independent review of the combined financial results of

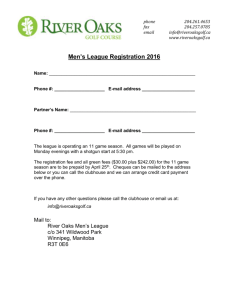

advertisement