Personal Finance Test Review 2

advertisement

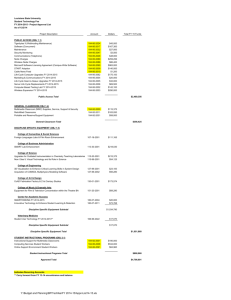

Personal Finance Test Review 2 Multiple Choice Identify the choice that best completes the statement or answers the question. 1. Monica Ramirez works at the hospital as a nursing assistant. She works 15 hours per week and earns $8.50 per hour. What is Monica’s straight-time pay for each week? a. $120.00 c. $127.50 b. $127.00 d. $120.50 2. Jason Ayers works as a lifeguard earning $8.75 an hour for 20 hours per week. What is Jason’s straight-time pay for the week? a. $175.00 c. $170.00 b. $165.00 d. $170.50 3. Julie Meier is the manager for the ACE Trucking Company. During December she worked 165 hours and was paid $27 per hour. What was her straight-time pay for December? a. $4,400 c. $4,500 b. $4,450 d. $4,455 4. Macie Andersen earns $9.75 an hour working at the local bookstore. Last week she worked 17 hours. This week she worked 25 hours. What was her straight-time pay for the two weeks? a. $409.00 c. $404.75 b. $409.50 d. $404.25 5. Phyllis Doran worked at Symmes Medical Center for hours on Monday and from 8:30 AM until 1:00 PM on Tuesday. What is the total number of hours she worked? a. 12 c. 11 b. d. 13 6. At the local sandwich shop, employees earn double time for any hours worked in addition to their regular 40-hour week. Last week, Cooper Jones worked his regular 40 hours plus 9 hours of overtime. Cooper is paid $8.50 per hour. What is his total pay for the week? a. $833.00 c. $416.50 b. $416.75 d. $493.00 7. At the Red Apple Health Food Store, employees earn time and a half for any hours they work in addition to their regular 35-hour work week. Nicole Logan is paid $8.00 an hour. This week she worked 46.25 hours. What is her total pay? a. $355 c. $415 b. $380 d. $370 8. Carlos Garcia works at Dan’s Car Wash. Use his time card, shown below, to find the total number of hours he worked for the week. EMPLOYEE TIME CARD DATE IN OUT IN OUT 9/15 8:00 AM 11:00 AM 12:00 PM 4:00 PM NAME: CARLOS 9/16 8:30 AM 12:00 PM 12:30 PM 4:30 PM HOURS GARCIA DEPT.: SALES 9/17 9/18 9/19 EMPLOYEE SIGNATURE a. 8:00 AM 8:30 AM 8:30 AM 12:30 PM 12:30 PM 12:00 PM 1:30 PM 1:00 PM 12:30 PM 4:30 PM 5:00 PM 5:00 PM TOTAL HOURS hours b. 38 hours c. 32 hours d. 26 hours 9. Odette Alverez works at the Digitech Warehouse eight hours a day, earning $9.48 an hour. She is asked to work two additional hours at time and a half to help prepare for an incoming shipment of merchandise. How much will she earn for these two hours of overtime? a. $28.00 c. $28.44 b. $28.75 d. $28.74 10. Annie Kramer embroiders baseball caps. She is paid $2.50 for each hat she embroiders. Her production sheet is shown below. What is her total pay for the week? DATE 6/14 6/15 6/16 6/17 6/18 CAPS 42 37 0 24 41 a. $360 b. $375 c. $350 d. $345 11. Linda Rove is paid $6.39 for each table she assembles. Last week she assembled the following number of tables. What was Rove’s pay for the week? DATE Monday Tuesday Wednesday Thursday Friday a. $460.08 b. $455.09 TABLES 16 12 11 14 19 c. $465.75 d. $475.75 12. George Saylor provides childcare in his home. He charges $5 an hour per child. On Tuesday he cared for Amy for 3 hours, Itsu for 4 hours, Kaylee for 6 hours, and Jasmine for 4 hours. What was his total pay? a. $65 c. $45 b. $85 d. $95 13. Anoki Shah washes windows for Sparkle Cleaners. He gets paid $1.39 per window. Last week he cleaned 284 windows. What was his total pay? a. $383.40 c. $432.00 b. $654.00 d. $394.76 14. Robin Cline is a computer analyst. Her annual salary is $52,789. What is her monthly salary? a. $3,444.22 c. $4,100.00 b. $4,399.08 d. $4,700.87 15. Franklin Neason earns $5,250 a month as a sales manager. What is his semimonthly salary? a. $2,365 c. $2,625 b. $10,500 d. $5,250 16. Dr. McCoy earns $51,233 teaching at the university. What is his weekly salary? a. $985.25 c. $1,970.50 b. $1,024.66 d. $1,970.00 17. Betty Black is an attorney. Her biweekly salary is $6,514. What is Betty’s annual salary? a. $78,168 c. $105,312 b. $156,336 d. $169,364 18. Briana Driscoll sells real estate. She earns a 6% straight commission on each sale. She recently sold a house for $355,000. What was her commission? a. $23,300 c. $20,900 b. $21,300 d. $23,500 19. Marta Perez sells coffee beans to local coffee shops. She earns a 10% straight commission on all sales. In November, her sales totaled $38,500. What was her commission? a. $385 c. $38 b. $3,850 d. $3,800 20. Colleen Truman earns a 4.5% commission on all sales. In June, her sales totaled $40,000. How much did she earn in commission? a. $18,000 c. $1,080 b. $1,800 d. $14,500 21. Terrence McGraw sells lumber. He earns 4% commission on the first $5,000 in sales, 8% on the next $5,000, and 12% on sales over $10,000. Last month he sold $18,000 worth of lumber. What was his total commission? a. $1,570 c. $1,560 b. $1,750 d. $1,650 22. Cody Summer sells tires for tractor trailers. He earns 4.5% commission on the first $6,000 in sales, 8% commission on the next $6,000, and 12% commission on sales over $12,000. Last month he sold $18,000 worth of tires. What was his total commission? a. $1,470 c. $1,540 b. $1,450 d. $1,650 23. At a recent computer convention, Pomie Lau demonstrated new software to potential customers. She was paid $15 each for the first 10 demonstrations in one day and $17.50 for each demonstration over 10. What was her commission if Pomie makes 12 demonstrations in one day? a. $185 c. $165 b. $210 d. $175 24. Some sales positions pay a commission if sales exceed a set quota. Yolanda Gonzalez is paid $1,750 per month plus a commission of 9.5% on all sales of more than a $25,000 monthly quota. What is Yolanda’s total pay for a month in which her sales totaled $37,500? a. $5,625.00 c. $2,973.50 b. $5,265.00 d. $2,937.50 25. A portion of Neka Patel’s time card is shown below. How many hours did he work for the week? DATE IN OUT IN 12/13 8:00 AM 12:00 PM 12:30 PM 4:30 PM 12/14 12/15 12/16 12/17 8:30 AM 8:35 AM 8:15 AM 8:00 AM 1:30 PM 12:35 PM 12:15 PM 1:00 PM 2:10 PM 1:30 PM 12:45 PM 1:30 PM 5:10 PM 5:30 PM 3:45 PM 5:30 PM a. b. OUT c. 40 hours hours d. 41 hours hours 26. Sita Rahim keeps records of her expenditures. She wants to know how much she spends each month, on the average. Her records for three months are shown below. What is her average monthly expenditure? Month August September October Expenditure $3,156.00 2,896.50 2,666.00 a. $2,344.50 b. $2,906.17 c. $3,001.01 d. $3,004.20 27. Harold Chung keeps records of his expenditures. He wants to know how much he spends each month, on the average. His records for three months are shown below. What is his average monthly expenditure? Month September October November Expenditure $1,988.00 2,234.50 2,099.00 a. $1,999.00 b. $2,107.17 c. $2,234.50 d. $2,300.90 28. Kar and Ching Sho keep records of their expenditures. They want to know how much they spend each month, on the average. Their records for four months are shown below. What is their average monthly expenditure? Month January February March April a. $3,765.22 b. $3,988.00 Expenditure $3,356.00 3,988.50 4,010.02 4,765.87 c. $4,001.01 d. $4,030.10 29. Carly and Tom Mason keep records of their expenditures. They want to know how much they spend each month, on the average. Their records for four months are shown below. What is their average monthly expenditure? Month January February March April Expenditure $5,678.54 3,665.77 4,231.98 4,768.99 a. $3,877.99 b. $4,586.32 c. $4,988.01 d. $5,001.01 30. Marilyn and Thomas Meyer keep records of their expenditures. They want to know how much they spend each month, on the average. Their records for four months are shown below. What is their average monthly expenditure? Month January February March April Expenditure $3,878.54 2,465.27 3,232.98 2,768.09 a. $2,887.09 b. $2,980.00 c. $3,086.22 d. $3,777.65 31. ALGEBRA Martha Jackson had a $396.25 average monthly expenditure for clothing during the first quarter of the year. She spent $401.50 in April and $250.00 in May. How much can Martha spend in June to have the same average as in the first quarter? a. $437.25 c. $537.25 b. $450.00 d. $554.25 Figure 3.1. Use this chart with the question(s) about the Thompson family below. A MONEY MANAGER FOR Thompson Family MONTHLY LIVING EXPENSES Food/Grocery Bill $232.00 Household Expenses Electricity $167.20 Heating Fuel $ 45.09 Telephone $ 31.87 Water $ 13.07 Garbage/Sewer $ 16.33 Fee Other $ _____ TOTAL $ _____ Transportation Gasoline/Oil $ 25.00 Parking $ _____ Tolls $ _____ DATE 10/01/-MONTHLY FIXED EXPENSES Rent/Mortgage Payment Car Payment Other Installments Appliances Furniture Regular Savings Emergency Fund TOTAL ANNUAL EXPENSES Life Insurance Home Insurance Car Insurance Real Estate Taxes $ $ 675.00 178.50 $ ______ $ ______ $ 75.00 $ 50.00 $ 978.50 $ 75.00 $ 240.00 $ 475.00 $1,215.00 Commuting Other Personal Spending Clothing Credit Payments Newspaper, Gifts Pocket Money Entertainment Movie/Theater Sporting Events Recreation Dining Out TOTAL $ _____ $ _____ $ $ $ $ 30.00 60.00 25.00 57.00 $ 5.00 $ 12.00 $ _____ $ 10.00 $505.00 Car Registration Pledges/Contributions Other TOTAL MONTHLY SHARE (Divide by 12) MONTHLY BALANCE SHEET Net Income (Total Budget) Living Expenses Fixed Expenses Annual Expenses TOTAL MONTHLY EXPENSES BALANCE $ 26.50 $ 100.00 $ ______ $2,631.50 $ ______ $ $ $ $ $ $ ______ 505.00 978.50 ______ ______ ______ 32. Use Figure 3.1. What is the Thompsons’ monthly expenditure for personal spending? a. $172.00 c. $245.88 b. $232.00 d. $321.00 33. Use Figure 3.1. What is the Thompsons’ monthly expenditure for household expenses? a. $273.56 c. $287.33 b. $276.83 d. $333.45 34. Use Figure 3.1. What is the Thompsons’ mortgage payment? a. $465.00 c. $765.00 b. $675.00 d. $765.50 35. Use Figure 3.1. How much do the Thompsons spend monthly for real estate taxes? a. $101.25 c. $209.88 b. $125.00 d. $1,215.00 36. Use Figure 3.1. What is the Thompsons’ monthly share of their annual expenses? a. $219.29 c. $312.45 b. $265.09 d. $410.09 Figure 3.2. The table shows the Webster’s monthly expenses for the first three months of the year. Use this table for the questions below. January Mortgage Loan Groceries Electricity Dentist Phone/Internet Gasoline Water/Sewer Credit Card Basketball Game Gift Clothing Car Loan Car Repair February $975.00 Mortgage Loan 275.00 136.50 100.00 45.65 123.40 32.75 80.00 35.00 57.60 189.54 315.50 236.50 Electricity Restaurants Movies Phone/Internet Groceries Gasoline Water/Sewer Credit Card Gift Dry Cleaning Car Loan Home Repair March $975.00 Mortgage Loan 234.00 120.56 35.00 65.45 301.98 129.05 39.65 100.54 28.97 42.39 315.50 150.00 Electricity Doctor Copay Pharmacy Phone/Internet Gasoline Groceries Basketball Game Credit Card Water/Sewer Clothing Car Loan Home Repair $975.00 301.63 25.00 35.00 58.74 90.87 285.62 35.00 125.00 32.75 190.87 315.50 150.00 Vet Bill Total 85.00 Donation $2,687.44 Total 75.00 Fuel Oil $2,613.09 Total 187.66 $2,808.64 37. Use Figure 3.2. What is the average monthly expenditure for the telephone? a. $56.12 c. $56.71 b. $56.61 d. $58.13 38. Use Figure 3.2. Transportation costs include car payments and costs for gasoline, repairs, etc. What is the average monthly expenditure for transportation costs? a. $508.77 c. $528.45 b. $518.77 d. $582.45 39. Use Figure 3.2. What is the average monthly expenditure for all expenses? a. $2,703.06 c. $3,009.06 b. $2,908.76 d. $8,109.17 40. Use Figure 3.2. What is the average monthly expenditure for electricity? a. $136.50 c. $224.04 b. $163.50 d. $242.04 41. The Cohens’ monthly budget allowed them to spend $245.00 for groceries each month. During November they spent $356.82. How much more or less did they spend than budgeted? a. $223.64 less c. $111.82 more b. $111.82 less d. $223.64 more 42. The Flynns’ monthly budget allowed them to spend $555 for household expenses. During June and July they had a room in their home remodeled and spent a total of $2,035 for household expenses. By how much did they overspend? a. $675 c. $925 b. $897 d. $1,200 43. The Bose family’s monthly budget allowed them to spend $155 for personal expenses. To prepare for vacation, their personal spending in June totaled $355. By how much did they overspend? a. $100 c. $300 b. $200 d. $510 44. The Hongs’ monthly budget allowed them to spend $455 for household expenses. During June they spent $235 for household expenses. How much less did they spend than budgeted? a. $220 c. $400 b. $235 d. $455 45. Rafiq Jackson’s monthly budget allows him to spend $175 for groceries. In August he spent $85 and in September he spent $123. How much more or less did he spend than budgeted? a. $142 less c. $152 more b. $132 less d. $175 more 46. Norma Richard’s monthly budget allows her to spend $125 for entertainment. In June she spent $185. How much more or less did she spend than budgeted? a. $76 less c. $45 more b. $60 less d. $60 more 47. Recently Orlando Jones moved into a new house. Now his expense sheet for transportation to work looks like this: Gas/Oil Parking Tolls Commuting $55.60 76.00 14.00 66.00 Before he moved into the new house, Orlando’s budget for transportation was $165 per month. How much more or less are Orlando’s expenses now than the $165 budgeted? a. $46.00 less c. $36.00 more b. $45.70 less d. $46.60 more 48. Bettina Amman is a sales consultant. She travels all over the country selling her company’s products. Her total monthly expenses for June, July, and August were $4,356.01, $9,011.20, and $8,780.00. What was her average monthly expenditure? a. $6,565.00 c. $8,090.25 b. $7,382.40 d. $22,147.21 49. Aneas Arnold sells lighting supplies. She travels all over New England. Her total monthly expenses for August, September, and October were $2,700, $1,100, and $2,200. What was her average monthly expenditure? a. $2,000 c. $3,000 b. $2,200 d. $6,000 50. Betty Glacier is a manufacturer’s representative for a plastics company. She travels all over the country selling her company’s products. Her total monthly expenses for August, September, and October were $2,756.11, $7,111.20, and $5,080.70. What was her average monthly expenditure? a. $3,898.01 c. $4,567.76 b. $3,983.45 d. $4,982.67 51. Ann Day’s monthly budget and actual amount spent for household expenses in June is shown below. How much more or less did Ann spend than she budgeted? Household Electric bill Telephone bill Heating fuel Water bill Cable TV bill Amount Budgeted $45.00 35.00 50.00 24.50 25.00 a. $27.85 less b. $22.50 less Actual Amount Spent $44.00 31.25 25.00 31.75 25.00 c. $22.00 more d. $35.00 more 52. Bella Sanchez’s budget and expenditure for personal items during the month of July is shown below. How much less did Bella spend than she budgeted? Personal Clothing Toiletries Newspapers, gifts a. $24.50 b. $24.55 Budget $30.00 60.00 20.00 Expenditure $32.75 41.00 11.75 c. $32.45 d. $32.55 53. Maya Saharaj keeps records of her expenditures. She wants to know how much she spends each month, on the average. Here are her records for three months. What is her average monthly expenditure? Month August September October Expenditure $6,700.00 2,825.09 2,274.00 a. $3,434.04 b. $3,890.32 c. $3,905.53 d. $3,933.03 54. Cleveland and Briana Baker keep records of their expenditures. They want to know how much they spend each month, on average. Here are their records for 4 months. What is their average monthly expenditure? Month January February March April Expenditure $3,776.77 3,877.32 8,986.43 4,436.98 a. $4,589.98 b. $5,269.38 c. $5,342.98 d. $6,876.88 55. The Cook family bought a new speedboat. How much more or less is the amount they spent than the amount they budgeted? Budgeted: $11,654.00 a. $224.99 less b. $224.87 less Spent: $11,878.99 c. $224.53 more d. $224.99 more Matching Match the following terms with the descriptions. a. b. c. d. hourly rate double time straight-time pay salary e. f. g. h. commission weekly time card piecework gross income ____ 56. A fixed amount of money that you earn on a regular basis ____ 57. An overtime pay rate ____ 58. The total amount of money you earn during a pay period ____ 59. A fixed amount of money for every hour that you work ____ 60. An amount of money you are paid for selling a product or service ____ 61. The total amount of money you earn during a pay period at your regular rate ____ 62. When you are paid a specific amount of money for each item of work completed ____ 63. A daily record of when you report to work and when you leave Match the following terms with the descriptions. a. b. c. d. recordkeeping expenditures budget sheet living expenses e. f. g. h. fixed expenses annual expense expense summary emergency fund ____ 64. Compares the amount you spend with your budget ____ 65. Regular expenses which do not vary from one month to the next ____ 66. The items you spend your money on ____ 67. A tool to record your expenses ____ 68. Expenses that occur once a year ____ 69. A way to manage your money ____ 70. Routine expenses, including amounts for food, utility bills, and pocket expenses ____ 71. Extra money set aside for unpredictable expenses Personal Finance Test Review 2 Answer Section MULTIPLE CHOICE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: 1.1 1.1 1.1 1.1 1.3 1.2 1.2 1.3 1.2 1.4 1.4 1.4 1.4 1.5 1.5 1.5 1.5 1.6 1.6 1.6 1.7 1.7 1.7 1.7 1.3 3.1 3.1 3.1 3.1 3.1 3.1 3.1 3.1 3.1 3.1 3.2 3.1 3.1 3.1 3.1 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: 3.3 3.3 3.3 3.3 3.3 3.3 3.3 3.1 3.1 3.1 3.3 3.3 3.1 3.1 3.3 MATCHING 56. 57. 58. 59. 60. 61. 62. 63. OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 1.1 | 1.2 | 1.3 | 1.4 | 1.5 | 1.6 64. 65. 66. 67. 68. 69. 70. 71. OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: OBJ: 3.1 | 3.2 | 3.3 3.1 | 3.2 | 3.3 3.1 | 3.2 | 3.3 3.1 | 3.2 | 3.3 3.1 | 3.2 | 3.3 3.1 | 3.2 | 3.3 3.1 | 3.2 | 3.3 3.1 | 3.2 | 3.3