From Partial to Systemic Globalization: International Production

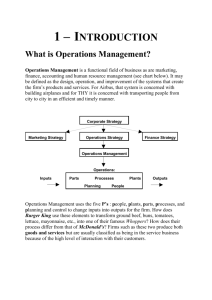

advertisement