Brand Experience: What Is It? How Is It

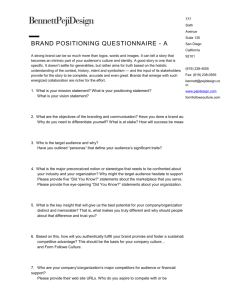

advertisement