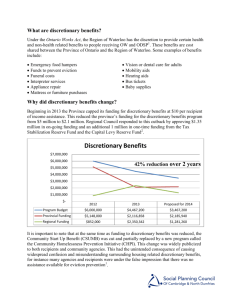

Discretionary Benefits

advertisement

Discretionary Benefits Discretionary Benefits Training Manual History Discretionary Health Benefits • Based on actual expenses Discretionary NonHealth Benefits • $8.75 per case per month Discretionary Benefits Prior to April 1, 2013, First Nations Ontario Works had two (2) discretionary benefits fund with the following funding formula: Effective April 1, 2013, discretionary benefits are no longer separated, they are combined into one (1) discretionary benefits funding allocation. Prior to April 1, 2013 • Discretionary Benefits allocation were based on the fiscal year April - March Effective April 1, 2013 • Discretionary Benefits allocation are based on the calendar year due to the cost sharing formula. 1 Cost Sharing Discretionary Benefits issued on behalf of “status” recipients is cost shared between Ministry of Social and Community Services (MCSS) and Aboriginal Affairs Northern Development Canada (AANDC) based on the cost-sharing formula. 2010 2011 2012 2013 2014 2015 2016 2017 2018 Ongoing First Nations Share 19.4% 18.8 % 17.2% 14.2 % 11.4 % 8.6% 5.8% 2.8% 0% 0% Provincial Share 80.6% 81.2 % 82.8% 85.8 % 88.6 % 91.4% 94.2% 97.2% 100% 100% Discretionary Benefits that are issued on behalf of Non-Status recipients are cost shared at 100% provincial however, all expenses are allocated and deducted from your Fiscal year Discretionary Benefits allocation. 2 Current Funding Discretionary Benefits funding allocation is based on your caseload. Caseloads determination is the combined monthly total of Ontario Works (OW) and Ontario Disability Support Program (ODSP) recipients. • First Nations that have less than 250 cases per month will be allocated an amount of $2, 500 per month ($30, 000 annually) for all health and non-health discretionary items. 250 or more Cases • First Nations with 250 or more cases per month will be allocated based on the capped funding forumal of $10.00 per case per month for all health and non-health discretionary items. Discretionary Benefits Less than 250 cases Group Delivery • Group Delivery Agents will recieve funding based on the combined total of all First Nations caseload within thier organization at a capped rate of $10.00 per case per month. First Nation Ontario Works caseloads that vary from 250-250 + each month, will be reconciled at the end of the fiscal year to determine an annual average of the total cases. 3 Discretionary vs. Mandatory First Nation Ontario Works Administrators must have the ability to distinguish the difference between Discretionary Benefits and Mandatory Benefits. Discretionary Benefits is defined as assistance for non-health related items, and health related for adult members such as dental and vision. Decision of the issuance of Discretionary Benefits issuance cannot be appealed. First Nation Ontario Works Administrations have the authority to approve or deny the issuance of benefits. Discretionary Benefits Mandatory Benfits • Issued on a case by case basis, based on needs and funding availabilty • Capped funding • First Nation develops local policy to guide decision making • Issued to recipeints who meet eligibility • Based on acutual expenses • MCSS approved list of benefits that must be provided It is importation to remember that the funding formula is only for Discretionary Benefits. 4 Eligible Mandatory Benefits are not allocated to discretionary benefits and do not effect allocation. Mandatory Benefits Mandatory Benefits include: Dental for dependent children Vision for dependent children Surgical supplies and dressings Guide dog allowance Discretionary Benefits Medical transportation If a recipient meets eligibility requirements and has supporting documentation to support the need of a mandatory benefit, it must be issued. Denying mandatory benefits can be appealed. 5 What Directive support Discretionary Benefits Under the Ontario Works Directives, 7.1 (Summary of Benefits) provides the following information on Mandatory and Discretionary Benefits. Policy Basic financial assistance includes mandatory and discretionary benefits. Mandatory benefits are provided to all eligible Ontario Works recipients and/or members of the benefit unit. Discretionary benefits are provided on a case-by-case basis at the discretion of the First Nation Ontario Works Administrator to: 1. Persons in receipt of assistance under the Ontario Works Act, 1997, including children on whose behalf Temporary Care Assistance (TCA) is being paid. 2. Persons in receipt of income support under the Ontario Disability Support Program Act, 1997 or 3. A member of a prescribed class, such as a person in receipt of Assistance for Children with Severe Disabilities (ACSD) The First Nation Ontario Works Administrator determines the amount provided for discretionary benefits. 6 What are allowable Discretionary Benefits? Discretionary Health Related 1. Dental Care for adults: Benefits 2. Vision care for adults (eye glasses, including lenses and frames, repairs or replacements) when necessary as a result of a significant change in prescription or to support the person’s employability or participation requirements 3. Prosthetic appliances (the recommendation of an approved health professional and estimate of the cost of such appliances are required) Discretionary Benefits a. Emergency dental care which is necessary to relieve pain for medical or therapeutic reasons b. Dental care which supports the person’s employability or participation requirements 4. Funerals and Burials (recommended maximum of $2250 for funeral and burial or cremation costs) 5. Heating payments and payments for low-cost heating energy conservation measures (may be provided to recipients who are home owners or renters when recipient is responsible for utility) 7 Non-Health Related 1. Vocational training and retraining (when costs do not meet the parameters of training under Employment Related Expenses) 2. Travel and Transportation that is not for health-related purposes (when administrators considers reasonable and appropriate, for example domestic violence, etc.) 3. Moving expenses (The Administrator may approve payments to cover the costs of moving household furniture from one place of residence to another) 4. Any other special service, item or payment authorized by the Director. The following special services, items or payments are currently approved by the Director: 8 o Chiropractic services o Northern allowances for communities north of the 50th parallel without year round road access o Wheelchair and mobility devices (e.g. lifts) batteries, replacement batteries, and necessary repairs) o Provision, replacement and repairs of hearing aids including batteries for the portion not covered by the Assistive Devices Program o Certification of a learning disorder by a qualified medical doctor or psychologist o Cost of an alerting shaking (e.g. lightflasher, bed-shaker or other appropriate alerting mechanism) if the o o o o o o o o o o o Discretionary Benefits o recipient or a member of the benefit unit is deaf or hearing impaired Cost for completing medical forms not covered by OHIP, as required to verify eligibility for assistance, benefits or other required purposes Replacement of repair of essential household furniture and appliances Replacement or purchase of smoke alarms and batteries for recipients who own their homes and are not in receipt of the maximum shelter allowance Replacement of household items and personal effects in emergency situations (e.g. fire, flood, storms) Electric beds to avoid bedsores for persons confined to a bed Air conditioners for severe asthmatics Electric breast pumps Layettes and baby supplies Blood tests required for Applications for Support where the cost cannot be paid by some other means (e.g. Legal Aid) Cost of preparing a will where the cost cannot be paid by some other means (e.g. Legal Aid) Initial deposits required by landlords or others for rent, hydro and heating where necessary Payments for continuation of hydro or heating service, or to prevent eviction, payments for low-cost energy and water conservation measures. 9 Non-Health Related Discretionary Benefit example Form Name of Applicant: Ontario Works Are you currently in receipt of: ODSP Other Explain: Reason for Request: _________________________________________________ _________________________________________________ _________________________________________________ _________________________________________________ Funds requested: Travel and Transportation $ Special Services, Items and Payments $ Non-health related (up to $250) $ Total Amount Approved $ Verification Attached (documentation to support issuance) For example: Doctor or professional note, estimates, etc. Applicant Signature: Date: 10 For in office only: Approved Denied Yes No How do I record Discretionary Benefits? First Nation Ontario Works delivery agents must ensure their software has the capacity to track, monitor and report on all discretionary benefits issued. Under the current system of AD Morrison you will be able to locate the Discretionary Benefits tracking tool by the following: Discretionary Benefits 1. Click on Reporting the main task bar. 2. Another menu will drop down and click on Q. Discretionary Benefits Tracking Tool 11 3. The Discretionary Benefits Tracking Report will appear. The monthly tracking tool will automatically populate at the end of each month that is closed. First Nation Ontario Works must track and monitor expenditures to ensure expenditures are within funding allocations. Once the First Nation depletes the Discretionary Budget, the budget will remain at ZERO until the new Discretionary reporting year. Any unused funds cannot be carried over into the fiscal year. 12 The Ministry of Community and Social Services have made it a requirement that all First Nation Ontario Works delivery agents ensure that they make monthly submissions on the twentieth (20th) of each month to report all Ontario Works expenditures for the month. Discretionary Benefits Discretionary Benefits are tracked on the subsidy claim form. For example; 13 Develop A Local Policy First Nation Ontario Works delivery agents have the authority to create local Discretionary Benefits policies to identify: Eligible Expenses Set rates and amounts for services and payments Identify priority use of funding Determine limits 14 Funerals and Burials Funerals and Burial costs of Ontario Works/ODSP recipients up the guideline amount of $2,250.00 are charged to Discretionary Benefits. First Nation Ontario Works Administrators will need to fill out the Application for Monthly Payment of Provincial Subsidy for Assistance (FORM 5). Capture the Funeral and Burial (up to the provincial guideline amount) in Section 2A Discretionary Benefits Any funerals and burials costs above the $2, 250.00 is 100% provincially reimbursed and must be claimed in the correct line of the subsidy claim. 15 Funeral and Burials Form 5 example 1. Guideline amount should be inserted into 2A – Funerals and Burials 1st $2250 of funeral expenses claimed here 2. Above the Guideline Amount should be inserted 4 Line Item “Other” Any costs above $2250 claimed here 16 Any approved expenses above the guideline amount of $2250.00 are allocated to Section 4- “Other” line item in the 100% provincially funded tab. Recovery of Funeral and Burials or Cremations Costs First Nation Ontario Works delivery agents must recover any amount paid for a funeral, burial or cremation from any person or organization liable for the payment of these expenses. When the First Nation Ontario Works recovers any amount paid for a funeral, burial or cremation from any person or organization liable for the payment of these expenses. Recovery will ensure that: 1. The 100% Provincially Funded portion is repaid first 2. The Funeral and Burial (up to provincial guideline) of $2, 250.00 is recovered. Discretionary Benefits Complete an Assignment of Benefits Form for Canada Pension Plan (CPP) or Old Age Security (OAS) for which the decreased is eligible or may make a claim against the estate. 17 Audit Requirements To ensure First Nation Ontario Works delivery agents are meeting audit requirements, the following is needed on file: 18 1. Review Ontario Works Discretionary Benefits funding to ensure sufficient funds to allow you to provide funding to community members who are social assistance recipients living in municipalities (or another First Nation community) and wish to be buried in their home community (First Nation) 2. First Nation Ontario Work Administrators must demonstrate that all available resources are exhausted or denied to cover the cost of the funeral, and the funeral burial. In addition, ensure that expenses are cost efficient. 3. Allocate the provincial guideline amount of $2, 250.00 for funeral and burial or cremation costs out of your Ontario Works Discretionary Benefits funding. 4. Any approved expenses above the provincial guideline amount of $2, 250.00 is allocated to 100% provincially funded expense item. 5. Proper documentation must be on file to ensure a complete record of monies received from the estate and the repayment is captured on the Application of Monthly Subsidy Form 5, in the month that it is received. Where do I send my Form 5 First Nation Ontario Works delivery agents must send their Form 5 submission by the 20th day of the following month to the Ministry. First Nation Ontario Works delivery agents can submit the signed original claims by mail to the following address: MCSS – Business Unit Sudbury, Ontario P3N 1E5 Email a copy to Aboriginal Affairs and Northern Development Canada (AANDC) Discretionary Benefits 199 Larch Street, Suite 1002 reportsontario@aandc-aadnc.gc.ca If you require further clarification on Discretionary Benefits and or Funerals and Burials contact your MCSS Program Supervisor and/or ONWAA at (705) 942-3157. 19