Brand Positioning - Department of Higher Education

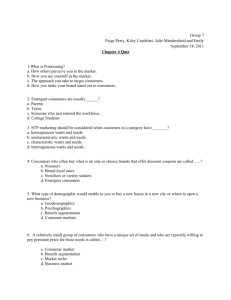

advertisement