Monetary Policy – April 2015

advertisement

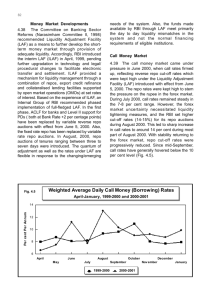

Economics Monetary Policy – April 2015 In its maiden policy announcement of FY16, the Reserve Bank of India kept the key policy rate i.e. the repo rate unchanged at 7.5% putting a pause to the two rate cuts earlier in 2015 (both were out of the policy cycle). This is in line with CARE’s forecast of a status quo on the repo rate. In the policy announcement, the RBI has seemingly put forward further preconditions before taking action on easing its stance any further. April 7, 2015 Highlights Policy repo rate under the Liquidity Adjustment Facility (LAF) is held constant at 7.5%. Therefore, reverse repo stands unmoved 100 bps lower than the repo rate at 6.5% while the Marginal Standing Facility (MSF) rate remains 100 bps higher than the repo rate at 8.5%. Cash Reserve Ratio (CRR) of scheduled banks is also unchanged at 4% of NDTL Liquidity front Continue providing liquidity under the overnight repos at 0.25% of bank wise NDTL at the LAF repo rate and through the 7-day and 14-day term repos of up to 0.75% of NDTL of the banking system through auctions. Continuation of daily variable rate repo and reverse repo auctions to foster the smooth management of liquidity. Macroeconomic Backdrop Global Assessment: Global growth is picking momentum in 2015 so far relative to the previous year. GDP growth continues to strengthen in the USA; however Q1 2015 is expected to record a muted growth. Growth has firmed marginally in the Euro area as also Japan where exports have also recorded improvement. However, China remains a weak link with the country’s officials recognizing that it is off its peak growth phase. Additionally, monetary policies across advanced economies such as USA, Euro zone, Canada, Japan, and emerging economies such as China, Indonesia, Thailand, South Korea etc are in an easing cycle in order to provide a fillip to economic growth. As regards financial markets, strong foreign inflows particularly into emerging economies with a stronger fundamental remain high thereby creating a risk of major outflow and dent in the financial markets when the monetary cycle in the USA begins to turn around. Domestic Economy: o Growth: Growth in the domestic economy has strengthened from a year ago levels with the GDP estimate of 7.4% for FY15 as against 6.9% in FY14. This stronger growth is expected to be supported by the primary and secondary sectors of the economy as food production is viewed to be higher than the weak outlook for the same at the start of FY15. The positive IIP growth for 1 Economics the last three consecutive months implies a revival in industry and in particular the manufacturing sector. o Inflation: Throughout fiscal ’15, RBI maintained a razor sharp focus on the Consumer Price Inflation (CPI) and strived towards following the ‘disinflationary glide path’ put forward by the Dr. Urjit Patel Committee report in Dec ’13. However, inflation has receded considerably since then. CPI inflation was well within RBI’s target as of Feb ’15 at 5.3% despite the reversal of the high base effect. At the wholesale level, inflation entered negative territory at -2.1% in Feb ’15. o Liquidity: Liquidity management has been proactively carried out through the various term repo auctions by the RBI. This has ensured a smooth flow and availability of sufficient liquidity in the system. o Trade: Export growth is muted currently primarily on account of the relatively stronger INR visà-vis the USD which has impacted the country’s export margins. However, a strong export of services in software and travel has contributed towards a lower Current Account Balance of 1.6% of GDP in Q3 FY151. Although foreign inflows have moderated marginally, they remain on the higher end. Thus the strong foreign inflows into domestic equity, debt securities and by way of FDI have implied an enhancement to the country’s Foreign Exchange Reserves. Policy Rationale After inflation being the prime determinant of the RBI policy, the focus has now shifted to the monetary transmission mechanism. Thereby, policy rationale for the status quo position on the policy rate emanates from the weak transmission channel of the monetary policy despite a low credit off take throughout FY15. Transmission Mechanism: Notwithstanding the two rate cuts exercised earlier in 2015, the same has not transpired into a contemporaneous cut in bank lending rates. Thus, improvement in the transmission mechanism appears to be an underlying precondition to any further action on the interest rates. On the same note, there is an expectation that comfortable liquidity conditions in the system will enable banks to exercise a reduction in their lending rates. As a step towards improving the transmission mechanism, the RBI has introduced ‘marginal-cost-of-funds-based’ determination of the Base rates of Banks. However, given that Banks would have to consider their average cost of portfolio practically, it remains to be seen if the marginal cost pricing method would work effectively. The RBI is also cognizant of the low credit off-take compared with year ago levels. While recognizing that CPI inflation has traversed the envisaged path and was in fact considerably under the target range for Jan ’15, there remain certain threats to price stability going ahead. There remains uncertainty over the monsoon in FY16 as gauged by the unseasonal rains already recorded in parts of the country. This is likely to cause a sizeable deviation of vegetable and fruit prices from their seasonal average. Further, volatility in global geo-political space is bound to have ramifications on commodity prices as also exchange rate. 1 Note, the new GDP series would have also provided some cushion to CAD for Q3 FY15 2 Monetary Policy – April ‘15 Economics There is also a sense that RBI is conscious of the impending rate hike in the USA and its immediate impact on domestic financial markets, foreign exchange reserves and the linked chain reaction on exchange rate, trade and current account balance. Hence, providing a cushion against any untoward developments and to await further data to better assess the domestic economic health appear to be the distinct rationale behind the status-quo position in the repo rate. RBI’s Macro Outlook Growth: RBI expects there to be a modest pick-up in GDP growth in FY16 supported by the Government’s thrust on infrastructure, a stable inflationary outlook and improving business environment with an increase in private investment. Thereby, the RBI holds a conservative forecast for GDP growth at 7.8% in FY16 compared with 7.4% in FY152. Inflation The RBI expects consumer inflation to prevail near existing levels for Q1 FY16, soften in Q2 to reach around 4% in Aug ’15 and then increase to 5.8% by Mar ’16. Going ahead, the RBI has stated that its preconditions on further policy easing would emanate from the developments in the transmission channel of the monetary policy (lending rate cuts by Banks), movement in food prices and progress of monsoon. Lastly, although the Indian economy stands in better light than the last instance, RBI would closely monitor signs of monetary policy normalization in the USA. CARE’s View Overall, RBI’s first bi-monthly credit policy has been largely in line with CARE’s expectations. We retain our expectation of a GDP growth of 8% in FY16 contingent on a normal monsoon and absence of any untoward shock. While, we still foresee a 50 basis points cut in the repo rate in FY16, the same is unlikely to be seen till June ’15. Thus, the 10 year government security paper is viewed to remain around 7.7% until any action on interest rate is taken by the RBI. 2 A downward revision is anticipated in GDP growth for FY15 3 Monetary Policy – April ‘15 Economics Contact: Madan Sabnavis Chief Economist madan.sabnavis@careratings.com 91-022-61443489 Garima Mehta Associate Economist garima.mehta@careratings.com 91-022-61443526 Disclaimer This report is prepared by the Economics Division of Credit Analysis &Research Limited [CARE]. CARE has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain. However, neither the accuracy nor completeness of information contained in this report is guaranteed. CARE is not responsible for any errors or omissions in analysis/inferences/views or for results obtained from the use of information contained in this report and especially states that CARE (including all divisions) has no financial liability whatsoever to the user of this report. 4 Monetary Policy – April ‘15