McGraw-Hill/Irwin

advertisement

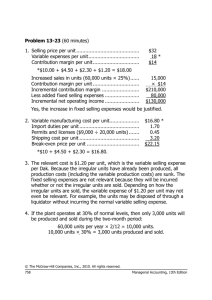

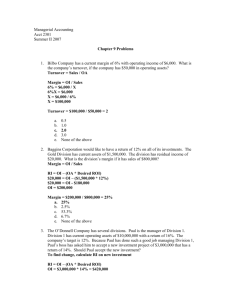

Solution to Chapter 13 E13‐24,25,26,27,29 13‐34,35,46 EXERCISE 13-24 (10 MINUTES) = = = 8% Capital turnover = = = 2.5 Return on investment = = = 20% Sales margin EXERCISE 13-25 (15 MINUTES) There are an infinite number of ways to improve the division's ROI to 25 percent. Here are two of them: 1. Improve the sales margin to 10 percent by increasing income to $12,500,000: ROI = sales margin × capital turnover = = 10% × 2.5 = 25% Since sales revenue remains unchanged, this implies a cost reduction of $2,500,000 at the same volume. 2. Improve the turnover to 3.125 by decreasing average invested capital to $40,000,000: ROI = sales margin × capital turnover = = 8% × 3.125 = 25% Since sales revenue remains unchanged, this implies that the firm can divest itself of some productive assets without affecting sales volume. McGraw-Hill/Irwin Managerial Accounting, 8/e 11-1 2009 The McGraw-Hill Companies, Inc. EXERCISE 13-26 (5 MINUTES) Residual income = investment center income – = $10,000,000 – ($50,000,000 × 11%) = $4,500,000 EXERCISE 13-27 (15 MINUTES) 1. Sales margin = = £ £ = 5% *Income = £300,000 = £6,000,000 – £3,300,000 – £2,400,000 2. Capital turnover = £ = £ ROI = = £ = 2 £ ROI = 15% = = 10% = £ Income = 15% × £3,000,000 = £450,000 Income = sales revenue – expenses = £450,000 Income = £6,000,000 – expenses = £450,000 Expenses = £5,550,000 Therefore, expenses must be reduced to £5,550,000 in order to raise the firm's ROI to 15 percent. 3. Sales margin = = £ £ ROI = sales margin × capital turnover = 7.5% × 2 = 15% McGraw-Hill/Irwin Managerial Accounting, 8/e 11-2 2009 The McGraw-Hill Companies, Inc. EXERCISE 13-29 (30 MINUTES) 1. Average investment in productive assets: Balance on 12/31/x1 ....................................................................................... Balance on 1/1/x1 ($25,200,000 ÷ 1.05)........................................................ Beginning balance plus ending balance...................................................... Average balance ($49,200,000 ÷ 2) .............................................................. a. $25,200,000 24,000,000 $49,200,000 $24,600,000 ROI = = = 20% b. Income from operations before income taxes..................................... Less: imputed interest charge: Average productive assets ....................................... $24,600,000 × .15 Imputed interest rate ................................................. Imputed interest charge .................................................................... Residual income ..................................................................................... McGraw-Hill/Irwin Managerial Accounting, 8/e 11-3 $ 4,920,000 3,690,000 $ 1,230,000 2009 The McGraw-Hill Companies, Inc. EXERCISE 13-29 (CONTINUED) 2. Yes, Fairmont’s management probably would have accepted the investment if residual income were used. The investment opportunity would have lowered Fairmont’s 20x1 ROI because the project's expected return (18 percent) was lower than the division's historical returns (19.3 percent to 22.1 percent) as well as its actual 20x1 ROI (20 percent). Management may have rejected the investment because bonuses are based in part on the ROI performance measure. If residual income were used as a performance measure (and as a basis for bonuses), management would accept any and all investments that would increase residual income (i.e., a dollar amount rather than a percentage) including the investment opportunity it had in 20x1. 3. In the electronic version of the solutions manual, press the CTRL key and click on the following link: BUILD A SPREADSHEET EXERCISE 13-34 (10 MINUTES) 1. Transfer price = outlay cost = $450* + opportunity cost + $120† = $570 *Outlay cost = unit variable production cost †Opportunity cost = $570 – $450 = $120 2. = forgone contribution margin If the Fabrication Division has excess capacity, there is no opportunity cost associated with a transfer. Therefore: Transfer price = outlay cost + = $450 McGraw-Hill/Irwin Managerial Accounting, 8/e 11-4 + opportunity cost 0 = $450 2009 The McGraw-Hill Companies, Inc. EXERCISE 13-35 (25 MINUTES) 1. The Assembly Division's manager is likely to reject the special offer because the Assembly Division's incremental cost on the special order exceeds the division's incremental revenue: Incremental revenue per unit in special order ....................... Incremental cost to Assembly Division per unit in special order: Transfer price ...................................................................... Additional variable cost...................................................... Total incremental cost .............................................................. Loss per unit in special order .................................................. 2. $561 150 711 $ (11) The Assembly Division manager's likely decision to reject the special order is not in the best interests of the company as a whole, since the company's incremental revenue on the special order exceeds the company's incremental cost: Incremental revenue per unit in special order .................... Incremental cost to company per unit in special order: Unit variable cost incurred in Fabrication Division ........ Unit variable cost incurred in Assembly Division .......... Total unit variable cost .......................................................... Profit per unit in special order .............................................. 3. $700 $700 $450 150 600 $100 The transfer price could be set in accordance with the general rule, as follows: Transfer price = outlay cost = $450 + opportunity cost + 0* = $450 *Opportunity cost is zero, since the Fabrication Division has excess capacity. Now the Assembly Division manager will have an incentive to accept the special order since the Assembly Division's incremental revenue on the special order exceeds the incremental cost. The incremental revenue is still $700 per unit, but the incremental cost drops to $600 per unit ($450 transfer price + $150 variable cost incurred in the Assembly Division). McGraw-Hill/Irwin Managerial Accounting, 8/e 11-5 2009 The McGraw-Hill Companies, Inc. PROBLEM 13-46 (25 MINUTES) 1. The Birmingham divisional manager will likely be opposed to the transfer. Currently, the division is selling all the units it produces at $1,550 each. With transfers taking place at $1,500, Birmingham will suffer a $50 drop in sales revenue and profit on each unit it sends to Tampa. 2. Although Tampa is receiving a $50 “price break” on each unit purchased from Birmingham, the $1,500 transfer price would probably be deemed too high. The reason: Tampa will lose $40 on each satellite positioning system produced and sold. Sales revenue………………………………….. Less: Variable manufacturing costs………. Transfer price paid to Birmingham… Income (loss)…………………………………… $2,800 $1,340 1,500 2,840 $ (40) 3. Although top management desires to introduce the positioning system, it should not lower the price to make the transfer attractive to Tampa. MTI uses a responsibility accounting system, awarding bonuses based on divisional performance. Top management’s intervention/price-lowering decision would undermine the authority and autonomy of Birmingham’s and Tampa’s divisional managers. Ideally, the two divisional managers (or their representatives) should negotiate a mutually agreeable price. 4. MTI would benefit more if it sells the diode reducer externally. Observe that the transfer price is ignored in this evaluation—one that looks at the firm as a whole. Put simply, Birmingham would record the transfer price as revenue whereas Tampa would record the transfer price as a cost, thereby creating a “wash” on the part of the overall entity. Sales revenue.................... Less: Variable cost:: $1,000....................... $1,000 + $1,340........ Contribution margin ......... McGraw-Hill/Irwin Managerial Accounting, 8/e 11-6 Produce Diode; Sell Externally Produce Diode; Transfer; Sell Positioning System $1,550 $2,800 1,000 $ 550 2,340 $ 460 2009 The McGraw-Hill Companies, Inc.