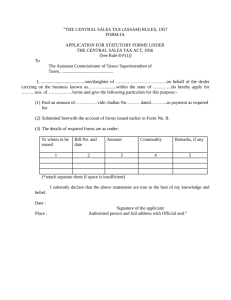

Chapter 3 Accounting Books and Records

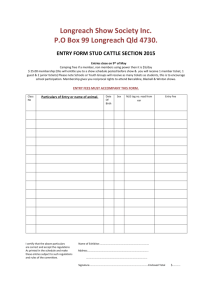

advertisement