Presented by: Dr. Werner R. Murhadi

advertisement

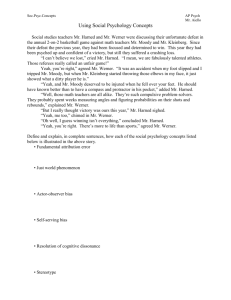

Presented by: Dr. Werner R. Murhadi Dr. Werner R. Murhadi I. A Comprehensive Strategic Management Model External Audit Developing a Strategic Vision & Business Mission Setting Objective Evaluate & Select Strategies Implementing & Executing the Strategy Evaluating Performance Internal Audit Strategic Formulation Dr. Werner R. Murhadi Strategic Implementation Strategic Evaluation I. Strategic Vision & Business Mission A Vision is a description of what competitive position the company wants to attain over a given period of time, & what core competencies it will need to acquire to get there. It can be summarizes a company’s broad strategic focus for the future (De Kluyver) A vision statements reflect what the future course and path of development should be like (Thompson) Something seen in a dream (Merriam-Webster) The vision statement answers the question, “Where do we want to go?” Dr. Werner R. Murhadi An Example: ☺ Eastman Kodak: To be the world’s best in chemical & electronic imaging ☺ Compaq Computer: To be the leading supplier of PCs & PC servers in all customer segments ☺ Visi BNI: Menjadi Bank kebanggaan nasional yang Unggul, Terkemuka dan Terdepan dalam Layanan dan Kinerja ☺ Visi Bank Mandiri: Bank terpercaya pilihan anda ☺ Visi Pegadaian: PEGADAIAN PADA TAHUN 2010 MENJADI PERUSAHAAN YANG MODERN, DINAMIS DAN INOVATIF DENGAN USAHA UTAMA GADAI Dr. Werner R. Murhadi Mission is the reason for the organization’s existence (Boseman) Mission is basic purposes of the organization and show out the reason why and organization exist (Rue) Mission is answer the question “what is our business?” (Thompson) A mission statement answers the question, “Why do we exist?” Dr. Werner R. Murhadi An Example: ☺ Avis rent a car: Our business is renting cars, our mission is total customer satisfaction ☺ Ritz Carlton Hotel is a place where the genuine care & comfort of our quest is our highest mission ☺ Misi BNI: Memaksimalkan stakeholder value dengan menyediakan solusi keuangan yang fokus pada segmen pasar korporasi, komersial dan konsumer ☺ Misi Bank Mandiri: Berorientasi pada pemenuhan kebutuhan pasar Mengembangkan sumber daya manusia professional Memberi keuntungan yang maksimal bagi stakeholder Melaksanakan manajemen terbuka Peduli terhadap kepentingan masyarakat dan lingkungan ☺ Misi Pegadaian: IKUT MEMBANTU PROGRAM PEMERINTAH DALAM UPAYA MENINGKATKAN KESEJAHTERAAN MASYARAKAT GOLONGAN MENENGAH KE BAWAH MELALUI KEGIATAN UTAMA BERUPA PENYALURAN KREDIT GADAI DAN MELAKUKAN USAHA LAIN YANG MENGUNTUNGKAN Dr. Werner R. Murhadi II. External Audit ۩ Remote Environment PEST Analysis ☼ Industry Environment Five Forces Model Operating Environment -Creditor -Labor Union -Government Business Firm Dr. Werner R. Murhadi Dr. Werner R. Murhadi Dr. Werner R. Murhadi Dr. Werner R. Murhadi FIVE FORCES MODEL BY MICHAEL PORTER Potential New entrants Suppliers Industry Competitors Substitute Products Dr. Werner R. Murhadi Buyers Dr. Werner R. Murhadi Dr. Werner R. Murhadi Dr. Werner R. Murhadi Industry Analysis: The External Factor Evaluation (EFE) The EFE Matrix can be developed in five steps: 1. List key external factors as identified in the external audit process. List the opportunities first and then the threat. 2. Assign each factor a weight that ranges from 0,0 (not important) to 1,0 (very important). The weight indicates the relative importance of that factor to being successful in the firm’s industry. The sum of all weights assigned to the factors must equal 1,0. 3. Assign a 1 to 4 rating to each key external factor to indicate how effectively the firm’s current strategies respond to the factor, where 4= the response is superior; 3= the response is above average; 2= the response is average; and 1= the response is poor. Dr. Werner R. Murhadi 4. Multiply each factor’s weight by its rating to determine a weighted score. 5. Sum the weighted scores for each variable to determine the total weighted score for the organization. Dr. Werner R. Murhadi An Example: EFE Matrix for Morgan Stanley Dean Witter Dr. Werner R. Murhadi The Competitive Profile Matrix The competitive Profile Matrix (CPM) identifies a firm’s major competitors and its particular strengths and weaknesses in relation to a sample firm’s strategic position. The weight & total weighted score in both CPM and EFE have the same meaning. However, critical success factor in a CPM include both internal & external issues; therefore the ratings refer to strengths and weaknesses; where 4= major strength; 3=minor strength; 2= minor weaknesses; & 1 = major weaknesses. An example of CPM for Gateway computer company (the best price) compare with apple (the best product quality & management experiences) and Dell (the best market share & inventory system). Dr. Werner R. Murhadi Dr. Werner R. Murhadi III. Internal Audit Based on The Resources Based View (RBV) contend that organizational performance determined by internal resources: - Physical Resources (Plant & equipment; location, technology; raw material; machines) - Human Resources (all employee; training; experience; intelligence; knowledge, skill, abilities) - Organizational Resources (firm structure; information system; patents; trade mark; copyrights, database, etc) Also Look on Marketing and finance perspective Dr. Werner R. Murhadi Industry Analysis: The Internal Factor Evaluation (IFE) The IFE Matrix can be developed in five steps: 1. List key internal factors as identified in the internal audit process. List the strengths first and then the weaknesses. 2. Assign each factor a weight that ranges from 0,0 (not important) to 1,0 (very important). The weight indicates the relative importance of that factor to being successful in the firm’s industry. The sum of all weights assigned to the factors must equal 1,0. 3. Assign a 1 to 4 rating to each factor to indicate whether that factor represent a major weakness (=1), a minor weakness (=2); a minor strengths (=3) and major strengths (=4) Dr. Werner R. Murhadi 4. Multiply each factor’s weight by its rating to determine a weighted score. 5. Sum the weighted scores for each variable to determine the total weighted score for the organization. Dr. Werner R. Murhadi An Example: IFE Matrix for Morgan Stanley Dean Witter Dr. Werner R. Murhadi IV. Setting Objective Establish Long Term Objective The Nature of Long Term Objective: 1. Quantifiable 2. Measurable 3. Realistic 4. Understandable 5. Challenging 6. Attainable 7. Congruent among organizational unit 8. Time SMART (specific, measurable, attainable, realistic, time) Dr. Werner R. Murhadi IV. Evaluate & Select Strategies STAGE I: THE INPUT STAGE EFE Matrix Competitive Profile Matrix (CPM) IFE Matrix STAGE II: THE MATCHING STAGE TOWS Matrix SPACE Matrix BCG Matrix IE Matrix Grand Strategy Matrix STAGE II: THE DECISION STAGE Quantitative Strategic Planning Matrix (QSPM) Dr. Werner R. Murhadi TOWS Matrix TOWS Matrix consist of four type of strategies: 1. SO (Strength – Opportunities) Strategy 2. WO (Weakness – Opportunities) Strategy 3. ST (Strength – Threat) Strategy 4. WT (Weakness – Threat) Strategy Dr. Werner R. Murhadi Internal Kekuatan (S) Kelemahan (W) Eksternal Kekuatan/Peluang Memilih keuntungan Kelemahan/Peluang Memanfaatkan peluang Peluang (O) Strategi Pemecahan Masalah, Perbaikan & Pengembangan Ancaman (T) Mengerahkan kekuatan Kekuatan/Ancaman Dr. Werner R. Murhadi Mengendalikan ancaman Kelemahan/Ancaman The TOWS Matrix can be developed in eight steps: 1. List the firm key external opportunities 2. List the firm key external threats 3. List the firm key internal strengths 4. List the firm key internal weakness 5. Match internal strength with external opportunities, & record the resultant SO Strategies in the appropriate cell. 6. Match internal weakness with external opportunities, & record the resultant WO Strategies. 7. Match internal strength with external threat, & record the resultant ST Strategies. 8. Match internal weakness with external threat, & record the resultant WT Strategies. Dr. Werner R. Murhadi An Example: TOWS Matrix for Morgan Stanley Dean Witter Dr. Werner R. Murhadi SPACE Matrix The Strategic Position and Action Evaluation (SPACE) Matrix consist of four quadrant framework indicate whether aggressive, conservative, defensive, or competitive strategies are most appropriate for a given organization. The axes of the SPACE Matrix represent two internal dimension: Financial Strength (FS) and Competitive Advantage (CA); and two external dimension: Environmental Stability (ES) and Industry Strength (IS) Dr. Werner R. Murhadi The SPACE Matrix can be developed in sixth steps: 1. Select a set of variable to define FS, CA, ES and IS. 2. Assign a numerical value ranging from +1 (worst) to +6 (best) to each of variables that make up the FS and IS dimensions. Assign a numerical value ranging from -1 (best) to -6 (worst) to each the variables that make up the ES and CA dimension. On the FS & CA axes, make comparison to competitor. On the IS & ES, make comparison to other industries. 3. Compute an average score for FS, IS, ES and CA by summing the values given to the variables of each dimension & then by dividing by the number of variables included in the respective dimension. 4. Plot the average score for FS, IS, ES & CA on the appropriate axis in the space matrix. Dr. Werner R. Murhadi 5. Add the two score on the X axis and plot the resultant point on X. add the two scores on the Y axis and plot the resultant point on Y. Plot the intersection of the new XY point. 6. Draw a directional vector from the origin of the SPACE matrix through the new intersection point . This vector reveals the type of strategies recommended for the organization: aggressive, competitive, defensive or conservative. Dr. Werner R. Murhadi An Example: SPACE Matrix for Morgan Stanley Dean Witter Dr. Werner R. Murhadi FS = 2,29 & ES = -1,71 CA = -1,43 & IS = 4,25 FS Y-axis = 2,29 + (-1,71) = 0,58 X-axis = 4,25 + (-1,43) = 2,82 Aggresive Conservative CA IS Competitive Defensive ES Dr. Werner R. Murhadi Dr. Werner R. Murhadi BCG Matrix The BCG matrix or also called BCG model relates to marketing. The BCG model is a well-known portfolio management tool used in product life cycle theory. BCG matrix is often used to prioritize which products within company product mix get more funding and attention. The BCG matrix model is a portfolio planning model developed by Bruce Henderson of the Boston Consulting Group in the early 1970's. The BCG model is based on classification of products (and implicitly also company business units) into four categories based on combinations of market growth and market share relative to the largest competitor. Dr. Werner R. Murhadi The BCG matrix Market Growth = Sales Industryt – Sales Industryt-1 Sales Industryt-1 Market Share = Sales Companyt / Sales Industryt Dr. Werner R. Murhadi BCG Matrix closed related with Product/Business Life Cycle Introduction Growth Mature Dr. Werner R. Murhadi Decline BCG STARS (high growth, high market share) - Stars are defined by having high market share in a growing market. - Stars are the leaders in the business but still need a lot of support for promotion a placement. If market share is kept, Stars are likely to grow into cash cows. BCG QUESTION MARKS (high growth, low market share) - These products are in growing markets but have low market share. - Question marks are essentially new products where buyers have yet to discover them. - The marketing strategy is to get markets to adopt these products. - Question marks have high demands and low returns due to low market share. - These products need to increase their market share quickly or they become dogs. - The best way to handle Question marks is to either invest heavily in them to gain market share or to sell them. Dr. Werner R. Murhadi BCG CASH COWS (low growth, high market share) - Cash cows are in a position of high market share in a mature market. - If competitive advantage has been achieved, cash cows have high profit margins and generate a lot of cash flow. - Because of the low growth, promotion and placement investments are low. - Investments into supporting infrastructure can improve efficiency and increase cash flow more. - Cash cows are the products that businesses strive for. BCG DOGS (low growth, low market share) - Dogs are in low growth markets and have low market share. - Dogs should be avoided and minimized. - Expensive turn-around plans usually do not help. Dr. Werner R. Murhadi Internal External (IE) Matrix The IE matrix helps to make more sense out of the EFE and IFE matrixes. The IE matrix is based on two criteria the score from the EFE for its y-axis and the score from the IFE for its x-axis. After you plot the point, the IE then provides a strategy for the company to follow. The Internal-External (IE) Matrix positions an organization's various divisions in a nine cell display illustrated in Next Figure. The IE Matrix is similar to the BCG Matrix in that both tools involve plotting organization divisions in a schematic diagram; this is why they are both called portfolio matrices. Also, the size of each circle represents the percentage sales contribution of each division, and pie slices reveal the percentage profit contribution of each division in both the BCG and IE Matrix. Dr. Werner R. Murhadi But there are some important differences between the BCG Matrix and IE Matrix. First, the axes are different. Also, the IF Matrix requires more information about the divisions than the BCG Matrix. Further, the strategic implications of each matrix are different. For these reasons, strategists in multidivisional firms often develop both the BCG Matrix and the IE Matrix in formulating alternative strategies. A common practice is to develop a BCG Matrix and an IE Matrix for the present and then develop projected matrices to reflect expectations of the future. This before-and-after analysis forecasts the expected effect of strategic decisions on an organization's portfolio of divisions. Dr. Werner R. Murhadi The IE Matrix is based on two key dimensions: the IFE total weighted scores on the x-axis and the EFE total weighted scores on the y-axis. Recall that each division of an organization should construct an IFE Matrix and an EFE Matrix for its part of the organization. The total weighted scores derived from the divisions allow construction of the corporate-level IE Matrix. On the x-axis of the IE Matrix, an IFE total weighted score of 1.0 to 1.99 represents a weak internal position; a score of 2.0 to 2.99 is considered average; and a score of 3.0 to 4.0 is strong. Similarly, on the y-axis, an EFE total weighted score of 1.0 to 1.99 is considered low; a score of 2.0 to 2.99 is medium; and a score of 3.0 to 4.0 is high. Dr. Werner R. Murhadi The IF Matrix can be divided into three major regions that have different strategy implications. First, the prescription for divisions that fall into cells- I, II, or IV can be described as grow and build. Intensive (market penetration, market development, and product development) or integrative (backward integration, forward integration, and horizontal integration) strategies can be most appropriate for these divisions. Second, divisions that fall into cells III, V, or VII can be managed best with hold and maintain strategies; market penetration and product development are two commonly employed strategies for these types of divisions. Third, a common prescription for divisions that fall into cells VI, VIII, or IX is harvest or divest. Successful organizations are able to achieve a portfolio of businesses positioned in or around cell I in the IE Matrix. Dr. Werner R. Murhadi Dr. Werner R. Murhadi Dr. Werner R. Murhadi An Example :IE Matrix for Morgan Stanley Dean Witter IFE = 3,4 and EFE 3,4 External Score Dr. Werner R. Murhadi Another Example for division in one company Dr. Werner R. Murhadi An example of a completed IE Matrix is given in Figure 6-10, which depicts an organization composed of four divisions. As indicated by the positioning of the circles, grow and build strategies are appropriate for Division 1, Division 2, and Division 3. Division 4 is a candidate for harvest or divert. Division 2 contributes the greatest percentage of company sales and thus is represented by the largest circle. Division 1. contributes the greatest proportion of total profits; it has the largest-percentage pie slice. Dr. Werner R. Murhadi Grand Strategy Matrix In addition to the TOWS matrix, SPACE Matrix, BCG Matrix & IE Matrix, the Grand Strategy Matrix has become a popular tool for formulating alternative strategies. The Grand Strategy Matrix is based on two evaluative dimensions: Competitive Position and Market Growth. Firm in Quadrant I are in an excellent strategic position. For these firms, continued concentration on current market (market penetration & market development) and product (product development) is an appropriate strategy. When a quadrant I organization have excessive resources, then backward, forward or horizontal integration may be effective strategies. When firm is to heavily committed to single product, then concentric diversification may reduce the risk associated with a narrow product line. Dr. Werner R. Murhadi Firm in Quadrant II need to evaluate their present approach to the marketplace seriously. Although their industry growing, they are unable to compete effectively. Firm in Q-II are in rapid market growth industry, an intensive strategy (as opposed to integrative or diversification) is usually the first option that should be considered. However, if the firm is lacking a distinctive competence or competitive advantage, then horizontal integration is often a desirable alternative. As a last resort, divestiture or liquidation should be considered. Divestiture can provide funds needed to acquire other businesses or buy back shares of stock. Dr. Werner R. Murhadi Quadrant III firm compete in slow growth industries and have weak competitive position. Theses firms must make some drastic changes quickly to avoid further decline and possible liquidation. Extensive cost and asset reduction (retrenchment) should be pursued first. An alternative strategy is to shift resources away from the current business into different areas (diversify). if all else fails, the final options for Q-III business are divestiture or liquidation. Dr. Werner R. Murhadi Finally, Quadrant IV firm have strong competitive position but are in slow growth industry. These firms have the strength to launch diversified programs into more promising growth areas. Q-IV firms have characteristically high cash flow levels and limited internal growth needs and often can pursue concentric, horizontal, or conglomerate diversification successfully. Q-IV firms also may pursue joint ventures. Dr. Werner R. Murhadi Rapid Market Growth Weak Competitive Position Quadrant II 1. Market Development 2. Market Penetration 3. Product Development 4. Horizontal Integration 5. Divestiture 6. Liquidation Quadrant III 1. Retrenchment 2. Horizontal Diversification 3. Concentric Diversification 4. Conglomerate Diversification 5. Divestiture 6. Liquidation Quadrant I 1. Market Development 2. Market Penetration 3. Product Development 4. Forward Integration 5. Backward Integration 6. Horizontal Integration 7. Concentric Diversification Strong Competitive Position Quadrant IV 1. Horizontal Diversification 2. Concentric Diversification 3. Conglomerate Diversification 4. Joint Ventures Slow Market Growth Dr. Werner R. Murhadi Dr. Werner R. Murhadi Quantitative Strategic Planning Matrix (QSPM) Quantitative Strategic Planning Matrix (QSPM) is a high-level strategic management approach for evaluating possible strategies. Quantitative Strategic Planning Matrix or a QSPM provides an analytical method for comparing feasible alternative actions. The QSPM method falls within so-called stage 3 of the strategy formulation analytical framework. The Quantitative Strategic Planning Matrix or a QSPM approach attempts to objectively select the best strategy using input from other management techniques and some easy computations. In other words, the QSPM method uses inputs from stage 1 analyses, matches them with results from stage 2 analyses, and then decides objectively among alternative strategies. Dr. Werner R. Murhadi Stage 1 strategic management tools... The first step in the overall strategic management analysis is used to identify key strategic factors. This can be done using, for example, the EFE matrix and IFE matrix. Stage 2 strategic management tools... After we identify and analyze key strategic factors as inputs for QSPM, we can formulate the type of the strategy we would like to pursue. This can be done using the stage 2 strategic management tools, for example the SWOT analysis (or TOWS), SPACE matrix analysis, BCG matrix model, or the IE matrix model. Stage 3 strategic management tools... The stage 1 strategic management methods provided us with key strategic factors. Based on their analysis, we formulated possible strategies in stage 2. Now, the task is to compare in QSPM alternative strategies and decide which one is the most suitable for our goals. Dr. Werner R. Murhadi QSPM Step by Step 1.Provide a list of internal factors -- strengths and weaknesses. Then generate a list of the firm's key external factors -- opportunities and threats. These will be included in the left column of the QSPM. You can take these factors from the EFE matrix and the IFE matrix. 2. Having the factors ready, identify strategy alternatives that will be further evaluated. These strategies are displayed at the top of the table. Strategies evaluated in the QSPM should be mutually exclusive if possible. 3. Each key external and internal factor should have some weight in the overall scheme. You can take these weights from the IFE and EFE matrices again. You can find these numbers in our example in the column following the column with factors. Dr. Werner R. Murhadi 4. Attractiveness Scores (AS) in the QSPM indicate how each factor is important or attractive to each alternative strategy. Attractiveness Scores are determined by examining each key external and internal factor separately, one at a time, and asking the following question: Does this factor make a difference in our decision about which strategy to pursue? If the answer to this question is yes, then the strategies should be compared relative to that key factor. The range for Attractiveness Scores is 1 = not attractive, 2 = somewhat attractive, 3 = reasonably attractive, and 4 = highly attractive. If the answer to the above question is no, then the respective key factor has no effect on our decision. If the key factor does not affect the choice being made at all, then the Attractiveness Score would be 0. Dr. Werner R. Murhadi 5. Calculate the Total Attractiveness Scores (TAS) in the QSPM. Total Attractiveness Scores are defined as the product of multiplying the weights (step 3) by the Attractiveness Scores (step 4) in each row. The Total Attractiveness Scores indicate the relative attractiveness of each key factor and related individual strategy. The higher the Total Attractiveness Score, the more attractive the strategic alternative or critical factor. 6. Calculate the Sum Total Attractiveness Score by adding all Total Attractiveness Scores in each strategy column of the QSPM. The QSPM Sum Total Attractiveness Scores reveal which strategy is most attractive. Higher scores point at a more attractive strategy, considering all the relevant external and internal critical factors that could affect the strategic decision. Dr. Werner R. Murhadi An Example QSPM Matrix for Morgan Stanley Dean Witter Dr. Werner R. Murhadi Another Example (Attractiveness Score: 1 = not acceptable; 2 = possibly acceptable; 3 = probably acceptable; 4 = most acceptable; 0 = not relevant) Dr. Werner R. Murhadi Another Example: Indonesian Cases Dr. Werner R. Murhadi Dr. Werner R. Murhadi