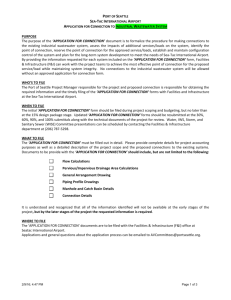

TABLE OF CONTENTS

advertisement