attached

advertisement

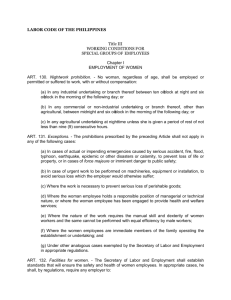

Safeguard of Women and Children Provisions in Standard Bidding Document The Standard Bidding Document for Pradhan Mantri Gram Sadak Yojana provides for mandatory observance of existing Labour Laws. The provisions relating to safeguard of women and children engaged in construction activity are given in various labour laws. Clause 57 of General Conditions of Contract is reproduced below. 57. COMPLIANCE WITH LABOUR REGULATIONS 57.1 During continuance of the Contract, the Contractor and his sub Contractors shall abide at all times by all existing labour enactments and rules made there under, regulations, notifications and bye laws of the State or Central Government or local authority and any other labour law (including rules), regulations, bye laws that may be passed or notification that may be issued under any labour law in future either by the State or the Central Government or the local authority. Salient features of some of the major labour laws that are applicable to construction industry are given in Appendix to Part I General Condition of Contract. The Contractor shall keep the Employer indemnified in case any action is taken against the Employer by the competent authority on account of contravention of any of the provisions of any Act or rules made there under, regulations or notifications including amendments. If the Employer is caused to pay or reimburse, such amounts as may be necessary to cause or observe, or for non-observance of the provisions stipulated in the notifications/bye laws/Acts/Rules/regulations including amendments, if any, on the part of the Contractor, the Engineer/Employer shall have the right to deduct any money due to the Contractor including his amount of performance security. The Employer/Engineer shall also have right to recover from the Contractor any sum required or estimated to be required for making good the loss or damage suffered by the Employer. The employees of the Contractor and the Sub-Contractor in no case shall be treated as the employees of the Employer at any point of time. The Appendix to Part – I General Conditions of Contract gives salient features of some major labour laws applicable to establishments engaged in building and other construction work the appendix is reproduced below. Appendix to Part I General Condition of Contract SALIENT FEATURES OF SOME MAJOR LABOUR LAWS APPLICABLE TO ESTABLISHMENTS ENGAGED IN BUILDING AND OTHER CONSTRUCTION WORK. a) Workmen Compensation Act 1923: - The Act provides for compensation in case of injury by accident arising out of and during the course of employment. b) Payment of Gratuity Act 1972: - Gratuity is payable to an employee under the Act on satisfaction of certain conditions on separation if an employee has completed the prescribed minimum years (say, five years) of service or more or on death the rate of prescribed minimum days’(say, 15 days) wages for every completed year of service. The Act is applicable to all establishments employing the prescribed minimum number (say, 10) or more employees. c) Employees P.F. and Miscellaneous Provision Act 1952: The Act Provides for monthly contributions by the Employer plus workers at the rate prescribed (say, 10% or 8.33%). The benefits payable under the Act are: i. Pension or family pension on retirement or death as the case may be. ii. Deposit linked insurance on the death in harness of the worker. iii. Payment of P.F. accumulation on retirement/death etc. d) Maternity Benefit Act 1961: - The Act provides for leave and some other benefits to women employees in case of confinement or miscarriage etc. e) Contract Labour (Regulation & Abolition) Act 1970: - The Act provides for certain welfare measures to be provided by the Contractor to contract labour and in case the Contractor fails to provide, the same are required to be provided, by the Principal Employer by Law. The principal Employer is required to take Certificate of Registration and the Contractor is required to take license from the designated Officer. The Act is applicable to the establishments or Contractor of Principal Employer if they employ prescribed minimum (say 20) or more contract labour. f) Minimum Wages Act 1948: - The Employer is to pay not less than the Minimum Wages fixed by appropriate Government as per provisions of the Act if the employment is a scheduled employment. Construction of buildings, roads, runways are scheduled employment. g) Payment of Wages Act 1936: - It lays down as to by what date the wages are to be paid, when it will be paid and what deductions can be made from the wages of the workers. h) Equal Remuneration Act 1976: - The Act provides for payment of equal wages for work of equal nature to male and female workers and for not making discrimination against female employees in the matters of transfers, training and promotions etc. i) Payment of Bonus Act 1965: - The Act is applicable to all establishments employing prescribed minimum (say, 20) or more workmen. The Act provides for payments of annual bonus within the prescribed range of percentage of wages to employees drawing up to the prescribed amount of wages, calculated in the prescribed manner. The Act does not apply to certain establishments. The newly set-up establishments are exempted for five years in certain circumstances. States may have different number of employment size. j) Industrial Disputes Act 1947: - The Act lays down the machinery and procedure for resolution of industrial disputes, in what situations a strike or lockout becomes illegal and what are the requirements for laying off or retrenching the employees or closing down the establishment. k) Industrial Employment (Standing Orders) Act 1946: - It is applicable to all establishments employing prescribed minimum (say, 100, or 50). The Act provides for laying down rules governing the conditions of employment by the Employer on matters provided in the Act and get these certified by the designated Authority. l) Trade Unions Act 1926: - The Act lays down the procedure for registration of trade unions of workmen and Employers. The Trade Unions registered under the Act have been given certain immunities from civil and criminal liabilities. m) Child Labour (Prohibition & Regulation) Act 1986: - The Act prohibits employment of children below 14 years of age in certain occupations and processes and provides for regulations of employment of children in all other occupations and processes. Employment of child labour is prohibited in building and construction industry. n) Inter-State Migrant Workmen’s (Regulation of Employment & Conditions of Service) Act 1979: - The Act is applicable to an establishment which employs prescribed minimum (say, five) or more inter-state migrant workmen through an intermediary (who has recruited workmen in one state for employment in the establishment situated in another state). The Inter-State migrant workmen, in an establishment to which this Act becomes applicable, are required to be provided certain facilities such as Housing, Medical-Aid, Travelling expenses from home up to the establishment and back etc. o) The Building and Other Construction workers (Regulation of Employment and Conditions of Service) Act 1996 and the Cess Act of 1996: - All the establishments who carry on any building or other construction work and employs the prescribed minimum (say, 10) or more workers are covered under this Act. All such establishments are required to pay cess at the rate not exceeding 2% of the cost of construction as may be modified by the Government. The Employer of the establishment is required to provide safety measures at the building or construction work and other welfare measures, such as canteens, first-aid facilities, ambulance, housing accommodations for workers near the work place etc. The Employer to whom the Act applies has to obtain a registration certificate from the Registering Officer appointed by the Government. p) Factories Act 1948: - The Act lays down the procedure for approval of plans before setting up a factory, health and safety provisions, welfare provisions, working hours, annual earned leave and rendering information regarding accidents or dangerous occurrences to designated authorities. It is applicable to premises employing the prescribed minimum (say, 10) persons or more with aid of power or another prescribed minimum (say, 20) or more persons without the aid of power engaged in manufacturing process The brief abstract of provisions relating to safeguard of Women Workers / Child Labour in the Standard Bidding Document is given in the table below. Provisions for Safeguard of Women Workers / Child Labour in the Standard Bidding Document (Reference: Appendix to Part-I of General Conditions of Contracts) # 1. 2. 3. Act Workmen’s Compensation Act Maternity Benefit Act 1961 Equal Remuneration Act 1976 Section 4 &7- General Provision Compensation to Workman including Women workers for injury by accident. Maternity Benefits Extended to workers Equal remuneration to Male and female worker for same work. No discrimination in employment on the basis of gender. 4. Building and other Chapter VI, Provision of Crèches for children of women construction Part-III Chapter workers. workers(Regulation of VI,VII Restriction on the weight of loads to be lifted and Employment and conditions carried by women workers. of Service)Act 1996 and Provision of accommodation facilities. Cess Act 1996 Emergency care (including gynecological emergencies). 5. Payment of Gratuity Act 1972 2, 2A 6 i) Inter State migrant workmen Act 1979 Chapter VI & VII Chapter II ii) Central Rule 1980 7 8. The Child Labour (Provisions and Regulation Act), 1986 Separate and adequate washing and screening facilities shall be provided for the use of male and female workers. Crèche facility also for migrant female workers. Section 3 Prohibition of employment construction industry. Chapter III Chapter-V The Factories Act 1948 The Industrial Employment (Standing orders) Central Rule 1946 Application of Labour Laws – same for female workers No female migrant workmen shall be employed by any Contractor before 6 AM or after 7 PM Chapter V Chapter VI Para (66) 9. Same benefits for male and female workers. Rule 14 of children in Separate enclosed accommodation to be provided for male and female workers. Separate and adequately screened working facilities shall be provided for the use of male and female workers. Separate suitable room for children with adequate facilities. Restriction on working hours – No woman shall be required or allowed to work in any factory except between the hours 6 AM to 7 PM. Penalty for sexual harassment by any worker The abstract of some provisions in some of the applicable laws is given below. Workmen’s Compensation Act CHAPTER – II WORKMEN’S COMPENSATION 3. Employer's liability for compensation. - (1) If personal injury is caused to a workman by accident arising out of and in the course of his employment, his employer shall be liable to pay compensation in accordance with the provisions of this Chapter: Provided that the employer shall not be so liable – 1) in respect of any injury which does not result in the total or partial disablement of the workman for a period exceeding [three] days; 2) in respect of any [injury, not resulting in death, caused by] an accident which is directly attributable to – (i) the workman having been at the time thereof under the influence of drink or drugs, or (ii) the wilful disobedience of the workman to an order expressly given, or to a rule expressly framed, for the purpose of securing the safety of workmen, or (iii) the wilful removal or disregard by the workman of any safety guard or other device which he knew to have been provided for the purpose of securing the safety of workmen. [(2) If a workman employed in any employment specified in Part A of Schedule III contracts any disease specified therein as an occupational disease peculiar to that employment, or if a workman, whilst in the service of an employer in whose service he has been employed for a continuous period of not less than six months (which period shall not include a period of service under any other employer in the same kind of employment) in any employment specified in Part B of Schedule III, contracts any disease specified therein as an occupational disease peculiar to that employment, or if a workman whilst in the service of one or more employers in any employment specified in Part C of Schedule III for such continuous period as the Central Government may specify in respect of each such employment, contracts any disease specified therein as an occupational disease peculiar to that employment, the contracting of the disease shall be deemed to be an injury by accident within the meaning of this section and, unless the contrary is proved, the accident shall be deemed to have arisen out of, and in the course of, the employment: [PROVIDED that if it is proved,-(a) that a workman whilst in the service of one or more employers in any employment specified in Part C of Schedule III has contracted a disease specified therein as an occupational disease peculiar to that employment during a continuous period which is less than the period specified under this subsection for that employment, and (b) that the disease has arisen out of and in the course of the employment, the contracting of such disease shall be deemed to be an injury by accident within the meaning of this section: PROVIDED FURTHER that if it is proved that a workman who having served under any employer in any employment specified in Part B of Schedule III or who having served under one or more employers in any employment specified in Part C of that Schedule, for a continuous period specified under this sub-section for that employment and he has after the cessation of such service contracted any disease specified in the said Part B or the said Part C, as the case may be, as an occupational disease peculiar to the employment and that such disease arose out of the employment, the contracting of the disease shall be deemed to be an injury by accident within the meaning of this section.] [(2A) If a workman employed in any employment specified in Part C of Schedule III contracts any occupational disease peculiar to that employment, the contracting whereof is deemed to be an injury by accident within the meaning of this section, and such employment was under more than one employer, all such employers shall be liable for the payment of the compensation in such proportion as the Commissioner may, in the circumstances, deem just.] (3) [The Central Government or the State Government] after giving, by notification in the Official Gazette, not less than three months' notice of its intention so to do, may, by a like notification, add any description of employment to the employments specified in Schedule III, and shall specify in the case of employments so added the diseases which shall be deemed for the purposes of this section to be occupational diseases peculiar to those employments respectively, and thereupon the provisions of sub-section (2) shall apply [in the case of a notification by the Central Government, within the territories to which this Act extends or in case of a notification by the State Government, within the State] as if such diseases had been declared by this Act to be occupational diseases peculiar to those employments.] (4) Save as provided by [sub-sections (2), (2A)] and (3), no compensation shall be payable to a workman in respect of any disease unless the disease is directly attributable to a specific injury by accident arising out of and in the course of his employment. (5) Nothing herein contained shall be deemed to confer any right to compensation on a workman in respect of any injury if he has instituted in a Civil Court a suit for damages in respect of the injury against the employer or any other person; and no suit for damages shall be maintainable by a workman in any Court of law in respect of any injury – (a) if he has instituted a claim to compensation in respect of the injury before a Commissioner; or (b) if an agreement has been come to between the workman and his employer providing for the payment of compensation in respect of the injury in accordance with the provisions of this Act. Maternity Benefit Act 1961 2. Application of Act. - [(1) It applies, in the first instance, (a) to every establishment being a factory, mine or plantation including any such establishment belonging to Government and to every establishment wherein persons are employed for the exhibition of equestrian, acrobatic and other performances; (b) to every shop or establishment within the meaning of any law for the time being in force in relation to shops and establishments in a State, in which ten or more persons are employed, or were employed, on any day of the preceding twelve months:] Provided that the State Government may, with the approval of the Central Government, after giving not less than two months' notice of its intention of so doing, by notification in the Official Gazette, declare that all or any of the provisions of this Act shall apply also to any other establishment or class of establishments, industrial, commercial, agricultural or otherwise. (2) [Save as otherwise provided in [sections 5A and 5B], nothing contained in this Act] shall apply to any factory or other establishment to which the provisions of the Employees' State Insurance Act, 1948 (34 of 1948), apply for the time being. 4. Employment of or work by, women prohibited during certain periods.-(1) No employer shall knowingly employ a woman in any establishment during the six weeks immediately following the day of her delivery, [miscarriage or medical termination of pregnancy]. (2) No women shall work in any establishment during the six weeks immediately following the day of her delivery [miscarriage or medical termination or pregnancy]. (3) Without prejudice to the provisions of Section 6, no pregnant women shall, on a request being made by her in this behalf, be required by her employer to do during the period specified in sub-section (4) any work which is of an arduous nature or which involves long hours of standing, or which in any way is likely to interfere with her pregnancy or the normal development of the foetus, or is likely to cause her miscarriage or otherwise to adversely affect her health. (4) The period referred to in sub-section (3) shall be(a) the period of one months immediately preceding the period of six weeks, before the date of her expected delivery; (b) any period during the said period of six weeks for which the pregnant woman does not avail of leave of absence under Section 6. 5. Right to payment of maternity benefits.- [(1) Subject to the provisions of this Act, every woman shall be entitled to, and her employer shall be liable for, the payment of maternity benefit at the rate of the average daily wage for the period of her actual absence, that is to say, the period immediately preceding the day of her delivery, the actual day of her delivery and any period immediately following that day.] Explanation.-For the purpose of this sub-section, the average daily wage means the average of the woman's wages payable to her for the days on which she has worked during the period of three calendar months immediately preceding the date from which she absents herself on account of maternity, [the minimum rate of wage fixed or revised under the Minimum Wages Act, 1948 (11 of 1948) or ten rupees, whichever is the highest]. (2) No woman shall be entitled to maternity benefit unless she has actually worked in an establishment of the employer from whom she claims maternity benefit, for a period of not less than [16] [eighty days] in the twelve months immediately preceding the date of her expected delivery: Provided that the qualifying period of [17] [eighty days] aforesaid shall not apply to a woman who has immigrated into the State of Assam and was pregnant at the time of the immigration. Explanation.-For the purpose of calculating under the sub-section the days on which a woman has actually worked in the establishment [18] [the days for which she has been laid off or was on holidays declared under any law for the time being in force to be holidays with wages] during the period of twelve months immediately preceding the date of her expected delivery shall be taken into account. [(3) The maximum period for which any woman shall be entitled to maternity benefit shall be twelve weeks of which not more than six weeks shall precede the date of her expected delivery:] Provided that where a woman dies during this period, the maternity benefit shall be payable only for the days up to and including the day of her death: [Provided Further that where a woman, having been delivered of a child, dies during her delivery or during the period immediately following the date of her delivery for which she is entitled for the maternity benefit, leaving behind in either case the child, the employer shall be liable for the maternity benefit for that entire period but if the child also dies during the said period, then, for the days up to and including the date of the death of the child.] [5A. Continuance of payment of maternity benefit in certain cases.-Every woman entitled to the payment of maternity benefit under this Act shall, notwithstanding the application of the Employees' State Insurance Act, 1948 (34 of 1948), to the factory or other establishment in which she is employed, continue to be so entitled until she becomes qualified to claim maternity benefit under Section 50 of that Act.] [5B. Payment of maternity benefit in certain cases.-Every woman(a) who is employed in a factory or other establishment to which the provisions of the Employees’ State Insurance Act, 1948 (34 of 1948), apply; (b) whose wages (excluding remuneration for over-time work) for a month exceed the amount specified in sub-clause (b) of clause (9) of Section 2 of that Act; and (c) who fulfils the conditions specified in sub-section (2) of Section 5, shall be entitled to the payment of maternity benefit under this Act.] 7. Payment of maternity benefit in case of death of a woman.-If a woman entitled to maternity benefit or any other amount under this Act, dies before receiving such maternity benefit or amount, or where the employer is liable for maternity benefit under the second proviso to sub-section (3) of Section 5, the employer shall pay such benefit or amount to the person nominated by the woman in the notice given under Section 6 and in case there is no such nominee, to her legal representative. 8. Payment of medical bonus.-Every woman entitled to maternity benefit under this Act shall also be entitled to receive from her employer a medical bonus of [24] [two hundred and fifty rupees], if no pre-natal confinement and post-natal care is provided for by the employer free of charge. [9. Leave for miscarriage etc.-In case of miscarriage or medical termination of pregnancy, a woman shall, on production of such proof as may be prescribed, be entitled to leave with wages at the rate of maternity benefit, for a period of six weeks immediately following the day of her miscarriage or, as the case may be, her medical termination of pregnancy]. [9A. Leave with wages for tubectomy operation.-In case of tubectomy operation, a woman shall, on production of such proof as may be prescribed, be entitled to leave with wages at the rate of maternity benefit for a period of two weeks immediately following the day of her tubectomy operation]. 10. Leave for illness arising out of pregnancy, delivery, premature birth of child, [miscarriage, medical termination of pregnancy or tubectomy operation].A woman suffering from illness arising out of pregnancy, delivery, premature birth of child [miscarriage, medical termination of pregnancy or tubectomy operation] shall, on production of such proof as may be prescribed, be entitled, in addition to the period of absence allowed to her under Section 6, or, as the case may be, under Section 9, to leave with wages at the rate of maternity benefit for a maximum period of one month. 11. Nursing breaks.-Every woman delivered of a child who returns to duty after such delivery shall, in addition to the interval for rest allowed to her, be allowed in the course of her daily work two breaks of the prescribed duration for nursing the child until the child attains the age of fifteen months. 12. Dismissal during absence of pregnancy.-(1) When a woman absents herself from work in accordance with the provisions of this Act, it shall be unlawful for her employer to discharge or dismiss her during or on account of such absence or to give notice of discharge or dismissal on such a day that the notice will expire during such absence, or to vary to her disadvantage any of the conditions of her service. (2) (a) The discharge or dismissal of a woman at any time during her pregnancy, if the woman but for such discharge or dismissal would have been entitled to maternity benefit or medical bonus referred to in Section 8, shall not have the effect of depriving her of the maternity benefit or medical bonus: Provided that where the dismissal is for any prescribed gross misconduct, the employer may, by order in writing communicated to the woman, deprive her of the maternity benefit or medical bonus or both. [(b) Any woman deprived of maternity benefit or medical bonus, or both, or discharged or dismissed during or on account of her absence from work in accordance with the provisions of this Act, may, within sixty days from the date on which order of such deprivation on discharge or dismissal is communicated to her, appeal to such authority as may be prescribed, and the decision of that authority on such appeal, whether the woman should or should not be deprived of maternity benefit or medical bonus, or both, or discharged or dismissed shall be final.] (c) Nothing contained in this sub-section shall affect the provisions contained in sub-section (1). 13. No deduction of wages in certain cases.-No deduction from the normal and usual daily wages of a woman entitled to maternity benefit under the provisions of this Act shall be made by reason only of(a) the nature of work assigned to her by virtue of the provisions contained in subsection (3) of Section 4; or (b) breaks for nursing the child allowed to her under the provisions of Section 11. Equal Remuneration Act 1976 4. Duty of employer to pay equal remuneration to men and women workers for same work or work of a similar nature. – (1) No employer shall pay to any worker, employed by him in an establishment of employment, remuneration, whether payable in cash or in kind, at rates less favourable than those at which remuneration is paid by him to the workers of the opposite sex in such establishment or employment for performing the same work or work of a similar nature. (2) No employer shall, for the purpose of complying with the provisions of subsection (1), reduce the rate of remuneration of any worker. (3) Where, in an establishment or employment, the rates of remuneration payable before the commencement of this Act for men and women workers for the same work or work of a similar nature are different only on the ground of sex, then the higher (in cases where there are only two rates), or, as the case may be the rate at which remuneration shall be payable, on an from such commencement to such men and women. Provided that nothing in this sub-section shall be deemed to entitle a worker to the revision of the rate of remuneration payable to him or her with reference to the service rendered by him or her before the commencement of this Act. 5. No discrimination to be made while recruiting men and women workers.- On and from the commencement of this Act, no employer shall, while making recruitment for the same work or work of a similar nature, 1*[or in any condition of service subsequent to recruitment such as promotions, training or transfer,] make any discrimination against women except where the employment of women in such work is prohibited or restricted by or under any law for the time being in force: Provided that the provisions of this section shall not affect any priority or reservation for Scheduled Castes or Scheduled Tribes, ex-servicemen, retrenched employees or any other class or category of persons in the matter of recruitment to the posts in an establishment or employment. Building and other construction workers (Regulation of Employment and Conditions of Service) Act 1996 and Cess Act 1996 CHAPTER – I PRELIMANRY ii) Short title, extent, commencement and application – (1) This Act may be called the building and other construction workers (Regulation of Employment and Conditions of Service) Act, 1996 (2) It extends to the whole of India. (3) It shall be deemed to have come into force on the 1st say of March, 1996. (4) It applies to every establishment which employs, or had employed on any building or other construction work. iii) Definitions – (1) In this Act, unless the context otherwise requires – (d) “building or other construction work” means the construction alteration, repairs, maintenance or demolition, of or, in relation to, buildings, streets, roads, railways, tramways, airfields, irrigation, drainage, embankment and navigation works, flood control works (including storm water drainage works), generation, transmission and distribution of power, water works (including channels for distribution of water), oil and gas installations, electric lines, wireless, radio, television, telephone, telegraph and overseas communication, dams, canals, reservoirs, watercourses, tunnels, bridges, viaducts, aqueducts, pipelines, tower, cooling towers, transmission towers, and such other work as may be specified in this behalf by the appropriate Government, by notification but does not include any building or other construction work to which the provisions of the Factories Act, 1948 (63 of 1948) or the Mines Act, 1952 (35 of 1952), apply; (e) “building worker” means a person who is employed to do any skilled, semiskilled, manual, supervisory, technical or clerical work for hire or reward, whether the terms of employment be expressed or implied, in connection with any building or other construction work but does not include any such person(i) who is employed mainly in a managerial or administrative capacity; or (ii) who, being employed in a supervisory capacity, draws wages exceeding one thousand six hundred rupees per mensem or exercises, either by the nature of the duties attached to the office of by reason of the power vested in him, functions mainly of a managerial nature; CHAPTER – VI HOURS OF WORK, WELFARE MEASURES AND OTHER CONDITIONS OF SERVICE OF BUILDING WORKSERS 32. Drinking water – (1) The employer shall make in every place where building or other construction work is in progress, effective arrangements to provide and maintain at suitable points conveniently situated for all persons employed therein, a sufficient supply of wholesome drinking water. (2) All such points shall be legibly marked "Drinking Water” in a language understood by a majority of the persons employed in such place and no such point shall be situated within six metres of any washing place, urinal or latrine. 33. Latrines and urinals – In every place where building or other construction work is carried on, the employer shall provide sufficient latrine and urinal accommodation of such types as may be prescribed and they shall be so conveniently situated as may be accessible to the building workers at all times while they are in such place: Provided that it shall not be necessary to provide separate urinals in any place where less than fifty persons are employed or where the latrines are connected to a water-borne sewage system. 34. Accommodation – (1) The employer shall provide, free of charges and within the works site or as near to it as may be possible, temporary living accommodation to all building workers employed by him for such period as the building or other construction work is in progress. (2) The temporary accommodation provided under sub-section (1) shall have separate cooking place, bathing, washing and lavatory. (3) As soon as may be, after the building or other construction works is over, the employer shall, at his own cost, cause removal or demolition of the temporary structures erected by him for the purpose of providing living accommodation, cooking place or other facilities to the building workers as required under sub-section (1) and restore the ground in good level and clean condition. (4) In case an employer is given any land by a Municipal Board or any other local authority for the purposes of providing temporary accommodation for the construction work is over, return the possession of such land in the same condition in which he received the same. 35. Crèches – (1) In every place wherein, more than fifty female building workers are ordinarily employed, there shall be provided and maintained a suitable room or rooms for the use of children under the age of six years of such female workers. (2) Such rooms shall – a. provide adequate accommodation; b. be adequately lighted and ventilated; c. be maintained in a clean and sanitary condition; d. be under the charge of women trained in the care of children and infants. Part – III SAFETY AND HEALTH Chapter – VI GENERAL PROVISIONS 38. Lifting and carrying of excessive weight – An employer shall ensure at a construction site of a building or other construction work that – (a) no building worker lifts by hand or carries overhead or over his back or shoulders any material, article, tool or appliances exceeding in weight the maximum limits set out in the following table: - Person Maximum Weight Load Adult man 55 kg Adult woman 30 kg Adolescent male 30 kg Adolescent female 20 kg unless aided by any other building worker or a mechanical device. (b) no building worker aided by other building workers, lift by hand or carry overhead or over their back or shoulders, any material, article, tool or appliance exceeding in weight the sum total of maximum limits set out for each building worker separately under clause (a), unless aided by mechanical device. Chapter XXIV MEDICAL FACILITIES 232. Emergency care services or emergency treatment – The employer shall ensure at a construction site of a building or other construction work that – a. essential life-saving aides and appliances required to handle – (i) head injuries and……. (ii) bleeding; (iii) fractures………. (iv) crush…….. (v) shock,……… (vi) dehydration……… (vii) snake bite,……….. (viii) burns,……… (ix) bends……… (x) other surgical, gynecological, obstetric or paediatric emergencies; THE BUILDING AND OTHER CONSTRUCTION WORKERS’ WELFARE CESS ACT, 1996 (28 of 1996) An act to provide for the levy and collection of a cess on the cost of construction incurred by employers with a view to augmenting the resources of the Building and Other Construction Workers’ Welfare Boards constituted under the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996. Be it enacted by Parliament in the Forty-seventy Year of the Republic of India as follows:1. Short title, extent and commencement – (1) This Act may be called the Building and Other Construction Workers’ Welfare Cess Act, 1996. (2) It extends to the whole of India. (3) It shall be deemed to have come into force on the 3rd day of November, 1995. 2. Definitions.- In this Act, unless the context otherwise requires, (a) “Board” means a Building and Other Construction Workers’ Welfare Board constituted by a State Government under sub-section (1) of section 18 of the Building and Other C0nstruction Workers (Regulation of Employment and Conditions of Service) Act, 1996; (b) “Fund” means the Building and Other Construction Workers’ Welfare Funds constituted by a Board; (c) “prescribed” means prescribed by rules made under this Act; (d) words and expressions used herein but not defined and defined in the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996 shall have the meanings respectively assigned to them in that Act. 3. Levy and collection of cess. - (1) There shall be levied and collected a cess for the purpose of the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996, at such rate not exceeding two per cent. but not less than one per cent. of the cost of construction incurred by an employer, as the Central Government may, by notification in the Official Gazette, from time to time specify. (2) The cess levied under sub-section (1) shall be collected from every employer in such manner and at such time, including deduction at source in relation to a building or other construction work of a Government or of a public sector undertaking or advance collection through a local authority where an approval of such building or other construction work by such local authority is required, as may be prescribed. (3) The proceeds of the cess collected under sub-section (2) shall be paid by the local authority or the State Government collecting the cess to the Board after deducting the cost of collection of such cess not exceeding one per cent. of the amount collected. (4) Notwithstanding anything contained in sub-section (1) or sub-section (2), the cess leviable under this Act including payment of such cess in advance may, subject to final assessment to be made, be collected at a uniform rate or rates as may be prescribed on the basis of the quantum of the building or other construction work involved. THE BUILDING AND OTHER CONSTRUCTION WORKERS’ WELFARE CESS RULES, 1998 2. Definitions.- In these rules, unless the context otherwise requires,(a) “Act” means the Building and Other Construction Workers’ Welfare Cess Act, 1996 (Act 28 of 1996); (b) “Main Act” means the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996 (Act 27 of 1996); (c) “Form” means the form annexed to these rules; (d) all other words and expressions used in these rules but not defined and defined in the Act or in the main Act shall have the meanings respectively assigned to them in those Acts; (e) “specified” means specified by a State Government by an order published in the Official Gazette; (f) “Cess Collector” means an officer appointed by the State Government for collection of cess under the Act; (g) “Assessing Officer” means a gazetted officer of a State Government or an officer of a local authority holding an equivalent post to a gazetted officer of the State Government appointed by such State Government for assessment of Cess under the Act; (h) “Appellate Authority” means an officer, senior in rank to the Assessing Officer, appointed by the State Government for the purposes of section 11 of the Act. Payment of Gratuity Act 1972 2. Definitions – In this Act, unless the context otherwise requires – (a) “appropriate Government” means – (i) in relation ………. (a) belonging to……………. (b) having branches in more than one State, (c) of a factory belonging ……….. (d) of a major port………….. (ii) in any…………. (b) “completed year…………. (c) “continuous……….. (d) “controlling authority”……….. (e) “employee”……………. (f) “employer”……………. (g) “factory”……………… (h) “family” in relation to an employee, shall be deemed to consist of – (i) in the case of a male employee, himself, his wife, his children, whether married or unmarried, his dependent parents and the dependent parents [and the dependent parents of his wife and the widow] and children of his predeceased son, if any, (ii) in the case of female employee, herself, her husband, her children, whether married or unmarried, her dependent parents and the dependent parents of her husband and the widow and children of her predeceased son, if any, 2A. CONTINUOUS SERVICE. - For the purposes of this Act, (1) an employee shall be said to be in continuous service for a period if he has, for that period, been in uninterrupted service, including service which may be interrupted on account of sickness, accident, leave, absence from duty without leave (not being absence in respect of which an order treating the absence as break in service has been passed in accordance with the standing order, rules or regulations governing the employees of the establishment), lay off, strike or a lock-out or cessation of work not due to any fault of the employee, whether such uninterrupted or interrupted service was rendered before or after the commencement of this Act. (2) where an employee (not being an employee employed in a seasonal establishment) is not in continuous service within the meaning of clause (1), for any period of one year or six months, he shall be deemed to be in continuous service under the employer – (a) for the said period of one year, if ……… (i) one hundred and ninety days…………. (ii) two hundred ………. (b) for the said period of six months, if ………….. (i) ninety-five days, …………. (ii) one hundred …………….. [Explanation: For the purpose of clause (2), the number of days on which an employee has actually worked under an employer shall include the days on which – (i) he has been ……………….. (ii) he has been on leave………. (iii) he has been absent ………… (iv) in the case of a female, she has been on maternity leave; so, however, that the total period of such maternity leave does not exceed twelve weeks.] Inter State Migrant Workmen Act 1979 THE INTER-STATE MIGRANT WORKMEN (REGULATION OF EMPLOYMENT AND CONDITIONS OF SERVICES) CENTRAL RULES, 1980 Chapter – II 11. Forms and terms and conditions of licence – (1) Every licence issued under sub-section (1) of section 8 shall be in Form VIII. (2) Every licence granted under sub rule (1) or renewed under rule 15 be subject to the following conditions, namely:(i) the licence…………. (ii) the terms…………. (iii) the number of migrant…………. (iv) the number of workmen………. (v) the rates of…………………….. (vi) save as provided……………….. (vii) a. in cases………. b. in other cases, the wage……… (viii) every migrant workman…….. (ix) no female migrant workman shall be employed by any contractor before 6 A.M. or after 7 A.M. Chapter – V MEDICAL AND OTHER FACILITIES TO BE PROVIDED TO MIGRANT WORKMAN 43. Washing Facilities – (1) In every establishment adequate and suitable facilities for washing shall be provided and maintained for the use of migrant workmen employed therein. (2) Separate and adequately screened facilities shall be provided for the use of male and female migrant workmen. (3) Such facilities shall be conveniently accessible and shall be kept in clean and hygienic condition. 44. Crèche – (1) In every establishment where 20 or more workmen are ordinarily employed as migrant workmen and in which employment of migrant workmen is likely to continue for three months or more, the contractor shall provide and maintain two rooms of reasonable dimensions for the use of their children under the age of six years, within fifteen days of the coming into force of the rules, in case of existing establishment, and within fifteen days of the commencement of the employment of not less than twenty women as migrant workmen in new establishments. (2) One of such rooms shall be used as playroom for the children and the other as bedroom for the children. (3) If the contractor fails to provide the crèche within the time laid down, the same shall be provided by the Principal Employer within fifteen days of the expiry of the time allowed to the Contractor. (4) The contractor or the principal employer as the case may be, shall supply adequate number of toys and games in the play rooms and sufficient number of cots and beddings in the sleeping room. (5) The crèche shall be so constructed as to afford adequate protection against heat, damp, wind rain and shall have smooth, hard and impervious floor surface. (6) The crèche shall be at a convenient distance from the establishment and shall have adequate supply of wholesome drinking water. (7) Effective and suitable provisions shall be made in every room of the crèche for securing and maintaining adequate ventilation by circulation of fresh air and there shall also be provided and maintained sufficient and suitable natural or artificial lightning. The Child Labour (Provisions and Regulation Act), 1986 The above act prohibits employment of children in certain occupations and processes. Section 3 of the act provides that no child shall be employed or permitted to work in any of the occupation set fourth in Part A of the schedule or in any workshop, wherein, any of the processes set fourth in Part B of the schedule is carried on. Under Part B of the schedule, Building and Construction Industry is mentioned, which includes road making, as such, the act shall be applicable to the construction/up-gradation of road under PMGSY. Part - II PROHIBITION OF EMPLOYMENT OF CHILDREN IN CERTAIN OCCUPATIONS AND PROCESSES 3. Prohibition of employment of children in certain occupations and processes – No child shall be employed or permitted to work in any of the occupations set forth in Part A of the Schedule or in any workshop wherein any of the processes set forth in Part B of the Schedule is carried on: Provided that nothing in this section shall apply to any workshop wherein any process is carried on by the occupier with the aid of his family or to any school established by, or receiving assistance or recognition from, Government. The Factories Act 1948 Chapter V WELFARE 43. Washing Facilities – (1) In every factory – (a) adequate and suitable facilities for washing shall be provided and maintained for the use of the workers therein; (b) separate and adequately screened facilities shall be provided for the use of male and female workers; (c) such facilities shall be conveniently accessible and shall be kept clean. (2) The State Government may, in respect of any factory or class or description of factories or of any manufacturing process, prescribe standards of adequate and suitable facilities for washing. Chapter VI WORKING HOURS OF ADULTS 66. Further restriction on employment of women – (1) The provision of this Chapter shall, in their application to women in factories, be supplemented by the following further restrictions, namely: (a) no exemption from the provisions of section 54 may be granted in respect of any woman; (b) no woman shall be [required or allowed to work in any factory] except between the hours of 6 AM and 7 PM.: Provided that the State Government may, by notification in the Official Gazette, in respect of [any factory or group or class or description of factories,] vary the limits laid down in clause (b), but so that no such variation shall authorize the employment of any woman between the hours of 10 PM and 5 AM. (c) there shall be no change of shifts except after a weekly holiday or any other holiday.] (2) The State Government may make rules providing for the exemption from the restrictions set out in sub-section (1), to such extent and subject to such conditions as it may prescribe, of women working in fish curing or fish canning factories, where the employment of women beyond the hours specified in the said restrictions is necessary to prevent damage to, or deterioration in, any raw material. (3) The rules made under sub-section (2) shall remain in force for not more than three years at a time. The Industrial Employment (Standing orders) Central Rule 1946 SCHEDULE – I [MODEL STANDING ORDERS IN RESPECT OF INDUSTRIAL ESTABLISHMENT NOT BENIG INDUSTRIAL ESTABLISHMENTS IN COAL MINES] 15. Disciplinary action for misconduct – (1) A workman may be fined up to two percent of his wages in a month for nay of the following acts and omissions, namely:………………………………………………………………………………… ………………………………………………………………………………… ………… Note – Specify the acts and omissions which the employer may notify with the previous approval of the…Government or of the prescribed authority in pursuance of section 8 of the Payment of Wages Act, 1936. (2) A workman may be suspended for a period nor exceeding four days at a time or dismissed without notice or any compensation in lieu of notice, if he is found to be guilty of misconduct. (3) The following acts and omissions shall be treated as misconduct:(a) willful in-subordination…………. (b) theft…………. (c) willful damage……………. (d) taking or giving……….. (e) habitual absence……… (f) habitual late………….. (g) habitual breach………. (h) riotous or ……………. (i) habitual negligence………. (j) frequent repetition………….. (k) striking work……………. (l) sexual harassment which includes such un-welcome sexual determined behaviour (whether directly or by implication) as – (i) physical contact and advances; or (ii) demand or request for sexual favours; or (iii) sexually coloured remarks; or (iv) showing pornography; or (v) any other un-welcome physical, verbal or non-verbal conduct of sexual nature.