The Importance of Defining the Scope of Representation

advertisement

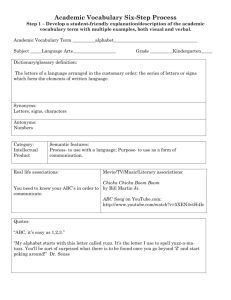

The Importance of Defining the Scope of Representation By Diana C. Manning and Risa D. Rich Executing a retainer agreement when commencing a legal matter has become routine. In fact, in most jurisdictions, a written agreement is required. In many cases, however, the primary focus of the parties is the fee arrangement. The description of the matter is often limited or even vague. Legal malpractice claims are asserted for different reasons, but often arise out of a dispute between a lawyer and a client about exactly what the lawyer was retained to do. Obviously, legal malpractice claims are a negative outcome for lawyers, but given the complexity and expense, they are also a less than optimal result for clients as well. Defining the scope of representation as clearly as possible at the beginning of the case is equally important to both the lawyer and the client for a successful attorney/client relationship. The hypothetical case study below is based upon true facts and circumstances. It illustrates how lawyers and clients sometimes develop misunderstandings that can lead to a legal malpractice claim, and how to minimize the risk of such a misunderstanding through a clearly defined scope of representation. Case Study: ABC Corp. v. Lawyers, P.C. Twenty years ago, ABC Corporation (“ABC”) became an independent entity when its parent Alphabet City Company (“Alphabet City”) elected to liquidate. In order to ensure payment of its postliquidation liabilities, Alphabet City transferred substantial assets to the Alphabet City Company Liquidating Trust (“Alphabet City Trust”). At the same time, ABC and Alphabet City entered into an Assignment and Assumption Agreement (the “Agreement”) that required ABC to assume primary liability for Alphabet City’s federal income taxes and assume secondary liability as a backstop to Alphabet City Trust for all other liabilities which it was unable to pay. Shortly thereafter, the IRS determined that Alphabet City was liable for having failed to withhold 30% of interest payments to a related entity, Alphabet City Finance (“ACF”), for a period of six years. The IRS issued a notice of deficiency to ABC and Alphabet City for improperly withholding taxes in the amount of $20 million. 1 Attempts to settle the tax matter failed. ABC then retained Lawyers, P.C. to resolve its dispute with the IRS. The retainer agreement executed by ABC and Lawyers, P.C. stated simply “ABC has engaged Lawyers, P.C. to represent it as agent for Alphabet City to resolve the tax issues currently before the IRS.” Lawyers, P.C. filed a petition in United States Tax Court challenging the alleged deficiencies. Over the ensuing months of litigation, ABC became increasingly frustrated by how long it was taking to resolve the case. At one point, the CEO of ABC raised with Lawyers, P.C. the issue of whether, in fact, ABC was primarily liable for the tax liability or whether it should be the primary obligation of Alphabet City Trust or ACF to pay the taxes. The matter was eventually litigated, and the Tax Court rendered a decision in ABC’s favor, rejecting the IRS’s claim for the subject withholding taxes. Following this victory on behalf of its client, Lawyers, P.C. requested payment of $1.5 million in outstanding legal fees pursuant to the terms of its retainer agreement. The retainer agreement provided that if Lawyers, P.C. was successful in resolving the tax matter with the IRS, ABC would pay Lawyers, P.C. a “success fee” calculated at 150% of Lawyers, P.C.’s billed time, subject to a $2 million cap. ABC, however, refused to pay the fee and even requested that Lawyers, P.C. return previously paid legal fees. ABC then commenced an action for legal malpractice alleging that, although it won the tax case, it suffered substantial damages as a result of Lawyers, P.C.’s failure to advise that it was only secondarily liable for payment of taxes as per the Agreement with its parent. Lawyers, P.C. denied that it was negligent and asserted it was retained to litigate only whether taxes were due, not to determine who was responsible for the taxes. So what went wrong? From the perspective of the lawyer, how did a win for a client become a legal malpractice action? From the perspective of the client, how could they become so dissatisfied with representation that resulted in a win? This case illustrates how a lawyer and a client can have a different understanding of what it means to represent the client’s interests in a particular matter. Here are some issues highlighted by the Case Study: • The lawyer and the client disagree about the scope of representation; • The description of the scope of representation in the retainer agreement is vague and does not fully reflect the client’s expectations for “successful” representation; • Neither the lawyer nor the client revisited the terms of the retainer agreement after the matter commenced to modify the terms to reflect changed expectations; • The client never confirmed in writing its desire for the lawyer to address the issue of who was primarily responsible to pay the taxes. 2 Things to consider when drafting or executing a retainer agreement: • Does the retainer agreement clearly identify the parties to the attorney/client relationship? • Does the retainer agreement set forth when the representation will end, i.e., upon entry of judgment or some other event? • Does the scope of representation include appeal(s)? • Have the parties confirmed any changes or modifications to the scope of representation in writing following execution of the retainer agreement? For more information, please contact: Diana C. Manning dmanning@bressler.com 973.660.4439 Risa D. Rich rrich@bressler.com 973.245.0673 17 State Street New York, NY 10004 212.425.9300 325 Columbia Turnpike Florham Park, NJ 07932 973.514.1200 www.bressler.com 2801 SW 149th Avenue Miramar, FL 33027 954.499.7979