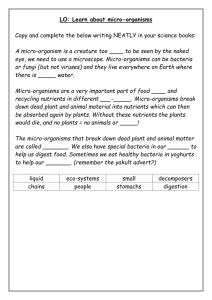

yakult annual report 2004

advertisement