CEE in the global crisis

- Stock-taking and perspectives -

Think Tank of Deutsche Bank Group

Gunter Deuber, April 2010

Agenda

1

After crisis year 2009, 2010 remains challenging

2

Some comments on recent eye-catchers in CEE

3

Summary & Outlook

1

CEE in the global crisis

Risk of economic setback initially underestimated

Strongest setback in growth

(expectations) in CEE & CIS

Setback in CEE was stronger than in

most other regions (DM & EM)

Real GDP growth (forecasts and final

outcome for the year 2009), % yoy

6

4

2

0

-2

-4

-6

-8

-10

-12

0

-2

-4

-6

Global crisis has hit CEE as “perfect

storm”

-8

-10

-12

-14

World

EA

EM

CEE

CIS

IMF WEO 08 forecast (left)

IMF WEO 09 forecast (left)

Final outcome (left)

Difference WEO 08 WEO 09, percentage points (right)

Source: IMF, DB Research

Gunter Deuber, April, 2010

Page 3

Better outcome than in IMF’s WEO

2009 forecast mainly driven by

Poland’s weight in the CEE

aggregate

1

CEE in the global crisis

Current account adjustment comparable to Asian crisis

Substantial current account

adjustment within 1 year

CEE: Adjusting to new reality

8

Change in the current account balance in % of

GDP, percentage points

6

4

12

10

2

8

0

6

-2

4

-4

2

-6

0

-8

-2

-10

t-5

t-4

t-3

CEE

t-2

t-1

t0

t+1

ASEAN-5

2005

2006

2007

Current account, % of GDP

CEE t0=2009; ASEAN t0=1998.

Sources: IMF, DB Research

Gunter Deuber, April, 2010

2004

Source: National sources, DB Research

Page 4

2008

2009

2010E

Real GDP, % yoy

1

CEE in the global crisis

What‘s the difference to the Asian crisis

Large on-shore presence of foreign

banks plus coordinated action

(private + public sector)

Trade performance CEE (2009)

vs. ASEAN-5 (1998)

% yoy

30

25

20

15

10

5

0

-5

-10

-15

-20

Early IMF/EU support and increased

flexibility in IMF/EU conditionality

t-8

t-7

t-6

t-5

t-4

t-3

t-2

t-1

t0

t+1

CEE export volume of goods

CEE import volume of goods

ASEAN-5 export volume of goods

ASEAN-5 import volume of goods

Sources: IMF, DB Research

Gunter Deuber, April, 2010

Page 5

Weak backdrop in most DM (incl.

major EU countries) will not bode

well for a strong and sustainable

export-led recovery

1

CEE in the global crisis

Different crisis reaction in comparison to Euro area strongly differing performance in the global crisis

CEE: Low saving rates, soaring

consumption

Striking country differences

in coping with the global crisis

Gross national savings, % of GDP, private

consumption, % yoy

23

21

19

17

15

15

10

10

5

8

0

6

-5

4

-10

2

-15

0

-20

-2

-25

97

99

01

03

05

07

09

15

10

5

0

97

99

01

03

05

07

09

CEE maximum* real GDP, % yoy (left)

CEE minimum* real GDP, % yoy (left)

Difference Max Min GDP growth rate (right)

Savings Euro area (left)

Savings CEE (left)

Private consumption Euro area (right)

Private consumption CEE (right)

* Maximum and minimum growth rate among all CEE.

Sources: IMF, DB Research

Gunter Deuber, April, 2010

20

95

-4

95

25

Sources: IMF, national sources, DB Research

Page 6

1

CEE in the global crisis

2010 will remain challenging for CEE banks

A lot of adjustment in the real

economy and the banking sectors did

take place already

Rise in NPLs and unemployment

to bottom out later in 2010

NPLs in % of total loans (nat. definition),

30

25

20

15

10

5

0

CZ

HU

PL

EE

BG

LT

RO

LV

NPLs, 2008 eop

NPLs, latest value

Unemployment, 2008 eop

Unemployment, latest value

NPLs peak level forecast lower bound*

NPLs peak level forecast upper bound*

Forecasts for NPL peak level DBR Credit Monitor Eastern Europe,

Sources: Eurostat, nat. central banks and regulators, DB Research

Gunter Deuber, April, 2010

Page 7

However, CEE will remain the most

vulnerable EM region due to high

external financing requirements and

debt overhang

NPLs and unemployment to peak

later in 2010, only sluggish

downtrend afterwards

1

CEE in the global crisis

Maastricht criteria in reach – be prepared for challenging

sovereign debt outlook in developed markets

CEE: Debt criterion well in reach

Welcome to a new world!

Budget deficit, % of GDP (y-axis), public debt,

% of GDP (x-axis)

Public debt*, % of GDP (baseline)

140

120

-9

LV

-7

RO

-5

EE

-3

-1

LT

LV

1

SI

SK

RO

BG

BG

LT

100

PL

CZ

80

HU

60

HU

40

PL

SK

CZ

20

SI

0

95 97 99 01 03 05 07 09 11 13 15 17 19

EE

3

0

20

2007

40

60

2010

80

Emerging markets

*GDP-weighted. Source: DB Research, Public Debt in 2020

Sources: Eurostat, DB Research

Gunter Deuber, April, 2010

Developed markets

Page 8

1

CEE in the global crisis

CEE to profit from export-led rebound in Germany and

its close trade links to Europe‘s export hub

Sluggish Eurozone recovery …

… but CEE to join EM recovery

Real GDP, % yoy

Real GDP, % yoy

8

6

6

4

4

2

2

0

0

-2

-4

-2

-6

-4

-8

-10

2008

-6

2008

G7

2009E

US

EA

2010F

DE

2011F

Euroland

PL

CEE

Sources: DB Global Markets Research, DB Research

Gunter Deuber, April, 2010

2009

2010F

CZ

RU

Sources: national sources, DB Research

Page 9

2011E

HU

EM

Agenda

1

After crisis year 2009, 2010 remains challenging

2

Some comments on recent eye-catchers in CEE

3

Summary & Outlook

2

CEE in the global crisis

Some comments on recent eye-catchers in CEE

What is the reason for Poland’s outstanding economic performance?

Was it a mistake to develop export-oriented industries that suffered much from

shrinking EU markets?

Has it been an advantage to be in the Eurozone?

Will western banks be able to support their CEE subsidiaries?

Gunter Deuber, April, 2010

Page 11

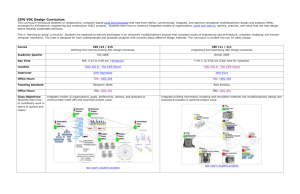

2

CEE in the global crisis

What is the reason for Poland’s outstanding economic

performance?

No pre-crisis economic boom

Moderate credit expansion

Real GDP, % yoy

Credit growth, % yoy

15

100

10

80

5

60

0

40

-5

20

-10

-15

0

-20

-20

02

03

04

05

06

07

08

09

10E

03

04

05

06

07

08

CEE maximum* credit growth, % yoy

CEE minimum* credit growth, % yoy

Poland

CEE maximum* real GDP, % yoy

CEE minimum* real GDP, % yoy

Poland

* Maximum and minimum growth rate among all CEE.

Sources: IMF, national sources, DB Research

* Maximum and minimum growth rate among all CEE.

Sources: IMF, national sources, DB Research

Gunter Deuber, April, 2010

02

Page 12

09

10E

2

CEE in the global crisis

What is the reason for Poland’s outstanding economic

performance?

Strong fiscal expansion to

counterbalance downturn

Flexibility like in hard hit countries

(HU, RO or Baltics)

Cyclically-adjusted fiscal balance, % of GDP

Difference between export and import growth,

percentage points

2

15

0

10

-2

-4

5

-6

0

-8

-5

-10

-10

-12

2000

2002

CZ

2004

HU

Sources: OECD, DB Research

Gunter Deuber, April, 2010

2006

PL

2008

2010E

Eurozone

-15

2006

PL

2007

CZ

2008

2009

HU

2010

RO

Sources: Eurostat, national statistics, DB Research

Page 13

2011

Baltics

2

CEE in the global crisis

Poland’s outstanding economic performance – A brief

summary

Mix of structural factors and good policies

–

–

–

–

–

–

No pre-crisis economic boom

Economy was hit in late stage of cyclical upturn

Lower dependency on external trade

Credible monetary and FX regime

Prudent stance in the banking sector, regulation on FX (household) lending

Fiscal leeway to counterbalance downturn

The year 2009 was exceptional due to strong government expansion

and positive growth contribution of net exports

Gunter Deuber, April, 2010

Page 14

2

CEE in the global crisis

Was it a mistake to develop export-oriented industries

that suffered much from shrinking EU markets?

Pronounced dependency on

intra-EU-trade

Most CEE strongly exposed to trade

shocks as most of them are small

and open economies

Intra-EU-trade, % of total trade (2008)

85

80

Trade dependency

75

65

- above the average of most

developed EU countries

60

- higher than in most other EM

70

55

50

CZ SK PL LV EE HU SI RO LT BG BE NL DE IT UK

Dependency on intra-EU-trade higher

than in most EU-15 countries

Sources: Eurostat, DB Research

Gunter Deuber, April, 2010

Page 15

2

CEE in the global crisis

Was it a mistake to develop export-oriented industries

that suffered much from shrinking EU markets?

Striking dependency on

manufacturing exports, higher than in

the EU-15 and most other EM

High concentration on sectors

hit hard by the global crisis

Share in total trade, %

100%

80%

Manufacturing concentrated in the

sectors of durable consumption and

investment goods (sectors that

suffered the most in the global crisis)

60%

40%

20%

0%

Exports

Imports

Exports

Imports

EU 15

EU 15

CEE

CEE

Services

Transport equipment

Other manufacturing

Primary goods

Source: Eurostat, OENB, DB Research

Gunter Deuber, April, 2010

Page 16

- Exports of goods from CEE dropped by

23% during the peak of the crisis in

2009, service exports by 6%

2

CEE in the global crisis

Was it a mistake to develop export-oriented industries

that suffered much from shrinking EU markets?

The region’s specialization and export orientation should not be devalued

There was not alternative, but future strategies should focus on diversifying

exports in terms of sectors (especially services) and markets

Growth potential of export shares within EU largely exploited

Recovery in the EU will the sluggish

Strong export-orientation in manufacturing has important implications

- Strong pressure to preserve international (cost) competitiveness

- Cost advantages can erode quickly

- Competitiveness will have to be based on productivity rather than costs

going forward

Gunter Deuber, April, 2010

Page 17

2

CEE in the global crisis

Has it been an advantage to be in the Eurozone?

Benefits of EMU membership not straightforward

– EMU a shelter in terms of relative currency and capital (in)flow stability as

well as the pass-through of low interest rates

– EMU no quick fix to economic vulnerabilities, joining EMU not an optimal

strategy at every point in time, without sustainable convergence EMU entry

might turn even out as suboptimal strategy (e.g. currency devaluation no

option as shock absorber)

– EMU membership has not necessarily supported sustainable fiscal policy,

painful price signals of bond markets had been muted before the global

crisis

Recent (market) events inside the EMU are a good reminder that

membership does not shield from sovereign risks

Gunter Deuber, April, 2010

Page 18

2

CEE in the global crisis

Has it been an advantage to be in the Eurozone?

Two countries, with different

reactions to falling interest rates

130

120

110

100

90

80

70

60

50

1995 1997 1999 2001 2003 2005 2007 2009

Is a turnaround easier in- or

outside the EMU?

180

23

18

13

160

8

140

120

6

100

8

3

GR public debt, % of GDP (left)

HU public debt, % of GDP (left)

GR long-term int. rates, % (right)

HU long-term int. rates, % (right)

4

80

60

2009

2

2011

2013

2015

2017

2019

GR public debt, % of GDP (left)

HU public debt, % of GDP (left)

GR long-term int. rates, % (right)

HU long-term int. rates, % (right)

Sources: OECD, Eurostat, DB Research

Sources: OECD, Eurostat, DB Research

Gunter Deuber, April, 2010

10

Page 19

2

CEE in the global crisis

Has it been an advantage to be in the Eurozone?

EMU not essential for FX stability

2004=100, negative slope = appreciation,

positive slope = depreciation

REER adjustment difficult with

limited nominal FX flexibility

2005=100

115

140

110

130

105

120

100

95

110

90

85

100

80

90

75

70

04

05

EUR/CZK

06

07

EUR/HUF

08

09

EUR/PLN

10F

11F

EUR/SKK

Source: ECB, DB Research

Gunter Deuber, April, 2010

80

2001

GR

2003

2005

PT

Source: OECD, DB Research

Page 20

SK

2007

CZ

2009

HU

2011

PL

2

CEE in the global crisis

Has it been an advantage to be in the Eurozone?

Substantial long-term benefits of a

well-prepared EMU entry depending

on vulnerability to currency risks,

competitiveness position and

“Maastricht fitness” …

EMU: No one size fits it all

long-term interest rate

Long-term government bond yields, %

8.0

7.5

7.0

6.5

6.0

5.5

5.0

4.5

4.0

3.5

3.0

… but incentives to join decreased

- Monetary stability and low interest

rates can be preserved outside EMU

01

02

03

04

05

06

07

CZ

EA

SK

GR

IL

PL

08

09 10F 11F

SI

- Challenging sovereign debt outlook

in major EMU countries

Sources: ECB, OECD, DB Research

Gunter Deuber, April, 2010

- Securing outside help (IMF & EU)

easier as non member (HU vs. GR)

Page 21

2

CEE in the global crisis

Will western banks be able to support their CEE

subsidiaries?

... but no widespread

retrenchment of Western banks

Banking sector deleveraging

underway ...

International claims, BIS reporting banks,

Q3 2009/Q3 2008, %

CZ

RU

PL

HU

KZ

UA

RO

BG

LT

EE

LV

0

20

40

60

Foreign liabilities in % of total assets (Dec 08)

Foreign liabilities in % of total assets (Dec 09)

50

Sources: National central banks, DB Research

Gunter Deuber, April, 2010

BG

PL

HU

RO

CZ

LT

EE

UA

LV

KZ

RU

75

Sources: BIS, DB Research

Page 22

100

125

2

CEE in the global crisis

Will western banks be able to support their CEE

subsidiaries?

Declining bank lending to private

non-financial sector

% yoy

Strong setback in bank lending in the

context of the global crisis

60

50

Currently, no indications of a credit

crunch, demand for credit is low

40

30

20

But funding to remain a growth

constraint in the years to come

10

0

-10

Q2 08

Q3 08

CZ

BG

Q4 08

Q1 09

HU

RO

Q2 09

PL

Baltics

Q3 09

Q4 09

SK

Sources: ECB, national central banks

Gunter Deuber, April, 2010

Page 23

2

CEE in the global crisis

Will western banks be able to support their CEE

subsidiaries?

Not meaningful recovery of

int. bank lending up to now

Constraints to ECB's ability to exit

from extraordinary (liquidity)

measures increased

International claims, BIS reporting banks,

% change qoq

25

15

DB expects first ECB rate hike in

March 2011, banking sectors in CEE

to profit as “free riders”

5

-5

-15

-25

Mar 07 Aug 07 Jan 08 Jun 08 Nov 08 Apr 09 Sep 09

Developed countries

Asia & Pacific (without KZ)

Latin America/Caribbean

Eastern Europe (without TR, RU, UA)

Eastern Europe (without TR, with RU, UA, KZ)

Nevertheless, the crisis has shown

that keeping exposure does not

mean strong expansion ...

... and currently, other EM regions

are doing better in attracting crossborder banking flows

Source: BIS, DB Research

Gunter Deuber, April, 2010

Page 24

Agenda

1

After crisis year 2009, 2010 remains challenging

2

Some comments on recent eye-catchers in CEE

3

Summary & Outlook

3

CEE in the global crisis

Summary & Outlook

Multiple speed recovery in 2010 – country & banking sector differentiation to

remain in place in CEE

Structurally driven contraction/stagnation in the real economy and the

banking sector will continue in some CEE countries

Increasing differentiation between self-funding markets & market segments

vs. externally financed markets & market segments

Public debt challenge in the EU-15 & EMU may have a significant impact on

CEE and CEE financial markets

Low debt public debt levels in CEE (relative to EU-15, not EMs!) should be

preserved as comparative advantage

Gunter Deuber, April, 2010

Page 26

© Copyright 2010. Deutsche Bank AG, DB Research, D-60262 Frankfurt am Main, Germany. All rights reserved. When quoting please cite

“Deutsche Bank Research”.

The above information does not constitute the provision of investment, legal or tax advice. Any views expressed reflect the current views of

the author, which do not necessarily correspond to the opinions of Deutsche Bank AG or its affiliates. Opinions expressed may change

without notice. Opinions expressed may differ from views set out in other documents, including research, published by Deutsche Bank. The

above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. No warranty or

representation is made as to the correctness, completeness and accuracy of the information given or the assessments made.

In Germany this information is approved and/or communicated by Deutsche Bank AG Frankfurt, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht. In the United Kingdom this information is approved and/or communicated by Deutsche Bank AG London, a member

of the London Stock Exchange regulated by the Financial Services Authority for the conduct of investment business in the UK. This

information is distributed in Hong Kong by Deutsche Bank AG, Hong Kong Branch, in Korea by Deutsche Securities Korea Co. and in

Singapore by Deutsche Bank AG, Singapore Branch. In Japan this information is approved and/or distributed by Deutsche Securities

Limited, Tokyo Branch. In Australia, retail clients should obtain a copy of a Product Disclosure Statement (PDS) relating to any financial

product referred to in this report and consider the PDS before making any decision about whether to acquire the product.

Gunter Deuber, April, 2010

Page 27