Antonios Roustopoulos - Villanova Law School

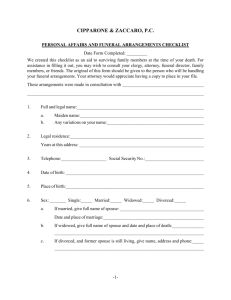

advertisement