Session 7 Lecture Notes

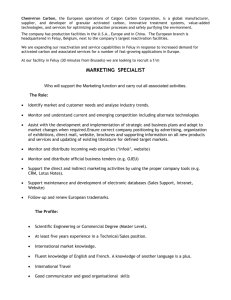

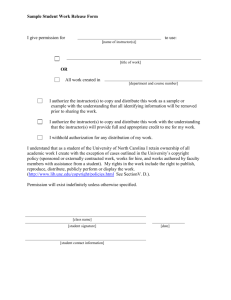

advertisement

“…it should be understood that forecasts have no intrinsic value. They acquire value through their ability to influence the decisions made by users of the forecasts.” Allan H. Murphy, 1993 “What is a Good Forecast? An Essay on the Nature of Goodness in Weather Forecasting” 1 MBA elective - Models for Strategic Planning - Session 7 The Value of Information Essential ideas Information must influence your decisions to have any value Value of Information = the increase in Expected Value from having information over not having it Real information is often incomplete, unreliable: ‘Perfect Information’ provides an upper bound on information value Value of Information determines an optimal information search, rather than a perpetual plea that “more research is needed” Real Options share close similitude with Perfect Information: both derive their value from avoiding the downside, or capitalizing on the upside, of a risk © 2009 Ph. Delquié 2 • Information Any piece of knowledge liable to alter your beliefs about the uncertainties you are facing Ex: forecasts; experts’ opinions; results of market studies, surveys,... • Reliability of information - Real information is less than perfectly reliable: Prob[ X happens given Information predicts so ] < 100% Forecasts contain error; Survey results inaccurate; Experts fallible1 - However, not always possible to assess reliability of information - Thus, introduce the concept of “Perfect” information • Perfect information - Predicts outcomes with 100% reliability - The value of perfect information will provide an upper bound on the value of any information 3 Example: Marketing Strategy (from Exercise Set) The management of a motion picture studio has determined the following payoff table for marketing choices for a new film (the amounts are in millions of dollars): Box Office Result Distribute as ‘A’ Feature Distribute as ‘B’ Feature Sell to TV network Success 25 15 5 Failure -10 -5 5 The probability that this new production will be a hit has been judged initially at 30%. The studio is considering to obtain a pre-release forecast based on various studies (such as a series of sneak previews, or opinion markets, e.g., www.hsx.com) before deciding how to market the new film. Historically, it has been found that favorable forecasts have been obtained for 70% of all successful films, while unfavorable forecasts have resulted from 80% of the box office failures subjected to such experimentation. a) Build a decision tree model to analyze this problem. b) What probabilities should be assigned to box office success, if the sneak preview is favorable? If the sneak preview is unfavorable? c) If a sneak preview results in a net cost of $500,000, would you recommend it be taken? (Assume that choices are based on expected values.) 4 Calculations – Value of Perfect Information Decision with Perfect Information Decision without information Decision Uncertainty Suppose a “Clairvoyant” could foretell the outcome with 100% reliability1 Perfect Information Payoff Information Message Decision given Information 0.3 Box-office Success 25 25 Distribute as A feature 0.3 1Box-office Success! EV = 0.5 0.7 Box-office Flop Distribute as B feature 1 -10 Sell to TV network Clairvoyant affirms1 15 5 11 Distribute as B feature EV = 15 25 0.3 Box-office Success 3 Payoff Distribute as A feature Distribute as A feature -10 1 0.7 Box-office Flop 0.7 1Box-office Flop! Distribute as B feature -5 3 -5 5 Sell to TV network Sell to TV network 5 EV = 5 5 EV without information = $5M ≤ EV with perfect information = $11M Expected Value of Perfect Information (EVPI) = ∆EV = 11 – 5 = $6M 5 Calculating the Expected Value of Perfect Information (EVPI) 1. Draw the tree of Perfect Information messages + their subsequent decisions 2. Calculate EV of above tree: that’s EV with Perfect Information 3. Calculate increase in EV due to perfect information: EVPI = EV with (costless) Perfect Info − best EV without info Perfect Information is, by definition, the highest quality information, therefore EVPI provides an upper limit on the value of any information about the uncertainty at hand. 6 Calculating EVPI (cont’d) In a decision tree, obtaining Perfect Information amounts to inverting the decision–chance sequence: without PI with PI Decide, then find out Find out, then decide → EV without information ≤ EV with perfect information 7 Calculating the Expected Value of Imperfect Information (EVII) • EVII defined similarly as EVPI: EVII = EV with (costless) Imperfect Info − best EV without the Info • Notes: - Cost of Imperfect Info is not included in calculating EVII. - EVPI ≥ EVII ≥ 0 • (always!) Information is worth acquiring if its value exceeds its cost, that is, if: EVII > Cost of Information 8 Calculations – Value of Imperfect Information Im perfect Inform ation Inform ation Message Decision given Inform ation Uncertainty Payoff 0.60 Box-office Success 25 Distribute as 'A' feature 11 0.40 Box-office Flop -10 0.60 Box-office Success 0.35 Favorable 15 1 Distribute as 'B' feature 11.00 7 0.40 Box-office Flop -5 Sell to TV network 5 Run Sneak Previews 5 0.14 Box-office Success 7.10 25 Distribute as 'A' feature EV with imperfect information = $7.10M -5.15 0.86 Box-office Flop -10 0.14 Box-office Success 0.65 Unfavorable 15 3 Distribute as 'B' feature 5.00 -2.23 0.86 Box-office Flop -5 Sell to TV network 5 5 Expected Value of Imperfect Information (EVII) = 7.10 – 5 = $2.10M < EVPI 9 Practical interest of EVPI • Provides a quick upper bound estimate on whether real information may be worth acquiring • No need to know actual information reliability to calculate EVPI • When facing multiple uncertainties, EVPI may help prioritize which ones are most worthy of further research 10 To do for next session( Review Solution Set 7 To be posted on website shortly Prepare Exercise Set 8 Topic: Risk preferences Exercise 8.1: may be a bit tricky, take a look but don’t spend time (will be revisited in Session 10) Case “Measuring Your Risk Attitude”: - the ASSESS program can be installed on your PC - Measure your risk tolerance using both the CE method and PE method. No need to turn in a report, just be prepared to show and debrief the findings from your experiment 11