Phases in the Development of a Start

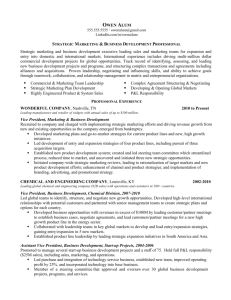

advertisement

Managing Expectations • The role of a founder • Founders versus managers • Not all founders are good managers • Roles change over time • Start-up business plans change a lot! • Goal Synergy: • Compensation: cash or equity? • What are ‘realistic expectations’? Development of a Start-up Company Commercializing Technologies at the University of Minnesota Venture Center University of Minnesota Elements of Success There are 3 major requirements for a successful start-up company: World-class technology Experienced management Adequate financing from experienced investors Technology Ownership For University intellectual property (IP): The Bahy-Dole Act (1980) Grants ownership of IP to the University Requires the University to use its best efforts to commercialize University Regents Policy on cash proceeds from commercialization 1/3 share to the researcher or research team 1/3 share to the research college or department 1/3 share to the University Ownership Goals of a Venture Center Start-up University Management Investors Phases of a Start-up Company’s Growth and Development Phases Description 0 Pre-company Formation 1 Start-up/Company Formation 2 Development Stage 3 Growth Stage 4 Preparation for Exit Pre-company Formation Milestones: Technology assessment Evaluate strength of intellectual property Proof of concept Business/commercialization assessment Determine market need and size Develop 5 year revenue projections Does return on capital meet investor requirements Draft initial business plan Start-up/Company Formation Organizational Structure Chief Technical Advisor (Plus 1-2 Additional) Vice President Research & Development Engineering Team Chemistry Team Chief Executive Officer Chief Financial Officer (Part Time) Accounting Board Of Directors (3 Members) Vice President Business Development Start-up/Company Formation Milestones: Initial management group formed Obtain license from the University Raise initial financing (1st round) Establish initial company operations Develop commercial prototype Start-up/Company Formation Ownership structure following license agreement and initial financing Management University Investors Development-Stage Company Organizational Structure Chief Technical Advisor (Plus 1-3 Additional) Vice President Research & Development Director Engineering Chief Financial Officer (Part Time) Director Chemistry Engineering Team Board Of Directors (4 Members) Chief Executive Officer Controller Vice President Operations Quality Manager Chemistry Team Accounting IT Manager Vice President Business Development Manufacturing Manager Vice President Sales and Marketing Development-Stage Company Milestones: Raise 2nd round financing Expand and develop operations in preparation to launch products Implement manufacturing and sales and marketing strategies Complete development of first product platform Development-Stage Company Ownership structure following second financing Management University Investors Growth-Stage Company Organizational Structure Chief Technical Advisor (Plus 1-3 Additional) Vice President Research & Development Director Engineering Chief Financial Officer (Part Time) Director Chemistry Controller Board Of Directors (5 Members) Chief Executive Officer Vice President Business Development Quality Manager Manufacturing Manager Vice President Operations Instrument Service Vice President Sales and Marketing Technical Service Manager Marketing Manager Engineering Team Chemistry Team Accounting Sales Manager IT Manager Growth-Stage Company Milestones: Launch first product Raise 3rd round financing Drive rapid revenue growth, name and brand recognition - worldwide Continue product development, especially product improvements Growth-Stage Company Ownership structure following third financing Management University Investors Preparation for Exit Milestones: Launch 2nd generation product Achieve profitability Continue rapid revenue ramp Maintain R&D activity Preparation for Exit Example of valuation at exit: Assume revenues of $50 M and profitability Expect multiples in the range of 2.5-6.0 times revenue This produces valuations in the range of $125 M $300 M University portion in the example was 24.5% (or approximately $49 M at a $200 M valuation) Of this portion, the University research team would receive approximately $16 M at the time of exit