notice of full redemption

advertisement

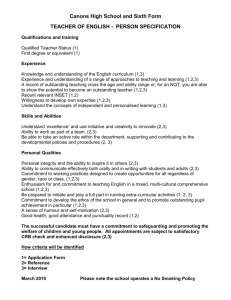

NOTICE OF FULL REDEMPTION State of Missouri lh Building General Obligation Refunding Bonds Series 2002A Notice is hereby given that, pursuant to the redemption provisions of the governing documents authorizing the issuance, sale and delivery of the above-captioned bonds, ALL OUTSTANDING have been called for redemption on October 1, 2012 at the redemption price of 100% of the principal amount thereof, together with interest thereon, to the date of redemption. Interest on the bonds called for redemption will cease to accrne from and after October 1,2012. The Bonds called for redemption are further described as follows: Bond Number All outstanding All outstanding All outstanding All outstanding All outstanding All outstanding All outstanding All outstanding All outstanding Stated Maturity 10/0112013 10/0112014 10/0112015 10/0112016 10/0112017 10/0112018 10/01/2019 10/0112020 10/0112021 Interest Rate 3.375% 5.000% 5.000% 5.000% 5.000% 5.000% 4.125% 4.250% 4.500% Amount of Bonds $10,295,000 $10,720,000 $11,265,000 $11,835,000 $12,450,000 $13,095,000 $13,700,000 $8,460,000 $8,830,000 CUSIP Number* 60630lFTl 60630lFU8 60630 I FV6 60630lFW4 60630lFX2 60630lFYO 60630lFZ7 60630lGAI 60630lGB9 This redemption is conditional upon the sale by the State of Missouri of its Series 2012A Bonds on or before October 1, 2012. Bondholders should assume the Bonds will be paid in full on October 1, 2012 unless otherwise notified by the Paying Agent In order for bondholders to receive payment for the principal amount of called Bonds, the bonds should be presented for payment as follows: Via US Mail First Bank of Missouri c/o Security Bank ofK C Attn: Corporate Trnst P.O. Box 171297 Kansas City, KS 66117 Via Courier or Hand Delivery First Bank of Missouri c/o Security Bank of K C Attn: Corporate Trust 70 I Minnesota Ave, Suite 206 Kansas City, KS 66101 Under the provisions of the Interest and Dividend Tax Compliance Act of 1983, as amended, paying agents making payments of principal on municipal bonds may be obligated to withhold 28% of any such remittance to individuals who have failed to furnish the paying agent with a certified taxpayer identification number. In order to avoid the application of these provisions, bondholders should submit a completed IRS Form W-9 to the paying agent. If you have any questions regarding this redemption, please direct them to Erica Lemon at 913-279-7957. Dated: August 20,2012 First Bank of Missouri as Paying Agent *The CUSIP Number is included solely for the convenience ofthc bondholders. First Bank of Missouri shall not be responsible for the selection or use ofthe CUSIP number, nor is any representation made as to its correctness on this notice or any certificate.