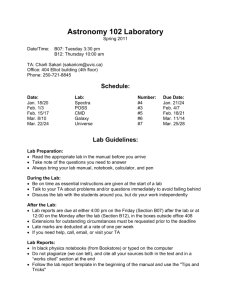

CO 4201 - Loyola College

advertisement

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.A. B.Sc DEGREE EXAMINATION – ECONOMICS & MATHEMATICS SUPPLEMENTARY EXAMINATION – JUNE 2007 CO 4201 - FIN. ACCOUNTS & FIN. STAT. ANALYSIS Date & Time: 26/06/2007 / 9:00 - 12:00 Dept. No. Max. : 100 Marks SECTION - A (10 x 2 = 20) Answer ALL the questions 1. 2. 3. 4. 5. 6. 7. 8. Define Accounting State the rules of double entry accounting. What is meant by real account? Give relevant examples. Differentiate Capital expenditure from Revenue expenditure. What is a trial balance? Define accounting ratio. Write a note on cash from operations. How would you incorporate the following items in Loyola Tennis Club’s Balance Sheet for the year 2006: (Rs.) Medal distribution fund 26000 Medals distributed 4500 Interest on fund invest ments 3500 Medal distribution fund investments 25000 9. Prepare Single Column Cash Book of Mr. Valan Date Particulars Amount (Rs.) 2007 Jan 1 Started business with Cash 35000 5 Bought goods for Cash 15000 10 Sold goods to Mohan on credit 50000 15 Paid Rent 10000 20 Mohan settled his account by cash 50000 25 Sold an unused bike for cash 20000 30 Bought a second-hand car for cash 60000 31 Paid salaries 5000 10. From the following details, determine the managerial remuneration available to a full time director of a manufacturing company. The P&L account of the company shows a Net Profit of Rs.4000000 after taking into account the following items: a) Depreciation (including Special depreciation of Rs.40000) Rs.100000 b) Provision for income tax Rs.200000 c) Donation to political parties Rs.50000 d) Ex-gratia payment to a worker Rs.10000 e) Capital profit on sale of assets Rs.15000 SECTION - B (5 x 8= 40) Answer any FIVE questions 11. Briefly explain any eight accounting concepts. 12. Distinguish between Receipts & Payment account and Income & Expenditure account. 13. What are the advantages of preparing Cash Flow Statement? 14. Pass journal entries in the books of Mr.Mani for the month of Jan. 2007: 2007 Jan1. Started business with Cash Rs.75000 and Plant Rs.25000 6. Bought goods for Cash Rs.30000 9. Sold goods to Mr.Ameer on credit Rs.25000 12. Bought a Computer from M/s. Laptop Ltd. on credit Rs.40000 16. Received interest by cheque, which is deposited immediately Rs.1000 20. Paid Commission by cheque Rs.3000 24. Final settlement by Mr.Ameer Rs.24500 and discount allowed Rs.500 31. Paid Salaries Rs.20000 15. Record the following transactions in the relevant Subsidiary books of M/s. Soosai Stationery Mart for the month of March 2007: Mar1. Bought from M/s.Camlin Pencils 10 Gross full scale @ Rs.60 per dozen 40 Dozen Geometry Box @ Rs.50 each Trade discount on all the above items @ 12% Mar 5. Bought from M/s. Natraj Stationeries 15 Gross HB Pencils @ Rs.24 per dozen 10 Gross Art Pencils @ Rs.4 each Mar 10 Returned to M/s. Camlin Pencils 20 Nos. full scales bought on Mar.1 Mar 20 Sold to St.Xavier Mat. School, Chennai. 10 Dozen Geometry box @ Rs.900 per dozen 5 Gross HB Pencils @ Rs.3 each Trade discount on all the above items @ 10% Mar 25 Sold unused furniture for Cash Rs.15000 Mar 30 Returned by St.Xavier Mat. School, Chennai 5 Nos. Geometry box sold on Mar 20. 16. From the following details prepare Receipts and Payments account of Arnold Sports Club for the year ended 31-3-2007: Particulars Rs. Particulars Rs. Balance as on 1.4.2006 3000 Subscriptions for the year: Entrance fees 5500 2005-06 4000 Rent paid 52000 2006-07 200000 Stationery purchased 2000 2007-08 6000 Sports equipments purchased 60000 Donations received 10000 Wages paid 24000 Annual Day party expenses 25000 Maintenance charges 12000 Interest paid 9000 17. Prepare Bank reconciliation statement of Mr.Raja for the month of March 2007: (a) Balance as per Cash book Rs.20000 (b) Cheque deposited into bank but not credited Rs.5000 (c) Cheque issued to Ramu, but not cleared till date Rs.3000 (d) Bank Charges debited in the pass book Rs.20 (e) Interest credited in the pass book till 31-3-2007 Rs.200 (f) Our client Mr.Pandian has directly paid into our account Rs.7000 (g) LIC premium paid by the banker as per our standing instructions Rs.1000 (h) Banker has given a wrong credit Rs.750 2 18. From the following Balance Sheet of M/s. Ashok Ltd. you are required to prepare a Cash Flow Statement: 2005-06 2006-07 2005-06 2006-07 Liabilities (Rs.) (Rs.) Assets (Rs.) (Rs.) Share Capital 1200000 1500000 Cash 180000 282000 Creditors 420000 270000 Debtors 720000 690000 Profit & Loss a/c. 60000 138000 Stock 480000 540000 Land 300000 396000 1680000 1908000 1680000 1908000 SECTION - C (2 x20=40) Answer any TWO questions 19. Prepare Three Column Cash Book of Mr.Kurana for the month of March 2007. Date Particulars Rs. 2007 Mar. 1 Cash in hand 50000 Bank balance (Cr.) 5000 3 Bought goods for Cash 30000 5 Sold goods for Cash 40000 9 Bought furniture for cash and payment by cheque 5000 12 Commission paid 3000 14 Rent received by cheque and banked immediately 12000 16 Deposited into bank 35000 20 Bought goods from Arun on credit 12000 22 Returned goods to Arun 2000 23 Final settlement made to Arun 9750 25 Withdrew from bank 20000 27 Sold goods to Mathew for credit 25000 29 Final settlement made by Mathew 24500 30 Withdrew from bank for own use 1000 31 Deposit into bank all cash in excess of 5000 20. Prepare a Trading and Profit & Loss account for the year ended 31.12.2006 and a Balance Sheet on that date from the Trial Balance of Mr. Irudayam. Particulars Debit (Rs.) Particulars Credit (Rs.) Opening stock 10000 Capital 350000 Buildings 500000 Bank loan 75000 Furniture 40000 Creditors 25000 Purchases 200000 Purchase returns 2000 Salaries 30000 Interest received 3000 Bad debts 1500 Sales 450000 Cash 12500 Bills Payable 20000 Sales returns 3000 Factory rent 24000 Advertising 15000 Power 18000 Stationery 4000 Wages 12000 Carriage inwards 3000 Debtors 42000 3 Insurance 10000 925000 925000 Adjustments: (a) Stock as on 31-12-2006 Rs.150000 (b) Salaries unpaid Rs.6000 (c) Insurance prepaid for a quarter. (d) Depreciate Furniture @ 10% p.a. (e) Write off further bad debts Rs.2000 21. Prepare a Balance Sheet with as many details as possible from the following information: (a) Gross Profit ratio 20% (b) Debtors turnover 6 times (c) Current Ratio 2.5 (d) Liquid Ratio 1.5 (e) Fixed assets to net worth 0.80 (f) Stock turnover ratio 6 times (g) Net working Capital Rs.300000 (h) Capital Rs.1000000 (i) Reserves & Surplus Rs.500000 . xxxxxxxxxxxxxx 4