Sustainability Report 2011

About

This Report

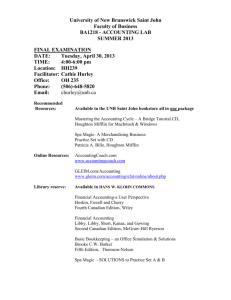

This is Union National Bank’s (UNB) 2011 sustainability report, the Bank’s first annual report that covers its integrated economic, social and environment performance and impact. The report highlights UNB’s strategic direction and approach to the implementation of sustainability management, the Bank’s 2009-2011 sustainability performance as well as commitment for moving towards consistently achieving award winning and long term performance.

This report has been developed using the Global

Reporting Initiative (GRI) G3 Guidelines, the most internationally recognized and used sustainability reporting framework. We declare this report to have achieved a GRI level A+ for transparency and disclosure; this has been checked by the GRI and confirmed (please see annex B for our GRI statement).

UNB is committed to producing an annual sustainability report to better engage and work with all stakeholders on key sustainability development topics. Therefore

UNB is interested in receiving stakeholders› feedback on this report and encourages them to send their notes and recommendations to the following email: sustainability@unb.ae.

This baseline report covers all UNB Group operations in the UAE which includes UNB, Injaz, Union Brokerage

Company(UBC) and Al Wifaq Finance Company. However, the financial figures reflect the entire UNB Group including the International subsidiaries & operations.

Table of Contents

Chairman’s Message

CEO Message

About UNB

Why We Care About Sustainability

Our “We Care” Approach

Our Sustainability Framework

Our Sustainability Strategy

Our Perspective and Commitments

We Care About Our Customers

We Care About Our Employees

We Care About Our Society and Our Business Partners

We Care About Our Environment

We Care About Our Shareholders

Our Sustainability Key Performance Indicators - Summary

Annexes

Annex A – Who We Care About

Annex B - Report Parameters

Annex C - GRI Application Level Statement

Annex D - GRI Index

Annex E - Glossary

Annex F - Acronyms

8

16

18

4

6

18

20

21

22

48

56

64

30

42

71

72

68

70

77

78

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 6

Chairman’s

Message

UNB‘s vision, mission and strategy have been developed in consultation with all stakeholders

On behalf of the Board of Directors, it is a great pleasure to present to all our stakeholders UNB’s first sustainability report.

Considering the challenging market conditions that arose after the world’s recent financial turmoil, UNB has continued to deliver solid results by maintaining strong liquidity and proactively managing its asset quality. UNB is aware that the road ahead is paved with both risks and opportunities, and is taking the lead in responding to these issues by considering sustainability as a vital part of its business strategy. UNB’s sustainability activities are fully aligned with Abu Dhabi’s Economic Vision 2030 guidelines and priorities to support the Emirate’s socioeconomic progress. UNB’s vision, mission and strategy have been developed in consultation with all stakeholders, guaranteeing an aligned and clear road-map to achieve its long-term goals.

Since its inception, UNB has accomplished a lot in terms of delivering customer service excellence while promoting local development. UNB was among the first banks in the

UAE to offer full service centers catering to the needs of

Small and Medium Enterprises (SMEs), and the partnership with Khalifa Fund is helping UNB to broaden its outreach to support and encourage national entrepreneurs.

UNB is also proud to have an engaged and challenged workforce. UNB supports UAE’s Emiratization Policy, and has a division exclusively dedicated to achieve the set Emiratization objectives. To make sure the Bank is directly impacting Emiratization on a national level,

UNB actively encourages its employees to participate in activities supporting the community and the environment.

UNB’s hiring policy focuses on empowering fresh Emirati graduates through training and skills enhancement within the financial services sector. Furthermore, UNB’s procurement is local-focused and plays a key role in the local development by creating new jobs and opportunities.

UNB actively encourages its employees to participate in activities supporting the community and the environment.

All these advances underscore UNB’s commitment to continue investing on the sustainability agenda. We invite all our stakeholders to continue partnering with UNB, seeking innovative opportunities for collaboration and sustainable business growth. It is our duty to create value for our shareholders, our customers and our business partners.

We would also like to take this opportunity to thank all UNB employees for their continued support and engagement, without which our accomplishments would not have been possible.

H.H. Sheikh Nahayan Mabarak Al Nahayan

Chairman

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 8

CEO’s Message

We are aiming to position UNB as the best in class for the banking industry in the UAE.

It is my pleasure to introduce UNB’s first sustainability report, a key milestone in our long record in investing on sustainable management practices.

We believe that by launching this baseline sustainability report, we are responding to our stakeholders’ needs and expectations on higher levels of transparency and accountability, while committing publicly to a set of initiatives that will guide us towards achieving our mission to deliver superior customer service, grow market share and shareholder value and establish the Bank as the employer of choice in the UAE. Furthermore, this report also demonstrates our commitment and alignment to Abu

Dhabi’s overall sustainability agenda.

Sustainable Management represents a new landscape for conducting business more responsibly. Changes in consumer behavior and customer awareness are raising the flag for more transparency in the way companies are conducting their business and it is important that we, as a bank and a catalyst for development, understand the risks related to these changes and turn them into opportunities.

By accepting the challenges of embedding sustainability management in our organizational performance and culture as “The Bank That Cares”, we are aiming to position UNB as the best in class for the banking industry in the UAE.

In the past years, we have received several awards and accolades as an affirmation and testament to UNB’s quest for business excellence. We are the first commercial bank in the world to be certified by M/s Lloyd’s Register Quality

Assurance (LRQA) Ltd. to the Integrated Management

System (IMS) comprising three standards in Quality,

Environment and Health and Safety Management (ISO

9001, ISO 14001 and OHSAS 18001). UNB is one of the most stable banks in the UAE. This is reflected in its consistent ratings and robust performance throughout the years. Despite the global downturn UNB has achieved consistent revenues and sustained business growth while adhering to the highest quality standards for customer service and operations.

To continue being among the best performing banks, we have created a customer-focused and pro-community motto that is the true essence of the way we conduct our business: “The bank that cares”. We are a bank that cares about our customers, employees, society, environment and our shareholders.

We care about our customers by ensuring that our business operations are customer focused and equipped with a number of tailored products and services to meet client needs. In 2011, we were awarded the «Best Domestic Retail

Bank» award by the Banker Middle East Industry Awards. In addition, as part of our strategy of growth, we are expanding our operations to Kuwait, marking the third GCC country where the Bank will be present, besides Qatar. UNB is also present in China with a Representative Office in Shanghai and in Egypt through UNB-Egypt with a total of 28 branches across the country. When caring about our customers, we also care about our society and business partners by ensuring strategic and regular dialogues are conducted.

To be successful in business, we need ambassadors who promote our brand and help create a pillar for delivering the best customer service. We care about our employees, who are our ambassadors and endeavor to contribute to their personal well-being. Our employees benefit from a clear strategy based on performance, and our “open door” policy has created a working environment where everyone feels free to address their issues regardless of titles. In 2011, we received the “Dream Company to work for” award from the

Asian Leadership Awards, which not only recognizes our good practices but also publicly emphasizes our image as a Bank that is committed to empowering and developing its employees.

We also care about our environment and we are committed to enhancing environmental awareness amongst our employees and customers. The implementation of the

Integrated Management System (IMS) will help us manage our environmental performance, and some initiatives such as recycling waste and purchasing recycled paper are already raising awareness among employees on the importance of conserving the environment. Last but not least, we care about our shareholders through continually ensuring strong financial performance, good governance practices and high levels of transparency and accountability.

In 2012 we will be focused on further enhancing our responsibility towards the community, employees and the environment. This means that we will continue aiming for customer loyalty by strengthening and delivering superior customer service, listening to our customer’s expectations and directly catering to them. At the same time, for our staff we are looking at implementing new employee - focused programs which will help in motivating them and performing even better.

Furthermore to support our community we will explore more opportunities for community care programs that empower the

UAE youth and contribute to our nation’s overall workforce.

Moving forward, we will also strive to adopt innovative ideas that mitigate the environmental impact of our business operations while helping our stakeholders to reduce their own environmental impact, and meeting our responsibility to protect and develop the environment in which we operate.

To believe and commit to Sustainable Management is fundamental to ensure quality to you, our stakeholder, in all aspects of our business. We do not invest in sustainability for publicity, we do it for conviction.

This report materializes our commitment to continue partnering with our stakeholders by ensuring high levels of transparency and accountability. Your feedback is of utmost importance and we encourage you to join us in our sustainability journey.

We are the first commercial bank in the world to be certified by M/s Lloyd’s

Register Quality Assurance

(LRQA) Ltd.

Mohammad Nasr Abdeen

Chief Executive Officer

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 1 0

About UNB

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 1 2

VISION

2010-2018: “To be the best in class for the banking industry in the UAE”

MISSION

2010-2012: “To deliver superior customer service, grow market share and shareholder value, and establish the Bank as an employer of choice in the UAE”

Union National Bank (UNB) headquartered in Abu Dhabi is one of the leading domestic banks in the United Arab Emirates (UAE). UNB is unique within the UAE banking sector, with 60% of its shareholding held by the government of Abu Dhabi and Dubai and 40% held by public investors.

UNB delivers its services through a network of 80 branches and business offices across all seven

Emirates in UAE. UNB offers a variety of products and services, addressing needs ranging from basic requirements of individuals to the more complex requirements of corporate entities. UNB caters to the retail, corporate and high networth clients offering conventional and Sharia compliant products and services to meet a range of banking requirements from basic individual needs to complex commercial transactions. The bank also offers investments, brokerage and IPO related services.

wE cARE ABOUT

Overview - Key Indicators 2011

Revenues (AED million)

Net Profit (AED million)

Total assets (AED million)

Number of branches/business offices

Number of employees

2,838

1,500

82,469

80

1,445

UNB has grown into a Group entity spread across geographical boundaries. Union Brokerage Company

(UBC), one of the leading and oldest brokerage firms in UAE, is a subsidiary of UNB and operates through a network of three branches across UAE. Al Wifaq Finance Company is another subsidiary offering Sharia›a compliant products and services and has 4 branches across the UAE.

A B O U T U N B

UNB acquired the erstwhile Alexandria Commercial and Maritime Bank in Egypt to set up operations as

UNB Egypt and has expanded its network to over 28 branches across the country. In addition, UNB is one of the first banks in the UAE to open a representative office at Shanghai in China. UNB also has a branch in Qatar at the Qatar Financial Center, Doha, and is all set to operationalise its branches in Kuwait.

PARTNERSHIPS ANd MEMBERSHIPS

UNB’s partners include over 250 correspondent banks in nearly 50 countries, marketing and advertising agencies, IT software and hardware companies communication infrastructure companies, core banking solution providers, training and accreditation/certification institutions, facility management establishments, as well as entities such as Visa International and MasterCard. Beside, UNB partners with several government departments and regulatory authorities for a smooth conduct of its business operations.

UNB is a member of the Emirates Banking Association and also contributes to the Emirates Institute for Banking and Financial Studies.

UNB’S JOURNEY TOwARdS ExcELLENcE

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 1 4

UNB ORGANIZATIONAL STRUcTURE

A B O U T U N B

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 1 6

Key Achievements

A B O U T U N B

• Our net profit increased by 11.1% in 2011.

• UNB has been recognized in the World Finance 100 list for 2011.

• UNB recognized as a ‘Superbrand’ in 2011 and 2012.

• First commercial bank in the world to be certified by M/s Lloyd’s Register Quality

Assurance (LRQA) Ltd. to the Integrated Management System (IMS) comprising of three standards, ISO 9001, ISO 14001 and OHSAS 18001 for the entire bank and its operations including branches and alternate delivery channels throughout UAE.

• UNB has been consistently ranked in the Top 2 with regard to Customer Service, based on Customer Satisfaction Benchmarking surveys carried out by reputed external market research agencies. UNB’s Complaint Management system is certified to ISO 10002 Standards.

• UNB was ranked amongst the Top 50 Safest Banks in Emerging Markets in

2011 – Global Finance.

• 2011 Brand Leadership Award at the Global Awards for Brand Excellence.

Other Prestigious awards & Recognitions conferred upon UNB

• 2011 Stevie Distinguished Honoree - Executive of the Year Financial Services for

UNB CEO at the International Business Awards.

• 2011 Stevie Distinguished Honoree - Company of the Year Financial Services at the International Business Awards.

• 2011 People’s Choice Stevie Awards for Favorite Companies at the International

Business Awards.

• “Dream Company to work for” Award (2011) at the “Asian Leadership Awards”

• 2011 Golden Award for Quality from the Arab Administrative Development

Organization member of the Arab League and Tatweej Academy for Excellence and Quality.

• “CEO of the Year” at the CEO Middle East Award (2010).

• UNB won the Dubai Quality Award for the 2nd consecutive cycle (2009).

• UNB won the Sheikh Khalifa Excellence Award (SKEA) Gold category for the 2nd consecutive cycle (2009).

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 1 8

Why We

Care About

Sustainability

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 2 0

OUR “wE cARE” APPROAcH

For UNB, sustainability management can be seen as an evolution of our position as “The Bank That Cares”.

Based on the principle of creating value for all of our stakeholders the “We Care” approach is focused on the systematic understanding and addressing of the issues that our stakeholders care most about.

OUR SUSTAINABILITY FRAMEwORK

Following on from our approach, our sustainability framework has been built on the five stakeholder groups that we feel are most impacted by the bank, or have a major influence over the bank’s operations. These include our customers, employees, society and business partners, the environment and shareholders. We have determined what the top issues are for each stakeholder and tailored our strategy accordingly to address these issues.

Although often not seen as a stakeholder, we see the inclusion of the environment as an important strategic move given that environmental risks and opportunities continue to have a substantial impact on our economy, society and nation, and thus our business. For more information on the analysis of our stakeholders needs and our response, please see Annex A.

w H Y w E c A R E A B O U T S U S T A I N A B I L I T Y

Priority Sustainability Area Key Issues

• High-quality customer service and delivery

We Care About Our Customers • Innovative products and services

• Financial inclusion

We Care about Our Employees

• Diversity and Emiratization

• Employee engagement and satisfaction

• Employee training and development

• Employee well-being and benefits

• Strategic community investment

We Care About Our Society and

• Social inclusion and financial literacy

Our Business Partners

• Strategic business partners and strong relationships

We Care About

Our Environment

We Care About

Our Shareholders

• Efficient operations

• Protecting the environment through responsible banking

• Risk-registers in all locations

• Strong financial performance and shareholders return

• Strong governance practices – including risk management

and compliance

• Transparency and accountability

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 2 2

OUR SUSTAINABILITY STRATEGY

We see the implementation of sustainability management and reporting as an opportunity to build a unique advantage in the marketplace. Our sustainability strategy is built on three key components, drawn from an analysis of our stakeholders and current context:

1. world leading management systems

UNB is the first commercial bank in the world to be certified to the Integrated Management System

(IMS) comprising of ISO 9001, ISO 14001 and OHSAS 18001 standards. Through sustainability we aim to leverage and broaden our management systems to generate greater levels of performance that outpaces the market, and satisfies the needs and expectations of stakeholders.

2. Award winning Leadership

Sustainability management, and especially public sustainability reporting will help us to further develop the measurement and transparency of the performance that has helped us to win numerous awards. This will allow our stakeholders to be the judges of our success, not just award panels.

3. Innovation

We shall actively seek to work together with all our stakeholders to demonstrate “Care” by developing products and services that provide financial benefits alongwith enhanced environmental and social benefits. In addition, we will foster sustainability in our value chain and workplace, encouraging everyone to innovate and propose more sustainable solutions to existing operations.

w H Y w E c A R E A B O U T S U S T A I N A B I L I T Y

OUR PERSPEcTIVE ANd cOMMITMENTS

Priority Sustainability Area UNB Perspective

We Care About

Our Customers

Our 2012 commitment

UNB strives to provide high-quality services and customer care to all its customers and potential customers. UNB aims to provide innovative and sustainability-oriented products and services while increasing its customer base in current segments as well as under-served segments

• Conduct an assessment of all retail products to identify opportunities for integrating sustainability principles

• Engage with two corporate customers on adopting sustainability management and reporting

We Care about Our

Employees

We Care About

Our Society and

Our Business Partners

We Care About

Our Environment

Human capital is core to UNB’s success. UNB spares no efforts in investing and developing its employees, and engaging them in achieving its targets while providing a healthy working environment and competitive remuneration packages and benefits.

• Conduct two sustainability training sessions for all employees

• Integrate sustainability into employees job description

• To increase annualized intake of new

UAE National recruits by 4% every year

As a community member, UNB takes responsibility for contributing to community development through responsible lending and strategic community investment that contributes to financial inclusion and enhances financial literacy. UNB aims to systematically engage with its business partners to achieve this through strategic partnerships.

• Enhance UNB community investment

• projects and their impact through the development of Community Investment strategy that incorporates UNB’s core competencies into its community investments

Develop UNB current procurement policy and guidelines to incorporate further sustainability criteria

UNB respects the environment and aims to achieving environment friendly operations through the adoption of energy efficient practices while minimizing materials consumption in all its operations. UNB also recognizes that financial institutions are strongly linked to other strategic sectors at the national level, and accordingly UNB works to mitigate its environmental impact in its investments and lending processes.

• Reduce UNB’s greenhouse gas emissions through reduced resource consumption arising from internal awareness and new technology adoption

We Care About

Our Shareholders

UNB realizes that adopting sustainability management provides wide range of opportunities of products and services innovation that could lead to increased business and revenue leading to improved shareholder value. UNB would support this approach by adopting best governance,

• Issue a GRI level A+ sustainability report

• Create a sustainability stakeholder council to inspire co-innovation and collaboration accountability and transparency practices.

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 2 4

We Care About

Our Customers

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 2 6 w E c A R E A B O U T O U R c U S T O M E R S

wE cARE ABOUT OUR cUSTOMERS

UNB Perspective Our 2012 commitments

UNB strives to provide high-quality services and customer care to all its customers and potential customers. UNB aims to provide innovative and sustainability-oriented products and services while increasing its customer base in current segments as well as under-served segments

• Conduct an assessment of all retail products to identify opportunities for integrating sustainability principles

• Engage with two corporate customers on adopting sustainability management and reporting

• Engage with corporate clients to determine their capabilities for IMS implementation and set a mechanism to incorporate the weightage of the same for credit evaluation in the future

Abu dhabi Economic Vision 2030 Objectives

1. Enlarge the enterprise base

2. Stimulate faster economic growth in the regions

UNB contribution

Participating in the Khalifa Fund – a program to support and develop small and medium enterprises (SMEs)

UNB provides Microfinance to SME non-banking customers in order to enhance their financial skills and provide them with the required banking services and finance that supports their growth and business elevation from one sector to another.

UNB launched the Medic Loan; The Best Innovative SME product in the Middle East as per “Banker Middle East 2011 Product Awards”.

UNB’s “Medic loan is an SME product that provides healthcare providers easy access to finance.

UNB also launched the innovative prepaid Hadiya Gift Card for the first time in the UAE.

In cooperation with the Abu Dhabi Cooperation UNB launched Extra credit card offering exclusive discounts for the Coop’s shoppers as well as cash back

Customers are the central component of our “We Care” approach, one of the main reasons for us winning “Best Domestic Retail Bank” award at the 2011 Banker Middle East Industry Awards. Customers are our most important stakeholders we strive to not only care for them by satisfying their banking needs, This is why we will continually aim to better engage customers in the development and implementation of new and innovative products and services that combine financial sense with enhanced environmental and social benefits.

UNB’s excellence in performance in terms of customer service and products and services innovation, highlighted in this section, was recognized and awarded in several areas:

• Superbrands Award for 2011 and 2012

• EveryDay Interest Savings Account wins Best Savings Account Award at the 2011 Banker Middle East Product Awards

• “Best Domestic Retail Bank» award at the 2011 Banker Middle East Industry Awards

• “Extra” credit card received Best Credit Card Award at the 2010 Banker Middle East Product Awards

UNB has around 200,000 retail customers who are served through an extensive network of branches and through a range of convenient and flexible delivery channels. More than 37% of UNB’s retail customers have a relationship with the Bank for longer than 5 years.

Our ‘consumer sector’ customers have been growing and represent 20% of our total loans and advances in 2011, followed by ‘real estate sector’ customers and ‘government sector’ customers which account for 16% and 14% of our loans and advances in 2011, respectively.

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 2 8 w E c A R E A B O U T O U R c U S T O M E R S

PROdUcT ANd SERVIcE dEVELOPMENT ANd

INNOVATION

Our Products and Services

UNB offers a variety of products and services, addressing needs ranging from the fundamental requirements of the individuals to the more specific requirements of corporate entities or investments. Our main business lines include retail banking, corporate banking, SME banking, real estate banking,

Islamic banking and private banking for high net-worth customers offering conventional and Sharia›a compliant products and services.

Our International and Investment Banking Division offers various services comprising of structured finance, treasury and investments, private banking and wealth management in addition to brokerage services through UNB›s subsidiary “Union Brokerage Company” (UBC). developing Innovative Products and Services

Creativity and innovation are integral to our product development methodology. Input is taken from both internal and external partners to design, develop and deliver competitive products and services that really do respond to what our customers expect from a bank that cares.

To ensure that our customer’s inputs and needs are captured and integrated into our products and services a variety of surveys are administrated by a dedicated Research and Business Development department that works in close coordination with the Product Development team.

Other innovative products and services:

• SMART Account: A Unique account that addresses the issue of involuntary job loss in the market place. Customer can choose an insurance benefit up to a maximum of AED 50,000 per month for a period up to 12 months. In addition, the customer is also eligible for a cover of AED 200,000 in case of death due to any reason.

• Every Day Savings Interets: An account that credits interest on a daily basis to the account. In order to encourage customers to save more, the product pays higher interest for higher amounts saved in the account

• SME Medic Loan: A unique product that is designed and targeted to SMEs involved in the medical sector such pharmacies, diagnostic centres, laboratories etc. The customer can receive a loan for business expansion, cash flow management etc.

• UNB Hadiya Pre-paid Gift Cards: UNB was the first Bank in the UAE to launch the concept of pre-paid Gift cards with Hadiya

• Extra Card: UNB partnered with Abu Dhabi

Co-operative Society to introduce an exclusive shopping card offering significant rewards and incentives to UNB Extra credit card holders at

ADCOOP outlets in terms of cashback as well as exclusive discounts on everyday shopping items as well as high end electronic items

As a bank that is committed to actively contributing to the Abu Dhabi

Economic Vision 2030, we see our commitment to sustainability and product and service innovation as an ongoing mission. We continue to work on developing innovative products and services that meet and align customers’ requirements to national, social, environmental and economic requirements and vision.

Supporting Micro enterprises and SMEs

UNB is one of the few banks in the UAE to offer dedicated service centers specifically catered to supporting micro-enterprises and

SMEs. In 2011, we partnered with Khalifa Fund 1 through providing various services to UAE national entrepreneurs to encourage them to become successful business owners and thus increase the number of projects and business enterprises created and managed by UAE nationals. In 2011, the total number of SMEs customers was around 5,000 accounting for a significant portfolio within the Retail Business.

1 UNB signed a Memorandum of Understanding (MOU) with Khalifa Fund. The Khalifa Fund supports the Small and Medium Enterprises (SMEs) sector and is committed to driving the adoption of an entrepreneurial culture among Emirati youth. The Fund supports successful businesses founded and nurtured by UAE nationals.

In a bid to further support the growth of the small business sector in the UAE, UNB introduced new and innovative financial solutions for SMEs among which was UNB’s “Medic loan”; The Best Innovative product in the Middle East as per “Banker Middle East 2012 Product Awards”. UNB’s “Medic loan” is an SME product that provides healthcare providers easy access to finance with simple documentation. The purpose of the loan facility could be for equipment purchase, expansion or cash flow requirements. customers can choose from a combination of loan or overdraft or both depending on their needs. UNB introduced this product as the Medical segment has largely been overlooked by financial institutions and financing options have either been structured on the basis of corporate customers or at very high rates. “Medic loan” addresses the funding needs of all private sector healthcare providers such as hospitals, medical centers, clinics, labs and pharmacies authorized by health authorities. The facility is offered to those who have service agreements with one or more insurance company against assignment of proceeds to UNB.

In addition to the “Medic loan” UNB offers a wide range of SME products including commercial loan, rental loan. UNB also provides finance to specialized business requirements such as buying equipments, importing goods, issuing letters of guarantee as well as its special UNB SME credit card.

UNB also provides Microfinance to SME non-banking customers in order to enhance their financial skills and provide them with the required banking services and finance that supports their growth and business elevation from one sector to another.

Through UNB›s variety of SME products UNB expands its financial facilities among diversified segments offering finance to various industries including education, health commercial and industry as all play a vital role in the UAE›s economic development.

SERVIcE MANAGEMENT, cUSTOMER cARE

ANd SATISFAcTION

We are committed to being the bank that cares. That is why our focus has always been on staying close to the customers, listening to them, engaging with them, meeting their requirements, exceeding their expectations and focusing on earning their trust and loyalty. UNB has a dedicated customer care unit as well as a Research and Business Development Division that conducts regular customer satisfaction surveys and monitors customers’ feedback through different tools such as mystery shopping surveys.

Our Network

UNB utilizes a variety of mediums in determining the customers’ day to day requirements including customer service officers, relationship managers and the customer call center, depending on the customer group.

In addition to our branches and ATMs, we have also worked hard to launch a variety of new more flexible and convenient technologies that allow our customers to conduct banking services anytime, anywhere. Our delivery channels include:

UNB Network

Branches/Business offices 80

ATMs 167

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 3 0

• ATM Banking: Ensuring the customers’ reach and ease of banking, our

ATM network extends to 167 ATMs across the UAE. ATM banking offers a wide range of services with convenient locations within each emirate. In addition to traditional cash related services, our ATMs offer remittances, bills payments, and inquiries services.

• Internet Banking - Uninet: Uninet is the main electronic channel that offers the utmost services to our customers around the clock. Among the services offered are inquiry, remittances, cards services, donations, utilities payments, 3rd party payments, and account maintenance related services.

• Phone Banking – Unicall: Unicall is our phone banking channel offering a wide range of banking services to our customers on a 24/7 basis.

Services offered covers both enquiries and financial transaction services, including remittances, bills payments, cards services etc.

• call center: We have a dedicated team of customer service representatives who are available 24/7 to serve all customer needs. Our call center offers a range of services to customers in addition to catering to any enquiries or interest shown by non-customers. Our team of call center representatives are highly trained and monitored to ensure the highest level of quality, meeting international call center standards.

• Mobile Banking: Mobile banking is another electronic channel that is available to our customers. This channel offers Push Services that alerts the customers on all their banking transactions and account/ credit card related movements. Pull Service is another offering that allows customers to obtain financial information related to their accounts/ credit cards, in addition to transaction related services, such as cards activation.

customer care and Satisfaction

To build, maintain and enhance our relationship and knowledge of our customers, independent customer satisfaction surveys are conducted for each business group within UNB on a regular basis. The table across shows the frequency of customer satisfaction surveys per business group. In 2011,

UNB achieved a total customer satisfaction percentage of 87% among its retail customers and 82% customer satisfaction among its corporate banking customers.

We encourage our customers to provide their feedback, suggestions and complaints, so that we can continue to improve our processes, products and services.

Internet Banking

Number of customers (Index)

2009 2010 2011

N/A 100 145

Banking in Remote Areas

UNB has been consciously increasing its presence in the UAE through a wide network of branches offering more convenience to its customers.

Through its expansion strategy UNB has focussed on improving its presence and reach in remote areas, with around 29.1% of our retail branches in remote areas as of 2011. UNB is also one of the only Banks to offer financial services through its retail branch at Habshan, in the Western Region of Abu Dhabi.

Business Groups

Retail Banking

Corporate Banking

Commercial and SME banking

Real Estate

Al Wifaq Finance Company

Union Brokerage Company

Private Banking & Wealth

Management

Frequency of Survey

Annual

Annual

Annual

Annual

Annual

Annual

Annual w E c A R E A B O U T O U R c U S T O M E R S

Retail Banking customer satisfaction

Corporate banking customer satisfaction

2009 2010 2011

85% 88% 87%

81% 79% 82%

The UNB Customer Care Unit (CCU) provides a variety of channels for customers to express their views or submit queries through dedicated telephones and email address. We also encourage customers to voice their opinion through “Viewpoint” feedback forms which are available at all branches.

All complaints received are analyzed to identify root cause for corrective and preventive actions. Necessary reports are submitted periodically to the relevant managers and action plans are sought from them to address the areas for improvement in a time-bound manner. UNB’s complaint resolution process is unique as an independent validation is conducted for all resolved complaints. In case the client is not completely satisfied with the resolution, the case is re-opened for investigation. UNB’s Complaint Management system is certified to ISO 10002 standards.

We are proud that there have been no breaches of confidential customer data during the reporting period. We have also a fully equipped Business

Continuity Plan (BCP) and a Disaster Recovery site. BCP testing is being conducted annually from BCP site to ensure that identified critical activities can be carried out and customers can be served irrespective of any crisis or contingency from the alternative location even if the main server or the premises is not available.

Our Marketing and communication

We firmly believe and have inculcated the habit of fairness and transparency across the organization. It is the policy of the Bank to clearly outline to the customers the terms and conditions of each product and service including the fees and charges and all our communication channels consistently maintain the corporate ethic and help in strengthening the core position of UNB as a bank that cares. These charges are clearly displayed in the branches as well as on the banks web-site. In a recently launched product, the Bank has also introduced a 30 day free trial period whereby customers can avail the product and choose to opt out of the product, if so desired, without any charges. customer privacy breaches

2009 2010 2011

0 0 0

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 3 2

We Care About

Our Employees

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 3 4

wE cARE ABOUT OUR EMPLOYEES

UNB Perspective Our 2012 commitments

Human capital is core to UNB’s success.

UNB spares no efforts in investing and developing its employees, and engaging them in achieving its targets while providing a healthy working environment and competitive remuneration packages and benefits.

• Conduct two sustainability training sessions for all employees

• Integrate sustainability into employees job description

• To increase annualized intake of new UAE

National recruits by 4% every year

Abu dhabi Economic Vision 2030 Objectives UNB contribution

14% of our employees are Emiratis

1.

2.

3.

4.

5.

Increased participation of nationals in the workforce, especially in the private sector

Expanded skilled workforce and reduced dependence on unskilled Labor

Increased national workforce participation and employability

Working with the UAE Academy, Higher Colleges of Technology and UAE University to develop curricula that ensures employability upon completion, helping to improve the overall number of Emirati workforce. Union National

Bank signed an agreement with the Higher

Colleges of Technology (HCT) to establish the

‘Union National Bank Chair of Financial Services’.

Through the agreement, HCT has set up the

‘Union National Bank Chair of Financial Services’ fully sponsored by UNB. This reflects UNB’s commitment to harness local talent.

Optimized use of the workforce

Enhanced workforce productivity

Encouraging all staff to continue acquiring relevant higher professional qualifications (for example, Certified Islamic Banking Professional,

Chartered Financial Analyst, etc.) and support with fees reimbursement and learning resources.

Union National Bank implemented an In-House accreditation program for its Retail Banking staff. The accreditation process involved selfstudy, group study, training coupled with e-learning programs, followed by assessments to be completed by all the branch staff.

w E c A R E A B O U T O U R E M P L OY E E S

OUR wORKFORcE PROFILE, dIVERSITY ANd EMIRATIZATION

Over the past few years, the impact of the economic crisis has pushed many companies to reduce their hiring activities or even the number of people they employ. At UNB we have managed to continue increasing the number of employees year after year and maintain healthy hiring rates. We have also achieved consistent increases in our Emiratization rate and female employment year on year for the past three years.

Employment by level

Senior Management

Middle Management

Staff

Total

2009

51

308

995

1,354

2010

58

324

978

1,360

2011

57

334

995

1,386

We strive to attain a reasonable mix of cultures to make the bank reflect the demographic indicators of the region as closely as possible. This has been achieved through targeted selection and natural attrition. By the end of 2011, the number of UNB employees in the UAE was 1,445 – including subsidiaries – from 30 different nationalities, of which 14% were Emirati and 86% non-Emirati.

Employment by contract

Full-time employees

Part time employees

Total work force

Number of new joiners

2009

1,354

51

1,405

114

2010

1,360

77

1,437

235

2011

1,386

59

1,445

254

UNB’s Emiratization strategy focuses on recruiting and training fresh graduates offering them an opportunity to gain valuable banking experience, which helps them build successful careers in the financial industry. As a consequence, the Bank helps in increasing the calibre and quality of UAE nationals joining the work force in the financial sector as a whole. As a responsible corporate institution

UNB through its Emiratization strategy supports the development of the UAE community and invests in building careers of young Emiratis unlike other institutions that usually insist on recruiting employees with prior experience. UNB is also committed to developing their skills through on the job practical training, sponsorship programs, summer trainings and open employment days.

While increasing employment opportunities overall, we have continued to increase the percentage of UAE nationals demonstrating our commitment to supporting the hiring and training of the local population, in line with Abu Dhabi Vision 2030 which emphasises the support of the Emiratization initiative. This has been achieved by identifying and developing a pool of well educated and highly qualified nationals.

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 3 6

Employment by Nationality

Percentage of Nationals

Percentage of Expatriates

Number of Nationalities employed

2009

10%

90%

33

2010

13%

87%

31

2011

14%

86%

30

Initiatives that support Emiratization include:

• Working with the UAE Academy, Higher Colleges of Technology and UAE University to develop curricula that ensure employability upon completion helping to improve the overall number of

Emirati workforce.

• Creating a dedicated post of Emiratization Manager and a dedicated Emiratization Department

• UNB is keen on recruiting fresh graduates into the workforce and is committed to attracting

UAE nationals and developing their skills through implementing special strategies which include practical training for UAE graduates as well as sponsorship programs and summer trainings.

workforce by Gender

Female

Male

Total

2009

391

1,014

1,405

2010

417

1,020

1,437

2011

430

1,015

1,445

We are dedicated to ensuring equal opportunities are provided for both male and female employees from all nationalities across all divisions and at all levels of our organization. This includes ensuring equality in compensation and benefits for all employees.

At end of 2011, 30% of our employees were female, an increase of 10% from the year 2009. Female participation in UNB’s workforce is not limited to one employment level but spans across all employment levels as demonstrated in the table below.

Female Participation in the workplace and Management (%)

% of Total Workforce - Female

% of General Staff- Female

% of Middle Management - Female

% of Senior Management - Female

2009 2010 2011

28%

37%

7%

2%

29%

40%

8%

3%

30%

40%

10%

4% w E c A R E A B O U T O U R E M P L OY E E S

EMPLOYEE ENGAGEMENT ANd wELL BEING

As an organization that cares for its employees, we aim to create a dynamic environment that motivates and enthuses the team to participate in improvement activities. This is practically achieved through different engagement channels such as; the open door policy, meetings schedule, performance management process, explicit policies and procedures and recognition , employee suggestion schemes and reward programs and staff fraternization activities.

An Engaged Team

Our ‘open door policy’ practiced across the organization allows employees at all levels to communicate with any senior manager.

An important tool for employee engagement is the staff suggestion scheme titled “The Challenge”.

The scheme encourages employees to make suggestions for continual improvement at the bank, and has met with significant success by enhancing involvement of staff as the primary stakeholders of the bank. This scheme provides a systematic framework to the staff to suggest ideas for reducing cost and/ or improving quality, service or productivity. The ultimate goal is to encourage initiatives for bringing in a culture of continuous improvement through staff involvement. This scheme has been functional in the bank since Sept 2001 and has been continuously reviewed and refined for improvement.

The challenge Suggestion Scheme

Number of suggestions received

Number of suggestions approved/ implemented

2009

179

20

2010

256

35

2011

211

48

Fraternization programs to encourage bonding beyond the workplace such as children’s programs, bowling events and desert safaris are regularly conducted at various locations.

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 3 8

300

270

240

210

180

150

120

30

0

90

60

Performance Management

The leaders of our organization provide support to staff to achieve their objectives and targets through continuous on-the-job guidance, performance development reviews, in addition to developing clear policies and procedures that delineate well defined roles, responsibilities and accountabilities. High quality and efficient performance are considered as the basis of reward and recognition, and hence the performance of all employees is reviewed regularly. Organizational leaders oversee the annual performance development reviews of staff. The Management ensures consistency and objectivity in the process and directly links the performance with the rewards.

Performance Review

Percentage of employees undergone performance review

2009

94%

2010

93%

2011

94%

Reward and Recognition

Based on the prevailing market practices, and in compliance with the UAE Labor law, UNB offers staff benefits such as low-interest loans, leave air passage and education subsidy. We also have free medical insurance for all the staff and their family members (100% premium subsidy for spouse and up to three children), savings scheme, and free credit cards.

The key differentiating factors that form the backbone of our reward policy include:

• Similar benefits across levels - loan entitlements are linked to the salary multiple and do not differentiate employees based on levels.

• Staff loans at less than the inter bank offer rate.

• We also bear the passports renewal costs for staff as well as their families

• Support staff members to obtain visit visas for their family members.

• We have a unique Voluntary Employee Savings Scheme (VESS), wherein the employee pays a percentage of his basic salary as savings into this scheme. On a reciprocal basis, the Bank also w E c A R E A B O U T O U R E M P L OY E E S makes a contribution to the scheme equal to the contribution made by the employee. The employee is entitled to get the full amount at the time of leaving the organisation.

We are aware of the need and positive impact of recognizing both team and individual efforts and this has been embedded as a shared core value. At a team level, since 2005 the “Best Service Branch

Award”, and since 2007 the “Best Corporate Service Division Award” have been awarded annually to recognize superior performance of the branches in the Retail Banking and Corporate Banking Divisions respectively. These awards are primarily based on customer service attributes tracked and monitored through mystery shopping surveys, service quality facilitation, customer satisfaction surveys etc.

Health and Safety

Demonstrating our dedication to employee wellbeing, our health and safety performance has been excellent having recorded zero injuries and lost days for the last five years. Certification to the Integrated

Management System, consisting of ISO 9001, ISO 14001 & OHSAS 18001 has earned UNB the distinction of becoming the first commercial bank in the world to be certified by LRQA on the three standards.

Occupational Health and Safety

Rate of Injury

Rate of Occupational Disease

Lost Days

Absenteeism

Number of Work-related fatalities

2009

0

0

2010

0

0

0 0 0

0 0 0

0 0 0

2011

0

0

UNB buildings are equipped with appropriate fire fighting equipments; Regular fire drills are conducted, and training provided to the select group of staff to assume the role of safety wardens. First aid boxes are available in each branch and each floor of the head office. Staff are also trained and briefed on fire fighting and other safety and security procedures on a periodic basis.

In 2011, we also conducted several health awareness sessions for our staff which focused on healthy living and the preventive measures to avoid serious diseases and critical illnesses including:

• Benefits of Quitting Smoking and How to Kick the Habit, 2011

• Free Spinal Health Evaluation Day, 2011

• Healthy Living - Heart Care, 2011

• Cervical Cancer Awareness

• Breast Cancer Awareness

• Sheikh Khalifa Medical Centre – Health Check-up Mar 2012

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 4 0

Human Rights

UNB complies with national laws and regulations concerning human rights. We do not allow any form of forced labor and we do not hire any employee below the minimum legal age. Discriminatory practices are unacceptable and we are proud to have recorded zero cases of discrimination for the last three years.

We try to watch our human rights performance in all our supply chain and plan to embed human rights clauses into our contracts throughout our supply chain.

EMPLOYEE TRAINING ANd dEVELOPMENT

Regular training and development initiatives ensure that staff members have the requisite skills and capabilities to handle both the present and the future needs of the bank.

Think Bank

Think Bank, ‘Continuous Learning’ initiative was launched in February 2005 to promote organizational and individual learning. The objective is to promote a ‘learning culture’ by enthusing staff to:

1) Be aware of and appreciate good practices

2) Introspect on how these could be applied in thework situation

3) Implement progressive changes

Training is provided to the staff based on:

1) The identification of training needs as identified by the division / group head / bank.

2) The individual needs identified by staff through their individual development plans.

The Learning & Development function offers adequate facilities for learning and highly competent faculty. In addition the Learning Resource Centre has many books, magazines,

CDs and DVDs across a range of relevant subjects for all employees to explore and gain from.

The bank also offers e-learning as one of the most contemporary, convenient and effective ways of learning. Staff can enroll online and access a wide variety of courses based on their needs.

With the objective of developing people through work experience, on-the-job training is regularly provided to the staff. This has proved beneficial especially for the Emiratis recruits, many of whom join the bank without any prior banking experience. Specific emphasis is placed by UNB on training of

UAE nationals, who attend various programs to hone their competencies.

w E c A R E A B O U T O U R E M P L OY E E S

UNB Fellowship Program – Ms. Sabha Al Dhafri

In 2010, Ms. Sabha Al Dhafri, a UAE National Branch Manager, was selected for the prestigious

Hubert H Humphrey Fellowship Program after a rigorous selection process.

This initiative has been driven by UNB’s policy of developing UAE Nationals and providing them with opportunities to grow and develop.

Ms. Sabha was on the fellowship for 14 months. She had the distinction of being the only lady from UAE to have received the Fellowship. Sabha successfully completed the program and has rejoined UNB equipped with the leadership skills she learnt through her fellowship

Training company-wide

Total number of Training hours provided *

Average hours of training per year per employee

Cost of Annual Training (AED’000)

* Training hours have been estimated where actuals have not been computed

2009 2010 2011

34,421 40,449 39,396

24.58

3,195

28.89

3,083

28.14

2,651

We encourage all staff to continue acquiring relevant higher professional qualifications (for example, Certified Islamic Banking, Chartered Financial analyst, etc.) and will often support with fees reimbursement and learning resources by the bank. UNB invests around AED 1.3 million annually in the EIBFS training.

EMPLOYEE SATISFAcTION ANd TURNOVER

We have conducted annual staff satisfaction surveys regularly since 2000. The staff satisfaction survey generally measures 13 key dimensions that impact staff satisfaction and can be clustered into three main categories:

1) Job content and immediate superior,

2 Work environment within the group or division, and

3) Compensation package and related organizational issues.

Turnover

Total Turnover (%)

Total Turnover (%) excluding INJAZ

Senior Management

Middle Management

Staff

Asian Leadership

Award:

“Dream

Company to work for”, 2011

2009 2010 2011

11 % 14 % 18 %

11 %

0.4 %

2.1 %

8.5 %

13.5 %

0.4 %

2.3 %

11.3 %

15.5 %

0.5 %

2.4 %

14.1 %

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 4 2

In 2011, we achieved 69% staff satisfaction in comparison to 70% in 2010, with an average response rate of 92% in 2011. This has been achieved by engaging with staff, communication of the results and by setting SMART action plans for improvements based on the findings.

Turnover by Gender

Turnover number of female employees

Turnover number of males employees

2009

48

2010

66

2011

81

116 137 165

The feedback arising from the staff satisfaction survey is continually used by the leadership to draw up and implement timely action plans to address any persisting or one off issues that arise from the results. This serves as another tool for the bank to remain closely connected, actively listening and responding to the voice of our staff.

Turnover by Age (number of employees)

18-30

31-40

41-50

51-60+

Total

2009 2010 2011

72 85 115

56 84 90

16 15 18

20 19 23

164 203 246

In addition to creating an engaging, motivating and friendly working environment, we measure our staff turnover and always strive to minimize it. Our high satisfaction rate was reflected on an employee turnover rate of 18% for UNB in 2011. This turnover includes employees for Injaz Sales &

Marketing, the Direct Sales & Marketing arm for UNB which typically has a higher rate of employee turnover. Further the turnover tends to be higher amongst the younger age category and within the junior level staff.

w E c A R E A B O U T O U R E M P L OY E E S

Employment by Region

Staff from Dubai

Staff from Abu Dhabi

Staff from Sharjah & Northern Emirates

Total workforce by Age

18–30

31–40

41–50

51–60+

Total

2009

245

986

2010

246

1,013

2011

264

996

174 178 185

1,405 1,437 1,445

2009 2010 2011

522 494 460

539 593 616

183 194 221

161 156 148

1,405 1,437 1,445

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 4 4

We Care About

Our Society and

Our Business

Partners

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 4 6

wE cARE ABOUT OUR SOcIETY ANd OUR BUSINESS PARTNERS

UNB Perspective Our 2012 commitments

As a community member UNB takes responsibility for contributing to community development through

• Enhance UNB community investment projects and their impact through the development of

Community Investment strategy that incorporates

UNB’s core competencies. responsible lending and strategic community investment that contributes to financial inclusion and reduces financial literacy. UNB aims to

• Develop UNB procurement policy and guidelines to incorporate further sustainability criteria systematically engage with its business partners to achieve this through strategic partnerships.

Abu dhabi Economic Vision 2030 Objectives

1.

Enhance competitiveness

UNB contribution

Regular dialogue with partners and suppliers to enhance service efficiency

2.

Environmental Sustainability

Strategic partnerships to improve performance and customer value

3.

Streamlined Government Processes

4.

Optimal Government Spending

Enhanced government operations that add customer value

Strategically planned community initiatives

BUSINESS PARTNERS

UNB follows a policy of partnering with leading organizations in order to develop mutually beneficial relationships that bring value to the partner as well as the customer and all other key stakeholders.

Building Impactful Business Partnerships

Identification of partners is based on well-defined criteria including their quality of service, ability to provide solutions and financial strength.

We have a dedicated Vendor Management team in our IT department which ensures robust and effective partnering relationship with the vendors while ensuring continued, uninterrupted maintenance and enhancement support to the bank. UNB also has correspondent banking

UNB has won several accolades and recognition from its partners including:

• STP Excellence Award from Commerzbank in 2011.

• Deutsche bank USD STP Excellence award 2010.

• Excellent Quality in EUR Denominated

Payments from Commerzbank in 2007

• USD Straight Through Processing (STP)

Excellence Award from Deutsche Bank in 2006;

• Funds Transfer Award from the Bank of New

York in 2005; w E c A R E A B O U T O U R S O c I E T Y A N d O U R B U S I N E S S P A R T N E R S relationships with over 250 global banks to ensure efficient services to its customers worldwide. Our policy for selecting and managing partner relationships is clearly linked to our vision, mission, and strategic objectives, and thus serves as a framework to ensure that partnerships help deliver on our strategic goals.

The Financial Institutions & Structured Finance (FI&SF) Division develops and maintains all international correspondent-banking partnerships. This allows corporate and retail customers have access to the world through banks in more than 50 countries.

Effective supply chain partnerships that add value to UNB and its customers...

• Streaming utility bill payments - The tie up with Dubai e-government, Etisalat, Du, Abu

Dhabi Distribution Company (ADDC), Dubai Electricity and Water Authority (ADWEA), Sharjah

Electricity and Water Authority (SEWA) and Al Ain Utility through a direct link-up from the

Bank’s Online (Uninet) as well as the partner’s website for instant utility bill payments.

• UNB has also partnered with Gemalto International – the world leader in digital security for the introduction of advanced payment chip-based cards to all its card customers,

• Partnering with Visa for improved products and customer service - Visa International has consistently supported the Bank to launch various new products such as Hadiya Gift card, Cashback card and International Travel card, as well as improve efficiencies in various operational domains e.g. through benchmarking and improvement of authorization rates which has resulted in better customer service and usage of the cards.

• Innovating in Insurance - UNB’s partnership with Arab Orient Insurance resulted in providing travel insurance and credit shield insurance. UNB was amongst the first banks in the region to bundle a loss of employment offer with the standard personal accident insurance cover.

• UNB has also partnered with Oman Insurance Company in jointly developing the innovative

UNB Smart Account product.

We actively evaluate suppliers on a continuous basis to identify and leverage economics of scale by sourcing multi service and product suppliers from vendors. New initiatives, trends and methods to improve processes and operations and cost efficiency are discussed with the suppliers and actions are undertaken to facilitate better execution.

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 4 8

Fostering Sustainability in our Supply chain

As part of our sustainability strategy and alignment to the Abu Dhabi Economic Vision 2030 to

‘Enhance Competitiveness’ and ‘Environmental Sustainability’, UNB is seeking to embed sustainability into partnerships and procurement practices. By engaging more with its partners and suppliers on the sustainability topics, we hope to embed principles of sustainable innovation into partnerships through collaboration and also ensure that social and environmental criteria are used in the selection and evaluation of key suppliers.

Our policy is to promote local suppliers as part of our socio-economic responsibility to the nation as well as local communities, while ensuring that these local suppliers meet the highest possible international standards. For the past three years, we have ensured that 100% of our procurement budget was spent on local suppliers.

2009 2010 2011 Spending on locally-based suppliers

Total amount spent on procurement

(contractors & suppliers) (AED)

Amount spent on local suppliers (AED)

% of total procurement spending gone to local suppliers

Number of local and foreign suppliers

154,465,012

154,100,812

100%

814

171,158,080

171,152,379

100%

814

170,865,999

170,569,899

100%

814

cOMMUNITY INVESTMENTS ANd dEVELOPMENT

community Investment

Total community investment (AED ‘000)

2009

927.5

2010

1,089.5

2011

1,500.8

We are committed to taking a leading role in supporting local communities by actively contributing to their needs and priorities in areas such as education, the environment, health, special needs, cultural development, Emiratization and philanthropic activities. UNB has a dedicated budget allocated for community investment and development each year, which was AED1.5 Million in 2011, representing

0.1% of pre-tax profits.

MoU with Ministry of Environment and water

UNB was the first organization in the UAE to sign a Memorandum of Understanding (MOU) with the Ministry of

Environment & Water (MOEW) as a Strategic Partner during 2010. As per the MOU, all key initiatives undertaken by the Ministry are reviewed and approved by UNB representatives who evaluate the same and based on the approvals the initiatives are confirmed and implemented. The initiatives that were undertaken included the UAE

Free of Plastic campaign, “My Environment My Responsibility” Video, as well as educational sessions at schools and stands at Malls where MOEW created awareness in the public and distributed recycled jute bags sponsored by UNB. Jute bags were also distributed by UNB to all its employees to encourage them to avoid using Plastic bags. The MOU with the Ministry was renewed during 2011-12 to continue the Strategic Partnership w E c A R E A B O U T O U R S O c I E T Y A N d O U R B U S I N E S S P A R T N E R S

CSR is a key area of focus for the Bank and is intrinsically embedded in the Bank’s Vision, Mission and strategies. CSR objectives form an integral part of the UNB senior management ‘Management By

Objectives’ (MBOs) and this is diligently tracked on a periodical basis to ensure that the CSR strategy and initiatives are on track.

All CSR initiatives are evaluated on the basis of stringent criteria and submitted to Senior

Management for approvals. The Bank has over the years consistently supported community initiatives and ensures that it plays an important and active role as a responsible corporate citizen.

Key 2011 CSR initiatives

• Al Noor Fun Fair participation

• Future Centre sponsorship

• Khorfakkan Club for Handicapped -

Braille Quran

• Earth Hour initiative participation

• Small World Charity sponsorship -

Silver sponsor

• Platinum sponsor -

Education without Borders

• SME Evolution Program -

Platinum sponsor

• Abu Dhabi Industry Awards 2011 -

Support sponsor

• World Environment Day participation

We continue to develop programs and community investment and development initiatives that are more aligned strategically with our vision, mission and core business practices. This includes supporting community members’ to learn more about finance and banking and increase their financial literacy allowing them to use our banking services to enhance their economic situations.

In 2011, we conducted a number of workshops and participated in a range of exhibitions that promoted

SME development as well as other banking specific sponsorships. The courses ranged from best practices for improving business efficiency, to expanding businesses and competing internationally and were conducted both as webinars as well as in person. UNB conducted one such exclusive session for more than 40 of its SME customers at the UNB Head Office premises recently. In addition, UNB sponsored the SME exhibition which was organized to meet the needs of SME customers from a Retail and Government perspective and was a sponsor of the UAE Internal Audit Association as well as the

Indian Chartered Accountants Association.

UNB was the Platinum sponsor of the SME Evolution Program organised by M/s Potential an SME Consultant.

The SME Evolution program aims to reach thousands of SMEs by providing valuable free online interactive training sessions, online content and live workshops. The best businesses that go through the program were selected for a more advanced phase of development.

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 5 0

We Care About

Our Environment

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 5 2

wE cARE ABOUT OUR ENVIRONMENT

UNB Perspective Our 2012 commitments

UNB respects the environment and aims to achieving environment friendly operations through the adoption of energy efficient practices while minimizing materials

• Reduce UNB’s greenhouse gas emissions through reduced resource consumption arising from internal awareness and new technology adoption consumption in all its operations. UNB also recognizes financial institutions are strongly linked to other strategic sectors at the national level, and accordingly we work to mitigate our environmental impact in our investments and lending processes.

1.

Abu dhabi Economic Vision 2030 Pillars

Environmental Sustainability

UNB contribution

Our organizational Environmental Management

System – as part of our Integrated Management

System – achieved ISO 14001 certification.

In the last three years since 2009, UNB sent an estimated of 78.6 tons of paper waste for recycling.

UNB has begun purchasing sustainable paper that is manufactured from 100% recycled materials since 2010. 56% of our paper consumption in

2011 was from this recycled paper w E c A R E A B O U T O U R E N V I R O N M E N T

ENVIRONMENTAL cHALLENGES ANd OUR

ENVIRONMENTAL RESPONSIBILITY

The United Arab Emirates has one of the highest per capita energy consumption in the world, and is amongst the top 20 most water scarce countries according to ‘water stress index 2011’.

Given these important facts and other key environmental trends and impacts such as climate change, we recognize that we have a responsibility to care for our environment, and also see an opportunity to tackle these issues through innovative products and services and stakeholder collaboration.

Across the bank we are currently identifying areas for rapid environmental gains that would not only help us fulfill our responsibility to the environment, but also reduce costs and increase efficiency. Our organizational environmental management system – as part of our Integrated Management System

– achieved ISO 14001 certification during 2011. Through this system, we aim to better measure and manage our use of precious resources and minimize waste.

We are also committed to caring for the environment together with our customers. For this reason we are also implementing initiatives that will help us to achieve higher level of efficiency in our operations, while offering customers more sustainable and paper free channels to conduct their banking. On the corporate banking side we are also exploring opportunities for investing in more socio-environmental projects, working together with clients to implement sustainability, while also adopting more responsible lending practices to reducing the environmental impact in projects that we lend to.

MANAGING ANd cONSERVING OUR PREcIOUS RESOURcES

Materials Management

In 2011, we achieved a 2% reduction in printer toner cartridges consumption as a result of automating a range of processes and changing the default settings for the printers and the copying machines to double side printing at our head office and all branches, as well as reducing the font size used.

Materials used by weight or volume

Paper consumption (Kg)

Paper Consumption (Kg/ full-time employee)

2009

133,862

98.9

% of recycled paper purchased

Printer Toner cartridges (Kg)

Plastic water bottles (Kg)

Plastic bank cards (Kg)

N/A

4,226

Savings achieved from material reductions (AED)

The environmental numbers in this table include UNB operations

454

2010

137,241

100.9

40%

4,366

New indicator

436

New indicator

2011

139,600

100.7

56%

4,281

590

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 5 4

We realize that paper is the most consumed material in our day to day operations; therefore, we work hard to reduce our paper consumption through different measures. By the end of 2011, 56% of our total paper purchased was from recycled paper, a 40% increase compared to 2010. However, our total paper consumption increased by 1.7%. We are committed to expand our process automation to include more processes in a wider range of our network to achieve better results in our paper consumption in 2012.

We continue to work to measure the monetary savings as a result of these reductions and the amount of plastic water bottles we consume.

Energy Management

In 2011 we consumed 85,719.8 Gigajoules (GJ) of energy from our operations representing a 12.5% increase on 2010. This increase was primarily due to the increase in branches and office locations over the past two years.

Energy consumption

Electricity (kWh)*

Vehicle Fuel, gasoline (liters)

Vehicle Fuel, diesel (liters)

Electricity (GJ)

Vehicle Fuel (GJ)

Total (GJ)

Energy consumption (GJ) per full time employee

Revenues generated (AED) per GJ of energy consumed

2009

52,124

0

72,037.4

1721.2

73,758.6

54.5

2010

20,010,376 20,668,758 23,161,532

53,936

1,097

74,407.5

1821.0

76,228.5

56.1

2011

70,591

200

83,381.5

2338.3

85,719.8

61.8

28,718.9 33,515.4 33,105.6

* Electricity consumption numbers in this table does not include office locations where no electricity is charged, such offices has a very low electricity consumption as they comprise few desks within a big space. However, the electricity consumption numbers reflect 80 office locations in 2011, 84 office locations in 2010 and 77 office locations in 2009.

** The environmental numbers in this table include UNB operations

To help reduce our electricity consumption we have installed timers which automatically switch off lights on all non critical floors, while manual switching off is done within critical floors by in house technicians. We also now monitor all offices on a daily basis to ensure that personal computers and office equipment are switched off after operating hours.

In the efforts towards optimizing transportation usage, UNB’s fleet of 21 vehicles is maintained at authorized service centers leading to better quality of service through specialized and expert technicians. Scheduling of the Bank’s vehicles is done on the basis of online requests. The car pool is w E c A R E A B O U T O U R E N V I R O N M E N T managed by a dedicated transport manager and assisted by transport officer and trained drivers. All

UNB cars run on special green unleaded petrol.

In 2011, our direct and indirect energy consumption resulted in the emitting of 17,832 tons of

Greenhouse Gases (GHG), which represents a 12.2% increase on 2010. Demonstrating our commitment to the environment we aim to reduce GHG emissions in 2012 by increasing internal efficiency and the installation of new technologies.

How did the ‘Superdome’ servers help us improve our efficiency and reduce our footprint?

• Support Desk calls related to core system performance problems reduced by approximately 85%

• End Of Day processing timings for systems reduced by approximately 50%

• Backup timing for systems reduced by approximately 70%

• Overall reduction in data centre space requirements

• Reduce power consumption through consolidation of 25 servers into 3 Superdomes

Greenhouse Gas emissions (tons)

Electricity consumption, GHG

Vehicle Fuel, GHG

Air transport – Business trips, GHG

2009

15,222

126

38.9

2010

15,723

133

39.9

Total GHG Emission 15,387 15,896

The environmental numbers in this table include all UNB operations in the UAE

2011

17,619

172

40.7

17,832 water Management

With the increased number of branches and office locations over the past two years, our water consumption was 215,037,000 liters at the end of 2011. This is considered as the baseline year for water consumption because water consumption for the previous years could not be calculated due to the lack of reliable data records from the relevant authorities.

water consumption

Water consumption (liter)

Water consumption liter) per full time employee

2009

N/A

N/A

2010

N/A

N/A

Revenues generated per liter of water consumed (AED) N/A N/A

The environmental numbers in this table include all UNB operations in the UAE

2011

215,037,000

158,816

9.9

S U S T A I N A B I L I T Y R E P O R T 2 0 1 1 5 6

Reducing and Recycling waste