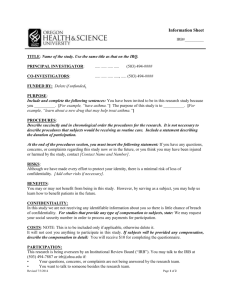

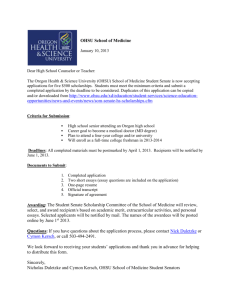

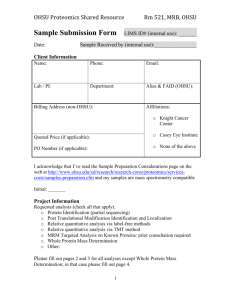

Summary of full benefits - Oregon Health & Science University

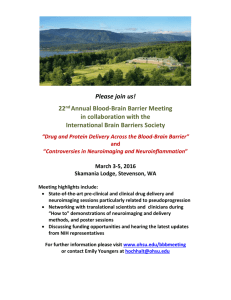

advertisement