United Airlines Media Plan

advertisement

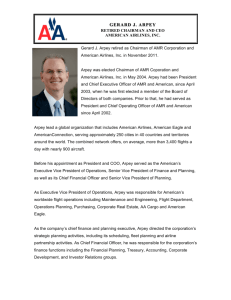

UNITED MEDIA PLAN Presented by: Sydney McKinney, Alex Mario, Brittany Raia, Brad Booker, & Ryan Spencer Executive Summary United’s Brand United Airlines is the world’s leading airline with hundreds of comprehensive domestic and global routes. It strives to be the airline customers want to fly, the airline employees want to work for, and the airline shareholders want to invest in. Since merging with Continental Airlines in 2010 to become United Continental Holdings Inc., the two airlines have worked to consolidate and optimize their combined networks. According to recent data, United has a 13.4% market share within the airline industry and a 12.87% share of voice. The Challenge In the past, United has not put customer service at the forefront of its priorities. It faced an immense amount of negative PR in response to a viral youtube video “United Breaks Guitars,” which called out United’s poor customer service. Also, according to the 2012 Airline Quality Ratings report, United had the highest rate of customer complaints in 2011, beating out all other airlines. Additionally, United’s 3 main domestic competitors – Southwest, Delta and American Airlines all have either good customer service already or have advertising campaigns focused on customer service. The Strategy: A consumer relations-based campaign targeted at women professionals age 25-54 with a household income greater than $150,000. The goal of this campaign is to reach as much of the target audience as possible (ideally 75%+) with a message about United’s new emphasis on customer service. The campaign should encourage the target audience to choose United for their leisure trips because United is making strides to improve the customer experience, both on the plane and off. United will make their flight process easy, comfortable and enjoyable. Executive Summary Continued The campaign should target female professionals traveling for leisure purposes because recent data shows that the major market for domestic airlines is the private consumer, and that the business market is shrinking. Also females are more likely to fly and to fly United than the general population, compared to men who are less likely to do so. These women should be within the age range of 25-54 and should have a household income of $150,000+. Age and household income are two very important determinants when it comes to an individual’s likelihood of flying and there is support that individuals with these demographic characteristics are more likely to fly. This campaign will utilize three types of media: spot radio, spot television and Internet. It will aim to reach 77.2% of the target audience an average of 6.5 times per month during months of high demand: May-July and October-December, for a total of 500 GRPs per month in these months. Spot TV and spot radio will be used to advertise during these heavy up months. The spot campaigns will run in United’s major hubs including Los Angeles, Denver, Chicago, Washington, D.C., New York, NY, among others. The spot TV campaign will use 15-second advertisements on late fringe/news day parts, which will reach the target audience that gets home around 5-6 PM. The spot radio campaign will use 30-second morning drive spots, which will reach our target audience on their way to work in the morning. Additionally, a continuous, national Internet campaign will bolster reach and frequency throughout the calendar year. The Internet campaign will utilize banner advertisements on these websites: Facebook.com, LinkedIn.com, MarieClaire.com, TripAdvisor.com and NYTimes.com. These websites have high impressions and are used often by the target audience. The Creative: The advertisements should encourage women professionals to fly United. They should emphasize United’s new customer service oriented approach, with the main message relaying that United is revolutionizing the customer experience, both on and off the plane. Since women in business are frequent travelers, this message will resonate with them. Industry Overview The airline industry provides air transportation over scheduled routes. The key economic drivers behind the industry include corporate profit, the price of crude oil, per capita disposable income, domestic trips by US residents, and in-bound trips by non-US residents. Since 2009, the domestic airlines industry has suffered economically as a result of the recession. In a life cycle stage of decline with high revenue volatility and high levels of competition, in the past five years the industry has remained flat with revenue growing marginally at an estimated annualized rate of 0.3%. Currently on the rebound from this economic situation, the industry has seen improved performance as more passengers boarded domestic flights in 2010 and 2011. However, as growth in the industry is anticipated, consolidation of airlines is also anticipated as low-cost airlines prove to be viable competitors1. There are many economic factors that determine demand for domestic air travel, including corporate profit and amount of disposable income. Demand increases as more passengers and freight require transportation. The economic factors that play a role in demand for domestic air travel include consumer and business sentiment, corporate profit, disposable income, exchange rates and airfares. Other factors that influence air travel include consumer preferences, the size of the country and population density, leisure time availability and competition from substitute methods of travel. Leisure travel includes all non-business related travel. Demand for leisure travel is highly elastic as it fluctuates in response to amount of disposable income and amount of leisure time available. Business travel includes all travel for business purposes. Business travel has much less elastic demand as its determinants include corporate profit and business sentiment2. DEMAND DETERMINANTS Innovation Behind the scenes, airlines are using innovation to improve the consumer experience for air travelers. Some of these innovations include: • Equipment upgrades: United Airlines was the first to upgrade to the Boeing 787 Dreamliner, a fuel-efficient aircraft designed to be a “game changer” to the airline industry. • Entertainment upgrades: Many airlines now offer WiFi in-flight. Other airlines, including Delta, offer free WiFi and iPad use in airport terminals for passengers waiting for their flight. Additionally, new forms of entertainment including in-flight television, movies, and music are now offered by a variety of airlines. • Automation: Delta offers an automatic self-service turnstile that allows you to check in for your own flight. Many other airlines have followed in suit3. Airline Seasonality Demand for domestic flights fluctuates between three seasons including high season, shoulder season, and low season. High season, from June to August and from December 10th to January 10th, is when demand for domestic flights is the greatest. Shoulder season, when demand for domestic flights is lower than high season, spans from April to May and from September to October. Finally, low season, when demand is the lowest, is from January to March and from November to early December4. Early Year Late Year High Season June- August December 10-January 10 Shoulder Season April- May September- October Low Season January- March November- early December United: Business Situation Back in 2009, United faced a hurdle of negative publicity as a result of Dave Carroll’s viral YouTube trilogy, “United Breaks Guitars.” Within a week his satirical music video, which called out United’s poor customer service and brand, had gone viral across the web with over 3 million views. Subsequently, United faced tremendous amounts of negative PR resulting in an estimated loss of $180 million to stockholders5. In 2010 United Airlines and Continental Airlines merged, creating the world’s largest airline. Shortly thereafter, the company reported positive returns for the first time in three years. With 13.4% market share, United has maintained its revenue stream by charging higher fares in lieu of reduced number of travelers. With plans to cut unprofitable routes, remove less fuel-efficient aircraft, and expand in-air WiFi for customers, United intends to see profitable returns from their effort6. United and Continental both have a history of strategic advertising. Original advertisements included United’s “Come Fly the Friendly Skies” and Continental’s “We really move our tail for you” campaigns. Shortly thereafter, Continental launched its “Work Hard, Fly Right” campaign, in which business travelers were targeted using appeals to humor. In 2004, United launched its “It’s Time to Fly” campaign, which also targeted business travelers using an emotional appeal with a direct concentration on customer service7. After merging with Continental in 2010 to become United Continental Holdings, Inc., United revamped their marketing to merge the two brands together. This reimage involved the creation of a new logo, new airplane design, and new advertising campaign. Media spend was conservative, totaling to $63.2 million in 2010. The New York Kaplan Thaler Group handled the original roll out of new advertising as described by the Wall Street Journal: “The new ads, which won't have a tagline, will highlight the combined airline's larger route network, new "outlook," low-fare guarantees and various product attributes, according to a review of six examples.”8 By August 2011, United chose McGarryBowen and Horizon as new long-term agency partners to be responsible for creative, digital, and media duties.9 Respectively, McGarryBowen delivered the “Before they move us, we move them” campaign in correspondence with the 2012 Olympics10. The most recent campaign features the MileagePlus rewards program claiming, “We’re #1 in award seat availability among U.S. global carriers.” PROMOTIONAL ACTIVITY United: Where They Go! • United’s major hubs include Los Angeles, CA; Denver, CO; San Francisco, CA; Chicago, IL; Cleveland-Akron, OH; Washington, DC; New York, NY; and Houston, TX. See chart to the left for breakdown of main airports11. United Airlines competes primarily with traditional, network, low-cost, and even some regional airlines. Historically, the industry has been dominated by larger airlines, consisting of those that make over $1 billion annually. United faces competition on all fronts, even on the international scale where companies such as AirFrance, Lufthansa, and British Airways vie for customers.12 There are a number of values that consumers look for in an airline that contributes to this competition including flight prices, number and location of routes, customer service, and membership/ frequent flyer programs. Of all domestic airlines, Delta Airlines, Southwest Airlines, and American Airlines are the biggest competition for United. 13 While the markets for both freight and passenger transport are different, there is a significant advantage in providing both of these services. Many of United’s competitors benefit from this concept, even though most profit is made from passenger transport. From legacy hub-and-spoke carriers such as Delta to point-to-point low-cost carriers such as Southwest, the different types of competitors in the industry create a market that is highly competitive. 14 COMPETITION: THE INDUSTRY The fourth largest airline in the world when it comes to total passengers- miles transported as well as fleet size is American Airlines. American supplies around $150 billion dollars annually to the U.S. economy. Along with it’s regional affiliates, including American Eagle, American airlines makes around 4,000 daily flights serving 250 cities in over 40 countries. For five straight years following September 11, the company found itself in debt until finally seeing increase in profits in 2006. Since this time, American airlines has focused much of its effort towards sustaining costs. With much competition from other airlines, American created a special loyalty program featuring gifts and seat upgrades. The company filed for a Chapter 11 bankruptcy in late November 2011 and began making capacity cuts by July of 2012. Within the past few months, American has made it public that they are looking to merge with another airline. As of September 2012, the company announced the possibility of job loss to some 11,000 employees and a reduction in the number of flights.15 Advertising and promotional campaigns is an area that is greatly influenced by the airline industry competition. American Airlines has devoted its advertising efforts in recent years to establishing a strong, personal brand image that is deeply rooted in providing the best customer service possible. American Airlines wants to create a very personal connection with the consumer and is able to do this by using logos and slogans within campaigns. Currently, American Airlines has two slogans that they use including “Be yourself. Nonstop” and ‘We know why you fly”. Both campaigns have reached both local and national audiences and use different vehicles including newspapers and magazines as well as television.16 COMPETITION: AMERICAN AIRLINES Competition: American Airlines Strengths • Fourth largest in passenger miles transported • Very competitive in transcontinental market • Highest proportion of redeemable seating capacity among legacy • Largest passgener carrier airline between the United States and South America • One of the oldest, most established brands in the industry • Highly rated/investor confidence17 Weaknesses • Declining emphasis of value over quality • West coast weakness inhibits ability to reach Asian markets. • Credit rating inhibits ability to enter fuel hedging contracts. • Cost structure is inferior and financial position is not currently stable. • Large divisions create weak communication between each division.17 Opportunities • Favorable wave negotiation • New Flightplan 2020 encourages investing wisely in fleet, earning loyalty, strengthening global network. • Travel increasing in general • Potential for growth in Asian markets • Low interest rates • Upgrade business class on long-haul flights • Government backed loans 17 Threats • Increased air travel inconvenience • Business travel declining • Fuel market volatility • Availability of pricing information • Escalating militancy of labor unions • Growth in videoconferencing and travel alternatives 17 Delta is the largest airline in the world when it comes to fleet size, revenue passenger-kilometers flown, and scheduled passenger traffic. Headquartered in Atlanta, Georgia, Delta operates extensively in both the domestic and international network. Delta operates over 5,000 flights daily with a staff of 80,000 employees. Delta grew in size due to more than 18 subsidiary companies it acquired over the years. As the oldest airline still operating in the U.S. and the sixth-oldest operating airline by creation date, it is a well respected airline and one of the four founding members of the SkyTeam airline alliance program. Delta has tried to create different “category” airlines within itself, both Delta Express and Delta Song were created to compete with the lower cost airlines like JetBlue. However, both lines were shut down due to financial distress. Delta’s new advertising campaign “Keep Climbing,” is very effective. It addresses the constant issues that airlines and their passengers face, but explains that the issues they do have control over will be taken care of by Delta and its 80,000 employees. Wieden + Kennedy, Delta’s advertising company behind the campaign, claims that: “Delta’s brand campaign, “Keep Climbing” is a declaration of the company’s commitment to making flying better and a celebration of where the brand is and where it is heading. The truth we’ve uncovered is, no one who flies is waiting for a bigger airline—they’re waiting for one that’s going to make flying better. This is the thought behind Delta’s new tagline, “Keep Climbing,” and the campaign that supports it. The campaign consists of television spots "Reach," "Action Reaction,” “Human Factor” and “Lift”, as well as print ads, billboards, transit advertising, and a multitude of other executions.”18 COMPETITION: DELTA AIRLINES Competition: Delta Airlines Strengths • Very effective management • Large size advantage • Low costs translate to higher profit • Loyal customer base • International alliances • Merger with Northwest Airlines19 Weaknesses • Inconsistent customer service • Overdependence on passenger revenues in North America • Low performance of cargo division • Unfunded employee post retirement benefits19 Opportunities • Possible passenger growth in Pacific Asia • Recent growth in airline industry • Expanding outreach to smaller businesses • Increased awareness as international carrier through advertising19 Threats • Growing prices of fuel • High competition from other airlines • Most complaints of any airline (2010) • Environmental findings regarding gas emissions19 Not only the largest low-cost airline carrier in the U.S., Southwest is also the largest airline in the U.S. by domestic passengers carried as of June, 2011. Headquartered in Dallas, Texas, Southwest operates more than 3,400 flights per day and is run by more than 46,000 employees. Only using Boeing 737 planes, Southwest is the largest operator of this model worldwide and has 572 Boeing 737 planes in service. Each plane operates an average of six flights per day. In May 2011, Southwest acquired AirTran Airways and flies to 78 destinations in 39 states. Southwest has the highest rated customer service satisfaction out of any airline, and separates itself from the competition by putting their customer’s needs first. Southwest has affected the airline industry as other airline realize they can learn from Southwest. Two European airlines, EasyJet and Ryanair are two major airlines that have followed Southwest’s business model. Focusing on how it is “fun to fly” and its low cost appeal, Southwest implemented many new ideas in the airline industry such as: no assigned seats, which allows for quicker flight turnover, leading more flights in a day, which generates more revenue and ultimately leads to lower fare costs. Advertising for Southwest has helped spread the word of the humor and fun that lives within the company. Past advertising campaigns for the company have all been witty, "Love Is Still Our Field", "Just Plane Smart", "The Somebody Else Up There Who Loves You", "THE Low Fare Airline" and "Grab your bag, It's On!.” Currently Southwest is working on creating a new campaign after it acquired AirTran. Southwest has picked their final four advertising agencies and is waiting to process bids. 20, 21 COMPETITION: SOUTHWEST AIRLINES Competition: Southwest Airlines Strengths • Excellent customer service • U.S. lowest fare airlines • Free first bag • Offers credit based on the number of trips with the airline instead of the total miles traveled.22 Weaknesses • Limited sizes of airplanes • Scrutiny of potential employees based on personality before skill could be dangerous.22 Opportunities • Improve size of airplanes • Continue be the leading airline in customer satisfaction • Extend flights to further destinations. • Expanding services to include services for leisure or business classes.22 Threats • Intense competition and price discounting • Limited international flights • Government regulations that add to operating costs.22 Market Share Looking at the industry as a whole, United Airlines and its closest competitors dominate the domestic airline market (Figure 1 and 2). Delta captured a majority of the share of market with 16.2% between August 2011 and July 2012. Delta’s revenue exceeded 92 billion dollars for this period. Southwest had the second highest share of market with 14.9%. Revenue for Southwest was around 85 billion dollars. In comparison to its competitors, United falls in third place for market share with 13.4%. United brought in around 76 billion dollars for the year. Finally, American Airlines holds 13.1% or the market and made around 74 billion dollars for the year. 23 Analyzing the share of market for the 2010 year yields very similar results. There were no big changes for the top market share holders. Delta had a 16.2% market share while Southwest had a 14% market share. However, American Airlines had the third highest market share at 13.7% while United Airlines had only a 10.2% market share. United Airlines’ transition from the 4th highest market share holder to the third indicates the tight competitive nature of the market. 23 Share of Market United Delta American Southwest Other Share of Voice The sum for advertising spent across *Based on advertising spending all media types in the airline industry was data for airline industry across all $111,611,946.8 dollars for 2011. Of this media types. total expenditure, American airlines spent $9,867,268.38, United Airlines spent $14,360,644.29, Southwest Airlines spent $51,997,791.72, and Delta Airlines spent $16,385,608.62. Converted into percentages across the entire airline industry American Airlines )("*(+"+%,( -#./0,,%( has a 8.84% share of voice, United 1%+02"/'( Airlines has 12.87%, Southwest Airlines !"#$%&'( 3%,03( has 46.59%, and Delta Airlines has !"#$%&' ()*+,-' .%/$0' (1*2+-' 14.68%. The remaining 17.02% share of 34%5#60"' +*+1-' voice is consisted of any remaining, 789$:;%<$' 12*=>-' smaller airlines. ! Other American United Southwest Delta Category Media Mix Seven different types of media were used in total for the 2011 year by the airline industry including FSI coupons, local internet, local magazines, local news, network television, Spanish language network television, and spot radio. Each of these media were used consistently across the different companies within the airline industry with the exception of local news, which was only used by Southwest, JetBlue and Frontier airlines. Spot Radio Network Television FSI Coupon Local Internet Local Magazines SLNT Spot radio was the most dominant category of media that airlines used, representing 64.42% of the media mix. The second highest media used was network television with 17.88% of the media mix. The rest of the mix included FSI coupon with 3.68%, local internet with 1.13%, local magazines with 9.3%, and Spanish language network television with 3.55%. Local news had the least amount of use, with a representation of <1.0%. Local News United Airlines Media Mix Comparing the United Airlines Media Mix from 2011 with the overall industry’s Media Mix, there are some differences. United devoted 6.11% of it’s media to FSI coupon, <1% to local internet, 36.74% to local magazines, 22.76% to network television, <1% to Spanish language network television, and 33.09% to spot radio. United placed no attention to local news, spent more money on local magazines than spot radio, spent double the industry’s percentage on FSI coupon, and spent smaller percentages on the Spanish language network television and local internet. fsi coupon local internet local magazine network tv SNTV spot radio Competition: Price analysis Company Price United $333 Delta $452 American $435 Southwest $385 *(Data taken from company websites. Prices are based on one way tickets from LaGuardia airport to LAX on November 26, 2012. Seats are “economy” class. The price of a flight will vary based on a number of different factors. Some of these factors include where you are flying from, where your destination is, what class you choose to fly in, and when you fly. Based on pricing data from 2012, the average cost of a one-way flight from New York to Los Angeles during the Thanksgiving holiday would cost around $333 for United24. Using these same qualifications, Southwest charges an average of $385 25, Delta charges $452 26, and American charges $435 27. Looking at this example flight, United and Southwest had the lowest prices while Delta and American had the higher prices. The target audience for United Airlines is female professionals traveling for leisure purposes. Women (index 107) are 7% more likely than the general population to travel via plane, versus Men (index 92) who are 8% less likely to do so. Women (index: 105) are also 5% more likely than the general population to fly United, compared to men (index: 94) who are 6% less likely.28 The target should be women flying for leisure purposes because recent data shows that the major market for domestic airlines is the private consumer, with about 71.3% of industry revenue coming from individuals and households (in 2012) either flying for leisure purposes or sending cargo privately. This is up from about 69.5% in 2007. The business market for domestic airlines is shrinking, making up about 24.6% of the market in 2012, down from 26.7% in 2007.29 TARGET AUDIENCE PROFILE In general, more people travel for personal reasons than for business (42% to 16%, respectively).30 In addition, women are also more likely to travel for personal reasons. They are 13% more likely to travel for leisure than the general population and are also more likely to do so compared to men, who are 14% less likely to travel for personal reasons. Women are also more likely to travel for vacation (index: 104), compared to the general population as well as men (index: 96). In addition, out of adults who travel for personal reasons 58.3% are women, compared to 41.7% being men. Women who have graduated college plus are also more likely (35%) to travel for personal reasons than the general population, along with women with professional related occupations (31%) and women with management, business or financial operations occupations (20%). Married women are also more likely than women with other marital statuses to travel for personal reasons, with over half (58.6%) of women who travel for personal reasons being currently married. Women with household incomes > $150,000 are 26% more likely than the general population to travel for leisure.31 TARGET AUDIENCE PROFILE TARGET AUDIENCE: IDEAL CONSUMER The ideal consumer for United Airlines is a white woman who falls in the 25-54 age range, has a household income greater than $150,000, and is currently married. She has attended college and possibly attended a graduate school and has a professional occupation or works in a management, business or financial field. These demographic segments are all more likely than the general population to not only travel via plane, but also to fly United. For example, white women are 6% more likely to travel via plane and 12% more likely to fly United. As for age, most United travelers fall in three age groups 25-34, 35-44, and 45-54. This is probably because people in these groups have a greater amount of money and can afford flying as opposed to driving, for example. There is similar data for people to travel via plane, with 31.9% of people who travel via plane being women 25-54, compared to only 27.7% for men 25-54. Married women (indices: 115, 120) are more likely than the general population, as well as never married, engaged or widowed/divorced/separated women to travel via plane and to fly United as well. In addition, 52.5% of women who fly United have graduated college plus, and 48.1% of women who travel via plane fall into this segment as well. Women with household incomes greater than $150,000 are 112% more likely than the general population to travel via plane, and are 117% more likely to fly United. Finally, women with professional occupations (index: 158, 190) and occupations in management, business and financial fields (index: 200, 247) are also more likely to fly via plane and to fly United.32 Universe: There are 12,667,011 women in the United States in the age range of 25-54 who have a household income greater than $150,000.33 Women who travel via plane for personal/leisure reasons are less likely to have children, they have a home value of $500,000+, are more likely to travel in business class or in coach than in first class, they travel throughout the year, and they decide their trips on their own (i.e. without a travel agent).34 As for media consumption, these women use the Internet, watch TV, listen to the radio and read magazines and newspapers. They subscribe to digital cable and watch onDemand and pay-per-view movies. As for TV channels, they enjoy news channels, sports (golf, tennis, football), movie channels (such as Hallmark and Lifetime), awards shows, daytime and early morning talk shows and other miscellaneous varieties, such as HGTV, TLC, and WE TV. They read various types of magazines, mainly airline, business/finance, bridal, home service, fraternal, outdoor recreation, travel, and women. And they visit numerous websites, including mail sites (gmail, Windows Live Hotmail, AOL mail), news sites (abc.com, cbs.com, nbc.com), and music and movie sites (Hulu.com, iTunes.com, Pandora.com, IMBD.com).35 TARGET AUDIENCE: PSYCHOGRAPHICS & MEDIA CONSUMPTION TARGET AUDIENCE: UNITED United says its passengers have higher levels of education, household income and discretionary spending. Its business travelers are affluent, and its leisure travelers are “highnet-worth familiar and individuals flying for pleasure.” Its passengers are employed in the professional/managerial fields, are college educated & have household incomes greater than $50,000.36 TARGET AUDIENCE: HHI & AGE According to a Mintel Report on Airline Use in the Past 12 Months (Aug 2012), age and household income are two very important determinants when it comes to individual’s likelihood of flying. Those aged 25-34 are most likely to fly and they fly most frequently (an average of 6.2 trips per year). The report says travel for both personal and business reasons contribute to this age group’s increased likelihood of flying. Although age is an important factor, household income is the strongest determinant as to whether a person has flown. Affluent individuals have a greater likelihood of having flown and fly most frequently. People with an income of $100,000+ are more than three times as likely as those with incomes of less than $25,000 to have flown.37 MEET AMANDA: A TYPICAL UNITED PASSENGER Amanda, 30, lives in a town home in Atlanta with her husband of 2 and half years. She graduated from a small university in New England and moved to Atlanta to attend graduate school, where she earned her masters in business administration. Shortly after graduation she began working as a consultant for Bank of America, where she met John, her now husband. Amanda and John have a combined household income over $150,000, they do not have any children (yet), and they are registered to vote, having slightly conservative views. Amanda drives a 2006 BMW which she has had for a while. She wants a new car but buying one is not at the top of her priorities right now. When she drives, Amanda listens to the radio, tending to skip around, and preferring music sometimes and news others. Amanda occasionally goes for runs before work and on weekends, sometimes bringing along her chocolate lab, Molly, and never forgetting her iPod nano. She’s thinking about joining a gym because she would like to attend some of the workout classes but she’s not sure if she’ll have time. In her spare time, Amanda enjoys shopping, cooking and reading. She also enjoys hiking with John, spending time with her friends, and watching TV. Amanda usually finds commercials entertaining and does not skip them. She watches an average of 4 shows during the prime season. Amanda travels occasionally for her job and an average of 3-4 times per year via plane for leisure purposes. She travels leisurely with John and also on her own to visit family and friends. She travels mostly in the summer months (MayAugust) and around the holidays (October-January). When she flies, Amanda brings her iPad, laptop, and her iPhone. She occasionally buys a magazine at the airport to read during the span of time when you have to turn off all of your electronic devices. While waiting in the airport, Amanda checks her Facebook and her email and scans some news sites. She also reads on her iPad. Amanda rarely picks up a newspaper – instead preferring to get her news online from news sites or from social media. In addition to this media plan, which targets female professionals traveling for leisure purposes, it is also recommended there be an additional and separate media plan that targets Young Male Professionals traveling for business. Since the business sector still makes up a good portion of the market share for domestic airlines and because men are more likely to fly for business purposes (34% more likely than the general population), it is recommended that a separate media plan target this audience. It should target young men because men falling in the 25-34 age range are most likely to fly United (64% more likely than the general population and more likely than any other age category). It should target professionals because men with professional and related occupations are most likely to travel United (144% more likely than the general population).38 TARGET AUDIENCE: RECOMMENDATIONS UNITED: SWOT ANALYSIS Strengths • Strong operational network • Strategic alliances (merger with Continental) • Relatively high employee productivity • The world’s largest carrier in U.S. with strong global presence • Environmental initiative • Reward and membership program for loyal customers.39 Weaknesses • Weakening financial performance • Heavy dependence on third party providers • Strong unions • Horrible customer service!!!!! • Last in on-time performance for 2012 (many delays).39 Opportunities • Growing U.S. airlines industry • Global travel and tourism industry • Economic growth.39 Threats • Future oil prices • Intense competition and price discounting • World and U.S. Economy • Environmental regulations.39 OBJECTIVES Marketing Objective During calendar year 2013 (January- December 2013), increase United’s market share by 5% to a total of 18.4% market share making United a market leader. This represents an estimated $313,432,835 increase in sales (or 5% increase in sales). Advertising Objective During 2013, improve the brand perception of United among 77.2+ % of the 12,667,011 females age 25-54 with household income of $150,000 or more. Media Objectives Target Audience & Media Mix Target 12,667,011 female professionals age 25-54 with average household income greater than $150,000 per year. Reach, Frequency, and GRPs Reach 77.2% of female professionals age 25-54 an average of 6.5 times per month in the months of May, June, July, October, November, and December for a total of 500 GRPs per month in these heavy-up months. Bolster reach and frequency with a strong continuous monthly national internet campaign. Scheduling & Timing Maintain a base of monthly national advertising with heavy-up in spot markets during months of high demand, including May, June, July, October, November, and December. Media Objectives Media Budget Objective Allocate $388,375 per month to a continuous internet campaign. Allocate $746,750 to spot TV and $976,500 to spot radio per month in heavy up months, including May, June, July, October, November, and December. Please see Appendix for detailed allocation of money per month. Geography Objective Provide a constant base of national advertising with heavy-up in spot markets during times of high demand. Media Strategy: Internet Internet is the fastest growing advertising medium, and of all mediums, Internet has the biggest capability of reaching a large range of individuals. Websites have the ability of catering to individuals so you are able to advertise specifically to your target audience. There is also a quick conversion time that is associated with Internet. Many websites have links that enable the customer to purchase the product/service immediately. The Internet is also an efficient way to get information across to the customer. The customer can see details about the product/service and help the consumer feel that they are making an informed purchasing decision. Internet also has the capability of being more cost efficient than other mediums. By using targeting options such as “pay for click”, companies can track the users and end up paying only for those consumers that click on the advertisement. Internet can also be much easier for the company in terms of creation and also in terms of buying the actual advertising space. Banner ads are also an effective tool because they are used on high traffic websites and provide a link to the company website. Women are heavy users of the Internet (8% more likely than general population). 40 FACTS: -Females 25-54 are 20% more likely than the general population to be heavy users of Internet. -Women employed fulltime are 21% more likely than other women to be heavy users of the Internet. -74% of females 18-54 use Facebook and 48.8% of all Facebook users are females. -48% of young Americans said that they find out about their news through Facebook.40 Since women plan their flights in advance, we want to offer a strong continuous schedule of advertising. This will serve as the basis for our campaign as it will be both cost effective and highly persuasive to our target audience. Since women in our target audience are more likely to be heavy users of the internet than others, we will focus the majority of our campaign in this area. 25 Media Tactics: Internet We chose to run banner advertisements on targeted websites on a continuous, year round schedule. The five websites that we picked to run advertisements on were Facebook.com, MarieClaire.com, LinkedIn.com, NYTimes.com, and TripAdvisor.com. We decided to use banner advertisements because they are visually stimulating, provide a quick conversion link, and are able to reach a large number of individuals. We also wanted to position United Airlines as an “up to date” brand and by using the Internet we are able to connect with technology and business savvy working women. Most women will buy their airline tickets in advance, so it is important that we keep the message out there year round and not just during the busy season. We chose Facebook.com because it is the most visited website in the world and because it is a growing sector for middle-aged women. We chose MarieClaire.com because its demographic composition matches our target audience. We chose LinkedIn.com to tap into the professional social network. We chose NYTimes.com because it is the most read business news source in the nation. Finally, we chose TripAdvisor.com because it is one of the most used resources for travel by plane. Media Strategy: Spot TV We will use Spot TV in months of high demand to bolster our campaign and attain high amounts of reach and frequency during the months of May, June, July, October, November, and December. In order to reach business women, who get home from work around 5-6PM on average, we will run our advertisements during the late fringe/late news dayparts as these are the times they are most likely to tune in to news information. Spot TV is more cost effective than Scatter in the Early Morning and Late Night day parts. The costs during Prime can usually be around the same as Scatter. Spot TV can almost double the inventory available for an advertiser and can be purchased with a demographically targeted national footprint. Advertisers using spot can still achieve the same GRP level as national. 41 FACT: 78% of Americans get their news from local sources (on average). In addition, national advertisers do not always have a national footprint. (Ex. Having 100 locations in Florida and only 4 in North Carolina). The localized markets that will see the most benefit are those that are targeted. In turn, the markets with little to no presence are not involved. You can also analyze the ratings delivery for programs more effectively because they air in different parts of the country. 41 Media Tactics: Spot TV Use Spot Television in Major Markets United’s major hubs include Los Angeles, CA; Denver, CO; San Francisco, CA; Chicago, IL; Cleveland-Akron, OH; Washington, DC; New York, NY; and Houston, TX. Since these are the main places that United customers fly to and from, we will use Spot TV to advertise to these markets during times of high demand, including May, June, July, October, November, and December. In order to be both cost effective and create the maximum impact upon the target audience, we will advertise during these periods. Use Late Fringe/News Spots Using Late Fringe/News will allow us to reach our target audience, who get home from work on average around 5-6PM. Run 15 second advertisements for a total of 250 GRPs during the months of May, June, July, October, November, and December in the above specified spot markets. Media Strategy: Spot Radio In order to create a large impact during heavy-up months, including May, June, July, October, November, and December we will run spot radio ads in the same markets specified in the spot TV tactics. This way, we can reach the most frequent United flyers, be cost efficient, and make a large impact. By using spot radio instead of National radio, we will be able to better reach our target audience, business women 25-54 years-of-age. There are more than 9,000 independent radio stations within the United States, and spot radio provides the advertiser many options as to where they want to place their spot. Spot radio draws in 80% of all dollars spent on radio advertising per year. A big reason for choosing Spot radio was so we could better customize our message on a channel that was local to the area of our target audience. National radio does not offer as many channels as spot radio and is a much pricier option. 42,43 Media Tactics: Spot Radio Use Spot Radio in Major Markets United’s major hubs include Los Angeles, CA; Denver, CO; San Francisco, CA; Chicago, IL; Cleveland-Akron, OH; Washington, DC; New York, NY; and Houston, TX. Since these are the main places that United customers fly to and from, we will use Spot Radio to advertise to these markets during times of high demand, including May, June, July, October, November, and December. In order to be both cost effective and create the maximum impact upon the target audience, we will advertise during these periods. Use Morning Drive Spots We plan to use 30 second spots, which will keep the audience interested and works with our budget. Since we only want to hit our specific target, we decided spot radio would reach our target on their way to work, during the morning drive daypart. We chose to target on local news stations during the morning, and due to budgetary constraints, we cannot afford the evening rush hour spot. We hope that the medium to high frequency of our message on the radio combined with our other media vehicles will leave a strong impression of our company and our message in their minds. Run 30 second advertisements for a total of 250 GRPs during the months of May, June, July, October, November, and December in the above specified spot markets. Media Not Recommended: Newspapers Newspapers as a medium are cluttered with a short life term and often are poorly produced. As a result of all of these factors, newspapers should not be used. Additionally, since the poor quality of printing would reflect upon the United brand, the medium should not be included as to deter negative reflection upon the brand. While this medium could be used to fulfill the geography objective, we have found that spot TV and spot radio will be more effective at fulfilling this objective, as they are where our target audience looks for entertainment. Finally, since newspapers, in general, are a dying medium in print form as fewer people subscribe to them every day, we will use other mediums to accomplish our objectives as our goal is maximum impressions. Media Not Recommended: Outdoor While out of home and outdoor media are typically used to fulfill geographic objectives, other media sources are more influential to our consumer. Additionally, since outdoor advertisements have a very short exposure time since drivers only see these billboards, etc. very briefly, other media sources will be used to fulfill our objectives. Finally, since out of home advertisements cannot target specific demographics, we have found that other media sources could be used to more accurately pinpoint our target market for a more successful campaign. Media Not Recommended: National/ Primetime TV Primetime offers limited spots to advertisers for high costs. While we would love to advertise in a primetime slot, our budget does not allow for this targeting method. Additionally, since we are trying to reach an audience that is geographically located in the major United hubs, we will not be using national TV spots to try and appeal to a regional audience. Instead, we will buy specific spot TV advertisements in order to obtain a maximum reach in these geographic areas. Media Not Recommended: Print Magazines One of the greatest disadvantages of using magazines in a media plan is that they have limited reach and frequency. Based on the reach and frequency objectives specified, this media source would not fulfill the needs for the campaign. Additionally, magazines are expensive to advertise in. While magazines do allow for targeting, our campaign’s geographic objective specifies that we will be targeting specific spot markets with limited emphasis on national advertising due to budget constraints. Therefore, since most magazines are national, our campaign will not use this medium. Instead, to try and obtain this market we will advertise online through specific magazine’s websites in order to be cost effective. Creative Brief Brand Idea: United is the world’s leading airline, with comprehensive domestic and global routes. Since its recent merge with Continental Airlines (2010-12), United has further expanded it routes in an effort, on behalf of both companies, to consolidate and optimize the combined networks of the two airlines. Brand Personality: Customer-oriented, accommodating and pleasant. Modern and sophisticated. “United is the airline customers want to fly, the airline employees want to work for and the airline shareholders want to invest in” (United.com). Goals and Objectives: Reach as much of the target audience as possible (ideally 77.2%) promoting United’s new emphasis on customer service, in an attempt to change their view of the company and get them to choose United for their leisure trips. The Challenge: There is a lot of competition in the airline industry. United does not have the best reputation among consumers relative to some of the other airlines, especially since the “United Breaks Guitars” video went viral. This ad campaign should change that. The Strategy: Create ads that will convince working women that they should fly United because United is customer service-oriented and will make their flight and entire process easy, quick and comfortable. Who We Are Advertising To: Women age 25-54 with a household income of greater than $150,000. Amanda, 30, completed her masters in business administration 5 years ago and started working as a consultant for Bank of America shortly after graduation. Amanda travels occasionally for her job, and an average of 3-4 times per year via plane for leisure purposes. Amanda travels leisurely with her husband John, who she has been married to for 3 years, and also on her own to visit family and friends. Amanda and John have a household income greater than $150,000, no children (yet), and live in Atlanta. Creative Brief Continued Consumer Challenges and Barriers: Other airlines have better customer engagement and higher customer satisfaction. Because of the state of the economy, consumers, even those with high household incomes, are spending less. They may be cutting out leisure trips, they may be spending less on their trips (i.e. choosing to drive instead of fly), and they’re likely looking for the cheapest flight. Our Proposition Is: Flights done right. United will take care of you. And They Will Believe It Because: United is the world’s largest, leading airline. The ads will highlight United’s emphasis on customer-service and how United is making strides to improve the customer’s in-flight experience. Single Most Important Idea/Key Message: United is revolutionizing the customer experience, both on and off the plane. (Since women in business are the most frequent travelers this message will resonate with the target). Supporting Message: United Airlines makes traveling comfortable and easy. Call to action: Fly United. Interact with our brand. Tonality: Light, friendly and relaxed. The ads should inspire action on the part of the consumer. Execution/Strategy : Ads will run on spot radio, spot TV and the internet – Facebook.com, LinkedIn.com, MarieClare.com, nytimes.com and tripadvisor.com. We will run a monthly national advertising with heavy-up in spot markets during months of high demand, including May-July, and October-December. Budget Considerations: $15 million budget for the calendar year. Plan Summary The strategies this campaign will employ will help United increase its market share, making it a market leader in the airline industry. United is currently in a decent position relative to its competitors and in the overall market, but it is in a bad position in terms of its customer service. With the increasing use of social media, which allows consumers to interact with brands and, most importantly, to voice their opinions about a brand to their friends and followers, United needs to drastically improve its customer relations. This campaign will help the company do so and will encourage the target audience to choose United. This plan will help United garner a more positive image among consumers. With an emphasis on customer service and on making the flying process easy, comfortable and enjoyable, it will resonate with women professionals, who are very frequent flyers and change their perspective of United. Professional women age 25-54 with a household income greater than $150,000 and traveling for leisure are the perfect target audience for this product. Women are frequent flyers, and those with household incomes greater than $150,000 are more likely to fly than those with lower household incomes. The target spans a broad age range in order to reach both young women – who tend to fly more for business and personal reasons, and also older women, who usually have higher household incomes and more discretionary spending to put towards travel. In order for the campaign to be effective, it should reach more than 75% of the target an average of 6.5 times per month during the heavy-up months (May-July, Oct-Dec) with the message that United has revamped its customer service experience. The national and continuous Internet campaign will bolster this reach and frequency, reaching the target audience through a mix of websites including social media, news, personal and travel, that have high impressions and are used often by the target. A pulsing media schedule allows for continued reach throughout the year, which is essential for an airline since people plan their trips in advance, and spot coverage in heavy-up months of high demand. This plan proposes a way to satisfy the outlined objectives while staying within the overall media budget of $15,000,000. United Airlines should use this media plan to implement a successful campaign. Jan. Feb. March April May June July Aug. Sept. Oct. Nov. Dec. Internet Total GRPs LinkedIn.com Facebook.com MarieClaire.com NYTimes.com TripAdvisor.com Spot TV 250 Spot Radio APPENDIX: SCHEDULING FLOWCHART 250 APPENDIX: BUDGET ALLOCATION APPENDIX: MARKET SELECTION APPENDIX: YEAR AT A GLANCE APPENDIX: SPOT FLOWCHART Sources 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. http://clients1.ibisworld.com.libproxy.lib.unc.edu/reports/us/industry/default.aspx?entid=1125 http://clients1.ibisworld.com.libproxy.lib.unc.edu/reports/us/industry/productsandmarkets.aspx?entid=1125#DD http://academic.mintel.com.libproxy.lib.unc.edu/display/633823/ http://www.airtreks.com/ready/where-do-you-want-to-go/factors-that-affect-ticket-price/ http://www.huffingtonpost.com/2009/07/24/united-breaks-guitars-did_n_244357.html http://clients1.ibisworld.com.libproxy.lib.unc.edu/reports/us/industry/majorcompanies.aspx?entid=1125#MP347816 http://www.united.com/web/en-US/content/company/advertising/commercials.aspx http://online.wsj.com/article/SB10001424052748703933404576170393021650666.html http://adage.com/article/agency-news/mcgarrybowen-horizon-nab-united-continental-ad-business/229197/ http://www.mcgarrybowen.com/en/Work/United/Before-They-Move-Us-We-Move-Them/Volleyball http://www.unitedmediaservices.com/our-audience/where-we-fly.php http://www.bts.gov/publications/journal_of_transportation_and_statistics/volume_08_number_01/html/data_review/index.html http://hbswk.hbs.edu/archive/1896.html http://www.sgrlaw.com/resources/trust_the_leaders/leaders_issues/ttl14/859/ http://www.aa.com/i18n/amrcorp/corporateInformation/facts/amr.jsp http://www.aa.com/i18n/amrcorp/newsroom/general-advertising.jsp http://economics-files.pomona.edu/jlikens/SeniorSeminars/vector2010/pdf/amr.pdf http://news.delta.com/index.php?s=18&cat=47 http://academicmind.com/unpublishedpapers/business/management/2008-06-000aao-delta-an-anyalytical-view.html http://www.adweek.com/news/advertising-branding/southwest-airlines-review-enters-final-stages-139474#1 http://yousigma.com/benchmarking/southwestairlinesmarketingstrategy.html http://www.quality-assurance-solutions.com/southwest-airlines-swot-analysis.html#ixzz2Bx2CyXZ6 http://www.transtats.bts.gov/ http://www.united.com http://www.southwest.com http://www.delta.com http://www.aa.com Sources continued 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. http://ureporter.mriplusonline.com/selectdemo.asp MRI Fall Product 2011: Domestic Travel – Means of Travel, Any Trip Plane (scheduled) http://clients1.ibisworld.com.libproxy.lib.unc.edu/reports/us/industry/productsandmarkets.aspx?entid=1125#MM [also see corresponding image] http://academic.mintel.com.libproxy.lib.unc.edu/display/633835/ - Mintel Report Airlines – US – Aug 2012 – Airline Use in the Past 12 months http://ureporter.mriplusonline.com/selectdemo.asp MRI Fall Product 2011: Domestic Travel: Any Trip personal (not vacation); any trip vacation http://ureporter.mriplusonline.com/selectdemo.asp MRI Fall Product 2011: Airlines Used – Last/Any trip United; Any Trip Plane (scheduled) http://www.census.gov/prod/cen2010/briefs/c2010br-03.pdf http://ureporter.mriplusonline.com/selectdemo.asp MRI Fall Product 2011: Any Trip plane (scheduled); any trip personal (not vacation); any trip vacation See 34 http://unitedmediaservices.com/our-audience/passenger-demo.php [also see corresponding image] http://academic.mintel.com.libproxy.lib.unc.edu/display/633835/ - Mintel Report Airlines – US – Aug 2012 – Airline Use in the Past 12 months http://ureporter.mriplusonline.com/selectdemo.asp MRI Fall Product 2011: Airlines Used – Last/Any trip United; Any Trip Plane (scheduled) http://www.bankrate.com/brm/news/biz/Biz_ops/20010601a.asp http://www.wvlt.com/media.html http://www.buzzle.com/articles/advantages-of-internet-advertising.html http://whttp://www.produktutveckling.nu/online-ad-revenues-hit-record-31-7b-in-2011-surpass-cable-tv/ ww.tvb.org/media/file/Spot_TV_Advantage_Over_Scatter.pdf TARGET AUDIENCE SOURCES 29: 36: Because the amount of people flying for leisure or personal purposes is increasing and since this group currently accounts for a major portion of the market share for domestic airlines, we decided to target women who are flying for leisure purposes.