TAX 4001 Concepts of Federal Income Taxation FALL 2013 USF St

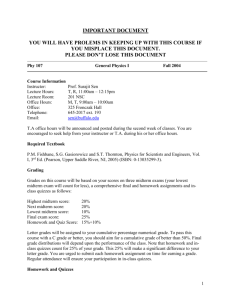

advertisement

TAX 4001 Concepts of Federal Income Taxation FALL 2013 USF St. Petersburg Prerequisites: ACG 3103 and ACG 3341 with a grade of "C" or better (not C-) in each course. Instructor: James A. Fellows, Ph.D, CPA Professor of Accounting USF-St. Petersburg Office: Davis Hall 223 Wednesday: 1:00-1:45pm And by appointment Phone: Fax: Virtual Office: My Virtual Office is open 24/7. You may contact me at any time. I will respond in a reasonably prompt manner, unless there are unforeseen events, such as email shut-downs and other unknown factors. E-mail is the preferred and best way to contact me, other than during my office hours. I am very good about giving a quick turn-around to your email questions. When contacting me via email please use your USF email account. Other personal email accounts are not always accepted by the USF email system. Taxation of Individuals: 2014 Edition (5th edition) Spilker, Ayers, Robinson et. al. Customized Paper-Bound Edition Publisher: McGraw-Hill Available ONLY at the USFSP Book Store [Cost is about $110] ---------------------------------------------------------------------------------------------------------------------------Catalogue course description: Major concepts used in taxation of income by the federal government, including enactment of tax laws, basic tax research, preparation of basic tax returns and exploration of tax policy issues. Text: Instructor course description: This course is a conceptual overview of the fundamental tax rules that affect individual taxpayers. Topics include the concepts of gross income, capital gains and losses, non-taxable exchanges, business income and expenses, tax credits and deductions. As a background for the discussion the policy implications for various income, deduction, or credit rules are discussed. The goal of the course is not to make the student an “expert” in taxation. Rather, the focus of this course is to make the student knowledgeable in the subject of taxation, someone familiar with the general concepts, who then knows how to seek answers to a difficult question. Also, please keep in mind that this course in not a course in “how to prep tax returns.” Reference is often made to tax forms throughout the course, as it is valuable to see how the concepts are applied to the compliance forms. Your required tax project may also involve the preparation of a tax return. Furthermore, there may be some fairly basic questions about the tax forms on each exam. But this is not an in-depth course on how to “fill out tax returns.” 1 The USFSP Program Accountancy has as one of its learning goals that “students completing the bachelor’s degree majoring in Accounting will demonstrate knowledge of business and personal income taxes.” In meeting this learning goal various learning objectives are covered in TAX 4001. Course Goals and Objectives: At the end of this course the student should be able to: a) Understand the concept of gross income and which items of income are taxable; b) Distinguish between deductions for and deductions from adjusted gross income; c) Compute income tax liabilities for taxpayers based on filing status; d) Determine allowed tax deductions for individual taxpayers; e) Compute a capital gains tax. f) Analyze the tax consequences of tax-deferred property exchanges; g) Comprehend the various tax credits that are allowed to individuals, and distinguish between refundable and non-refundable credits; h) Understand basic principles of business taxation; i) Understand basic income tax preparation principles; and j) Understand the basic IRS audit process and relevant tax authorities. In a more global sense, the objectives of this course also seek to expose the student to broader issues in their profession and community, as well as to have the student become proficient in communicative and technical skills. This is accomplished in the following manner: ------------------------------------------------------------------------------------------------------------------------------- Key leadership skills and perspectives addressed in this course: the numbers, ranging from 0 – 5, indicates the amount of emphasis placed on this particular goal or objective. A description of how these goals and objectives are applied follows the table. Interpersonal and Communication Skills Analytical and Critical Thinking Skills Information Technology Skills Reflective Thinking and Experiential Learning Ethical and Social Consciousness Multicultural Competence 2 5 3 5 4 2 INTERPERSONAL AND COMMUNICATIVE SKILLS Each student is expected to participate in class discussion about various tax issues related to individuals and business entities. The in-class problems and discussion of these are integral parts of the course. ANALYTICAL AND CRITICAL THINKING SKILLS These skills will be used throughout the course, from the first day of class to the last. Each student is expected to understand, and critically apply their knowledge of tax law to solve intricate tax problems facing hypothetical clients. The problems assigned at the end of each chapter are especially valuable in this context. INFORMATION TECHNOLOGY SKILLS Each student will be required to use the Internet, especially USF Blackboard, as part of this course. In addition, use of the IRS website may be required to complete a tax return of an individual taxpayer. 2 REFLECTIVE THINKING AND EXPERIENTIAL LEARNING Throughout the class, there will be discussion of actual “real world” examples, e.g., recent court cases, which are based on the Federal tax law being discussed. The student is expected to offer commentary on such contemporary issues. In addition, the course emphasizes that decisions should not be solely “taxdriven.” In other words, the taxpayer should not have as her main purpose the minimization of her tax liability. Each student should clearly understand by the end of this course that sound economic reasoning should dictate the maximization of the taxpayer’s welfare; however she may wish to define it. This does not necessarily imply maximizing monetary worth. ETHICS AND SOCIAL CONSCIOUSNESS Throughout this course there is a discussion of the ethical responsibilities of taxpayers, both individuals and business entities, to comply with the letter and spirit of the law. There will be discussions of penalties involved for misconduct and malfeasance of Federal tax laws. Taxpayers have an obligation to obey the laws of the United States. Title 26 of the U.S. Code of Laws is the Internal Revenue Code. A willful intent to evade tax is a crime, punishable by fines and imprisonment. The instructor places great emphasis on proper compliance with the tax laws. This is not to say that taxpayers can not practice legitimate tax avoidance, which is a legal attempt to lower one’s tax liability. This is different than tax evasion, which is tax fraud and a criminal offense. There are also ethical standards for tax practice that any tax preparer must adhere to. These ethical standards are discussed in Chapter 2 of the text, as well as throughout the course. MULTICULTURAL COMPETENCE Students should be aware of the impact of global issues. Individuals and businesses earn income and conduct commercial activity in foreign locations. There will be discussions in this class of Federal tax law as it applies to foreign income, as well as the Federal tax law surrounding the taxation of foreign citizens and entities doing business within the United States. Attendance Attendance is not mandatory in this class, other than on the first day of class, and at the exams of course. You are not “docked” points for missing class. However, you “cut” class at your own peril. Class discussion and review of the course material is a primary ingredient for doing well in this class. Disabilities Please let the instructor know if you have any disabilities that need to be considered. All reasonable accommodations will be made. The student must have verification of the disability, which requires a written statement of the disability from the Office of Disabled Student Services. Religious Holidays Please let the instructor know if you need to miss class, especially an exam date, for observance of a religious holiday. Reasonable accommodations will be made. 3 Audio and Video Recording: Use of Cell Phone Visual Recording You may audio-record the class. However, video-recording and the taking of photos or other visual images with a cell phone is not allowed. Please respect the privacy of your classmates and your instructor. Academic Dishonesty The University’s policy on academic dishonesty and disruption of the academic process is clearly set forth in the Undergraduate catalogue. This policy will be strictly enforced. Please be advised that punishment for academic dishonesty may result in an automatic “F” in the course, maybe even an “FF,” or action taken that may result in suspension or expulsion from the university. Grade Forgiveness Grade forgiveness allows a student to repeat a course, with the higher grade on the repeat performance completely replacing the earlier grade. This earlier grade is deleted from the GPA calculation. Accounting majors can use the forgiveness policy only once in upper level accounting courses (those numbered 3000 and above). Incomplete Grades An Incomplete, a grade of “I”, can only be given if the student has substantially completed the course, but due to events beyond their control, is unable to complete the course. In all cases, no grade of “I” can be given unless the student has taken all exams except the final exam. Even in that case, the “events beyond their control” criteria must be met by the student. An Incomplete grade cannot be given simply because the student has not prepared adequately for the last exam, and just needs more time to study, nor can an “I” grade be given just so the student can avoid being given a low grade for the course. Cell Phone Usage All cell phones MUST be turned off before coming to class. Exceptions will only be made for practicing physicians who are in the class, because they are the only ones who deal with REAL life and death situations, as opposed to imaginary ones. Failure to abide by this obvious rule of courtesy to one’s fellow classmates (not to mention the instructor) will subject the student to disciplinary action, as outlined under Disruptions of the Academic Process in the University catalogue. When taking your exams, your cell phones must be OFF your table desk. Place them in your purse, book-bags, travel bags, back-packs, on the floor, anywhere but on the table desks. W grade A “W” grade is given to students who have formally withdrawn from the course before the official drop date. The student must complete the withdrawal process through the Office of Admissions and Records, i.e., the Registrar. A “W” grade is not given just because the student stops coming to class, under the false assumption that the instructor will automatically “drop” them from the rolls. The official drop date for this semester is November 2. Students can drop the class any time on or before this date without any academic penalty, i.e., no letter grade other than a “W” is assigned. After that date, the instructor cannot give a grade of “W”. This is university policy. Note that it is the student’s responsibility to officially drop the class. The instructor can NOT drop students from the class. Please consult your advisor if there is any question about proper drop procedures. 4 Examinations There will be three (3) exams during the course. None of the exams are comprehensive. The instructor does NOT drop the lowest grade. These exams will be worth a total of 135 points [Exam 1 = 50, Exam 2 = 40 and Exam 3 = 45]. These exams constitute 135 out of a possible 150 points for the course, or 90% of your grade. There is a class project that counts 15 points, which is 10% of your final grade. Also, please note that the instructor does NOT give any “extra credit” assignments. Please do not ask for any. Format of exams Each of the three (3) exams is a multiple-choice exam, with the vast majority of the questions being problem solving, in which you must derive a correct numerical answer. Each question will be worth one point. No partial credit is given for multiple-choice exams, as you have the possibility of guessing answers correctly. -------------------------------------------------------------------------------------------------------------------The 76 Percent Solution: At the end of the semester, after all exams and projects for all sections of the class have been graded, I will ensure that the overall average is a minimum of 114 out of 150 [76%]. If the overall average is less than 114, points will be added to ALL students’ point totals, so that the class average is at a minimum of 114. If the overall class average is 110, and your point total is 118, I will add 4 points to all student scores, including yours, so that you now have a 122. This increases your final letter grade from C+ to B. When there is more than one section of the class in a semester, the 76 Percent Solution is implemented using the average of all sections combined. --------------------------------------------------------------------------------------------------------------------Each student is allowed to bring into the exam four (4) pages of “information pages,” on which can be written helpful notes and hints. You may write on the front and back of these pages, but you can NOT bring in 8 pages with writing on just one side of each page. Four pages, with notes on front and back allowed. If necessary, staple together two separate pages front to back of each other so that is in effect just one page. However, you cannot attach to any of the four pages what I call “flappers.” These are smaller pages attached to four main pages that “flap” loosely from the page. Penalties will be assessed for not following these instructions. You may of course “word process” these pages, using as small a font as possible. The page sizes can be no larger than 8½” x 11". NO SCRATCH PAPER IS ALLOWED. You may only use your information pages. There is plenty of space on the exam for “scratch work.” Each student must turn in these information pages with the exam. Please put your name on each page. If you wish make copies of the information pages, please do so before the exam and retain the copy. PLEASE BRING NUMBER 2 PENCILS TO THE EXAM. THE EXAMS ARE SCANTRON GRADED. THANK YOU. Exam Period with Multiple Sections of TAX 4001 Students are required to take exams with the section in which they have enrolled. It is not permissible to take the exam in the later section of TAX 4001 simply because more time is needed to study for the exam. This is unfair to the other students in the earlier section and thus will not be allowed. Cell Phones and Headsets All cell phones must be turned off and off your desk when taking the exams. In addition you are not allowed to wear any headsets or other listening devices while taking the exam. You can NOT use your cell phone or smart phone as a calculator. 5 Calculators Calculators may be used during the exam. Calculators that store formulas or text in memory are not allowed on accounting examinations. This is Program of Accountancy policy. Violation of this policy subjects the student to the university rules on academic dishonesty, as discussed above. Violation of this rule subjects the student to academic penalties. Review and Retention of Exams Exams will be reviewed during the LAST HOUR of the class following the exam date. I will retain the exams in my office until the end of the following semester. I do post grades on Blackboard. Exam scores are usually posted within a few days of the exam. Please be patient. Make-Up Exams Make-up exams can only be given if the student has made every effort to meet the exam date, but due to unforeseen circumstances, is unable to be there. Work commitments that require you to be out of town are an acceptable excuse, as is of course an illness. But make-up exams cannot be given just to give a student more time to study for the test. This includes students in the earlier section of the class taking the exam with the later section of that same week. Also, the student cannot delay taking the exam because he or she has another exam on the same day. The instructor has sole authority for determining what an acceptable excuse for taking a make-up exam is. Also, the instructor reserves the right to prepare a make-up exam that is different in style and manner than the regular exam. ALL MAKE-UP EXAMS ARE GIVEN DURING THE WEEK BEFORE FINAL EXAM WEEK. THE MAKE-UP WEEK IS THE WEEK OF DECEMBER 2-6. THERE IS NO EXCEPTION. Course Project: Each student must complete and turn in a course project. The course project and requirements can be found under “Course Documents” in Blackboard. This project is worth a maximum of 15 points. There is a power point narration in “Course Documents” that also explains the project. The project must be submitted through the “Assignments” section of Blackboard by the due date. Homework Problems: Each chapter has assigned homework problems. You should work these out after reading the chapter, and before coming to class. I do not collect homework or grade it, but without a proper study of the chapter, to include effort on the homework problems, the class lecture could be a “great fog” to you. I will review assigned problems on occasion, typically by special requests. Solutions to all the assigned problems will be posted at the course site on Blackboard. Look under Course Documents. --------------------------------------------------------------------------------------------------------------------------- 6 Additional Assignments outside of text and in-class lectures: There is some additional material posted on Blackboard. Others may be posted as needed. I will inform you if I do so. These are required study. All of these are Power Point Lecture Narrations at the Blackboard course site. Except for the Overview of Form 1040 and the explanation of Problem 54 in Chapter 6, they are also available just in readable Word format at Course Documents at the Blackboard course site, if you prefer this method of “silent” study. 1. 2. 3. 4. 5. 6. 7. 8. Overview of Form 1040 (Power Point Narration only) Tax computations to supplement Chapter 4 Dependents and Head of Household Filing Status: Chapter 4 Explanation of Problem 56 in Chapter 6 (Power Point Narration only) Earned income credit problems to supplement Chapter 7 Additional depreciation problems to supplement Chapter 9 Additional problems to supplement Chapter 10 Additional capital gain and loss netting problems to supplement Chapter 11 Grading Policy Final course letter grades will be distributed as follows, based on your final course point totals. Please note that I give “plus” and “minus” grades. Quality Points Awarded A+ = 144 - 150 4.00 A = 137 - 143 4.00 A= 134 - 136 3.67 B+ = 130 - 133 3.33 B = 121 - 129 3.00 B= 119 - 120 2.67 C+ = 115 - 118 2.33 C = 105 - 114 2.00 C= 100 - 104 1.67 D+ = 96 - 99 1.33 D = 90 - 95 1.00 F = Below 90 0.00 7 COURSE OUTLINE Topical Coverage for Each Chapter: Note that page numbers cited refer to the smaller hyphenated page numbers in the upper left and right corners of the book pages, closest to the binding. ---------------------------------------------------------------------------------------------------------------------------August 29: Course Introduction Chapter 2: Tax Compliance and the IRS Omit discussion of Tax Research on pp. 2-17 through 2-23. Assigned Problems: 43-49, 53-55, 76-77 Additional Assignment-Power Point Narration: Overview of Form 1040 ---------------------------------------------------------------------------------------------------------------------------September 5: Chapter 4: The Individual Tax Formula Omit Example 4-8 on p. 4-14. Omit discussion of Multiple Support Agreements at the bottom of page 4-15. Omit the “What if” scenario at the top of page 4-17 that deals with multiple support agreements and Anita’s grandfather Juan. Assigned Problems: 26-27, 32-35, 40, 43-46, 47(a)(b)(c)(d), 48, 49 Additional Assignment-Power Point Narrations: Tax Computation-Ch. 4 supplement; And Dependents and Head of Household Filing Status --------------------------------------------------------------------------------------------------------------------------September 12: Chapter 5: Gross Income and Exclusions Omit Claim of Right doctrine on page 5-7. Omit Community Property Systems on pp. 5-8 and 5-9. Omit discussion of Social Security computations on pp. 5-18 and 5-19. Just study the power point slide on this topic. Omit Imputed Income on pp. 5-19 and 5-20. Omit Gain on Sale of a Personal Residence on pages 5-22. We will discuss this issue in detail in Chapter 14. Omit Other Educational Subsidies on pp. 5-25 and 5-26. In the discussion on Foreign Earned Income you can omit the discussion of foreign housing costs provided by the employer. This is on page 5-28. Assigned Problems:38, 42(a)(c)(d), 45-48, 50-51, 55(a)-e), 60, 62 (omit housing costs issue), 63, 65(a)(b),66, 67(a)(b)(c),69, and 70. -----------------------------------------------------------------------------------------------------------------------------September 19: Chapter 6: Individual Deductions Omit discussion of Deduction for Qualified Education Expenses on pp. 6-11 and 6-12. Omit discussion at the top of page 6-21 and related Example 6-20 on donations of tangible personal property used for unrelated purposes. Omit discussion of Private Nonoperating Foundations on page 6-22. In Exhibit 6-9 ignore the third column, and Step 3 in the discussion above Exhibit 6-9 is not required. Assigned Problems: 36-39, 41,44,46-47, 50, 52-53, 56(a)(c)(e), 58, 60,61,63 Additional Assignment: Power Point Narration: Chapter 6-Problem 56 ------------------------------------------------------------------------------------------------------------------------------September 26: Chapter 7: Computation of Tax and Tax Credits Omit Example 7-5 on page 7-6. Omit discussion of the Kiddie Tax on pp. 7-7 to 7-9; Omit discussion on page 7-20 of the 8-step process for the Medicare tax that begins with the first full paragraph. Omit Example 7-18 related to this discussion. For this chapter the self-employment earnings will always be less than $200,000.Omit Example 7-24 on pages 7-31 and 7-32.Omit discussion of Prepayments and Filing on pages 7-37 to 7-41. Assigned Problems: 49(a)(b)(d), 52, 53, 56-57,63,66,67,72-74,76-78 Additional Assignment: Power Point Narration-EIC Problems --------------------------------------------------------------------------------------------------------------------------October 3: EXAM 1: Chapters 2, 4-7 [50 points] ---------------------------------------------------------------------------------------------------------------------------- 8 October 10: Chapter 8: Business Income and Deductions Omit the discussion of foreign travel at top of page 8-9 and the What if scenario to Example 8-8 on page 8-10.Omit discussion of Domestic Manufacturing Deduction on pages 8-11 to 8-13. Omit discussion of Accounting Periods on pp. 8-15 to 8-16. We assume in this course that all taxpayers, including business entities, use the calendar year for tax reporting. Omit the discussion of Advanced Payment of Goods and Inventories on pages 8-20 through 8-23. For the discussion of Payment Liabilities on page 8-26, omit all items from Exhibit 8-4 except Worker’s compensation, torts, breach of contract, violations of law and taxes. Omit the discussion of the Recurring item exception on page 8-27 up to Exhibit 8-5.Omit discussion of Changing Accounting Methods on page 8-33. Assigned Problems: 45-49, 57, 60, 62, 64, 65(a)(b), 69, 70, 72, 75, 76 (a)-(d), 77, 79 ---------------------------------------------------------------------------------------------------------------------------October 17: Chapter 9: Property Acquisition and Cost Recovery Omit discussion of Mid-Quarter Convention on pp. 9-10 to 9-14. We assume this convention does not apply in this course. Omit the discussion on pages 9-23 and 9-24 on when Listed Property falls below 50% business use in subsequent years. Omit depreciation for the AMT on page 9-27. In the discussion of Patents and Copyrights on page 9-34, omit any reference to copyrights. Just concentrate on the discussion of Patents. Omit Depletion on pp. 9-36 to 9-38. Assigned Problems: 38-39, 41-44, 46, 52(a)-(d), 53, 63(a)(b), 64, 66(a)(b), 67(a)(b)(d),68-69 Additional Assignment: Power Point Narration: Ch. 9 Additional Depreciation Probs ----------------------------------------------------------------------------------------------------------------------------October 24: Chapter 10: Property Dispositions In the discussion of Section 1245 Property on pp. 10-8 through 10-11 just read and study Scenarios 1 and 3. Omit Scenario 2. Omit Examples 10-6 and 10-8, which are connected with the omitted Scenario 2. Omit discussion of §1250 Recapture for Real Property on pp. 10-11 and 10-12 and Example 10-9. Omit discussion of Characterizing Gains on the Sale of Depreciable Property to Related Parties on page 10-14. Omit Example 10-11. Omit Gains Ineligible for Installment Reporting on pp. 10-32. Assigned Problems: 32-35, 37(a)(c), 40, 50-52, 56, 58-59, 63 Additional Assignment: Power Point Narration: Additional Section 1231 Problems ----------------------------------------------------------------------------------------------------------------------------October 31: EXAM 2: Chapters 8-10 [40 points] --------------------------------------------------------------------------------------------------------------------------- 9 November 7: Chapter 11 and 14 (partial): Investments Chapter 11: Omit discussion of Corporate and U.S. Treasury Bonds and U.S. Savings Bonds on pages 11-4 through 11-7. Omit discussion of Qualified Small Business Stock on page 11-12. The only “28% capital gain” we will discuss are Collectibles, e.g., works of art, gold coins, etc. Omit discussion relating to Example 11-10 beginning on page 11-19 [right after Example 11-9] and on pages 11-20 and 11-21. We assume in this chapter that all taxpayers are in the 33% tax bracket or higher. Omit discussion of Life Insurance and Educational Savings Plans on pp. 11-26 to 11-29. Omit discussion of Portfolio Investment Expenses on pp.11-31 to 11-35. Chapter 14: Loss rules for rental property. Read and study only Passive activity loss rules on pages 14-24 to 14-26. Omit Exhibit 14-6 on page 14-25. Assigned Problems-Chapter 11: 56,59, 65-68, 81-82, 84. Assigned Problems-Chapter 14: 67-68 Additional Assignment: Power Point Narration: Additional Capital Gain Netting Problems -------------------------------------------------------------------------------------------------------------------------November 14: Chapter 12: Compensation Omit Tax Planning with Fringe Benefits on pp. 12-31 and 12-32 Assigned Problems: 27, 28, 32, 35, 36(a)(b), 38-41, 48-50, 53-55 -------------------------------------------------------------------------------------------------------------------------November 21: Chapter 13: Retirement Savings and Deferred Compensation Omit pp. 13-3 to 13-6 on Defined Benefit Plans. Omit pp. 13-15 to 13-19 on Nonqualified Deferred Compensation. Omit discussion of traditional IRAs and married taxpayers who file separately at the bottom of page 13-21. Omit discussion of Nondeductible IRA contributions on pages 13-22 and 13-23. Omit the discussion of Roth IRAs and married taxpayers filing separately at the bottom of page 13-23. Assigned Problems: 52(a)-(c), 53, 61, 62, 63(a)-(c), 65, 66(a), 67(a), 69(a)(b), 72, 80, 81(a)-(d) ----------------------------------------------------------------------------------------------------------------------------November 28: NO CLASS. THANKSGIVING HOLIDAY -----------------------------------------------------------------------------------------------------------------------------December 5: Chapter 14: Tax Consequences of Home Ownership Omit the discussion of the “break-even” analysis for points and its accompanying Examples 14-10 and 14-11 on pages 14-14 and 14-15. Omit Rental Use of the Home on pp. 14-18 to 14-24. However, study the section on Losses on Rental Property. ( This was also assigned with the Chapter 11 material). Assigned Problems: 40-44, 47-48, 52, 56, 61-62, 67-68, 71,72(a)(b)(d), 73. TAX PROJECT IS DUE by 10pm [15 points] Submit completed project through Assignments module in Blackboard Review Power Point Narration at Blackboard on the Tax Project ------------------------------------------------------------------------------------------------------------------------------ December 12: EXAM 3: Chapters 11-14 [45 points] ------------------------------------------------------------------------------------------------------------------------------- 10