chapter 2d – officers and employees

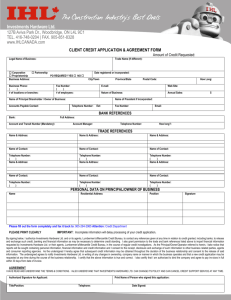

advertisement

Part 2D.1 – Duties and powers Division 1 – General duties [180.10] s 180 CHAPTER 2D – OFFICERS AND EMPLOYEES Part 2D.1 – Duties and powers 179 Background to duties of directors, other officers and employees (1) [Coverage of Part] This Part sets out some of the most significant duties of directors, secretaries, other officers and employees of corporations. Other duties are imposed by other provisions of this Act and other laws (including the general law). (2) [Director and officer defined] Section 9 defines both director and officer. Officer includes, as well as directors and secretaries, some other people who manage the corporation or its property (such as receivers and liquidators). DIVISION 1 – GENERAL DUTIES 180 Care and diligence—civil obligation only Care and diligence—directors and other offıcers (1) A director or other officer of a corporation must exercise their powers and discharge their duties with the degree of care and diligence that a reasonable person would exercise if they: (a) were a director or officer of a corporation in the corporation’s circumstances; and (b) occupied the office held by, and had the same responsibilities within the corporation as, the director or officer. Business judgment rule (2) A director or other officer of a corporation who makes a business judgment is taken to meet the requirements of subsection (1), and their equivalent duties at common law and in equity, in respect of the judgment if they: (a) make the judgment in good faith for a proper purpose; and (b) do not have a material personal interest in the subject matter of the judgment; and (c) inform themselves about the subject matter of the judgment to the extent they reasonably believe to be appropriate; and (d) rationally believe that the judgment is in the best interests of the corporation. The director’s or officer’s belief that the judgment is in the best interests of the corporation is a rational one unless the belief is one that no reasonable person in their position would hold. Note: This subsection only operates in relation to duties under this section and their equivalent duties at common law or in equity (including the duty of care that arises under the common law principles governing liability for negligence)—it does not operate in relation to duties under any other provision of this Act or under any other laws. (3) [Business judgment defined] In this section: business judgment means any decision to take or not take action in respect of a matter relevant to the business operations of the corporation. [Cross-references: ASIC: • Form EX01: Schedule B of Regulatory Guide 16 Report to ASIC under s 422, s 438D or s 533 of the Corporations Act 2001 or for statistical purposes; • RG 16: External administrators: Reporting and lodging; • RG 76: Related party transactions; • RG 94: Unit pricing: Guide to good practice; • RG 109: Assetless Administration Fund: Funding criteria and guidelines; • RG 186: External administration: Liquidator registration; • RG 217: Duty to prevent insolvent trading: Guide for directors.] [180.10] Scope Directors are responsible for the management and control of the company (see further s 198A). In light of this important role, directors bear strict legal duties, both at general law and under Pt 2D.1 of the Act, to act appropriately in governing the company’s affairs. One of the central duties is the obligation to act with care and diligence, known at common law as the duty to act with “care, skill and diligence”. Section 180(1) contains the equivalent statutory obligation, although it does not retain the reference to skill. However, judicial comment suggests that the omission of “skill” does not diminish the nature or strictness of the obligation to act with care and diligence, nor does it remove issues of appropriate skill from consideration. Section 180(1) sets out an objective test to measure the reasonableness of actions taken by directors or officers, requiring them to demonstrate the same degree of care and diligence that would be required of an ordinary reasonable person holding a similar position in the same circumstances. The strength of this © 2015 THOMSON REUTERS 211 CA ss 112-253N Note: This subsection is a civil penalty provision (see section 1317E). s 180 Chapter 2D – Officers and employees [180.20] objective standard is not diminished by the fact that the director is a non-executive, rather than an executive, director. However, the position held by the defendant director and the director’s responsibilities are clearly relevant for determining what a reasonable person would do in similar circumstances. Several high-profile cases concerning s 180 in recent times, including those involving former directors of HIH, One.Tel and James Hardie, have been vigorously defended by the former directors, giving rise to multiple cases on a range of aspects of legal procedure. However, some of these issues are more appropriately dealt with under more specific provisions of the Act. Therefore, reference should also be made to the annotations accompanying ss 206C, 1317E and 1317G. Recent significant decisions include the New South Wales Court of Appeal’s decisions in Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 (appeal on liability) and Vines v Australian Securities & Investments Commission (2007) 63 ACSR 505; 25 ACLC 867; [2007] NSWCA 126 (appeal on penalty). Whilst the first decision largely confirmed the lower court decision of Austin J (with 3 grounds of appeal upheld), there were some significant departures on assessment of liability. This in turn led the same Court of Appeal to revise significantly the decision of Austin J on penalties (see [180.40]). Another significant decision is Australian Securities & Investments Commission v Rich [2009] NSWSC 1229, discussed below at [180.20]. [180.20] Concepts Business judgment: Compliance with the business judgment rule will ensure a director or officer discharges his or her obligations under the Act. However, the rule cannot be used as a “safe harbour” where a director or officer neglects to make a business judgment or makes a judgment not in good faith for a proper purpose: Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171 at [453] per Santow J. The definition in s 180(3) can only be invoked by a director who has made a decision and cannot be relied on by a director who did not turn his mind to a question: Great Southern Finance Pty Ltd (in liq) v Rhodes [2014] WASC 431 at [46]. Discharge of duties: Directors are required to take the necessary steps to enable them to guide and monitor effectively the management of the company: Daniels v Anderson (1995) 37 NSWLR 438; 118 FLR 248; 16 ACSR 607; 13 ACLC 614. Occupied the offıce held by, and had the same responsibilities within the corporation: In Australian Securities & Investments Commission v Vines (2005) 55 ACSR 617; 23 ACLC 1,387; [2005] NSWSC 738, Austin J considered (at [1057]ff) that the standard imposed by s 180 required consideration of all of the circumstances of the officer’s role (including job description and what others within the corporation expected the officer to do) including any special tasks or responsibilities that the officer had. (In that case his Honour held that there was no difficulty in applying the statutory standard to an officer who had a special role within the corporation which did not fit neatly into the term “CEO” or “CFO”.) The wording appears to be intended to make it clear, after Daniels v Anderson, that non-executive directors are not subject to the same standard as executive directors, and partly to affirm that the standard is an objective one: Australian Securities & Investments Commission v Rich [2009] NSWSC 1229 at [7196]. The reference to the “same responsibilities within the corporation” is not limited to the specific tasks delegated to the particular director or officer by formal means such as the company’s constitution or a resolution: Australian Securities & Investments Commission v Rich (2003) 174 FLR 128; 44 ACSR 341; 21 ACLC 450; [2003] NSWSC 85 at [49]–[50]; Australian Securities & Investments Commission v Rich [2009] NSWSC 1229 at [7202]. Offıcer: It is important to note that this section applies not only to directors but also to officers: “officer” is defined broadly in s 9. See also Australian Securities & Investments Commission v Vines (2005) 55 ACSR 617; 23 ACLC 1,387; [2005] NSWSC 738. The Corporations and Markets Advisory Committee (www.camac.gov.au) has recently recommended the expansion and clarification of the duties under this section to cover officers more junior than those to which it currently applies, by including any person who takes part in or is concerned with the management of the corporation. Reasonable person: Assessing what a reasonable ordinary person, having the same skills and knowledge and acting on his own behalf, would do in the circumstances, will assist in determining reasonableness: Permanent Building Society (in liq) v Wheeler (1994) 11 WAR 187; 12 ACLC 674; 14 ACSR 109; Australian Securities Commission v Gallagher (1993) 11 WAR 105; 10 ACSR 43; 11 ACLC 286. In Australian Securities & Investments Commission v Vines (2005) 55 ACSR 617; 23 ACLC 1,387; [2005] NSWSC 738, Austin J held (at [1070]ff) that it was appropriate to refer to the principles developed 212 Corporations Act 2001 Part 2D.1 – Duties and powers Division 1 – General duties s 180 under the law of professional negligence in determining the content of the duty of care owed by company directors and officers. His Honour also held that liability under s 180 arises because of negligent conduct, not a mere mistake (at [1076]–[1077]). On appeal, Spigelman CJ (with whom Ipp JA agreed) held that the standard of care under s 180(1) was similar to that imposed by the law of negligence (see Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 at [137], [142]). Reasonable degree of care and diligence: A director’s statutory duty to exercise a reasonable degree of care and diligence cannot be defined without reference to the nature and extent of the foreseeable risk of harm to the company that would otherwise arise. No act or omission is capable of constituting failure to exercise care and diligence under the section, unless at the relevant time it was reasonably foreseeable that the act or omission might cause harm to the interests of the company: Vrisakis v Australian Securities Commission (1993) 9 WAR 395; 11 ACSR 162; 11 ACLC 763 at 212 (ACSR); Australian Securities & Investments Commission v Doyle (2001) 38 ACSR 606; [2001] WASC 187 at [222]; Australian Securities & Investments Commission v Maxwell (2006) 59 ACSR 373; 24 ACLC 1,308; [2006] NSWSC 1052 at [102]; Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 at [595]–[600]; Australian Securities & Investments Commission v Rich [2009] NSWSC 1229 at [7193]–[7196]. Corporation’s circumstances: Consideration must be given to the type of company involved; the size and nature of its business or businesses; the provisions of its constitution; the composition of the board and the distribution of the work between the board and other officers; the status of the company as a listed or unlisted entity; and, in the case of a parent company, the size and nature of the businesses of its subsidiaries if they are under the general supervision of the parent: Australian Securities & Investments Commission v Rich [2009] NSWSC 1229 at [7201]. [180.30] Key cases The key decision concerning the duty of care and diligence is Daniels v Anderson (1995) 37 NSWLR 438; 118 FLR 248; 16 ACSR 607; 13 ACLC 614 (AWA case), where the New South Wales Court of Appeal imposed on all company directors the fundamental obligation to take the necessary steps that will enable them to effectively guide and monitor the management of the company (see Daniels v Anderson at 501 (NSWLR) per Clarke and Sheller JJA). As to what the obligation to “effectively” monitor entails, the Court stated that the nature, size and complexity of the company assist in determining the content of that obligation. The decision of Santow J in Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171 has also become highly influential in recent times, providing a useful summary of the cases and legal principles at [372]. Reference should also be made to Austin J’s decisions in Australian Securities & Investments Commission v Vines (2003) 48 ACSR 291; [2003] NSWSC 1095 and Australian Securities & Investments Commission v Vines (2005) 55 ACSR 617; 23 ACLC 1,387; [2005] NSWSC 738 where his Honour engaged in a detailed consideration of the requirements of s 180. An appeal against Austin J’s decision in Vines was successful with respect to several (but not all) specific contraventions: Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75. Objective assessment The standard adopted until recently was based on a subjective assessment of what could reasonably be required given the particular director’s abilities (see Re City Equitable Fire Insurance Co Ltd [1925] Ch 407). However, the AWA case (Daniels v Anderson (1995) 37 NSWLR 438; 118 FLR 248; 13 ACLC 614; 16 ACSR 607) found (at 500 (NSWLR) per Clarke and Sheller JJA) that while there is no doubt reason for establishing a board which enjoys the varied wisdom of persons drawn from different commercial backgrounds … a director, whatever his or her background, has a duty greater than that of simply representing a particular field of experience. This demonstrates that directors and other company officers will not be able to rely on a lack of skills or knowledge to avoid liability. In Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171 at 347 (FLR), [372] Santow J made the following comment regarding the objective assessment of officer’s conduct: [I]n determining whether a director has exercised reasonable care and diligence one must ask what an ordinary person, with the knowledge and experience of the defendant might be expected to have done in the circumstances if he or she was acting on their own behalf. © 2015 THOMSON REUTERS 213 CA ss 112-253N [180.30] s 180 Chapter 2D – Officers and employees [180.30] See also Permanent Building Society (in liq) v Wheeler (1994) 11 WAR 187; 12 ACLC 674; 14 ACSR 109 at 159 (ACSR) per Ipp J. In Australian Securities & Investments Commission v Vines (2005) 55 ACSR 617; 23 ACLC 1,387; [2005] NSWSC 738, Austin J considered that the content of the defendants’ duty of care (ie what a reasonable officer actually would have done in the same circumstances) was heavily influenced by the purpose of the officer’s actions (in that case providing disclosure to target shareholders in a hostile takeover), so that the requirements of the duty were particularly high because of the known reliance and vulnerability of the target company’s shareholders (at [1085]). His Honour also found that the standard of care was not lowered by the fact that a breach of s 180 could give rise to civil penalties (at [1094]). This was confirmed on appeal: Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 (although Santow JA, in dissent, took a different view of Vines’ responsibility within the company). The issue of when it is reasonable for a director or other company officer to rely on information or tasks performed by others has been considered in a number of cases including the AWA case, where it was held that reliance would be reasonable only where the officer had sufficient monitoring systems in place so as to be aware of possible internal irregularities. It is never acceptable to blindly delegate responsibility: see eg Sheahan v Verco (2001) 79 SASR 109; 37 ACSR 117; 19 ACLC 814; [2001] SASC 91 (complete delegation to managing director). See further s 189 and the annotations accompanying s 588H. The content of the requirement of diligence: executive and non-executive directors The content of the requirement of diligence, as it applies to both executive and non-executive directors, is discussed in Australian Securities & Investments Commission v Rich [2009] NSWSC 1229 at [7203]–[7208] and [7211]–[7213]. It is important to note that Austin J (at [7214]–[7230]) relied on expert opinion evidence as to the roles and responsibilities of a managing director and a finance director. His Honour said (at [7213]) that recourse may be had to such evidence because the objective standard that applies to the duty of care and diligence has regard to the knowledge and expertise of persons in the same recognised calling as the person charged with the contravention. As to the level of diligence required on the part of a non-executive director, and the limits of that director’s ability to rely upon the expertise of co-directors or management, see Morley v Australian Securities & Investments Commission (2010) 247 FLR 140; 5 BFRA 364; 274 ALR 205; 81 ACSR 285; [2010] NSWCA 331. At [34]–[35], Spigelman CJ, Beazley and Giles JJA referred, with apparent approval, to submissions by the non-executive directors, that as non-executive directors, they were entitled to rely on competent management and advisers and other directors unless there was cause for suspicion or further enquiry; and by ASIC, that whatever the reliance on others, there was a “core, irreducible requirement of diligence” … , and that the circumstances of the non-executive directors included that they brought to the discharge of their duties [their] extensive individual skills and qualifications. The Court later said of the position of non-executive director (at [807]): It is an objective inquiry. The court is to consider what an ordinary person, with the knowledge and experience of the defendant, must be expected to have done in the circumstances if he or she was acting on his or her own behalf … Beyond that the circumstances include that a non-executive director may be reliant on management and other officers to a greater extent than an executive director, no general statement can be made. This decision was the subject of two appeals to the High Court: Australian Securities & Investments Commission v Hellicar (2012) 86 ALJR 522; 286 ALR 501; [2012] HCA 17 and Shafron v Australian Securities and Investments Commission (2012) 86 ALJR 584; 286 ALR 612; [2012] HCA 18. The first-mentioned appeal related to directors, but was confined to issues relating to evidence and the trial process; whereas the second-mentioned appeal related to a general counsel and company secretary, who was not a director. The above propositions were not discussed in either decision. However, the court’s construction of the provision in the latter case, insofar as it related to a company secretary (as discussed below), has some relevance to the construction of the provision as it relates to directors. Arguably, if a person is a director and has other responsibilities in the company, the duties in s 180 will apply to all of the person’s responsibilities and not just those that attach to the position of director. The content of the requirement of diligence: officers In Shafron v Australian Securities and Investments Commission (2012) 86 ALJR 584; 286 ALR 612; [2012] HCA 18 the High Court rejected an argument by the company’s “general counsel and company secretary” that: (a) he was only an “officer” on the basis that he was the company secretary; and (b) 214 Corporations Act 2001 [180.30] Part 2D.1 – Duties and powers Division 1 – General duties s 180 therefore, he was affected by s 180 only in his performance of the administrative roles associated with the office. In dismissing that argument, the Court said (at [18]): The degree of care and diligence that is required by s 180(1) is fixed as an objective standard identified by reference to two relevant elements – the element identified in para (a): “the corporation’s circumstances”, and the element identified in para (b): the office and the responsibilities within the corporation that the officer in question occupied and had. No doubt, those responsibilities include any responsibility that is imposed on the officer by the applicable corporations legislation. But the responsibilities referred to in s 180(1) are not confined to statutory responsibilities; they include whatever responsibilities the officer concerned had within the corporation, regardless of how or why those responsibilities came to be imposed on that officer. Degree of negligence The degree of negligence necessary to constitute a breach of the provision is no higher than that which would support a claim of negligence at common law: Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 at [63], [142]–[152], [587], [779] and [875]; Australian Securities & Investments Commission v Rich [2009] NSWSC 1229 at [7198]. Special categories – examples • Australian Securities & Investments Commission v Rich (2003) 174 FLR 128; 44 ACSR 341; 21 ACLC 450; [2003] NSWSC 85; Re One.Tel Ltd (in liq); Australian Securities & Investments Commission v Rich (2003) 21 ACLC 672; 44 ACSR 682; [2003] NSWSC 186 (chairman of the board). • Australian Securities & Investments Commission v Macdonald (No 11) (2009) 230 FLR 1; 256 ALR 199; 27 ACLC 522; [2009] NSWSC 287 (chairman and chief executive officer). • Morley v Australian Securities & Investments Commission [2010] NSWCA 331 (non-executive directors). • Shafron v Australian Securities and Investments Commission (2012) 86 ALJR 584; 285 ALR 612; [2012] HCA 18 (general counsel and company secretary). • Australian Securities & Investments Commission v Vines (2003) 48 ACSR 291; [2003] NSWSC 1095; Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 (chief financial officer). • Whitlam v Australian Securities & Investments Commission (2003) 57 NSWLR 559; 21 ACLR 1259; 46 ACSR 1; [2003] NSWCA 183 (proxy voting). • Wilkinson v Feldworth Financial Services Pty Ltd (1998) 29 ACSR 642; 17 ACLC 220 at 693 (ACSR) per Rolfe J (directors of trustee companies). To whom are directors’ duties owed? Directors’ duties are owed to the company and generally cannot be enforced by creditors outside of cases involving insolvent corporations: Spies v The Queen (2000) 201 CLR 603; 74 ALJR 1263; 18 ACLC 727; 35 ACSR 500; [2000] HCA 43. See further ss 588G–588X. The question of just how much attention directors can pay to other interests, especially those of creditors, has been considered in a number of cases over the years. Recently, in Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239, Owen J dealt with this issue in some detail at [20.3]. Directors’ duties are not ordinarily owed to individual shareholders (Percival v Wright [1902] 2 Ch 421), or to a parent company (Forty Two International Pty Ltd v Barnes [2014] FCA 85 at [435] to [436]), although in certain circumstances the relationship between directors and shareholders may give rise to fiduciary obligations to individual shareholders: Coleman v Myers [1977] 2 NZLR 225; Brunninghausen v Glavanics (1999) 46 NSWLR 538; 32 ACSR 294; 17 ACLC 1,247; [1999] NSWCA 199; Southern Cross Mine Management Pty Ltd v Ensham Resources Pty Ltd [2004] 2 Qd R 207; (2004) 22 ACLC 724; [2003] QSC 402; Crawley v Short (2009) 262 ALR 654; 76 ACSR 286; 27 ACLC 1,856; [2009] NSWCA 410. © 2015 THOMSON REUTERS 215 CA ss 112-253N The content of the requirement of diligence: Relevance of general law standard of care The general law of torts can be consulted as a source of guiding principles for the content of the statutory standard of care and for determining whether breach has occurred: Australian Securities & Investments Commission v Vines (2005) 55 ACSR 617; 23 ACLC 1,387; [2005] NSWSC 738 at [1070]. The application of the so-called “Shirt calculus” (Wyong Shire Council v Shirt (1980) 146 CLR 40; 60 LGRA 106; 29 ALR 217 at 47 (CLR)) is discussed in Australian Securities & Investments Commission v Rich (2009) 236 FLR 1; 75 ACSR 1; [2009] NSWSC 1229 at [7231]–[7243]. s 180 Chapter 2D – Officers and employees [180.30] In the last-mentioned case (Crawley v Short) the New South Wales Court of Appeal found that one director/shareholder owed fiduciary duties to his fellow director/shareholders, which duties he had breached. Young JA said (at [121]–[122]): 121. There will be a variety of situations where a shareholder or director/shareholder holds a special position where he or she may owe duties to another shareholder. 122. Without being an exhaustive list, this will occur where: one shareholder undertakes to act on behalf of another shareholder; where one shareholder is in a position to have special knowledge and knows that another shareholder is relying on her to use that knowledge for the advantage of another shareholder as well as herself; and where the company is in reality a partnership in corporate guise, nowadays termed a quasi partnership. Directors’ duties are generally not owed to employees: Parke v Daily News Ltd [1962] Ch 927. In Australian Securities & Investments Commission v Maxwell (2006) 59 ACSR 373; 24 ACLC 1,308; [2006] NSWSC 1052, Brereton J stated that the duty in s 180(1) relates only to conduct by the directors that poses a jeopardy to the company (eg in terms of potential fines). His Honour then stated (at [104]): But it is a mistake to think that ss 180, 181 and 182 are concerned with any general obligation owed by directors at large to conduct the affairs of the company in accordance with law generally or the Corporations Act in particular; they are not. They are concerned with duties owed to the company. This statement has been cited with approval in several subsequent decisions: Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 at [84] per Spigelman CJ; Australian Securities & Investments Commission v Warrenmang Ltd (2007) 63 ACSR 623; 25 ACLC 1,589; [2007] FCA 973 at [22] per Gordon J; Australian Securities & Investments Commission v Fortescue Metals Group Ltd (No 5) [2009] FCA 1586 at [897]. In Warrenmang, it was found that misuse of subscription funds created a risk of fines to the company without any countervailing benefit (as in Maxwell), and therefore constituted a breach of the Act (Ch 6D fundraising provisions) giving rise to a breach of directors’ duties. Examples of breach of duty • Neglecting to observe management, find out the actual financial position of the corporation and failing to inform the board of relevant developments that could adversely affect the corporation: Australian Securities & Investments Commission v Rich (2003) 174 FLR 128; 44 ACSR 341; 21 ACLC 450; [2003] NSWSC 85; Re One.Tel Ltd (in liq); Australian Securities & Investments Commission v Rich (2003) 44 ACSR 682; 21 ACLC 672; [2003] NSWSC 186. • Allowing the company to enter into transactions that produced no benefit to the company: Gamble v Hoffman (1997) 24 ACSR 369; 15 ACLC 1,314; Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171. • Failing to ensure that the company was properly licensed to carry on a financial services business and that all its staff were adequately qualified to provide finance advice: Australian Securities & Investments Commission v PFS Business Development Group Pty Ltd (2006) 57 ACSR 553; [2006] VSC 192. • Allowing the company to trade in an unreasonably risky manner, which went against industry practice: Circle Petroleum (Qld) Pty Ltd v Greenslade (1998) 16 ACLC 1,577. • Allowing a notice of meeting to be distributed to members where it contained numerous misleading statements: Australian Innovation Ltd v Petrovsky (1996) 21 ACSR 218; 14 ACLC 1,357. • Failing to supervise the accuracy of company financial accounts: Sheahan v Verco (2001) 79 SASR 109; 37 ACSR 117; 19 ACLC 814; [2001] SASC 91. • Failing to ensure that the company met basic legal obligations, such as record-keeping and payment of wages to employees: Australian Securities & Investments Commission v PFS Business Development Group Pty Ltd (2006) 57 ACSR 553; [2006] VSC 192. But note that not every breach of the Corporations Act by a company gives rise to a breach of directors’ duties provisions: Australian Securities & Investments Commission v Warrenmang Ltd (2007) 63 ACSR 623; 25 ACLC 1,589; [2007] FCA 973 at [29]; see also J & A Vaughan Super Pty Ltd (Trustee) v Becton Property Group Ltd [2014] FCA 581 at [23]. • Making unreasonable profit forecasts: Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75. • Failing to take part in active supervision of the company’s management: Daniels v Anderson (1995) 37 NSWLR 438; 118 FLR 248; 13 ACLC 614; 16 ACSR 607; Sheahan v Verco (2001) 79 SASR 109; 37 ACSR 117; 19 ACLC 814; [2001] SASC 91. • Voting to approve an announcement to the ASX concerning the corporate group’s ability to meet all legitimate present and future asbestos claims, in circumstances where: (in one case) the 216 Corporations Act 2001 Part 2D.1 – Duties and powers Division 1 – General duties [180.30] s 180 Business judgment rule The statutory business judgment rule in s 180(2) has been considered in a number of significant cases. The key case is Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171, where Santow J held that the defence did not apply to Adler and Williams because they had a material personal interest in the transactions that demonstrated their breach of duty. In Gold Ribbon (Accountants) Pty Ltd (in liq) v Sheers [2006] QCA 335, Keane JA found that a director who takes no interest in the affairs of the board cannot be said to have made a business “judgment” to come within the scope of this defence: at [244]–[248] per Keane J. (The director failed to attend board meetings after not being allocated specific tasks.) In Deangrove Pty Ltd v Buckby (2006) 56 ACSR 630; 24 ACLC 414; [2006] FCA 212, it was found (albeit as an alternative argument) that the conduct of receivers had come within the scope of s 180(2). However, there was little discussion of the exact elements of s 180(2). In Australian Securities & Investments Commission v Rich [2009] NSWSC 1229, Austin J considered a number of issues, including whether the statutory provision offers broader protection than the common law business judgment rule, the onus of proof, and each of the elements of s 180(2). The requirement that the judgment be rational was explained recently by the New South Wales Court of Appeal as constituting “a requirement going beyond mere grounds for a belief and could require identification of the facts and matters upon which any such belief was based”: MacDonald v Australian Securities & Investments Commission (2007) 73 NSWLR 612; 65 ACSR 299; [2007] NSWCA 304 at [14] per Spigelman CJ. In Ingot Capital Investments v Macquarie Equity Capital Markets (No 6) (2007) 63 ACSR 1; [2007] NSWSC 124, McDougall J cautioned (at [1426]–[1437]) against judicial use of hindsight, and noted that in some circumstances it may be necessary for directors to “display entrepreneurial flair and accept commercial risks to produce a sufficient return on the capital invested”, and that the mere foreseeability of harm does not of itself dictate that the directors must be found to have failed to exercise due care and diligence. His Honour went on to say that “it is necessary to balance risk and reward, or, more accurately, to be satisfied that the directors, acting reasonably and in the best interests of [the company] and employing their individual knowledge and skills and taking account of relevant circumstances, did so”. See further Hall v Poolman (2007) 215 FLR 243; 65 ACSR 123; [2007] NSWSC 1330. For decisions concerning the reluctance of the courts to question the validity of bona fide commercial decisions of company officers (the common law business judgment rule), see Harlowe’s Nominees Pty Ltd v Woodside (Lakes Entrance) Oil Co NL (1968) 121 CLR 483; 42 ALJR 123; Howard Smith Ltd v Ampol Petroleum Ltd [1974] AC 821; (1974) 48 ALJR 5 at 77 (NSWLR). In Australian Securities & Investments Commission v Fortescue Metals Group Ltd (2011) 190 FCR 364; 274 ALR 731; 81 ACSR 563; [2011] FCAFC 19, the director was found, by the Full Federal Court (prior to a successful appeal to the High Court) to have breached s 180 by authorising the company to release statements asserting falsely that it had entered into certain binding contracts, thereby exposing the © 2015 THOMSON REUTERS 217 CA ss 112-253N director ought to have known that it was misleading; (in two other cases) the directors had not obtained and familiarised themselves with the terms of the announcement; and (in the case of a director/CEO and of a secretary/general counsel), they failed to advise the board that the announcement was in too emphatic terms: Australian Securities & Investments Commission v Macdonald (No 11) (2009) 230 FLR 1; 256 ALR 199; 71 ACSR 368; 27 ACLC 522; [2009] NSWSC 287. On appeal the judgment as against the non-executive directors was set aside because it was not proven that they had in fact voted to approve the announcement: see [801]. However, if they had voted to approve the announcement, they would have been liable: see [831]. • As managing director and chief executive officer, authorising and procuring the company to make false and misleading statements to the ASX, thereby causing the company to contravene s 1041H of the Act: Australian Securities & Investments Commission v Citrofresh International Ltd (No 2) [2010] FCA 27. • Procuring payment by a company to a related entity of the director of an amount that the director erroneously believed was payable, where he should reasonably have appreciated that the company’s liability to make the payment was debatable: Diakyne Pty Ltd v Ralph (2009) 72 ACSR 450; [2009] FCA 721. That decision was upheld on appeal in Ralph v Diakyne Pty Ltd [2010] FCAFC 18. • Disclosing confidential information: Digital Cinema Network Pty Ltd v Omnilab Media Pty Ltd (No 2) [2011] FCA 509 (upheld on appeal: Omnilab Media Pty Ltd v Digital Cinema Network Pty Ltd [2011] FCAFC 166). s 180 Chapter 2D – Officers and employees [180.30] company to liability for breach of ss 674(2) and 1041H. The director could not rely on the defence because (per Keane CJ at [197]–[199], with whose reasons in that regard Emmett and Finkelstein JJ agreed): a. The director bore the onus of proving he made a judgment in good faith and for a proper purpose, and that his personal shareholding was not a material personal interest in the subject matter of his judgment, but failed to bring the requisite evidence. b. A decision not to disclose the true effect of agreements was not a “business judgment” at all, as it relates not to the business operations of the company, but to compliance with the requirements of the Act. The Chief Justice said (at [198]): It is not an intention lightly to be attributed to the legislature that a director of a company might lawfully decide, as a matter of business judgment, that a corporation under his or her direction should not comply with a requirement of the Act. c. Subsection 180(2) cannot be construed as providing a ground of exculpation where the breach results in a contravention of another provision of the Act, and where that other provision contains specific exculpatory provisions. The director as well as the company successfully appealed that decision: Forrest v Australian Securities and Investments Commission [2012] HCA 39. The High Court held unanimously that the relevant statements were not misleading and therefore the company was not in breach of ss 674(2) and 1014H. On that basis the director was not in breach of s 180(1). It was therefore not necessary for the High Court to enter into any consideration of the reasoning of the Full Federal Court concerning the business judgment rule, and it did not do so. Ratification The High Court of Australia has recently stated that shareholder consent cannot operate to excuse liability from a breach of the statutory duties in Pt 2D.1: Angas Law Services Pty Ltd (in liq) v Carabelas (2005) 226 CLR 507; 79 ALJR 993; 215 ALR 110; 53 ACSR 208; 23 ACLC 509; [2005] HCA 23 at [32] per Gleeson CJ and Heydon J. See also Forge v Australian Securities & Investments Commission (2004) 213 ALR 574; 52 ACSR 1; 23 ACLC 1,010; [2004] NSWCA 448 at [378]–[384] per McColl JA (the constitutional challenge to the Forge decision was dismissed on appeal to the High Court: Forge v Australian Securities & Investments Commission (2006) 228 CLR 45; 229 ALR 223; 80 ALJR 1606; 59 ACSR 1; [2006] HCA 44); Capricornia Credit Union Ltd v Australian Securities & Investments Commission (2007) 159 FCR 69; 95 ALD 277; 62 ACSR 671; 25 ACLC 834; [2007] FCAFC 79 at [76] per Dowsett, Edmonds and Besanko JJ. However, the High Court’s statements in Angas Law Services have been interpreted very broadly in the decision in Australian Securities & Investments Commission v Maxwell (2006) 59 ACSR 373; 24 ACLC 1,308; [2006] NSWSC 1052, where Brereton J relied on the joint judgment given by Gleeson CJ and Heydon J to hold that shareholder consent can prevent a breach of s 180(1): see [103]ff. Arguably, given ASIC’s role in promoting the public interest in proper administration of companies through enforcement of the statutory duties, the importance of shareholder consent should be considered in the context of applications for relief under either s 1317S or s 1318, rather than preventing a breach from arising altogether. It should also be noted that the Commonwealth Treasury has released a discussion paper (Review of Sanctions in Corporate Law, March 2007) that raises the prospect of extending the business judgment rule beyond s 180(1), and also the possibility of introducing some type of overarching defence for directors’ and officers’ duties. Relationship between s 180 and s 344 In Australian Securities & Investments Commission v Healey (2011) 278 ALR 618; 83 ACSR 484; [2011] FCA 717 at [188], Middleton J described the interplay between s 180 and s 344, so far as relevant to the circumstances of that case, as follows: (a) [t]he directors were required by s 180 to be diligent and careful in their consideration of the resolution to approve the accounts and reports; and (b) [t]he directors were required by s 344 to take all reasonable steps to secure compliance with the relevant provisions of the Act, and to at least inquire about any potential deficiency in the accounts and reports that they observed or ought by the exercise of the requisite care and diligence to have observed. Assignment of causes of action under ss 180–184 It was held in Re Novaline Pty Ltd (in liq) [2011] FCA 898 at [21] that causes of action under ss 180–184 are capable of being assigned by a liquidator under s 477(2)(c). That decision followed UTSA Pty Ltd (in liq) v Ultra Tune Australia Pty Ltd (1996) 21 ACSR 457. 218 Corporations Act 2001 Part 2D.1 – Duties and powers Division 1 – General duties s 181 However, in Re Colorado Products Pty Ltd (in liq) [2014] NSWSC 789 at [395], Black J held that an assignment of the statutory causes of action by a liquidator could not confer the necessary standing on an assignee to obtain an order for compensation under s 1317H. His Honour followed the decision of Barker J in MG Corrosion Consultants Pty Ltd v Gilmour [2012] FCA 383; (2012) 202 FCR 354, and also appears to have been influenced by the decision of the New South Wales Court of Appeal in Owners of Strata Plan 5290 v CGS & Co Pty Ltd [2011] NSWCA 168; (2011) 81 NSWLR 285, which held that the liquidator’s power in s 477(2)(c) does not render assignable that which is inherently unassignable (although the latter case did not concern causes of action for breach of directors’ statutory duties). It is submitted that the question of the assignability or otherwise of these statutory causes of action by a liquidator will remain unsettled until it is determined by an appellate court. A contravention of s 180 involving an action that materially affects a corporation can attract penalties of up to $200,000 under s 1317G. If a corporation suffers damage as a result of the contravention, a court may make a compensation order against the director or officer, under s 1317H. Sections 1317S and/or s 1318 may provide relief from liability for breach of this section and (in the case of s 1318) the equivalent general law duties. However, the mere fact that a breach of directors’ duties may eventually lead to the imposition of a penalty does not mean that s 180 requires a greater seriousness (ie something akin to criminal negligence): Vines v Australian Securities & Investments Commission (2007) 73 NSWLR 451; 62 ACSR 1; 25 ACLC 448; [2007] NSWCA 75 at [142]–[152] per Spigelman CJ (with whom Ipp JA agreed). As to the use of expert evidence in establishing whether an officer’s conduct has been negligent, see Forge v Australian Securities & Investments Commission (2004) 213 ALR 574; 52 ACSR 1; 23 ACLC 1.010; [2004] NSWCA 448 (the constitutional challenge was dismissed on appeal to the High Court: Forge v Australian Securities & Investments Commission (2006) 228 CLR 45; 229 ALR 223; 80 ALJR 1606; 59 ACSR 1; [2006] HCA 44) and Australian Securities & Investments Commission v Rich (2005) 3 ABC(NS) 492; 218 ALR 764; 54 ACSR 326; 23 ACLC 1,111; [2005] NSWCA 152; Australian Securities & Investments Commission v Healey (2011) 278 ALR 618; 83 ACSR 484; [2011] FCA 717. Australian Securities & Investments Commission v Rich [2009] NSWSC 1229 was concerned with the alleged failure of two executive directors to disclose to the board of directors the company’s true financial position, which allegedly they should have known. ASIC lost the case because it failed to prove its contentions about the true financial position of the company. The decision highlights a common forensic problem in claims against directors of insolvent companies, namely that the plaintiff (whether a regulator or a liquidator) is typically reliant to a great extent on documents to prove its case, while those with the best knowledge of the relevant events are typically the defendant directors: see [7319], [7320] and [7548] of the judgment. [180.50] Further reading As a result of the exceptionally large amount of academic comment regarding directors’ duties, the following journal references have been arranged thematically. Duty of care • Bednall T and Hanrahan P, “Officers’ liability for mandatory corporate disclosure: Two paths, two destinations?” (2013) 31 C&SLJ 474. • Bednall T and Ngomba V, “The High Court and the c-suite: Implications of Shafron for company executives below board level” (2013) 31 C&SLJ 6. • Gummow W, “The equitable duties of company directors” (2013) 87 ALJ 753. • Pearce M, “Company directors as ‘super-fiduciaries’” (2013) 87 ALJ 464. 181 Good faith—civil obligations Good faith—directors and other offıcers (1) A director or other officer of a corporation must exercise their powers and discharge their duties: (a) in good faith in the best interests of the corporation; and (b) for a proper purpose. Note 1: This subsection is a civil penalty provision (see section 1317E). Note 2: Section 187 deals with the situation of directors of wholly-owned subsidiaries. (2) [Contravention] A person who is involved in a contravention of subsection (1) contravenes this subsection. © 2015 THOMSON REUTERS 219 CA ss 112-253N [180.40] Practice points s 181 Chapter 2D – Officers and employees [181.10] Note 1: Section 79 defines involved. Note 2: This subsection is a civil penalty provision (see section 1317E). [Cross-references: ASIC: • Form EX01: Schedule B of Regulatory Guide 16 Report to ASIC under s 422, s 438D or s 533 of the Corporations Act 2001 or for statistical purposes; • RG 16: External administrators: Reporting and lodging; • RG 76: Related party transactions; • RG 94: Unit pricing: Guide to good practice; • RG 109: Assetless Administration Fund: Funding criteria and guidelines; • RG 186: External administration: Liquidator registration.] [181.10] Scope A director or officer will contravene the requirements of this section if his or her involvement in certain actions was not in good faith or for a proper purpose for the benefit of the corporation. The test applied by the courts is objective, based on what a comparable person, having the same knowledge and skills as the director or officer, would reasonably have done in the circumstances. A detailed review of the law was undertaken by Owen J in Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 (see Ch 20 of the judgment). However, the subjective intentions and beliefs of a director are relevant, as discussed in Bell Group Ltd at [291]. In Re S & D International Pty Ltd (No 4) [2010] VSC 388, Robson J said, at [283]: The basic common law duty of a director is that he or she must act bona fide in what he or she believes is in the best interests of the company as a whole. This duty is encompassed in s 181. [181.20] Key cases The duty to exercise powers for a proper purpose and the obligation to act in good faith are separate duties: Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 at [4456] per Owen J. The key decision concerning this duty is Howard Smith Ltd v Ampol Petroleum Ltd [1974] AC 821; [1974] 1 NSWLR 68; (1974) 48 ALJR 5 at 77 (NSWLR), where Wilberforce LJ proposed a two-step test for determining whether a director had acted improperly: [I]t is necessary to start with a consideration of the power whose exercise is in question, in this case a power to issue shares. Having ascertained, on a fair view, the nature of this power, and having defined as can best be done in the light of modern conditions the, or some, limits within which it may be exercised, it is then necessary for the court, if a particular exercise of it is challenged, to examine the substantial purpose for which it was exercised, and to reach a conclusion whether that purpose was proper or not. See also Mills v Mills (1938) 60 CLR 150; 11 ALJ 527; Permanent Building Society (in liq) v Wheeler (1994) 11 WAR 187; 12 ACLC 674; 14 ACSR 109 at 137 (ACSR) per Ipp J (who delivered the reasons of the Court); Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 at [20.4.1] per Owen J. The basic principle is that directors and other officers must use their powers for their intended purpose, not a collateral purpose: Whitehouse v Carlton Hotel Pty Ltd (1987) 162 CLR 285; 61 ALJR 216; 70 ALR 251; 11 ACLR 715; 5 ACLC 421; Permanent Building Society (in liq) v Wheeler (1994) 11 WAR 187; 12 ACLC 674; 14 ACSR 109. See also Ngurli Ltd v McCann (1953) 90 CLR 425; 27 ALJR 349. In another leading decision concerning s 181, Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171 at [738], Santow J found that allowing the company to purchase high-risk assets at a time when the company wanted to reduce its risk exposure would breach the duties owed under s 181. For a detailed discussion of the principles concerning directors acting under a conflict of interest by setting up a competing business, see Southern Real Estate Pty Ltd v Dellow (2003) 87 SASR 1; [2003] SASC 318; Courtenay Polymers Pty Ltd v Deang [2005] VSC 318. The content of the duty in s 181(1)(a) corresponds to the fiduciary duty owed at common law by an employee to an employer: Hodgson v Amcor Ltd [2012] VSC 94) at [1339]. The best interests of the corporation One of the key issues is defining the “best interests of the corporation”, particularly whether that phrase includes the interests of non-shareholders. The classic statement of the law was given in Greenhalgh v Arderne Cinemas Ltd [1951] Ch 286 at 291 where Evershed MR stated that the similar phrase “company as a whole” did not mean “the company as a commercial entity, distinct from the corporators: it means 220 Corporations Act 2001 [181.20] Part 2D.1 – Duties and powers Division 1 – General duties s 181 A duty to creditors? The High Court’s decision in Spies v The Queen (2000) 201 CLR 603; 173 ALR 529; 74 ALJR 1263; 35 ACSR 500; 18 ACLC 727; 113 A Crim R 448; [2000] HCA 43 confirms that the “best interests of the corporation” does not (while the company is solvent at least) involve a direct duty owed by directors to the company’s creditors. However, that does not mean that the interests of the company’s creditors are wholly irrelevant to directors’ duties under s 181. There is authority for the view that the “best interests of the corporation” will involve creditors’ interests where the company is insolvent or approaching insolvency: Kinsela v Russell Kinsela Pty Ltd (in liq) (1986) 4 NSWLR 722; 10 ACLR 395; 4 ACLC 215. See also Re New World Alliance Pty Ltd; Sycotex Pty Ltd v Baseler (No 2) (1994) 51 FCR 425; 122 ALR 531; 13 ACSR 766; 12 ACLC 494 at 785 (ACSR); Australian Securities & Investments Commission v Somerville (2009) 259 ALR 574; [2009] NSWSC 934 at [35]; Australian Securities & Investments Commission v Sydney Investment House Equities Pty Ltd (2009) 69 ACSR 648; [2009] NSWSC 144. Furthermore, as Barrett J stated in Hausmann v Smith (2006) 24 ACLC 688; [2006] NSWSC 682 at [12]: “There is a difference between the beneficiary of a duty and the delineation of the interests to be taken account of in performing the duty”. See further the detailed review of the authorities by Owen J in Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 at [20.3]. Content of the duty where company is solvent and the directors are the shareholders In ASIC v Maxwell (2006) 59 ACSR 373; [2006] NSWSC 1052, Brereton discussed the content of the duty under s 180, and as part of this discussion his Honour said: 103. The constitution of the corporation, and concomitantly the identity of those to whom the duty is owed, is of importance because the duties referred to in ss 180, 181 and 182 are not duties owed in the abstract, but duties owed to the corporation. ... 104. One consequence of this, of present significance, is that where there is an identity of interest between the directors and the shareholders, so that in effect the directors are the shareholders, the requirement to prevent self-interested dealing, constrain management and strengthen shareholder control — which is fundamental purpose and rationale of these duties — is much less acute. That is a circumstance which can impact considerably on the content of the duties. The significance of a correspondence between the identity of the directors and the shareholders is illustrated by the circumstance that, at general law, a fully informed general meeting can prospectively or retrospectively ratify the actions of directors of the company, though they involve negligence, breach of fiduciary duty or the exercise of the directors’ powers for an improper purpose...Where the directors and the shareholders are one and the same, ratification is implicit. Although the shareholders of a company cannot release the directors from their statutory duties imposed by ss 180, 181 and 182, their acquiescence in a course of conduct can affect the practical content of those duties, including any question of whether directors acted with a reasonable degree of care and diligence, and whether they made improper use of their position. 104. There are cases in which it will be a contravention of their duties, owed to the company, for directors to authorise or permit the company to commit contraventions of provisions of the Corporations Act. Relevant jeopardy to the interests of the company may be found in the actual or potential exposure of the company to civil penalties or other liability under the Act, and it may no doubt be a breach of a relevant duty for a director to embark on or authorise a course which attracts the risk of that exposure, at least if the risk is clear and the countervailing potential benefits insignificant. But it is a mistake to think that ss 180, 181 and 182 are concerned with any general obligation owed by directors at large to conduct the affairs of the company in accordance with law generally or the Corporations Act in particular; they are not. They are concerned with duties owed to the company. His Honour later pointed out (at [104]) that [Sections] 180, 181 and 182 do not provide a backdoor method for visiting, on company directors, accessorial civil liability for contraventions of the Corporations Act in respect of which provision is not otherwise made. © 2015 THOMSON REUTERS 221 CA ss 112-253N the corporators as a general body.” See further Darvall v North Sydney Brick and Tile Co Ltd (No 2) (1989) 16 NSWLR 260; 15 ACLR 230; 7 ACLC 659. Even accepting that the best interests of the corporation will generally be linked with the best interests of the shareholders as a general body, it must be noted that the general body of shareholders is not always a homogenous group with identical interests. In the situation where the interests of the shareholders diverge, the directors should act fairly between the different classes of shareholders: Mills v Mills (1938) 60 CLR 150; 11 ALJ 527 at 164 (CLR) per Latham CJ. s 181 Chapter 2D – Officers and employees [181.20] In Australian Securities and Investments Commission v Cassimatis [2013] FCA 641 the directors of a company, who were also its only shareholders, sought to have a claim by ASIC for breach of s 180(1) dismissed summarily. They argued that, as they were the company’s only shareholders, and as it was admittedly solvent at the time of the relevant conduct, they were entitle to risk the company’s capital as they wished. Reeves J declined to strike out the claim, on the basis that the issue was not one that was appropriate for summary determination. Mixed purposes Where the director’s or company officer’s conduct may be explained by a range of different purposes, the “but for” test is ordinarily used to determine what the relevant purpose was: Mills v Mills (1938) 60 CLR 150; 11 ALJ 527 at 186 (CLR) per Dixon J; later applied by the High Court in Whitehouse v Carlton Hotel Pty Ltd (1987) 162 CLR 285; 61 ALJR 216; 70 ALR 251; 11 ACLR 715; 5 ACLC 421 at 294 (CLR) per Mason, Deane and Dawson JJ. This means that the court will consider whether the director or officer would still have acted in the same manner had the collateral purpose not existed. See further the discussion by Owen J in Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 at [4461]–[4465]; Bell IXL Investments Ltd v Life Therapeutics Ltd (2008) 68 ACSR 154; 26 ACLC 1,138; [2008] FCA 1457. See also Short v Crawley (No 30) [2007] NSWSC 1322 at [402]ff which discusses rules for establishing causation of loss in the context of breach of fiduciary duty. Not surprisingly, a directory cannot avoid liability for breach of ss 181 or 182 by claiming, in relation to a transaction between a third party and the company, that he or she was acting for the third party in the transaction, as this merely establishes that the person had conflicting duties. The Full Federal Court (Finn, Stone and Perram JJ) pointed out in Grimaldi v Chameleon Mining NL (No 2) (2012) 200 FCR 296; [2012] FCAFC 6 (at [430]): It is a common, and rightly often deprecated, practice for persons to act in a dealing in which they owe conflicting duties to the several parties to the dealings. Honest intentions The law regarding the role of a director’s subjective intention, in contrast to an objective assessment of the director’s conduct, is not completely settled. In Marchesi v Barnes [1970] VR 434, Gowans J held that a predecessor provision to s 181 required subjective dishonesty. However, in Australian Growth Resources Corporation Pty Ltd v Van Reesema (1988) 13 ACLR 261; 6 ACLC 529, King CJ was of the view that a later predecessor to s 181 did not require any subjective dishonesty. In Permanent Building Society v Wheeler (1994) 11 WAR 187; 12 ACLC 674; 14 ACSR 109 at 137 (ACSR), Ipp J (who delivered the reasons of the Court) said that honest or altruistic behaviour by directors will not prevent a finding of improper conduct on their part, if that conduct was carried out for an improper or collateral purpose. His Honour also said that, whether acts were performed in good faith and in the interest of the company is to be objectively determined, although “statements by directors about their subjective intentions or beliefs will be relevant to that inquiry.” In Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171 at [738]–[740], Santow J seems to have favoured an objective test, or at least a minimal role for subjective intentions, expressing the view (at [738]) that the standard of behaviour required by s 181(1) is not complied with by subjective good faith or by a mere subjective belief by a director that his purpose was proper, certainly if no reasonable director could have reached that conclusion. In Australian Securities & Investments Commission v Maxwell (2006) 59 ACSR 373; 24 ACLC 1,308; [2006] NSWSC 1052, Brereton J followed the subjective approach outlined in Marchesi v Barnes [1970] VR 434. His Honour said (at [109]): In my opinion, s 181 is contravened only where a director engages deliberately in conduct, knowing that it is not in the interests of the company. However, in Australian Securities & Investments Commission v Sydney Investment House Equities Pty Ltd (2008) 69 ACSR 1; [2008] NSWSC 1224, Hamilton J considered that s 181(1) required an objective test. In Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 at section 20.7 [4589]–[4619], Owen J considered the authorities at length. His Honour set out his conclusions at [4619]: 1. The test whether directors acted bona fide in the interests of the company as a whole is largely (though by no means entirely) subjective. It is a factual question that focuses on the state of 222 Corporations Act 2001 Part 2D.1 – Duties and powers Division 1 – General duties s 181 mind of the directors. The question is whether the directors (not the court) consider that the exercise of power is in the best interests of the company. 2. Similar principles apply in ascertaining the real purpose for which a power has been exercised. 3. It is the directors who make business decisions and courts have traditionally not pronounced on the commercial justification for those decisions. The courts do not substitute their own views about the commercial merits for the views of the directors on that subject. 4. Statements by the directors about their subjective intention or belief are relevant but not conclusive of the bona fides of the directors. 5. In ascertaining the state of mind of the directors the court is entitled to look at the surrounding circumstances and other materials that genuinely throw light upon the directors’ state of mind so as to show whether they were honestly acting in discharge of their powers in the interests of the company and the real purpose primarily motivating their actions. 6. The directors must give real and actual consideration to the interests of the company. The degree of consideration that must be given will depend on the individual circumstances. But the consideration must be more than a mere token: it must actually occur. 7. The court can look objectively at the surrounding circumstances and at the impugned transaction or exercise of power. But it does so not for the purpose of deciding whether or not there was commercial justification for the decision. Rather, the objective enquiry is done to assist the court in deciding whether to accept or discount the assertions that the directors make about their subjective intentions and beliefs. 8. In that event a court may intervene if the decision is such that no reasonable board of directors could think the decision to be in the interests of the company. In Australian Securities & Investments Commission v Macdonald (No 11) (2009) 230 FLR 1; 256 ALR 199; 71 ACSR 368; 27 ACLC 522; [2009] NSWSC 287, Gzell J (at [657]) (NSWC) followed the subjective approach in Marchesi v Barnes [1970] VR 434. In Australian Securities & Investments Commission v Somerville (2009) 259 ALR 574; 74 ACSR 89; [2009] NSWSC 934, at [37], Windeyer AJ did not decide between the competing tests, although his Honour appears to have favoured the objective test, at least in relation to the “proper purpose” limb of s 181(1). The statement of a subjective test in Australian Securities & Investments Commission v Maxwell (2006) 59 ACSR 373; 24 ACLC 1,308; [2006] NSWSC 1052, was cited with approval by Gordon J in Digital Cinema Network Pty Ltd v Omnilab Media Pty Ltd (No 2) [2011] FCA 509 at [158] (which decision was upheld on appeal: Omnilab Media Pty Ltd v Digital Cinema Network Pty Ltd [2011] FCAFC 166). In Holyoake Industries (Vic) Pty Ltd v V-Flow Pty Ltd [2011] FCA 1154 at [150]–[151] Tracey J applied the subjective approach and stated that the weight of authority favoured it. In Mernda Developments Pty Ltd v Rambaldi [2011] VSCA 392, the Victorian Court of Appeal (Warren CJ, Mandie JA and Judd AJA) stated (at [33]): While there has been some debate about the application of an objective test, and whether it is appropriate to consider whether in fact the directors considered the interests of the company, it is now generally accepted that an objective test ought to be applied. The authorities cited for that proposition were Linton v Telnet Pty Ltd (1999) 30 ACSR 465; 17 ACLC 619; [1999] NSWCA 33 at 472 (ACSR); Farrow Finance Co Ltd (in liq) v Farrow Properties Pty Ltd (in liq) [1999] 1 VR 584; (1997) 26 ACSR 544; 16 ACLC 897 at 581 (ACSR); and Equiticorp Finance Ltd (in liq) v Bank of New Zealand (1993) 32 NSWLR 50; 11 ACSR 642; 11 ACLC 952 at 1019 (ACLC). There was no reference to the more recent decisions referred to above, and it is difficult to see how the Full Court could have reached the view that “it is now generally accepted that an objective test ought to be applied” if its attention were drawn to them. In Re Wan Ze Property Development (Aust) Pty Ltd [2012] NSWSC 722 Black J said, at [35], that whether a director acted for a proper purpose is to be determined objectively. In MG Corrosion Consultants Pty Ltd v Gilmour [2014] FCA 990 at [541], Barker J said that, following Westpac Banking Corporation v Bell Group Ltd (in liq) (No 3) (2012) 270 FLR 1; (2012) 44 WAR 1, the question whether or not a director acts for a proper purpose or for an improper purpose is “primarily determined objectively involving an assessment by the Court of the relevant circumstances”. Corporate groups The basic principle that the officers must act in the best interests of the company does not prevent an officer from engaging in an activity that would benefit an entity within the same corporate group, as the benefit accruing to the company may be direct or indirect: Maronis Holdings Ltd v Nippon Credit Australia Ltd (2001) 38 ACSR 404; 10 BPR 18,717; [2001] NSWSC 448 at [190] per Bryson J. Bryson J went on to comment at [191] (after a discussion of Walker v Wimborne (1976) 137 CLR 1; 50 ALJR 446; © 2015 THOMSON REUTERS 223 CA ss 112-253N [181.20] s 181 Chapter 2D – Officers and employees [181.20] 3 ACLR 529) that “regard for group interest is not a vitiating element and in my understanding it has not been judicially so treated; what would vitiate is lack of regard for the interest of the company entering the transaction”. As Owen J said in Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 at [4621]: The law does not require directors of a group of companies to ignore the interests of the wider group. But it does demand that where one or more companies in a group enter into a transaction or transactions, consideration must be given to the interests of that company or those companies. Most commercial transactions involve both benefits and detriments and, in considering the interests of the participants and those affected by the transaction, it will usually be a case of balancing the two. See also Mernda Developments Pty Ltd (in liq) v Rambaldi [2011] VSCA 392, and Mills Oakley Lawyers Pty Ltd v Huon Property Holdings Pty Ltd [2012] VSC 39 at [70]. Share issues The power to issue shares has generated a significant amount of case law concerning the duties in s 181 and its predecessors. In light of the guiding principle that directors and other officers must not use their powers for collateral purposes, the key question is whether the company has a genuine commercial need for issuing new shares, given that it would be an improper exercise of power, and probably a breach of the duty of care and diligence, to issue shares for no good reason. The leading decision is Harlowe’s Nominees Pty Ltd v Woodside (Lakes Entrance) Oil Co NL (1968) 121 CLR 483; 42 ALJR 123, where it was held that the primary purpose of the power to issue shares is to raise necessary capital for the company. However, that case also recognised that there may be legitimate commercial reasons to issue shares other than for capital raising (eg to preserve the long-term financial stability of the company or to take advantage of some genuine commercial opportunity). See also Howard Smith Ltd v Ampol Petroleum Ltd [1974] AC 821; [1974] 1 NSWLR 68; (1974) 48 ALJR 5; Teck Corp Ltd v Millar (1973) 33 DLR (3d) 288; Darvall v North Sydney Brick & Tile Co Ltd (1989) 16 NSWLR 260; 7 ACLC 659; 15 ACLR 230; Bell Group Ltd (in liq) v Westpac Banking Corp (No 9) (2008) 225 FLR 1; 70 ACSR 1; [2008] WASC 239 at Ch 20; Bell IXL Investments Ltd v Life Therapeutics Ltd (2008) 68 ACSR 154; 26 ACLC 1,138; [2008] FCA 1457. The cases clearly state, however, that issuing shares to manipulate or control voting power within a company is an improper purpose: see Howard Smith Ltd v Ampol Petroleum Ltd [1974] AC 821; [1974] 1 NSWLR 68; (1974) 48 ALJR 5; Whitehouse v Carlton Hotel Pty Ltd (1987) 162 CLR 285; 61 ALJR 216; 70 ALR 251; 11 ACLR 715; 5 ACLC 421. For a decision where a company secretary withheld information from the board so as to facilitate a share issue to themselves, which was held to be a breach of both ss 181 and 182, see Biodiesel Producers Ltd v Stewart [2007] FCA 722 (affirmed on appeal in Stewart v Biodiesel Producers Ltd [2008] FCAFC 66). Transactions with the company Hodgson v Amcor Ltd [2012] VSC 94 concerned the sale of certain businesses by a company, in transactions which permitted persons who were employees of the company at various levels to acquire the businesses. The case usefully illustrates the analysis for determining whether a person is an “officer” within s 9, and thus attracts the duties in s 181. Whilst a number of the employees were not at a sufficiently senior level to fall within that definition, they were held liable for breach of their fiduciary duties, as well as for breach of s 183, which extends to employees. As regards the one employee who was found to be an officer and to be liable under s 181, his liability arose from his failure to disclose his personal interest in the transactions, which deprived the company of the opportunity to take steps to protect its interests. Defences – Disclosure In Australian Securities & Investments Commission v Adler (2002) 168 FLR 253; 41 ACSR 72; 20 ACLC 576; [2002] NSWSC 171 at [735] Santow J stated that: in certain circumstances, such as a director in “a position of power and influence” over the board, mere disclosure of a conflict between interest and duty and abstaining from voting is insufficient to satisfy a director’s fiduciary duty. The director may also be under a positive duty to take steps to protect the company’s interest such as by using such power and influence as he had to prevent the transaction going ahead. Defences – Prior consent See above at [180.30]. 224 Corporations Act 2001 [181.40] Part 2D.1 – Duties and powers Division 1 – General duties s 181 Extraterritoriality Sections 180, 181, 182 and 183 apply to acts and omissions occurring outside of Australia: PCH Offshore Pty Ltd v Dunn (2009) 72 ACSR 99; 27 ACLC 752; [2009] FCA 553. Receivers The duty of a receiver and manager, appointed by a secured creditor, to exercise his powers in good faith and for a proper purpose, including the duty not to sacrifice the mortgagor’s interests recklessly, may be subsumed within the duty in s 181: Forest Marsh Pty Ltd v Pleash [2011] FCA 134 at [80]. No need to show actual undervalue/loss to establish liability under s 181 In Gerard Cassegrain & Co Pty Ltd (in liq) v Cassegrain [2013] NSWCA 455 the company’s directors caused it to transfer shares in two other companies to the wife of one of the director, and it was found at first instance that they did this at an undervalue, for improper purposes, and in breach of their duty to avoid a conflict. At first instance the directors and the wife were found liable for breaches of fiduciary duties as well as breaches of ss 180, 181(1) and 182(1), and the orders made included an order for an inquiry to be held to determine the amount of compensation to be paid. The wife successfully appealed on a pleadings point. On the directors’ appeal there was an issue concerning whether the shares were in fact transferred at an undervalue. The New South Wales Court of Appeal (per Emmett JA; Meagher and Ward JJA agreeing) was of the view that an undervalue was established on the evidence, although there was a real question as to the quantum of the undervalue (at [146]). However, the primary judge had made no binding determination as to the true value of the shares and had left that as a matter to be determined on inquiry, and on appeal this approach was accepted as being appropriate (at [177]). More importantly, because the improper purpose breach and the conflict breach were established, the company was entitled to the relief it sought, regardless of whether or not it could also establish undervalue at trial (at [48]). Clearly, evidence of undervalue would be important at the later inquiry to determine the quantum of compensation. Transaction affected by breach may be voidable A transaction brought about by directors breaching their duties in ss 181 or 182 will be voidable at the instance of the company if the counter-party entered into it with knowledge of the breach: Robbins v Incentive Dynamics [2003] NSWCA 71; (2003) 45 ACSR 244 at [72]; Allco Funds Management v Trust Company (RE Services) Ltd [2014] NSWSC 1251 at [124]. [181.40] Further reading The following journal articles may be of assistance on this topic: Fiduciary duties • Bathurst TF and Merope S, “It tolls for thee: Accessorial liability after Bell v Westpac” (2013) 87 ALJ 831. • Bednall T and Ngomba V, “The High Court and the c-suite: Implications of Shafron for company executives below board level” (2013) 31 C&SLJ 6. • Butler D, “Equitable remedies for participation in a breach of directors’ fiduciary duties: The mega-litigation in Bell v Westpac” (2013) 31 C&SLJ 307. • Conaglen M, “Interaction between statutory and general law duties concerning company director conflicts” (2013) 31 C&SLJ 403. • Gummow W, “The equitable duties of company directors” (2013) 87 ALJ 753. • Langford RT, “Directors’ fiduciary duties: The relationship between conflicts, profits and bona fides” (2013) 31 C&SLJ 423. • Langford RT, “Solving the fiduciary puzzle – the bona fide and proper purposes duties of company directors” (2013) 41 ABLR 127. • Turner RJ, “Directors’ fiduciary duties and oppression in closely-held corporations” (2013) 31 C&SLJ 278. Duties owed to creditors? • Bathurst TF and Merope S, “It tolls for thee: Accessorial liability after Bell v Westpac” (2013) 87 ALJ 831. • Maslen Stannage R, “Directors’ duties to creditors: Walker v Wimborne revisited” (2013) 31 C&SLJ 76. © 2015 THOMSON REUTERS 225 CA ss 112-253N [181.30] Practice points s 182 Chapter 2D – Officers and employees 182 Use of position—civil obligations Use of position—directors, other offıcers and employees (1) A director, secretary, other officer or employee of a corporation must not improperly use their position to: (a) gain an advantage for themselves or someone else; or (b) cause detriment to the corporation. Note: This subsection is a civil penalty provision (see section 1317E). (2) [Contravention] A person who is involved in a contravention of subsection (1) contravenes this subsection. Note 1: Section 79 defines involved. Note 2: This subsection is a civil penalty provision (see section 1317E). [Cross-references: ASIC: • Form EX01: Schedule B of Regulatory Guide 16 Report to ASIC under s 422, s 438D or s 533 of the Corporations Act 2001 or for statistical purposes; • RG 16: External administrators: Reporting and lodging; • RG 76: Related party transactions; • RG 109: Assetless Administration Fund: Funding criteria and guidelines; • RG 186: External administration: Liquidator registration.] [182.10] Scope Both ss 182 and 183 prohibit company officers from improperly using their positions to gain an advantage or cause the company detriment. This prohibition comes from the fiduciary duty to prevent conflicts from arising between the officer’s private interest and the company’s interest and the obligation to act only in the best interests of the company. [182.20] Concepts Improperly: “[I]mpropriety in the use of a position may consist in an abuse of the power or authority which the position confers”: R v Byrnes (1995) 183 CLR 501; 81 A Crim R 138; 69 ALJR 710; 17 ACSR 551; 13 ACLC 1,488 at 512 (CLR), 145 (A Crim R) per Brennan, Deane, Toohey and Gaudron JJ, although the same judges recognised that impropriety extends beyond an abuse of power or authority and is assessed objectively. The Full Bench of the South Australian Supreme Court has stated that the section does not impose a universal standard and that impropriety should be “determined by reference to the particular duties and responsibilities of the particular officer whose conduct is impugned”: Grove v Flavel (1986) 43 SASR 410; 11 ACLR 161; 4 ACLC 654 at 420 (SASR) per Jacobs J (with whom Matheson and Olsson JJ agreed). In Doyle v Australian Securities & Investments Commission (2005) 227 CLR 18; 80 ALJR 405; 223 ALR 218; 56 ACSR 159; [2005] HCA 78 at [35], the Court stated that impropriety will be found where the director or officer breaches “the standards of conduct that would be expected of a person in his [or her] position by reasonable persons with knowledge of the duties, powers and authority” of the person’s position as a director or officer. In Griffıths & Beerens Pty Ltd v Duggan (2008) 66 ACSR 472; [2008] VSC 201 at [54], Pagone J stated that the enquiry concerns whether the defendant’s “behaviour breached the norm of conduct thought necessary for the proper conduct of commercial life so that people will have confidence that the running of the marketplace is in safe hands”. See also Kwok v The Queen (2007) 64 ACSR 307; 175 A Crim R 278; [2007] NSWCCA 281 at [80] per Santow JA, where it was stated that “dishonest use of a director’s position would necessarily mean that the use was also improper, but not every improper use of position is necessarily dishonest”. The effect of Manildra Laboratories Pty Ltd v Campbell [2009] NSWSC 987 at [131]–[133] appears to be that, in the absence of a breach of either an equitable obligation, or a contractual obligation in relation to the use of information, there will be no impropriety for the purpose of ss 182 and 183. Impropriety is determined according to an objective standard: R v Byrnes (1995) 183 CLR 501; 17 ACSR 551; [1995] HCA 1; R v Towey (1996) 132 FLR 434; 21 ACSR 46; Re Wan Ze Property Development (Aust) Pty Ltd [2012] NSWSC 722 at [36]. However, where the impropriety consists of an abuse of power, the state of mind of the director is important: Allco Funds Management v Trust Company (RE Services) Ltd [2014] NSWSC 1251 at [123], citing R v Byrnes [1995] HCA 1; (1995) 183 CLR 501 at 514. 226 Corporations Act 2001

![[181.10] Scope [181.20] Key cases](http://s3.studylib.net/store/data/008321424_1-927199435ac3564c32ed9d8147e87b48-300x300.png)