ACT 6694 Income Tax Research - the Sorrell College of Business at

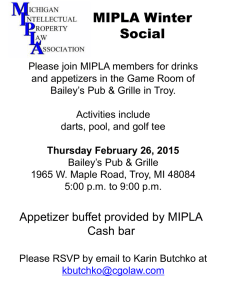

advertisement

TROY UNIVERSITY SORRELL COLLEGE OF BUSINESS SCHOOL OF ACCOUNTANCY TAX 6684-TXVA Federal Tax Research Fall 2013 August 14, 2013 through December 11, 2013 INSTRUCTOR INFORMATION: Dr. Kaye F. Sheridan, CPA Director and Professor School of Accountancy Troy University 155 Bibb Graves Hall Troy, AL 36082 334-670-3136 (secretary) EMAIL: ksheridan@troy.edu Students: Please put TAX6684V in the subject line of any emails sent to the instructor. OFFICE HOURS: Tuesday 1:00 – 3:00 pm in Troy Campus office Other times by appointment Students: Email is the best means of contacting Dr. Sheridan. Please feel free to contact Dr. Sheridan by email at any time. She checks her email continuously during the day and will respond to your email as soon as possible. If Dr. Sheridan has not responded to your email within 24 hours, please send her a follow-up email with TAX6684V Second Request in the subject. INSTRUCTOR EDUCATION: Doctor of Business Administration-Accounting, Mississippi State University, August 1998 Master of Tax Accounting, University of Alabama, August 1989 B.S.B.A. Major Accounting, Auburn University at Montgomery, March 1983 TEXT and Supplements Raabe, W. A., Whittenburg, G. E., and Sanders, D. L., (99h Ed., ISBN-13: 978-1-111-22164-5). Federal Tax Research. Mason, OH: South-Western Cengage Learning. Required Supplements Irvin N. Gleim, (2013 Edition). Gleim CPA Review Regulation with test prep software download. The textbook provider for eTROY of Troy University is MBS Direct. The Web site for textbook purchases is http://bookstore.mbsdirect.net/troy.htm. Students should have their textbook from the first week of class. Not having your textbook will not be an acceptable excuse for late work. Students who add this course late should refer to the “Late Registration” section for further guidance. LATE REGISTRATION Students who register during the first week of the term, during late registration, will already be one week behind. Students who fall into this category are expected to catch up with all of Week #1 and Week #2's work by the end of Week #2. No exceptions, since two weeks constitutes a significant percentage of the term's lessons. Students who do not feel they can meet this deadline should not enroll in the class. If they have registered, they should see their registrar, or academic adviser to discuss their options. Also note that late registration may mean you do not receive your book in time to make up the work you missed in Week #1. Not having your book on the first day of class is not an excuse for late work after the deadlines in the Schedule. COURSE PREREQUISITES ACT 4494, Income Tax Accounting I and ACT 4495, Income Tax Accounting II and Admission into the Accounting option of the MBA program, the Master of Taxation program, or the Master of Accountancy program COURSE DESCRIPTION This course is a study of how to identify federal tax issues, locate the applicable tax authorities, evaluate the weight of the authorities, reach conclusions, and communicate the results of the research. PURPOSE OF THE COURSE The purpose of this course is to introduce students to the methodology and practice of tax research. Students will gain an understanding of tax research procedures and the sources of tax law while developing tax research skills through “hands-on” analysis. In addition, students will review the concepts and doctrines of federal taxation and a review of federal tax rules. LEARNING GOALS AND OBJECTIVES On completion of the course, the student should be able to: 1. Identify and describe the sources of legal and ethical guidelines for tax practitioners 2. Identify and explain the primary and secondary sources of tax law 3. Demonstrate the ability to locate and interpret the precedential value of the primary sources of tax law 4. Exhibit familiarity with the use of on-line tax services 5. Describe the steps to the research process and utilize these steps to efficiently and thoroughly research a tax problem 6. Prepare a tax research file memorandum 7. Prepare a client letter communicating the results and recommendations of tax research 8. Write a research paper on a tax related topic 9. Demonstrate knowledge of the tax content covered on the CPA exam STUDENT EXPECTATION STATEMENT: The attached course schedule shows the order in which material is presented and the date homework assignments are due. Students are expected to complete all assignments and upload to Blackboard when due. Homework assignments are due before the start of class on the date assigned. Late assignments will be penalized A typical week of assignments below: Listen to audio lecture and post comments to Discussion Board in Blackboard. Complete and email homework assignments. Complete Gleim multiple choice quizzes online through the Gleim Test Prep site. Complete research problems, case brief assignments, and research paper assignments and post to Blackboard on assigned dates. Quizzes will be completed online after the class period the audio lectures are assigned. In order to succeed in this class, you must complete all assignments timely. You must read assignments and complete homework assignments and quizzes when due. Students are expected to check their emails and Blackboard announcements daily as Dr. Sheridan will communicate through email and Blackboard often. Those who get behind on assignments do not generally complete the course. ATTENDANCE POLICY In addition to interaction via Blackboard and e-mail contact, students are required to contact the instructor via e-mail by the first day of the term for an initial briefing. Students are expected to be in class at every meeting. Participation in all interactive, learning activities is required. Please notify Dr. Sheridan in advance if you will not be in class. MAKE-UP WORK POLICY Missing any part of this schedule may prevent completion of the course. If you foresee difficulty of any type (i.e., an illness, employment change, etc.) which may prevent completion of this course, notify Dr. Sheridan as soon as possible. Failure to do so will result in failure for an assignment and/or failure of the course. See “Attendance,” above. If Dr. Sheridan has not heard from you by the deadline dates for assignments, exams, or forums, no make-up work will be allowed (unless extraordinary circumstances existed, such as emergency hospitalization). Requests for extensions must be made in advance and accompanied by appropriate written documentation if the excuse is acceptable to the instructor. "Computer problems" are not an acceptable excuse. INCOMPLETE GRADE POLICY: Note: A grade of incomplete or “INC” is not automatically assigned to students, but rather must be requested by the student by submitting a Petition for and Work to Remove an Incomplete Grade Form (http://trojan.troy.edu/etroy/onlineundergraduateprograms/forms/index.html). Requests for an incomplete grade must be made on or before the date of the final assignment or test of the term. A grade of “INC” does not replace an “F” and will not be awarded for excessive absences. An “INC” will only be awarded to a student who presents a valid case for the inability to complete coursework by the conclusion of the term. It is ultimately Dr. Sheridan’s decision to grant or deny a request for an incomplete grade, subject to the policy rules below. Policy/Rules for granting an Incomplete (INC): • An incomplete cannot be issued without a request from the student. • To qualify for an incomplete, the student must: a) have completed over 50% of the course material (50% means all assignments/exams up to and including the mid-term point, test, and/or assignments) and have a documented reason for requesting the incomplete (e.g., doctor’s excuse). Note: Dr. Sheridan expects the student to have completed at least 75% of the course material. Incompletes are generally granted by Dr. Sheridan if an emergency happens in the last week of classes to prevent the student from completing the assignments for that last week. b) be passing the course at the time of their request. If both of the above criteria are not met an incomplete cannot be granted. • An INC is not a substitute for an F. If a student has earned an “F” by not submitting all the work or by receiving an overall F average, then the F stands. METHOD OF INSTRUCTION This is an eTROY class. It is not a “correspondence course” in which a student may work at his/her own pace. Each week there will be assignments, on-line discussions, and/or exams with due dates. Refer to the schedule at the end of this syllabus for more information. In the past, students who failed this course did so because of failing to complete assignments rather than failing the assignments. YOU MUST STAY UP-TO-DATE ON YOUR ASSIGNMENTS IN ORDER TO SUCCEED IN THIS COURSE. METHOD OF EVALUATION: There will be 1000 total possible points earned for this course. Your grade will be determined, as follows: Homework 100 Discussion Board participation 50 Weekly quizzes 100 Case brief(s) 50 Research problems (5) 200 Research paper and presentation 150 Mid-term exam 100 Final exam 250 TOTAL POINTS 1,000 ASSIGNMENT OF GRADES: All grades will be posted in the student grade book in Blackboard and will be assigned according to the following or similar scale: A B C D F 90 – 100% 80 – 89% 70 – 79% 60 – 69% 59% and below SUBMITTING ASSIGNMENTS: Federal Tax Research (FTR) end-of-chapter homework assignments should be submitted through email to FTRHomework@gmail.com using TAX 6684X as the subject. Case brief, tax research memos, research paper outline, research paper and research paper presentation will be submitted through the assignment feature in Blackboard. The Gleim homework assignments consist of submitting a Grade Report for completion of a multiple choice quiz on the unit assigned. The grade reports need to be submitted through email to GleimHomework@gmail.com using TAX 6684X as the subject. All quizzes and the final exam (proctored) will be taken online through Blackboard. Instructions for the case brief, tax research memos, and research paper will be available in the course documents section of Blackboard. After listening to each class lecture, you will be expected to answer the following questions on the Discussion Board: What was the most important concept you learned from the lecture? What was the most confusing concept covered in the lecture? What questions do you have about the concepts covered in the lecture? You are expected to read other students’ comments weekly and comment on at least one other student’s question posted on the Discussion Board each week during the semester. You will be graded on your active participation in the Discussion Board. EXAMINATION SCHEDULE & INSTRUCTIONS See assignment schedule at end of syllabus for due dates for quizzes and exams. The quizzes and exams will be multiple choice. They will be available for a specific time period. See the Course Schedule in the back of this syllabus for the dates during which time the quizzes will be available. Quizzes will be available from Friday at 8 am until Sunday at 11:59 pm during the week the quiz is assigned. A zero will be assigned if the quiz is not completed by 11:59 pm on the date due. The quizzes and exams will be delivered online via Blackboard. They will be found in the Exams/Quizzes section. The quizzes will be timed. Points will be deducted if the student overruns the time limit for the exam. See the quiz instructions for the time limit and how the overrun deductions are calculated. MASTER OF TAXATION RESEARCH REQUIREMENT: Master of Taxation students must earn a “B” or better in this course. The Master of Taxation student can satisfy the research component requirement by receiving a "B" or better in TAX 6684, Federal Tax Research, and by receiving a passing grade on the required research paper evaluated by a committee of faculty in their capstone course. Students must have completed 18 hours of program requirements before enrolling in their capstone course. A student may choose TAX 6685, Taxation of Individuals; TAX 6688, Taxation of Corporations and Shareholders; or TAX 6689, Taxation of Partnerships and Partners as his or her capstone course. Students failing to receive a grade of "B: or better on the required research paper in their capstone course will be required to enroll in an additional three-hour course, ACT 6627, Specialized Study in Accounting, and receive a grade of "B" or better evaluated by a committee of faculty on a research paper written in this course. Blackboard Support The quickest way to receive technical support for Blackboard is to submit a help desk ticket. If you are experiencing technical difficulties with your coursework or with features in Blackboard that are generating errors, please click the link below. Blackboard Support: http://troy.blackboard.com/bbcswebdav/institution/eCampus/Ed%20Tech/BB/index.html NON-HARASSMENT, HOSTILE WORK/CLASS ENVIRONMENT: Troy University expects students to treat fellow students, their instructors, other TROY faculty, and staff as adults and with respect. No form of “hostile environment” or “harassment” will be tolerated by any student or employee. AMERICANS WITH DISABILITY ACT (ADA): Troy University supports Section 504 of the Rehabilitation Act of 1973 and the Americans with Disabilities Act of 1990, which insure that postsecondary students with disabilities have equal access to all academic programs, physical access to all buildings, facilities and events, and are not discriminated against on the basis of disability. Eligible students, with appropriate documentation, will be provided equal opportunity to demonstrate their academic skills and potential through the provision of academic adaptations and reasonable accommodations. Further information, including appropriate contact information, can be found at the link for Troy University’s Adaptive Needs Program at http://troy.troy.edu/studentdevelopment/adaptiveneeds.html. HONESTY AND PLAGIARISM: The awarding of a university degree attests that an individual has demonstrated mastery of a significant body of knowledge and skills of substantive value to society. Any type of dishonesty in securing those credentials therefore invites serious sanctions, up to and including suspension and expulsion (see Standard of Conduct in each TROY Catalog). Examples of dishonesty include actual or attempted cheating, plagiarism*, or knowingly furnishing false information to any university employee. *Plagiarism is defined as submitting anything for credit in one course that has already been submitted for credit in another course, or copying any part of someone else’s intellectual work – their ideas and/or words – published or unpublished, including that of other students, and portraying it as one’s own. Proper quoting, using strict APA formatting, is required, as described by the instructor. All students are required to read the material presented at: http://troy.troy.edu/writingcenter/research.html. Students must properly cite any quoted material. A term paper, business plan, term project, case analysis, or assignment may have no more than 20% of its content quoted from another source. Students who need assistance in learning to paraphrase should ask the instructor for guidance and consult the links at the Troy Writing Center at: http://troy.troy.edu/writingcenter/. Troy University employs plagiarism-detection software, through which all written student assignments are processed for comparison with material published in traditional sources (books, journals, magazines), on the internet (to include essays for sale), and papers turned in by students in the same and other classes in this and all previous terms. CHEATING AND PLAGIARISM POLICY: Accountants must conduct themselves with the highest degree of ethical conduct. Therefore, Dr. Sheridan has zero tolerance for cheating. The penalty for plagiarism in Dr. Sheridan’s class will be a zero on the assignment. If plagiarism occurs on a second assignment in the course, the student will receive an “F” in the course. The penalty for cheating on an exam in Dr. Sheridan’s class will be an “F” in the course. Cheating includes looking at another student’s paper/screen during an exam, copying another student’s work, receiving assistance from another individual on an exam or assignment unless the students are members of same group for the particular assignment, copying from the internet or any other unauthorized source during an exam, having someone other than the student complete the student’s exam, soliciting someone to complete an exam for the student, talking to another student during an exam, passing notes or papers to another student during an exam, obtaining a copy of the exam prior to the exam, obtaining a copy of the solutions manual, and any other unauthorized assistance on an exam or assignment. Troy University has adopted an honor code which can be found on page 48 of The Oracle. The Honor Code reads: “I, (your name), will be honest in all of my academic work and strive to maintain academic integrity.” Students are expected to abide by this honor code and will be expected to write the statement on all assignments in this class. CELL PHONE AND OTHER ELECTRONIC DEVICE STATEMENT: Use of any electronic device by students in the instructional environment is prohibited unless explicitly approved on a case-by-case basis by the instructor of record or by the Office of Disability Services in collaboration with the instructor. Cellular phones, pagers, and other communication devices may be used for emergencies, however, but sending or receiving non-emergency messages is forbidden by the University. Particularly, use of a communication device to violate the Troy University “Standards of Conduct” will result in appropriate disciplinary action (See the Oracle.) In order to receive emergency messages from the University or family members, the call receipt indicator on devices must be in the vibration mode or other unobtrusive mode of indication. Students receiving calls that they believe to be emergency calls must answer quietly without disturbing the teaching environment. If the call is an emergency, they must move unobtrusively and quietly from the instructional area and notify the instructor as soon as reasonable possible. Students who are expecting an emergency call should inform the instructor before the start of the instructional period. TROY EMAIL: All Students Effective July 1, 2005, all students were required to obtain and use the TROY email address that is automatically assigned to them as TROY students. All official correspondence (including bills, statements, emails from instructors and grades, etc.) will be sent ONLY to the troy.edu (@troy.edu) address. All students are responsible for ensuring that the correct email address is listed in Blackboard by the first day of class. Email is the only way the instructor can, at least initially, communicate with you. It is your responsibility to make sure a valid email address is provided. Failure on your part to do so can result in your missing important information that could affect your grade. Your troy.edu email address is the same as your Web Express user ID following by @troy.edu. Students are responsible for the information that is sent to their TROY account. You can get to your email account by logging onto the course and clicking “email link.” You will be able to forward your Troy email to you’re a different email account. You must first access your Troy email account through the Troy email link found on the website. After you log in to your Troy email account, click on “options” on the left hand side of the page. Then click on “forwarding.” This will enable you to set up the email address to which you want your email forwarded. LIBRARY SUPPORT: The Libraries of Troy University provide access to materials and services that support the academic programs. The address of the Library Web site is http://library.troy.edu. This site provides access to the resources of all Campus and Regional Libraries, as well as to resources such as the Library’s Catalog and Databases. Additionally, the Library can also be accessed by choosing the “Library” link from the University’s home page, www.troy.edu/current/. FACULTY EVALUATION: Towards the end of the term, students will be notified of the requirement to fill out a course evaluation form. These evaluations are completely anonymous and are on-line. Faculty take the evaluations seriously and use them to improve their classes so PLEASE comply with the request when you receive the notification. Your feedback is valuable to Dr. Sheridan for improvements to the course. MISSION AND VISION STATEMENTS: School of Accountancy Mission Statement: The mission of the School of Accountancy is to advance the accounting profession by providing quality accounting education to both undergraduate and graduate students, publishing quality research and providing service to the professional community. We prepare students for successful careers with increasing professional and managerial responsibility in public accounting as well as government and industry and prepare undergraduate students for admission to graduate programs in accounting and business. SCOB Mission Statement The Sorrell College of Business supports the Troy University mission by preparing our diverse student body to become ethical professionals equipped to compete in the global business environment. To achieve this, our faculty, staff, and administration will: 1) provide quality education in global business through our undergraduate and graduate programs, delivered around the world through face-to-face and online environments, to traditional, non-traditional, military, and international students; 2) contribute to the development and application of knowledge focused on applied business, learning, and pedagogical research; 3) provide service to the University, business and professional organizations, and our communities through individual involvement, business outreach, and our centers for research. SCOB Value Statement The Sorrell College of Business will be a recognized and respected leader for quality and flexibility in the delivery of business education that prepares graduates to succeed in the global business environment. Troy University Mission Statement: Troy University is a public institution comprised of a network of campuses throughout Alabama and worldwide. International in scope, Troy University provides a variety of educational programs at the undergraduate and graduate levels for a diverse student body in traditional, nontraditional and emerging electronic formats. Academic programs are supported by a variety of student services which promote the welfare of the individual student. Troy University's dedicated faculty and staff promote discovery and exploration of knowledge and its application to life-long success through effective teaching, service, creative partnerships, scholarship and research.