATING FULLY & CONSTRUCTIVELY in all classroom activities and discussions; 4. DISPLAYING APPROPRIATE COURTESY to all involved in the class sessions. Courteous behavior specifically entails communicating in a manner that respects, and is sensitive to, the cultural, racial, sexual and other individual differences in the Cook School of Business community; 5. ADHERING TO DEADLINES AND TIMETABLES established by the instructor; 6. PROVIDING CONSTRUCTIVE FEEDBACK TO FACULTY MEMBERS regarding their performance as an instructor. Students should be as objective in their comments about instructors as they expect instructors to be in their evaluations of students. EXPECTATIONS FOR FACULTY 1. PREPARING THOROUGHLY for class; 2. PUNCTUALITY in beginning class sessions, and except under unusual circumstances, adherence to the established schedule for classes & exams; 3. PROVIDING SUFFICIENT INFORMATION and materials to enable students to prepare adequately for class; 4. DISPLAYING APPROPRIATE COURTESY to all involved in the class sessions. Courteous behavior specifically entails communicating in a manner that respects, and is sensitive to, the cultural, racial, sexual and other individual differences in the Cook School of Business community; 5. SUPPLYING TIMELY INFORMATION ABOUT STUDENT PERFORMANCE on projects, assignments, and examinations; 6. PROVIDING CONSTRUCTIVE FEEDBACK TO STUDENTS concerning their performance. Faculty should be as objective in their feedback to students as they expect students to be in their evaluation of faculty. 24