The income statement can be defined as: Income – Expenses = Net

advertisement

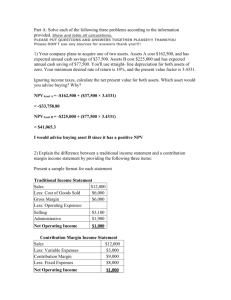

The income statement First, understand that the income statement is based on this equation: Income – Expenses = Net Profit / Loss. Understanding the income statement A profit and loss statement Reports the earnings of a company and the incurred expenses while generating that income Reveals a business’s cash generating ability As a scorecard, it reflects where expenses are incurred vs where sales are made Includes revenue, capital (depreciation), expenses, and cost of goods It does not show when expenses are paid or when revenue is collected (unlike a cash flow statement) It does show projected profitability of the business over a specific time frame How often should you generate an income statement? To assist in the business planning process, the income statement should be generated on a monthly basis during year one, quarterly in year two and annually from the third year. NOTE: Not all businesses are the same, and this will be reflected in your income statement. For example, service businesses will include supplies and spare parts under inventory, but nothing under manufacture or resale. On the other hand, retailers and wholesalers account for their resale inventory under cost of sales, which refers to the total price paid for goods during the accounting period, including freight and delivery. bizconnect.standardbank.co.za List your financial projections based on the following: Income. This includes all income generated by the business Cost of goods. This includes all costs related to the sale of products in inventory Gross profit margin. This can be expressed in rands, as a percentage, or both, and is the difference between revenue and cost of goods. As a percentage, the GP margin is always stated as a percentage of revenue Operating expenses. This includes all operational overhead and labour expenses Total expenses. The sum of operating expenses and cost of goods Net profit. The net income depicts the business’s debt and capital capabilities and is the difference between gross profit margin and total expenses Depreciation. The decrease in value of capital assets used to generate income. Also used as an indicator of the flow of money into new capital and as the basis for a tax deduction Earnings before interest and taxes. Shows the capacity of a business to repay its obligations Interest. This includes all short-term and long-term interest payable for debts Taxes. This includes all taxes on the business Net profit after taxes. Shows the company’s real bottom line bizconnect.standardbank.co.za